What If Ive Been Declined By Affirm In The Past

When you apply to pay over time, Affirm takes into account a number of factors, which can change, depending on when you apply and where youre shopping. So you may still be able to pay over time at Amazon using financing provided by Affirm, even if you had an application that wasnt approved in the past. Checking your eligibility wont affect your credit score.

Who Can Affirm Monthly Payments Be A Good Option For

Affirm can be a good option for those who need to make a large purchase and have the finances in place to make monthly payments to cover this. It can allow purchase and receipt of the item sooner than if you save for it.

It is also a possible option for those who dont have credit cards. Furthermore, it may be easier to obtain a purchase loan than a credit card, so is an option for those with worse credit history.

But you should consider your circumstances before taking out such a loan. If you already have significant debt, and do not have finances to cover payments, taking out another loan may not be a good idea.

An installment loan needs regular payments and if you are not good at managing this you can get into difficulty.

Reasons To Buy Flights With Affirm

Alternative Payment MethodsHow to get cheap airfares and the myths surrounding it is as hot of a topic as its ever been. And while weve given our own thoughts on the subject, even the most tried and tested methods still have a fair bit of ambiguity surrounding them.

We at Alternative Airlines believe that your efforts are much better aimed at how you pay, rather than what you pay. Thats why weve partnered with Affirm and given qualified US residents the ability to buy their flight tickets on finance and spread the cost of them over short amount of time or in monthly installments. Paying back the cost of your flight in smaller monthly payments can make air travel so much more affordable than paying the total price upfront.

Whether itâs to make 4 interest payments for smaller purchases or longer term loans, you have the flexibility.

Heres 14 reasons why you should buy flights using Affirm with Alternative Airlines.

