Sofi Student Loan Refinancing Eligibility

To qualify for student loan refinancing through SoFi, you must meet the following requirements:

- You must be at least the age of majority in your state

- You must be a U.S. citizen or permanent resident

- Non-permanent residents can qualify if they have a cosigner that is a U.S. citizen

Sofi Student Loans: A General Overview

SoFi was founded in 2011 and introduced student loan refinancing in 2012, one of its first financial products. The company began offering private student loans in 2019.

The company also has specialized products for certain groups: private loans for graduate students, law and business school students, and parents and refinance loans for medical residents and doctors, law and business school students, and parent PLUS loan borrowers. In this review, we will focus on SoFiâs undergraduate student loans and general student loan refinancing.

SoFi offers private student loans and refinance loans in all 50 states and Washington, D.C. Since most undergraduate students do not have enough credit history to qualify for a loan on their own, they typically apply with a co-signer. Applicants who use a co-signer may have a better chance at getting approved and securing a lower interest rate.

Basic Information: Sofi Student Loan Rates Terms Fees & Limits

SoFi undergraduate student loans come with the following rates, terms, fees, and loan limits:

- Fixed APR:5.73% to 11.99% with autopay

- Variable APR:4.73% to 11.74% APR with autopay

- Terms: Repayment options include immediate repayment, interest-only payments, partial payments, and full deferment

- Fees: None

- Limits:$5,000 minimum up to 100% of the school-certified costs of attendance

Read Also: How To Check Va Loan Eligibility

Are Sofi Student Loans Federal Or Private

SoFi student loans are private, not federal. Private student loans are different from federal loans in that they come with interest rates based on your and typically have less generous repayment, postponement and forgiveness options. For example, due to the Covid-19 pandemic, federal loan borrowers did not have to make payments from March 2020 to Jan. 31, 2022. Federal loans for undergraduate students also do not require a co-signer.

Is It Worth It

SoFi offers decent interest rates on shorter term loans . If youve got a great income, and a decent credit history, youll likely qualify for a loan from SoFi.

You can get a free rate estimate from SoFi , so take a few minutes to get your rate. Then compare that rate with other lenders before deciding where to refinance.

You May Like: Can I Get An Equity Loan

What Is The Difference Between Student Loan Consolidation And Student Loan Refinancing

Student loan consolidation and student loan refinancing may sound similar, but they’re very different terms.

Although they’re both loan payoff options, student loan consolidation refers to federal Direct Consolidation Loans. With a Direct Consolidation Loan, you can combine your eligible federal student loans. Repayment terms can be as long as 30 years, and your interest rate is based on the weighted average of your current interest rates.

With student loan refinancing, you work with a private lender to take out a loan for the existing debt. When you refinance, you’ll lose federal loan benefits. However, you can qualify for a lower interest rate and save money over time.

How Have Federal Student Loan Interest Rates Changed

Though interest rates on federal student loans have fluctuated over the last few decades, theyve been fairly steady in recent years. From the 1960s to 1992, Congress set fixed interest rates for student loans that ranged from 6% to 10%.

Over the past couple of decades, federal interest rates varied depending on whether borrowers were in school, in the six-month grace period after leaving school, or in repayment.

Until 2006, rates for federal student loans were a bit all over the spectrum. After 2006, rates became fixed again, but differed based on the type of loan .

These rates hovered around 6% or 7% until the 2009 recession, then fell to 3% or 4% for undergraduate loans and closer to 5% for graduate ones. In the 2020-2021 school year, amidst the pandemic, rates sunk to lows that hadnt been seen in many years. But compared to that year, federal student loan interest rates for the 2021-2022 academic year rose nearly 1% across the board.

Don’t Miss: How To Start Fha Loan Process

What To Like About Sofi Refinance For Student Loans

As you can see from our research and other SoFi reviews, the lender is one of the leading student loan refinancers in the country and its not hard to see why. Here are some of the advantages you may find at SoFi.

Accessible to associates degree-holders

Unlike many student loan refinancing companies, SoFi doesnt insist on a bachelors degree for you to qualify an associates degree is all thats needed.

If youre an associates degree-holder currently combing through this and other SoFi reviews, keep in mind that other lenders will work with you too. Splash Financial is among lenders willing to refinance for borrowers with an associates degree.

Deferment and forbearance options

Not all refinancing lenders allow you to temporarily pause your payments through student loan deferment. However, SoFi reviews your situation generously and allows you, for example, to defer your loans while in graduate school, as long as youre enrolled at least half time. Similarly, you can defer your loans for active duty military service or if you are on disability rehabilitation.

Here are all the types of deferment and forbearance made available by SoFi student loan servicer MOHELA:

| Deferment |

|---|

| Natural disaster National emergency |

Notes, however, that interest will still accrue during deferment or forbearance, and your loan will be reamortized to adjust for this.

Possible to transfer parent PLUS Loans

Repayment benefits for medical, dental school residents

How Long Does It Take To Get A Sofi Student Loan

Whether youre applying for student loan refinancing or a new private student loan, SoFi reviews your initial information within minutes and promises instant credit decisions. You just have to create an account and enter basic details about your situation.

