Pros And Cons Of Capital One Auto Finance

A prequalification that doesnt involve a hard credit pull is a nice perk, but that prequalification offer is only good at participating dealers. Youll have to look elsewhere for financing if youre searching for a private party auto loan. Here are other areas where Capital One auto loans stand out or fall short.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

What Does Auto Navigator Show

Auto Navigator clearly shows various specifications of vehicles like the model, mileage, kilometers covered, etc. from its inventory. It also indicates payment options so that you can plan your expenses and savings accordingly before deciding to buy your dream car. It shows monthly payment amount, APR, and other personal terms so that there is transparency in the selected offer.

Recommended Reading: Va Manufactured Home Loan Requirements

Is Capital One Right For You

Our Auto Navigator tool does a soft credit check for pre-qualification. The tool allows you to check even on minor finance details if you are buying on a tight budget. Remember, we provide loans to those who want to build their credit score. We offer a handy loan calculator if you’re going to check numbers before applying for pre-qualification. Our network of dealers is from all states except Alaska and Hawaii, with millions of cars in our inventory.

Should You Get An Auto Loan Through Capital One

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Read Also: How Do I Find Out My Auto Loan Account Number

Current Auto Loan Rates For 2021

Auto loans are secured loans that help borrowers pay for a new or used car. They are available from dealerships and a variety of lenders, so it’s important to shop around in order to find the best interest rates and terms for your vehicle. The lenders profiled on this page are a great place to start.

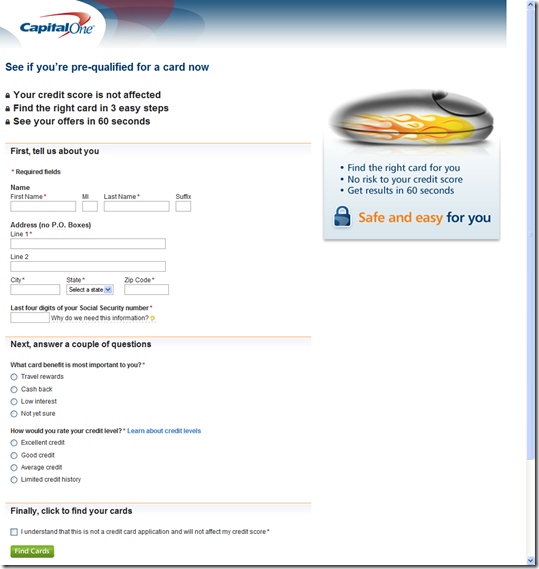

Choose The Right Card For You

From blackout-free travel to super-modern bistro-banks, there are many great reasons to apply for a Capital One credit card. Not to mention the companys longstanding reputation among credit card issuers and the fact that it is one of the largest issuers in the world. While it can be nerve-wracking to see the message that your application needs further review, a pending application is better than an instant denial.

Many people have reported being approved after calling their issuer to provide missing information or otherwise clarify or verify application data. If you do end up being denied for the Capital One card you were after, changing issuers might be all you need to successfully qualify for a great card. Whichever route you take, always compare your credit options to ensure you get the best terms and options that fit your personal spending habits.

Read Also: Usaa Refinancing Car Loan

If Your Application Is Denied Try These Alternatives

No matter how you get the news, finding out your Capital One application was denied can be disappointing and, sometimes, a shock. It isnt always those with poor credit who are denied a Capital One credit card, either. If your credit history is good but not very long, you may be denied a Capital One card. Some applicants also report being denied for submitting more than three Capital One credit card applications within a 30-day period.

Whatever the case, your best bet may be to try getting credit from another issuer entirely, as each credit card issuer has its own standards for extending credit. If you are concerned about your approval chances and want to avoid a futile hard credit pull, check to see if you pre-qualify before applying. No matter what type of credit you have or dont have, for those just starting out there is likely a credit card designed for you. See our top-rated cards below to start your search.

Alternatives For No Or Limited Credit

Anyone who has tried to start a new career is probably familiar with the common Catch-22 of, you need experience to get a job, and a job to get experience. A similar truth exists in finance: you need credit to get credit. To starting building your credit history, you need to establish some kind of credit and to qualify for most types of credit, you need to have an established credit history. Luckily, issuers are not unsympathetic to the plight of the creditless a number of options exist for those who are just starting on their credit journey.

