Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Federal Student Loan Repayment

Federal loan borrowers are considered to be in default once they go 270 days without making a payment. As of the first quarter of 2019, there are an estimated 5.2 million federal student loan borrowers in default. By contrast, 18.6 million borrowers are current on their federal loan payments.

As mentioned earlier, federal student loans come with certain borrower protections, including the ability to pause payments temporarily without the risk of wage garnishment or other such repercussions. Federal loan borrowers can get this relief via deferment or forbearance. With deferment, borrowers avoid accruing interest during the period in which payments arent being made. With forbearance, borrowers are still responsible for paying interest on their loans.

Furthermore, its possible to defer student loans for up to a period of three years. Forbearance, on the other hand, is a protection only offered for up to 12 months. As of the first quarter of 2019, there are an estimated 3.4 million federal student loans in deferment and another 2.7 million in forbearance.

Student Loan Repayment Status

Not everyone who takes out student loans can make good on those payments. Unfortunately, skipping payments can wreak havoc on a borrowers credit score, making it more difficult to get approved for future financing. Not only that, but those who default on their student debt risk having their wages garnished, thereby creating a serious financial hardship.

The Federal Reserve reported in 2018 that, among borrowers who took out student loans to fund their own education, 20% were behind on their payments. Those who didnt complete their degrees were the most likely to fall behind.

Don’t Miss: Which Student Loan Accrues Interest While In School

Debt From Medical School Vs Other Healthcare Fields

On average, medical school grads face higher debt loads compared to other students who graduate with advanced degrees. But debt for healthcare graduates, in general, tends to be high. To get a sense of graduate medical school debt versus different types of healthcare education debt, compare the debt loads for a variety of healthcare professions:

| Debt by Type of School; | Average Debt |

| Osteopathy; | $258,112 ; |

Medical school debt seems reasonable in comparison to other fields like dentistry and osteopathy. But if debt is something you are keen to avoid, it may be worth investigating another career, like a pharmacist or physician assistant, where graduates have less debt.