Alternative Airlines Managing Director, Sam Argyle, meets Affirm

Recommended Reading: How Much Car Can I Afford Based On Income

Does Affirm Perform A Credit Check

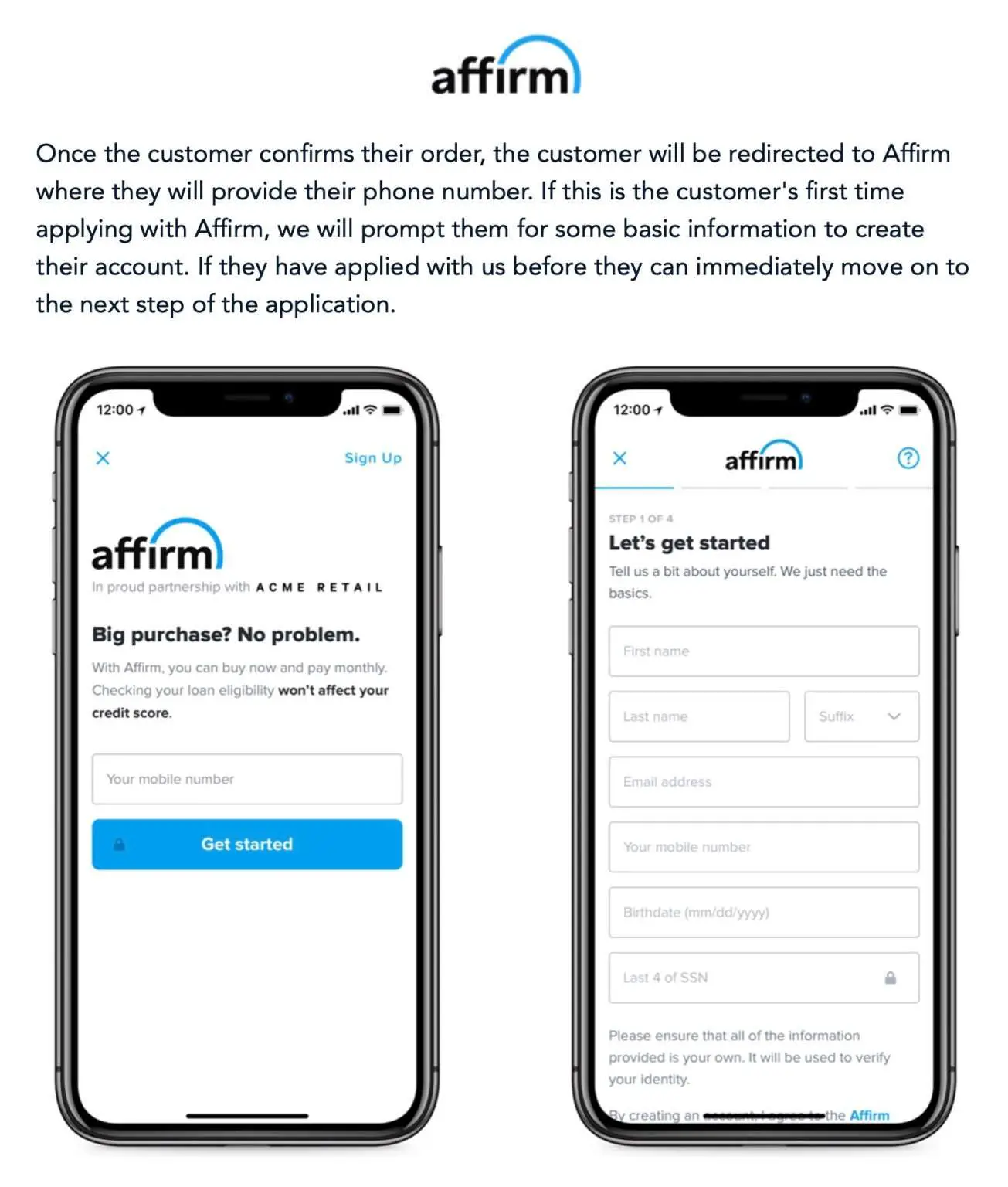

Yes, when you first create an Affirm account, we perform a soft credit check to help verify your identity and determine your eligibility for financing. This soft credit check should not have an effect on your credit score. If you choose to confirm a financing offer, we will perform a hard credit check when a merchant processes your order. This hard credit check will have some effect on your credit score.

Affirm will not perform another hard credit check unless you confirm another financing offer more than one year after your first Affirm loan.

