Factors Affecting Used Car Loan Interest Rate

Some of the factors affecting used car loan interest rates are listed as follows:

- Age : One of the crucial factors that determine the rate of interest on a used car loan is the age of the vehicle, as it becomes risky for the bank if you default on your loan. That is why, the banks also charge a high rate of interest on used car loans.

- : Your credit history and the ability to repay the car loans on time also affects the used car loan interest rate. If you have a credit score of above 700, banks easily approve your loan at an economical rate of interest.

- Down Payment : The amount of down payment you make on your car loan also impacts the car loan rates. The higher the down payment, the lower will be the rate of interest.

- Income Level : Lenders assess your commitments, your debt, and income ratio to ensure you can repay your loan without any default. The lower the debt-income ratio, the better it is.

FAQs

Is a guarantor required for a used car loan?

Bringing in a guarantor is not required in most of the cases. However, in case the applicant’s income is not meeting the minimum eligible criterion or if the cibil score is lower than expected, the bank may ask for the guarantor.

What is the maximum tenure for the used car loan repayment?

The maximum tenure for the used car loan is upto 7 years. But it is always advisable to apply for shorter tenure as longer tenure will mean higher interest.

Is there any need for collateral security for a used car loan?

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Car Loans For Bad Credit

Whether youre just starting out and have no credit history, or have simply made some credit mistakes along the way, its still possible to get an auto loan. Many lenders provide car loans for bad credit. If youd like to improve your chances of being approved or possibly get a lower rate now, consider adding a cosigner, making a large down payment or both.

A no-haggle, online experience could be extremely stress relieving. Read our full Carvana review.

WHERE IT MAY FALL SHORTYou cannot use a loan offer you got through Carvana to purchase a vehicle from any other seller.

Don’t Miss: Is Loan Lease Payoff Worth It

Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

Which Financing Option Is Better

Between the two financing options for used cars, it can be tough to come up with an exact response to a question that so many drivers have. Each option has its upsides and downsides and everyone has a preference as to the way they choose to go about paying off their loans. The choice really depends on your own financial situation. If youve got a credit score thats less than favorable, chances are youll have an easier time getting financing through a dealership. If your credit is favorable and your income is solid, maybe your bank will give you good a deal. Then again, whatever good deals offered by banks or car dealerships can simply be the convincing tactics of the most charming salesperson.

Rating of 4/5 based on 33 votes.

You May Like: Loan License In California

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Where To Find The Best Auto Loan Rates

The table below shows the lenders that offer the lowest auto loan rates. However, just because a loan provider offers low APRs does not mean everyone is eligible for that rate. Loan terms vary by individual, and there is no single best lender for all drivers.

Some lenders, like PenFed, offer car buying services. This means you can shop for a car and finance it in one place. Also, some lenders offer both purchase and refinancing loans, while others will offer either one or the other.

Best Auto Loan Rates| Varies by lender |

Drivers with poor credit are unlikely to be eligible for the interest rates noted in the table above. If you have poor credit, try comparing offers from multiple lenders using a site such as AutoCreditExpress.com. This site also specializes in finding loans for borrowers with bad credit, so if you have trouble finding auto loan offers, its worth checking.

When comparing loans, be sure to only submit applications to auto lenders that allow you to prequalify without a hard credit check. Hard credit checks can hurt your credit score even further. A good first step is to use an auto loan calculator to predict what your payment and total loan cost would be.

Recommended Reading: Usaa Car Loans Review

How To Get A Better Auto Loan Interest Rate

Auto loan rates are not set in stone. Since there are so many different factors at play when it comes to your loan being calculated, you can make decisions that will help you get the lowest rate. This will help you pay less for a car in the long run and ultimately get a better deal.