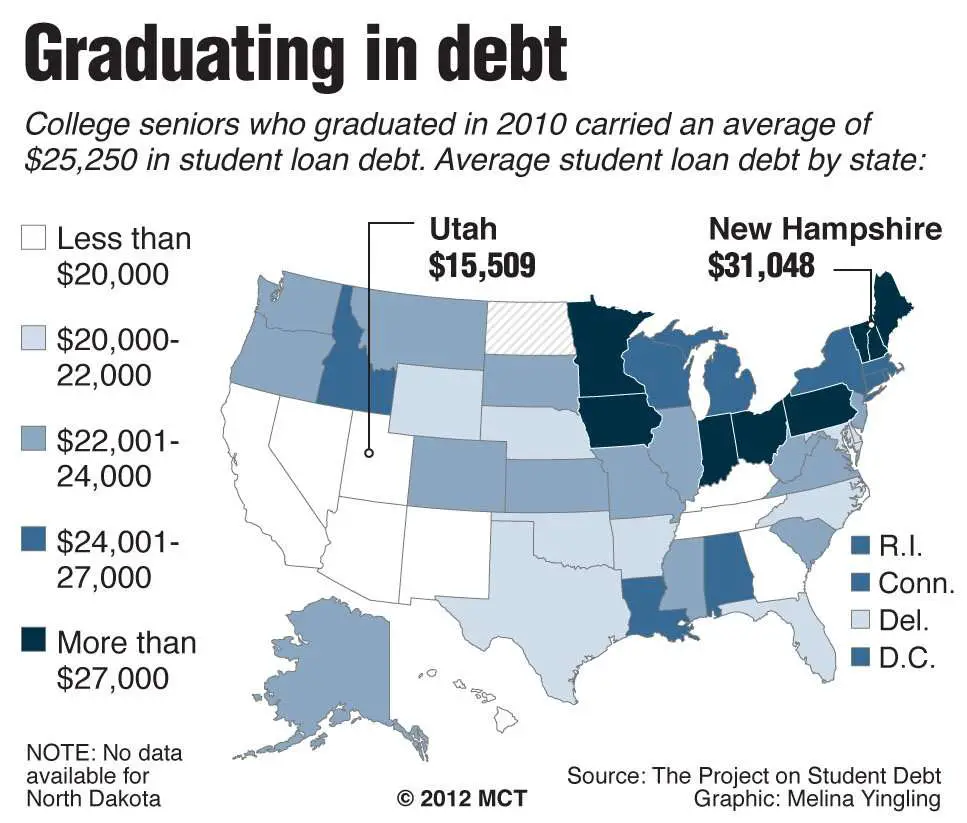

Student Debt In Perspective

Student loans help pay for tuition and fees, as well as room and board and other educational costs like textbooks. Among those who borrow, the average debt at graduation is $25,921; or $6,480;for each year of a four-year degree at a public university. Among all public university graduates, including those who didnt borrow, the average debt at graduation is $16,300.1 To put that amount of debt in perspective, consider that the average bachelors degree holder earns about $25,000 more per year than the average high school graduate.2 Bachelors degree holders make $1 million in additional earnings over their lifetime.3

Whats more, the share of student-loan borrowers income going to debt payments has stayed about the same or even declined over the past two decades.4 Although 42 percent of undergraduate students at public four-year universities graduate without any debt, a student graduating with the average amount of debt among borrowers would have a student debt payment of $269 a month.5 In recent years, most students with federal loans became eligible to enter an income-driven repayment plan for federal loans. Under such plans, students typically limit student-loan payments to 10 percent of their discretionary income. The average monthly payment was $117 for borrowers from four-year public universities in income-driven repayment plans in 2011, the most recently available data.6

Read Also: How Long Does It Take To Get Student Loan Money

Average Student Loan Debt In America: 2019 Facts & Figures

The average student debt in the United States is $32,731, while the median student loan debt amount is $17,000. With the rising costs of tuition and total student loan debt up around 302% since 2004, we decided to break down the data to get a better understanding of the different levels of student loan debt across different types of borrowers.

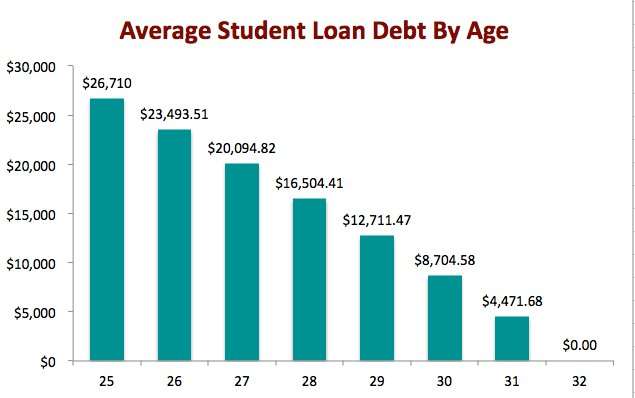

Student Loan Debts By Age

| Age group |

|---|

- 50 to 61: $42,290.32

- 62 and older: $37,739.13

It’s worth noting that, while age groups 35-to-49 and 50-to-61 have a similar average balance, the number of overall loan borrowers drastically decreases after age 49.

The;standard repayment plan;for;federal student loans is calculated on a 10-year timeline, but borrowers can choose an;income-driven repayment plan;which allows them to make smaller payments over 20 years.

In a 2019;study from New York Life, which polled 2,200 adults about their financial mistakes, the average participant reported taking 18.5 years to pay off their student loans, starting at age 26 and ending at 45.

You May Like: How Can I Refinance My Car Loan With Bad Credit

Strategically Manage Your Debt

Prioritize your highest-rate debt for repayment, even reducing payments to the minimum on the lower-rate debt so you have more cash flow for higher-rate debt. Ask your loan servicer if they offer a 0.25% interest rate deduction for automatic payments. Make voluntary payments to reduce the loans principal, if you can. Remember that a shorter repayment schedule will increase your monthly payments but decrease the total amount that must be repaid.

The Association of American Medical Colleges offers the online MedLoans Organizer and Calculator at no cost to enrolled medical students and medical school graduates. You can use the internet-based tool to upload your federal loans and run various repayment scenarios, save notes about loans, and calculate payment based on residency length.

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Don’t Miss: What Is The Best Student Loan Servicer

Student Loan Debt Statistics In : A Record $16 Trillion

Shutterstock

Student loan debt in 2020 is now about $1.56 trillion.