Also Check: Veteran Loans For Mobile Homes

Affirm Reviews: Is An Affirm Loan The Best Choice For You

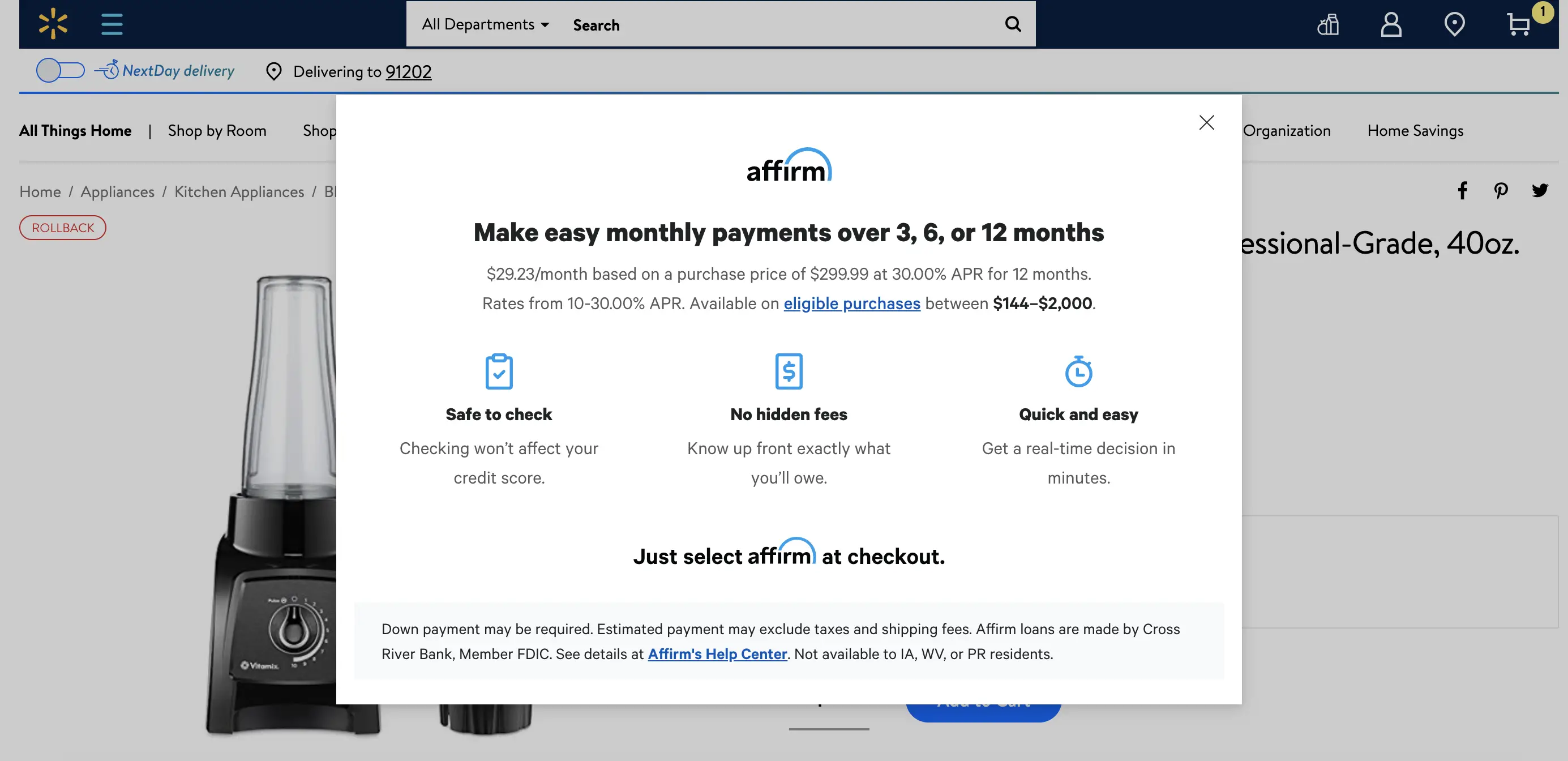

Affirm is a service that offers loans for online and in-store purchases. It provides short-term loan options at checkout with many retail partners.

This can make a larger purchase more affordable by spreading the cost.

Before you use Affirm, its worth reading some Affirm reviews to make sure you understand the interest rate and payment terms offered.

Don’t Miss: How Much Do Loan Officers Make In Commission

How Is Interest On An Affirm Loan Calculated

Affirm calculates the annual percentage rate of a loan using simple interest, which equals the rate multiplied by the loan amount and by the number of months the loan is outstanding.

This model differs from compound interest, in which the interest expense is calculated on the loan amount and the accumulated interest on the loan from previous periods. Think about compound interest as âinterest on interest,â which can increase the loan amount. Credit cards, for example, use compound interest to calculate the interest expense on outstanding credit card debt.

Affirm Personal Loans Review

With an Affirm personal loan, you can buy now and pay for purchases over time with fixed monthly payments.

Edited byAshley HarrisonUpdated October 14, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as âCredible.â

Best if:

- You dont have access to credit cards

- You need to make a purchase, but dont have enough money saved

While going into debt is never ideal, there are times when you have to make a purchase before you have the money saved. If you dont have a credit card or dont have the credit to qualify for a low-interest personal loan, theres another alternative: Affirm personal loans.

With Affirm, you can take out a personal loan to cover purchases at major retailers like Walmart and Rooms To Go. But Affirm isnt for everyone. While Affirm reviews often focus on its convenience, you should be aware of its interest rates and other drawbacks like a potentially negative impact on your credit before making a purchase.

Heres what you should know before taking out a loan with Affirm:

Recommended Reading: Nerdwallet Loan Calculator

What Happens If You Dont Pay Affirm

We donât charge late fees. Even so, partial payments or late payments may hurt your credit score or your chances of getting another loan with us. After you schedule a payment, weâll continue sending reminders by email and text message until any remaining balance is settled, but you wonât receive calls about your loan.

You May Like: Usaa Auto Refi Rates

Making Payments & Refunds

How do I make my payments?

Before each payment is due, Affirm sends you an email or SMS reminder with the installment amount that is coming due and the due date. You have the option to sign up for autopay, so you don’t risk missing a payment.