+See More Cards for Limited Credit

Also Check: Refinancing Car Loan Usaa

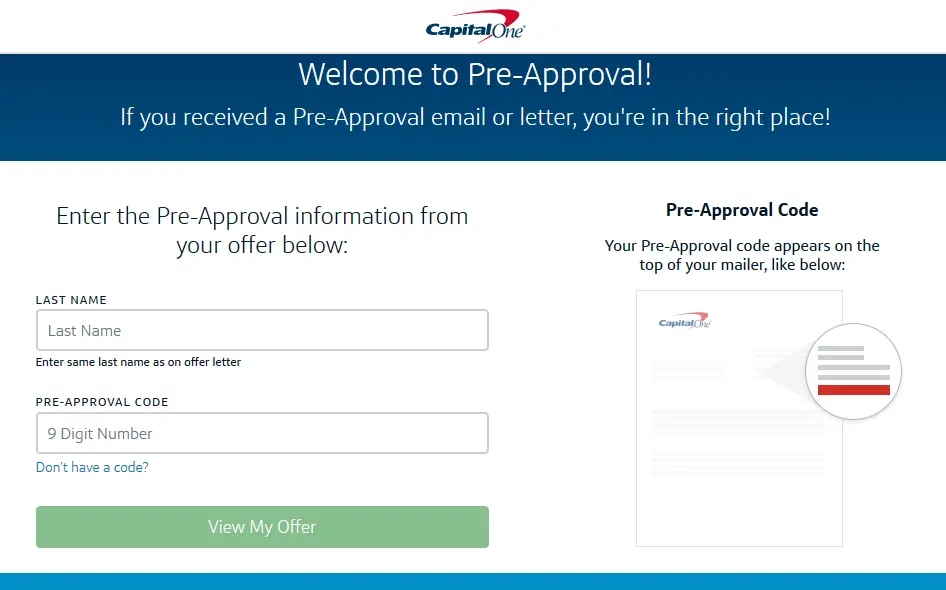

Heres How To Check For Capital One Pre Approval Online:

After a few seconds, you should see the Capital One credit cards that youre pre-approved for, if any. And youll be able to apply for one of them right away, if you wish. Capital One offers credit cards to people of all credit levels. So the odds are good that youll come away with at least one Capital One pre-approved credit card offer.

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

Also Check: How Much Car Loan Can I Afford Calculator

Easy Online Application For Pre

Shopping around for an auto loan and comparing offers is the best way to know that you’re getting a good deal. With Capital One, it’s easy to pre-qualify online and walk into a dealership with an idea of what you might pay.

If you pre-qualify in advance, you have more bargaining power with the dealership when it comes to talking interest rates. The interest rate on your auto loan is negotiable, and you could use your pre-qualification offer to beat an offer or be confident that you’ve got the best deal.

Types Of Auto Loans Available Through Capital One Auto Finance

Capital One provides auto financing for both new and used vehicles that you can use only at participating dealerships. While choosing from a participating dealer can limit your car-shopping choices, Capital Ones network consists of 12,000 dealerships nationwide. You can find a participating dealership online.

You can easily get pre-qualified for a new or used car loan with Capital Ones Auto Navigator. The process takes just a few minutes, and you dont need to have already identified the vehicle you want to buy.

Instead, you just need to have an idea of how much youll want to borrow. If youre approved, your pre-qualification letter can help you to bargain with a dealership. Plus, since theres no hard credit inquiry required upfront, getting pre-qualified with Capital One can be a great option when youre comparison shopping for the best auto loans.

Recommended Reading: How To Transfer Car Loan To Another Person

Capital One Car Loans Q& a

Get answers to your questions about Capital One Car Loans below. For more general questions, visit our Answers section.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

Capital One Auto Navigator

Rather than speculate on whether you could be approved for an auto loan, you could prequalify online with the Capital One Auto Navigator program. You could also apply for a Capital One auto loan at one of its participating 12,000 dealership partners search the directory here.

No matter how you apply, you will need to meet the following criteria:

- Be 18 years or older.

- Have a valid address in 48 states, excluding Alaska and Hawaii.

- Earn a minimum monthly income of $1,500 to $1,800, depending on your credit qualifications.

Read Also: What Bank Has The Lowest Home Equity Loan Rates

Capital One Rates Fees And Terms

Capital One rates start at 3.99% APR for borrowers with excellent credit. However the rate you get can be affected by factors such as your credit score, credit history, debt-to-income ratio as well as the type of car you choose. It isnt clear what fees you could be charged or the maximum APR it offers.