The latest student loan debt statistics for 2020 show how serious the student loan debt crisis has become for borrowers across all demographics and age groups. There are 45 million borrowers who collectively owe nearly $1.6 trillion in student loan debt in the U.S. Student loan debt is now the second highest consumer debt category – behind only mortgage debt – and higher than both credit cards and auto loans. The average student loan debt for members of the Class of 2018 is $29,200, a 2% increase from the prior year, according to the Institute for College Access and Success.

If you are a student loan borrower, the following student loan debt statistics can help you;make more informed decisions;regarding;student loan refinancing,;student loan consolidation,;student loan repayment;and;student loan forgiveness.

Student Loan Statistics: Overview

Total Student Loan Debt:;$1.56 trillion

Total U.S. Borrowers With Student Loan Debt:;44.7 million

Average Student Loan Debt: $32,731

Average Student Loan Payment: $393

Median Student Loan Debt: $17,000

Median Student Loan Payment: $222

Student Loan Delinquency Or Default Rate:;10.8%

Direct Loans – Cumulative In Default: $119.8 billion

Direct Loan In Forbearance:;$122.9 billion

Student Loan Forgiveness Statistics

Public Service Loan Forgiveness Statistics

As of September 30, 2019, here are the latest;public service student loan debt statistics:

Federal Student Aid

Know Your Interest Rate

Whether they’re still in college or recently graduated and starting their first job, borrowers ages 24 and younger haven’t yet seen the full effect of how interest can significantly increase their debt load.

Generally, student loans start to accrue interest daily once the loan is disbursed. An exception to this is direct subsidized federal loans, where the federal government pays the loan’s interest while the student is in college or while the loan is in deferment.

Student loans are already a sizable debt load to begin with, but balances balloon quickly when you add on daily interest.

Before you even take out a loan, look at the interest rate and calculate how much your student debt is actually costing you. Select offers a step-by-step guide on how to calculate your student loan interest payment.

Don’t Miss: What Is The Lowest Car Loan Rate

Canadians With Student Loans Owe More Than $17000 On Average: How To Manage Debt This School Season

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

Average Student Loan Debt By Race Or Ethnicity

Note: this report uses categories and terminology that conforms to data source material.

- Among Black women, the average student loan debt balance grows 13% over 12 years.

- Among black men, the average debt balance grows 11% over 12 years.

- The average federal student loan debt among Black and African American borrowers is $57,770.

- The average white student owes $30,520.

- Pacific Islander students borrow the most for postsecondary education, with each first-year, full-time student borrowing $13,262.

- Among part-time or part-year undergraduates, Asian students borrow the most at $9,223 each.

Find more detailed research in our report on Student Loan Debt by Race

Also Check: Should I Pick Variable Or Fixed Rate Student Loan

Federal Student Loan Status By Servicer

The major loan servicers handle billions of dollars of loans on behalf of the federal government. The chart above shows the status of loans managed by each entity. The nonprofit servicers have the lowest rate of loans in repayment and the lowest rate of loans in forbearance . Of the four biggest servicers, repayment and forbearance rates are as follows:

- AES-PHEAA: 67% repayment, 13% forbearance

- Great Lakes: 60% repayment, 11% forbearance

- Nelnet: 61% repayment, 8% forbearance

- Navient: 65% repayment, 12% forbearance

How Did Justin Avoid Paying Over $20000 In Student Loan Interest

Since Justin had six-figure debt, he also sought for ways to lower his interest rates. He decided to replace some of his student loans with a bank loan at a lower interest rate. He qualified for a loan at a 1.99 percent rate and used it to pay off his student loans that had an interest rate of 6.8 percent.

Don’t Miss: When Can I Apply For Second Ppp Loan

Consider Consolidating Or Refinancing Your Loans

Combining your existing loans into one is called consolidation. Consolidating your existing loans could provide a lower monthly payment and a more extended repayment period. However, you may also receive a higher interest rate, give up your grace period and other federal loan benefits, and have a longer repayment period .

If you refinance your student loans, you can lower your interest rate and thereby your payment. However, you may also forgo your grace period and other federal loan benefits, and have a longer repayment period.

With either option, make sure the benefits outweigh the federal protections you stand to lose.