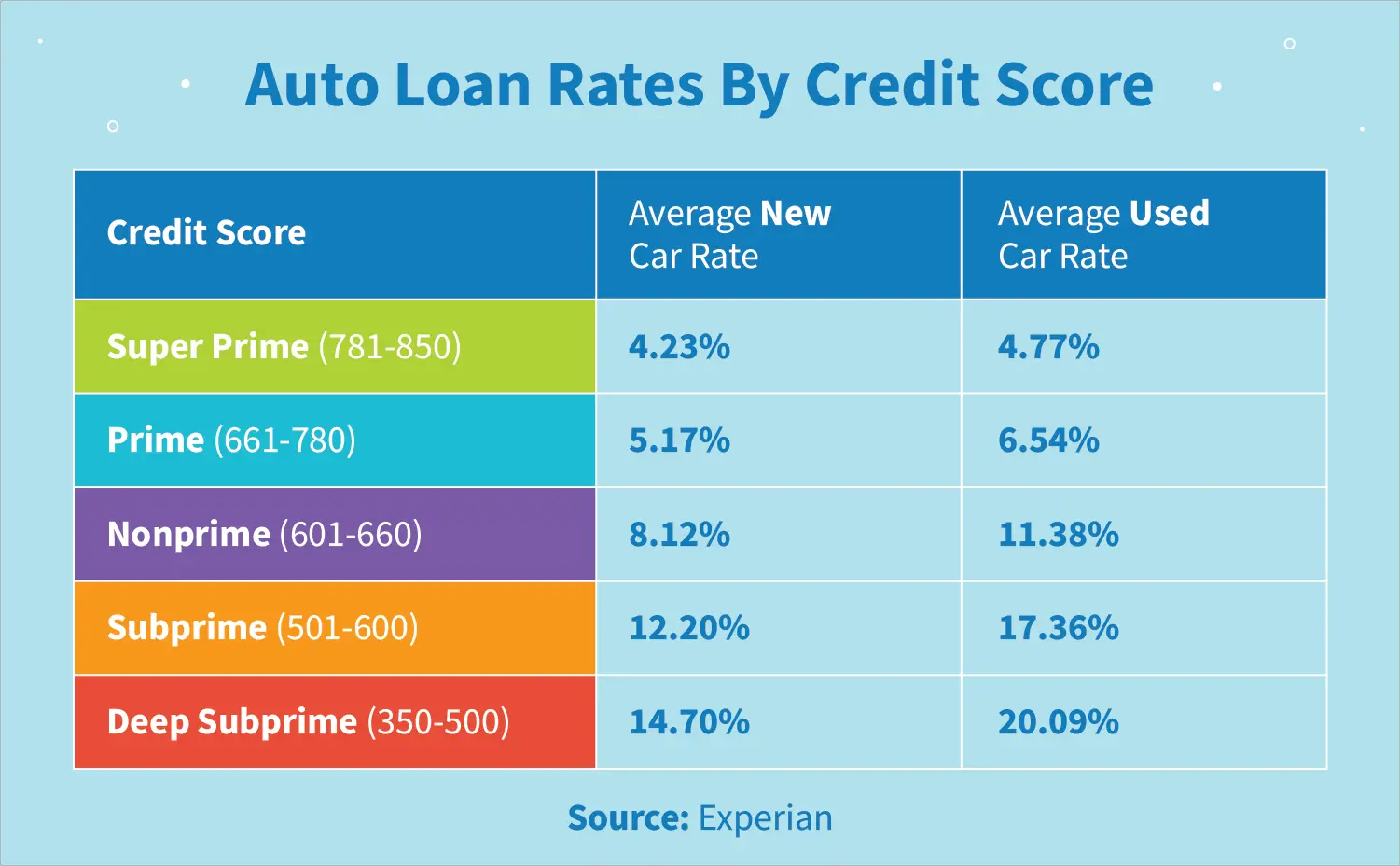

Increase Your Credit Score:The best way to get a better car loan interest rate is to increase your FICO and Experian credit score. It may take some time to do, but by working on your score, you can end up paying much less for a car by the time the whole thing is paid off. There are many different ways to increase your score if you have bad credit. These include paying bills on time, using less than 30 percent of your credit limit, increasing your credit history, and taking care of delinquencies.