Follow these steps to make a payment:

1. Go to www.affirm.com/account. 2. Enter your mobile phone number. Affirm sends a personalized security PIN to your phone. 3. Enter this security PIN into the form on the next page and click Sign in. 4. After you sign in, a list of your loans appears, with payments that are coming due. Click the loan payment you would like to make. 5. Make a payment using a debit card or ACH bank transfer.

If I return an item, how do refunds work?

A refund posts to your Affirm account if we process your refund request. In the event that we issue you store credit instead of a refund, you are still responsible for paying off your Affirm loan.

If you have already made loan payments or a down payment, Affirm issues a refund credit to the bank account or debit card that you used to make the payments.

Paid intetest

We do not refund any paid interest.

How long does it take to get my money back in the event of a return?

A refund credit appears in your account within three to ten business days, depending on your bank’s processing time.

Can I amend my order after my purchase has been processed? Can I be approved for a higher loan amount if my purchase amount increases?

Am I able to obtain a refund after my purchase?

Also Check: Capital One/auto Pre Approval

Affirm Fees And Payment Plans

Affirm does not charge any application or ongoing loan fees. It also does not charge fees to make overpayments or for missed payments .

The only additional payment is the interest payment, based on the payment plan chosen. For some merchants, you may be offered a 0% APR so you only repay the total purchase price.

Other offers will have an APR between 10% and 30%. Terms offered can vary from 1 to 48 months although most plans are 3, 6, or 12 months. Your offer will depend on the merchant, the purchase price, and your credit check results. Down payment may also be required for some purchases.

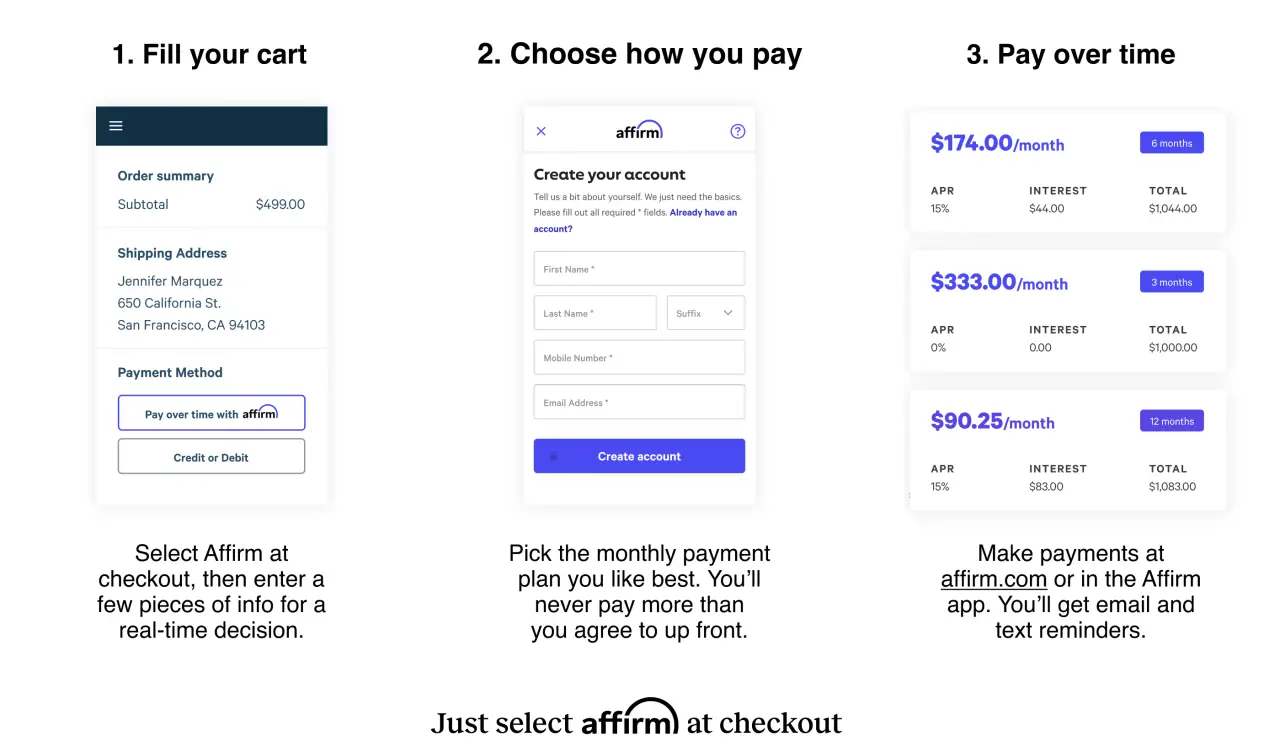

The following is an example of the repayments for a $500 purchase, with an APR of 15%:

| Term length |

|---|

| $541.80 |

How To Use Affirm In Stores

If you’d like to use Affirm in-store, you can do so with an Affirm virtual card. When you’re approved for buy now, pay later with Affirm, you can choose to have the amount loaded onto a virtual Visa card that works just like a credit or debit card for making purchases. To use your card in-store, you can access it from the Affirm app or link it to .

You May Like: Do Underwriters Verify Bank Statements

Financing A Purchase With Affirm

To show you what to expect when you use Affirm to finance your purchase, I created an Affirm account. Then I purchased two Adidas products, which I paid for with Affirm.

Let me walk you through what I did.

From my account on Affirm.com, I clicked on the featured Adidas page on the home page.

Selecting any of the three Shop now buttons on the featured page will send you to the Adidas.com store. You can still get to the store via web search.

I selected my order, confirmed my details on the Adidas.com checkout page, and clicked on Review and Pay to get to the payment.

Depending on the order and vendor, youd get the option of three, six, or twelve monthly payments.

I selected the 3 Interest-Free Payments by Affirm option available for my order, which brought up the Affirm login screen.

The goal here is to enter your number, confirm its you by entering the verification code sent to your phone. Once you enter that, you go through an easy application to get financed.

Prequalify for an Affirm loan to make this process faster.

The Financing Options Offered By This Leader In The Buy Now Pay Later Field

Buy now, pay later is a financing method that more Americans are using to make discretionary purchases, especially online ones. In fact, at least 39% of consumers have tried this option, also known as a point of sale installment loan, at least once, according to a 2021 survey from the Strawhecker Group. One of the biggest players in this fast-growing financing field is Affirm .

Established in 2012 by CEO Max Levchin, who co-founded the company that eventually became PayPal, Affirm trades on Nasdaqit went public in January 2021and has a market capitalization of $13.9 billion.

Affirm purports to offer a new spin on consumer financing: helping people afford to buy the things they want without getting into unmanageable debt. Here’s a closer look at how Affirm works and the pros and cons of its short-term installment loan arrangements.

Don’t Miss: Drb Refinance Reviews

Other Installment Plan Services

If you are looking for a payment plan solution, there are plenty of services to choose from beyond Affirm. If you have an American Express credit card, for example, you can take advantage of Pay it Plan it® the issuers own solution for paying off large purchases over time. Beyond this offering, plenty of third-party services have popped up over the last few years, each with its own unique benefits.

- Pay in four equal installments, spread over six weeks

- Zero interest and no fees when you pay on time

- 25% of the balance is due at the time of purchase

Customer Service And Support

Affirm encourages the use of their help page for getting support than their elusive customer care. Without a Live chat option, you can only get customer care by emailing or calling 855-423-3729.

To their credit, calls to this number are toll-free, the help page is exhaustive, and they claim to have a team on standby all days of the week. But, their response time needs optimizing.

Our rating: 3/5

Read Also: Usaa Auto Interest Rates

Can You Get Affirm If You Dont Have A Credit Card

You don’t necessarily need to have a credit card to use Affirm. If you don’t have a credit card and Affirm didn’t approve your loan application, it’s not necessarily because of the card. Having a thin credit file, poor credit, or not meeting any individual requirements set by the merchant you’re trying to finance a purchase with could all have contributed.

Is The Affirm Card A Virtual Card

The Affirm Card is a debit card that can be used in-person and online. As of this writing, it is unclear whether Affirm will also offer virtual debit cards to increase the security of your online purchases. Well have to wait and see whether an Affirm virtual card becomes part of the Affirm Card package.