Actually receiving the loan, however, takes additional time.

- For refinancing, you can quicken the pace by promptly requesting debt payoff letters from your existing loan servicers and lenders.

- For private student loans, the entire process is more dependent on your school and can take four to six weeks to complete.

| U-fi |

Don’t Miss: Where To Get Car Loan For Used Car

* Not Currently Enrolled In School For At Least Six Months

To qualify for SoFi student loan refinancing, you must be a full-time student. This means that your school must require you to take more than 12 credit hours per semester and/or 24 credit hours per year. If youre currently taking fewer than these requirements, then you are not eligible for SoFi refinancing. Additionally, if youre enrolled in an associates degree program or certificate program that does not count towards a bachelors degree and does not lead to professional licensure , then this may disqualify your application from being approved by SoFi.

If you are currently enrolled in an eligible school:

- You must be enrolled in a degree program that is eligible to receive federal financial aid . In other words, if the school has accreditation from the Department of Educations Council for Higher Education Accreditation or Commission on Recognition of Postsecondary Accreditation or another recognized accrediting agency if it participates in Title IV programs and if it holds at least one campus offering baccalaureate degrees then it is likely considered an eligible academic institution by SoFi.

Sofi Student Loan Review

Edited byHow Student Loan Hero Gets Paid

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

Don’t Miss: How To Shop For Auto Loan Without Hurting Credit

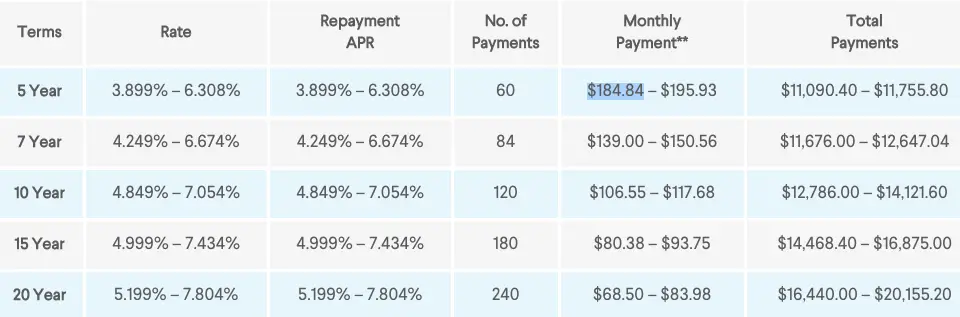

Sofi Refinance Rates And Options

SoFi offers a wide range of student loan refinancing options. As of July, 2022, the following rates and terms are available:

| SoFi Overview |

|---|

| $150 |

Borrowers can refinance federal student loans, private student loans, and Parent PLUS loans. SoFi, like most legit lenders, does not charge any application fee, origination fee, or prepayment penalties.

Looking at all of the SoFi possible rates and options, borrowers should be careful to tweak loan repayment lengths to find the sweet spot between getting the lowest rate and getting the best monthly payment.

For example, one strange aspect of the current SoFi options is the close rates offered for the longer length loans. The rate on a 10-year loan may be only a fraction of a percent less than the rate on a 15 or 20-year loan. Opting for a longer loan can result in an interest rate that is only slightly higher. The longer loan advantage is more flexibility.

Note: having a 20-year loan does not mean that a borrower must take 20 years to pay it off. Opting for the longer duration loan gives the borrower the flexibility of low minimum payments. Additionally, the loan can still be paid off aggressively by making extra or larger payments.

Sofi Student Loans Review

Since its April 2019 student loan product launch, SoFi has promised a seamless prequalification process to go along with competitive rates for undergraduate, graduate and professional students, as well as parent borrowers.

SoFi student loans are a good fit for borrowers enrolled at least half time who have good credit and value repayment flexibility while in school and after graduation. The lenders slow-moving cosigner release policy, however, is a shortcoming.

| What to like: |

|---|

| Reduce your interest rate by 0.25 percentage points if you enroll in autopay Three in-school repayment options, as well as full deferment Repayment term option: 5, 10, 15 years Release your cosigner after 24 months of prompt payments | |

| Support | SoFi offers economic hardship deferments and discretionary forbearances whether youre going back to school or experiencing financial hardship Forgiveness offered only the case of the primary borrowers death |

You May Like: How Long To Close On Home Equity Loan

Why You Should Compare Sofi To Other Companies

Any time you are making a major financial commitment like refinancing student loans its important to take time to research all of your options to find the best alternative. Depending on your needs and your credit profile, you could find one company that offers more of what you want.

Additionally, comparing student loan refinance lenders allows you to judge whether refinancing is the right option. If you have one or several federal loans, you have to weigh a lower interest rate against federal loan options like repayment or forgiveness programs that you lose access to with a private loan.

Sofi Student Loan Application Requirements

Here is an overview of the requirements youll need to meet to take out a SoFi student loan:

- You must be a U.S. citizen, resident, or visa holder.

- You have earned at least an associates degree from an eligible, accredited Title IV school.

- SoFi doesnt disclose any minimum income requirements, but the average SoFi borrower earns an annual income of over $100,000.