Areas With The Highest And Lowest Average Student Loan Debt

Canadian Credit Karma members living in Nunavut carry the highest average student loan debt, at $25,644, according to our analysis. Thats almost $4,000 more than in Yukon, the region with the second-highest average student loan debt among members, and more than twice the average student loan debt as members in Manitoba, the region with the lowest average student loan debt.

|

Student loan debt by province/territory |

|

Province/Territory |

| $11,831 |

While it has the highest average student loan debt among Canadian Credit Karma members, theres also some good news coming out of Nunavut. On average, Credit Karma members there have paid off more of their balances than any other region except the Northwest Territories.

When it comes to the largest metro areas in Canada Toronto, Vancouver and Montreal average student loan debt is higher or about the same as the average among all Canadian Credit Karma members carrying student loan debt. Among metro cities, Toronto has the highest average student loan debt among members, at $20,809, with Vancouver only about $300 behind. Compared to the average for all members in Quebec, Montreals student loan debt among members is about $2,000 higher than that of members in the rest of the province.

|

Student loan debt by major metropolitan area |

|

Metro |

| $17,463 |

You May Like: How Long Until You Can Refinance An Fha Loan

Average Number Of Student Loans Per Borrower

Of undergraduate students who borrow federal student loans to pay for a Bachelors degree, more than 95% borrow for at least four years.

On average, 85% of undergraduate students who borrowed a subsidized Federal Direct Stafford loan also borrowed an unsubsidized subsidized Federal Direct Stafford loan, based on data from the 2015-2016 NPSAS. Likewise, 85% of undergraduate students who borrowed an unsubsidized Federal Direct Stafford loan also borrowed a subsidized Federal Direct Stafford loan.

Thus, the typical student who borrows for a Bachelors degree will graduate with 7.5 or more Federal Direct Stafford loans, including both subsidized and unsubsidized loans.

About 11% also borrow institutional or private student loans and about 6% borrow institutional or private student loans without federal student loans. That brings the average number of student loans to 8.2 loans.

Thus, the typical number of student loans at graduation with a Bachelors degree will range from 8 to 12. This does not count Federal Parent PLUS loans.

Federal Student Loan Interest Rates

| Student Loan Type | Average Student Loan Interest Rate | Current Student Loan Interest Rates |

|---|---|---|

| Direct subsidized and unsubsidized loans | Undergraduate students | |

| Parents of undergraduate students and graduate or professional students | 7.04% | 5.30% |

Federal student loan rates change each school year, and they have varied significantly over the past 15 years. On direct subsidized and unsubsidized loans for undergraduates, for example, the lowest rate of 2.75% is less than half the highest rate on these loans of 6.8%.

Don’t Miss: How To Check If Loan Is Fannie Or Freddie

How Much Does A Student Loan From 1998 Pay

Student loans from pre-1998 known as mortgage-style loans dont work like modern ones. Theyre payable over a fixed number of instalments once you start earning over a threshold, currently £30,737 a year.

History of Student Loans. The federal government began guaranteeing student loans provided by banks and non-profit lenders in 1965, creating the program that is now called the Federal Family Education Loan program. The first federal student loans, however, provided under the National Defense Education Act of 1958,

What Does The Average Student Loan Debt Mean To You

Its easy to look at a bunch of statistics about student loan debt and become discouraged or even scared. What should these mean to you?

First, student loan debt is very real and very common. Its something that affects the lives of people everywhere. If you are planning for college, you should start to get an idea of how much debt you could be facing after you graduate. Use what you know about your family finances to consider what you can afford.

Second, every graduate should have a clear plan in place before entering school. Do research on which schools or degree programs would provide the best value – rather than the best name or popularity. Maybe there is a family tradition tied to a certain school. There are hundreds of reasons a student picks a certain college. But if you think you might end up taking on too much debt, perhaps you want to rethink your college plans to target schools which will give you more financial aid or scholarships.

Its very possible to minimize the amount of student loan debt youll experience with some advance planning. Its also possible to maximize your money and get the best value by being more strategic with your college choice. Edmit helps you compare college costs with data from lots of sources, showing you what youll really pay for college based on the information you provide.

Recommended Reading: Where To Get Fast Loan Online