Recommended Reading: Capital One Auto Loan Private Seller

The Affirm Mobile App

The Affirm app lets you manage your account and payments on the go. The app also lets you buy now and pay over time for new purchasesalmost anywhere online and in select stores. Just request an Affirm virtual card and use it to make your purchase.

Choose a store where you want to use Affirm, and enter the amount of your purchase. Round up to the nearest dollar, including taxes and shipping, and get a real-time credit decision. Choose your monthly payment plan and well instantly put the funds for your purchase on a one-time-use virtual card you can use at the store of your choice. Then, make simple monthly payments to Affirm.

Affirm one-time-use virtual cards can be used almost anywhere online and in select stores. Just enter the card number at checkout, along with your own name and billing address.

When you use a virtual card in stores, just show the card to the salesperson, tell them that youre paying with MasterCard, and ask them to key in the number just like a credit card.

The virtual card will expire 24 hours after issue. If the card expires before you use it, your Affirm loan will be canceled and you wont owe anything. You can always come back and request a new virtual card.

What Happens If You Pay Off Affirm Early

Affirmpaying off yourearlyif you pay off youryoupayyoupayoffyour AffirmPayment

For good measure, is affirm bad for your credit?

Impact to your credit: Creating an Affirm account, pre-qualifying and applying for a loan will not affect your credit score. However, proceeding with an Affirm loan may impact your score, since the company reports most of its loans and payments to the credit bureau Experian.

Then, can I pay affirm in full? And that could set you back hundreds of dollars, depending on the interest rate. Hynds said Affirm performed a soft credit check to see if she qualified for the 0% loan. … It’s always safer to just pay it in full, either using your debit card or if you pay off your each month, says Saunders.

In addition, can you reschedule an affirm payment?

Unfortunately, we can‘t change your due date each month or offer you more time to pay. However, you can make automatic payments on a date of your choice if you turn on AutoPay.

What is the catch with affirm?

You won’t get approved if you don’t have good credit You’ll need to have a good credit score to qualify for an Affirm loan. You may have to pay a downpayment For some borrowers, Affirm asks for a down payment that must be paid during purchase. This can be anywhere from 10% – 50% of the cost of the item.

16 Related Questions Answered

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

Why Does Affirm Need My Ssn

How does Affirm approve borrowers for loans? Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number. Affirm verifies your identity with this information and makes an instant loan decision.

Read Also: Usaa Used Car Loan Rate

Who Is Affirm Best Suited For

Affirm runs a flexible loan application process, which they claim does not consider your credit score or credit history. Any shopper who meets the requirement to create an Affirm account could be eligible for a loan at the vendors point of sale.

However, according to a report by CNBC Make It, POS loan options can harm your credit if not planned cautiously.

So, Affirm is the right financing option for you if you answer yes to any of the following:

- Do you have a low credit score?

- Are you new to credit?

- Can you set a suitable repayment plan? Or

- Do you need to make large purchases but cant pay your balance?

Then this solution might just be right for you.

Don’t Miss: Refinance Student Loans Usaa

Terms And Apy: What Does Affirm Offer

If you do qualify, its important to read the fine print before you accept. Again, Affirm loans can range from 0 to 30% interest, and from one to 48 months, though most often, the terms are three, six or 12 months. Its important that you understand the specifics before accepting.

Some merchants offer 0% APY for a limited time or for qualified purchases. According to CNBC, Affirm says about 43% of its loans offer 0% APY.

The merchant, your credit score and the amount you request all impact your interest rate, the terms and even whether you need to make an immediate payment . Affirm sometimes requires an initial deposit of up to 50%.

Youll click Confirm Loan to accept the companys offer. Your first payment typically will be due within 14 or 30 days of your initial confirmation.

You can pay with a debit card, check or via your bank account. Its possible to set up automated payments. Affirm will send you text message or email reminders about your upcoming payments.

According to CreditCards.com, the average interest rate on a credit card in the United States was 16.22% as of Sept. 15, 2021. So your interest could be 0%, or it could be much higher than what an average credit card offers.

Theres no penalty for paying off an Affirm loan early. Remember that the longer your term extends, the more interest youll ultimately pay. If youve ever bought a car, youre probably familiar with the sales tactic where your monthly payments are lower, but you pay for longer.