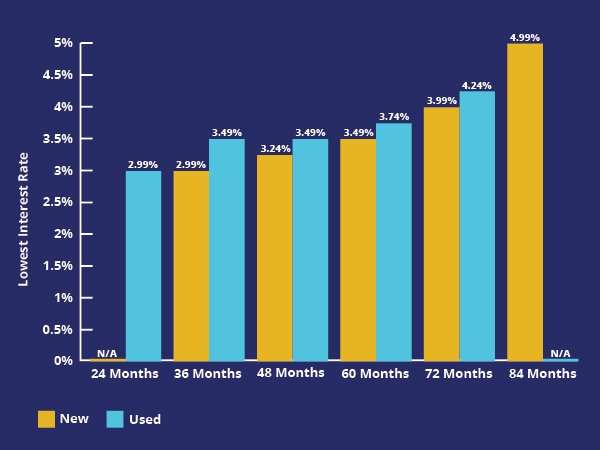

Buy New:You will almost always get low rates when buying a new car. It may seem that buying used is cheaper upfront, but once you factor in a higher APR and potential repair costs, the true cost may end up being more than purchasing a new car. Always figure out what your final price will be on a vehicle before deciding to buy used. You may be surprised to find that a new car ends up being cheaper when all is said and done.

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. Each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Read Also: Mlo Average Salary

How Do You Get A Better Rate For A Car Loan

There are many ways for you to influence your chance of getting a better rate. Lets take a look at a few of them:

Improve Your Credit Score Before Applying

Improving your credit score doesnt happen overnight. Over time, you need to show that you are responsible with your debts. This includes making your credit card payments on time and keeping the balance within 30% of your limit and building a diverse but manageable combination of debt. For more information about improving your credit score, check out Loans Canadas article on Improving Your Credit Score.

Increase Down Payment

No-money-down car loans may seem like a great deal, especially if you have trouble saving however, this route can almost certainly guarantee you a higher interest rate. Consider waiting a little longer before purchasing your car so that you have a sizeable down payment. Experts recommend at least 20%.

Get A Co-signer

Compare, Research, and Consider Pre-Approval

If you want to be prepared and well informed about the different deals and interest rates available to you, you might want to consider pre-approval for a loan. Dont worry a pre-approval wont damage your credit score. On the contrary, they can actually be quite helpful in helping you assess what youre eligible for. Furthermore, being able to compare rates with loans you are pre-approved for gives you more knowledge and in turn more power in negotiating a rate with a dealership.

Negotiate

What Should A Used Vehicle Interest Rate Be

Are you shopping for a new or new-to-you vehicle and are wondering if the interest rates offered to you are any good? You wouldnt be the first to notice that used cars dont come with the ultra-low promotional offers that are frequently advertised for new vehicle purchases. You shouldnt expect to see a 0% financing rate when purchasing a new car. But what should used vehicle interest rates be and how can you know you have found the best possible rate available for you?

At Autorama, we are passionate about helping you drive a car you love. We are here to help you understand used vehicle interest rates and what factors may influence the rate you would qualify for. We believe there is a car and financing option uniquely suited to your needs. Learn more about auto financing below or apply for auto financing online to get an idea of what you may qualify for. Have more questions? Dont hesitate to reach out to a member of our expert sales team.

Recommended Reading: Capitalone Com Auto Pre Approval

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it’s important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

Best Big Bank Lender: Capital One

Capital One

Capital One gives car shoppers the peace of mind of working with a major secure lender, placing it in the top spot as the best big bank lender.

-

Pre-qualify with a soft credit check

-

Big bank lender provides security

-

Must contact dealer directly to confirm vehicle is in stock

-

Loans only available through the lenders network of dealers

Understandably, some people aren’t as comfortable using lesser-known or niche lenders for something as crucial as an auto loan. If you want the backing of a major financial institution with a household name, Capital One may be your best bet. If you’re in the market for a new or used car, you can submit a request to get pre-qualified for auto financing through the bank’s Auto Navigator program. This early step does not affect your credit since it is a soft pull.

The pre-qualification is then valid at more than 12,000 dealers throughout the nation, each of which you can find on Capital One’s website. Just present the qualification note at a participating dealership and begin the full application process once you find the perfect ride.

Don’t Miss: Refinance My Fha Loan

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

- 2.99% to 24.99%

- Minimum loan amount: $4,000

Using a soft pull on your credit, LendingClub allows borrowers to compare refinancing options instantly.

-

Easily compare refinance rates online

-

Pre-qualify with a soft credit check

-

No origination fees or prepayment penalties

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto-loan refinancing. If you’re looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that won’t change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy, and you won’t pay an origination fee for your loan. Sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether you’re sure you want to refinance or just seeing what’s out there, LendingClub is a great option.