But unlike many lenders, its upfront about the amount you can borrow. You can finance as little as $4,000 through Capital One, and loan terms last anywhere from 36 to 72 months.

Capital One Auto Loan Application Process

The first step to getting a Capital One auto loan is to apply for preapproval. This can be done online and requires you to complete a brief questionnaire about your vehicle, income, and housing situation.

After pre-qualifying, you will be given loan offer details like APRs, monthly payment amounts, and even a list of for-sale vehicles from participating dealerships. Capital One does not run a hard check on your credit report during the prequalification process, meaning that you can see your loan offers without potentially lowering your credit score.

The company does, however, run a hard credit check if you choose to claim your Capital One auto loan offer. In addition to the credit check, you will need to supply the following documents before your loan is confirmed:

- Proof of income

- Proof of employment

- Vehicle title

It is possible that your final Capital One auto loan terms will differ slightly from those offered during preapproval.

Also Check: What Is The Maximum Fha Loan Amount In Texas

What Could Capital One Auto Navigator Do Better

Capital One Auto Navigator places some restrictions on the vehicles that you can buy. For example, it has a maximum and a minimum loan amount, only finances cars, SUVs, minivans, and light trucks, and certain makes and models are not eligible. You also need to have decent credit to qualify for a loan, so if youre looking for a lender that will work with people with poor credit.

You also need to work with a dealership thats in Capital Ones network, which may limit the inventory of cars that you can see and may mean you dont get to visit a dealership that youve worked with in the past and liked.

What Is Capital One

Capital One is the eighth largest bank in the U.S. by assets. It offers personal banking products including deposit accounts, credit cards and loans, as well as small business and commercial banking products. Its auto financing arm provides loans for new and used vehicles as well as refinance loans. You could even search for cars near your location through Capital Ones website, apply for prequalification and finish up the paperwork at the dealer.

Also Check: What Credit Score Does Usaa Use For Auto Loans

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Capital One Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

A Capital One auto loan could be good for car buyers seeking to prequalify for an auto loan on a new or used car from a dealership. If youre going into the dealership without first shopping around for an auto loan, then you may be leaving money on the table. Thats because the dealership may not offer your best rate.

However, Capital One Auto Finance wont be a good fit for those interested in buying a car from a private seller or even a wider selection of dealerships than those on the Capital One network.

Recommended Reading: Can I Buy A Manufactured Home With A Va Loan

Capital One Auto Finance Application Process

While you can apply for pre-qualification online, youll need to apply for a car loan through a participating dealership. You can bring your pre-qualification letter with you to streamline this process. Remember, its good for 30 days.

When you officially apply for a car loan through a dealership, Capital One will run a hard credit inquiry and give you your official financing terms.

Best Way To Buy A Car

I had not so great credit wasnt getting approved for auto loans below 11% got pre approved and found the car I wanted. Called customer service before I went to the auto place to have everything solid. Went to buy the car, the dealer told me it was sopposed to be $71 more dollars than what capital one had said. I called cap 1 customer service back from the dealership and put them on speaker. Suddenly the dealership changed their mind and was ok with my price and payment. Dealers will always try to get money out of you. They will do it in finance. I ended up getting a loan for 6% thru capital one!

You May Like: Ussa Auto Loan

Capital One Auto Loans Credit Criteria

Capital One Auto Finance has a great full spectrum lending program and, once again, now loan to A+, A, B, C and upper level D tier credit customers.

That being said, I just recently learned that Cap One is no longer offering their prime program to dealers and only financing for lower level B tier to upper level D tier credit is applicable to car dealership financing.

One minute they are there and the next minute they’re not…Now you see it now you don’t!

As I mentioned before, Capital One auto loans are a little tricky.

Customers that fit within one of those credit tiers will need a minimum credit score of 520.

Capital One Auto Finance as eight credit tier levels:

- Tier 1 = 730+ credit scores

- Tier 2 = 660 – 729 credit scores

- Tier 3 = 660 – 729 credit scores

- Tier 4 = 660 – 729 credit scores

- Tiers 5-8 = 520 – 659 credit scores

As I mentioned before, their auto loan program is a bit confusing and hard to narrow down. They have a computer scoring system that rates each customers credit file, residence stability, work history, etc. that determines what tier they will fit into.

It’s actually kind of funny, I can talk to one of their credit analysts and oftentimes they won’t even know why a deal was declined or approved.

Typically, to get an approval, a customer would have to have five prior or current lines of credit that were fairly well paid. It appears now that a longer credit history is important to Cap One and a seven year history is preferred.