- Your credit score needs to be at least 650, but the average SoFi borrower has a credit score of 700 or higher.

- Must be able to show proof of employment or that youre starting a job within the next 90 days.

- The minimum loan amount is $5,000 which can be a combination of both federal and private student loans.

- If youve previously filed for bankruptcy, youll need to wait until it drops off your report to apply. For a Chapter 13 bankruptcy, this will take at least seven years for a Chapter 7 bankruptcy, youll need to wait at least ten years.

Don’t Miss: How Do I Apply For Loan Forgiveness

Car Loan Amounts As Well As Terms

SoFi pupil financings begin at $5,000, though the minimum can be higher depending upon your state of house. The loan will hide to your colleges complete expense of presence, meaning the total cost of tuition, costs, bed and board as established by the financial aid workplace. You can repay your car loan over five, 7, 10 or 15 years.

More: Apply For Credit Card Consolidation Loan

Are There Any Costs Associated With Refinancing

Usually no. Many lenders do not charge origination, application or disbursement fees for refinancing student loans. If youre not sure, ask your lender about its fee structure before you refinance.

Note that when you refinance student loans, you can choose to extend your repayment terms. Opting for a long term can result in higher interest costs over the life of your loan. If you want to reduce the amount you pay in interest, consider selecting a shorter repayment term.

You May Like: What Is The Best Online Loan For Bad Credit

Choosing A Loan Offer

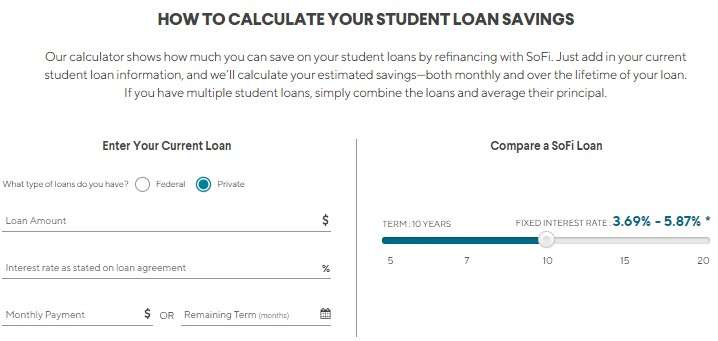

If youre prequalified for a loan, youll be able to review and choose between your different loan options. Theres also a savings calculator, where you can enter your estimated current loan balance, APR and term to see your monthly payments and lifetime cost.

The SoFi loan terms show you the interest rate, monthly payments and estimated lifetime or monthly savings. However, the SoFi loan options dont show the total lifetime cost of the loan, which can make it difficult to understand the impact of your decision. This is particularly an issue with the medical resident refi, as the $100 minimum monthly payment may not cover the interest you accrue during that period this would lead to a larger loan balance when you enter full repayment.

Private Student Loanundergrad Rates & Terms

For variable rate loans, the variable interest rate is derived from the 30 day average SOFR index rate plus a margin of between 0.82% and 11.06%. The current 30 day average SOFR index rate is 1.07%. Changes in the 30 day average SOFR index rate may cause your monthly payment to increase or decrease. Interest rates for variable rate loans are capped at 13.95%, unless required to be lower to comply with applicable law.

It is important to remember that interest begins accruing on the first disbursement date, but some repayment options do not require full principal or interest payments until the end of the deferment period. Any unpaid interest that has accrued and remains unpaid at the end of the deferment period will be added to the principal balance at the end of the deferment period. Thereafter, interest will accrue on this new principal balance.

How to read the repayment tables

For the tables below, the full deferment, interest only, and partial payment in-school repayment options assume that you remain in school for four years and have a six-month grace period before the loan term begins. The immediate repayment option assumes full payment begins one month after full disbursement.

SoFi reserves the right to change interest rates at any time and without notice. Such changes will only apply to applications begun after the effective date of the change. Calculations are estimates only.

Also Check: How To Remove Late Student Loan Payments From Credit Report

What To Keep In Mind About Sofi Student Loans

SoFi reviews might make the lender sound like the right fit for your borrowing needs. However, no one lender is the best option for everyone, and in some ways, SoFi may fall short of your needs.

Unfortunately, just getting in the door could be a challenge. SoFi doesnt state its specific credit requirements online, but your credit score is a heavily weighted factor when it comes to qualifying for a student loan. Of course, applying with a creditworthy cosigner makes borrowing possible for students with thin credit histories.

Some other lenders are more transparent about their criteria. Ascent, for example, accepts credit scores as low as 540.

Not accessible for students enrolled less than half time

Beyond its financial qualifications, SoFi has eligibility rules that sometimes limit access. You must be attending school at least half time, for example. If youre studying less than half time, you might find a better opportunity with competing lender College Ave.

Cosigner release takes two years

If youre an undergraduate student, its likely that youll need a cosigner to qualify with SoFi. A student loan cosigner agrees to repay your loan in the case that you became unable to pay on your own.

Unfortunately, SoFi doesnt offer you the ability to release your cosigner until after youve made two years of prompt payments.