Car Loan Emi Calculator

If you wish to calculate the monthly payments, you can use the car loan EMI calculator offered by BankBazaar. Apart from being easy to use, the calculator helps in saving time as well. Details such as the rate of interest, loan amount, processing fee, and repayment tenure must be entered to calculate the EMI. The details will be displayed almost immediately.

Recommended Reading: Credit Score Needed For Usaa Auto Loan

Understand Your Fico Score

This has a huge impact on whether you will get approved and what your auto loans interest rate will be. Fico scores are credit calculations or scores used by numerous lenders to assess your creditworthiness.

The fico credit score range is usually believed to be between 300 and 850, with higher numbers indicating stronger credit. Raising your fico score will help you not only receive the best auto loan rates but also save you thousands on the entire cost of the vehicle.

Best For Used Cars: Chase Auto

Chase

Chase Auto offers the security of a stable financial institution with competitive rates, high loan amounts, and a concierge car-buying program that makes it easy to get the best rates and financing options for a used car.

-

Pre-qualify with a soft credit pull

-

Car-buying and car-management services

-

0.25% discount for Chase Private Clients

-

Must finance from a Chase network dealer

-

New application needed when switching dealers

Chase Auto is the car financing arm of J.P. Morgan Chase & Co., the largest bank by assets in the U.S., and allows users to shop for, finance, and manage their vehicle all from one account.

Although Chase Auto doesnt list rates online, it has a calculator that will allow you to get an idea of your potential rate. Chase also offers generous loan amounts ranging from $4,000 to $600,000 and 12 to 84 months flexible repayment terms.

Chase Auto doesnt require you to make a down payment for a loan, though putting money down can reduce the total amount you need to borrow and your monthly payments. You can also get a 0.25% interest rate discount as a Chase Private Client, which requires you to have a minimum average daily balance of $150,000 in qualifying personal, business, and investment accounts or a Chase Platinum Business Checking account.

You May Like: Www Capitalone Com Auto Pre Approval

A Line Of Credit To Help Conquer Your Goals

Get convenient access to cash and only pay interest on the funds you use. Enjoy this low introductory rate, equal to CIBC Prime currently at RDS%rate.PRIME.Published%, until July 22, 2022.

All fixed and variable rate loans are based on the CIBC Current Prime Rate.1

Rates as of RDS%SYSTEM_DATE%

| Loans | |

|---|---|

|

Your choice of term, payment frequency and fixed or variable interest rate. |

1 to 5 years |

|

Get terms up to eight years, with the possibility of no down payment. |

1 to 8 years |

|

Borrow $5,000 to $50,000 to take advantage of unused RRSP contribution room. |

1 to 10 years |

|

Get a lower interest rate by using the equity in your home |

Open ended |

|

Get flexible access to funds at interest rates lower than most credit cards. |

Open ended |

|

Borrow up to $40,000 to help with your post-secondary education costs. |

Open ended |

|

Borrow up to $350,000 to help cover costs. |

Open ended |

Financing Through A Bank

The first option for financing a used car is as close to home as you can get, acquiring a loan through a bank. While you might be thinking of choosing the bank youre currently with, know that different banks will offer different rates, so it can be beneficial to shop around a bit before making your decision. Even if your bank doesnt offer a reasonable enough rate for a used car loan, you can always get financing through a separate banking institution or credit union.

The Advantages of Bank Financing

The Disadvantages of Bank Financing

- Because of the depreciation in value that used cars will have, banks are more wary about offering to finance used cars. While the value of a new car also has the tendency to depreciate, banks tend to grant loans for them with less apprehension.

- Banks have stricter rules and regulations for their lending process than dealerships will. So, banks require their borrowers to have favorable credit before granting them a car loan, even if its for a used vehicle. So, if you have bad credit, dealership financing will be the easier option.

- Since their regulations are more strict, they likely wont be open to changing their interest rates at all. What you see is what you get.

- You wont necessarily receive your loan right away, since the approval process takes several business days to go through, no matter how good your credit happens to be. When you get dealership financing, you can buy your car and drive it off the lot within the same day.

Read Also: Auto Refinance Calculator Usaa