Fha Benefits For Seniors

FHA loans can be great for seniors because they generally offer lower interest rates, lower down payments, approve lower credit scores, and sometimes cover closing costs. Fannie Mae and Freddie Mac both offer retirement fund annuitization procedures that require lenders to divide 70% of the value of a borrower’s fund over 360 or 180 months of the loan’s terms. This could significantly boost the amount of income in the senior’s 401k account. Not all mortgage companies offer this product, so many sure you ask your loan officer if this is something available to you. The AARP website has great information about all of the special programs for seniors, click here for more info.

- No appraisal required

FHA Streamline 5/1 Adjustable Rate Refinance Mortgage:

- FHA 5/1 ARM establishes a lower initial interest rate for the first five years, then the market determines your rate

- Adjustable Rate Mortgages typically have lower interest rates than fixed rate loans

- Useful if you plan on selling your home in the near future.

Other FHA Loan Considerations

For FHA loans, typically the property being financed is to be your primary residence and the loans cant be used for investment or rental properties. However, eligible residences include semi-detached homes. townhouses, row houses, and certain condominiums.

Have more questions on FHA loans? Take a look at our FHA vs Conventionalpage.

Is There Anything I Should Know Before Considering An Fha Or Va Mortgage Loan

- Lending and down payment requirements are more flexible with FHA loans. You will be required to purchase mortgage insurance premium when you finalize your loan and pay premiums as part of your monthly payments.

- VA loans have a funding fee that you can roll into the total loan costs or pay separately. Disabled veterans are eligible for exemption from this funding fee.

- With FHA and VA loans, you have options regarding how you pay your closing costs. For example, the seller can cover up to 6 percent of the total purchase price in closing costs, or the buyer can receive all or a portion of your closing costs as a gift.

Available down payment option as low as 3.5 percent of the purchase price

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5/1 ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Cherry Creek Mortgage Best For First

Cherry Creek Mortgage, which also does business as Blue Spot Home Loans and under a few other names, lends mortgages in 33 states.

Strengths: Cherry Creek Mortgage offers several low-down payment loan programs, including Conventional 97 and HomeReady loans and FHA, VA and USDA loans. The lenders website includes educational resources for first-time homebuyers, including a free downloadable guide to homeownership.

Weaknesses: Cherry Creek Mortgage isnt available in every state, and for FHA loans, it requires a minimum 620 credit score, which is higher than what some other lenders will accept.

What Are The Other Fha Refinance Requirements And Qualifications

Below is a summary of the requirements. Note, exceptions may apply.

As an FHA borrower:

- You must maintain mortgage insurance for a minimum of 11 years.

- Your total monthly debts must be below 43% of your gross monthly income.

- Your total mortgage payment must be below 31% of your gross monthly income. Mortgage payments include property taxes, mortgage insurance, homeowners insurance and homeowners association fees . Use our mortgage refinance calculator to get an estimate of your monthly payments.

- You must show proof of steady employment or you have worked for the same employer for the past 2 years.

- You must have a loan amount below the FHA mortgage loan amount limit. This limit caries by state, county and type of property.

- You must not have declared bankruptcy within the past two years.

- You must not have been in foreclosure within the past three years.

The property must:

- Be your primary residence

- Be a single-family home, a one- to four-unit building or an FHA approved condominium, manufactured home or mobile home

- Not be an investment property

- Be appraised by an FHA-approved appraiser

- Be in good condition. The FHA requires the seller to make any needed repairs before closing. Or, you can agree to pay for the required repairs at closing.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Do I Need To Apply For An Fha Or Va Loans

- The amount you would like to borrow and monthly payments you are comfortable paying

- The number of years you want to finance your loan

- Your current employment and income information

- Your phone number and email

- Information for joint borrowers you plan to include on the mortgage loan

- A Certificate of Eligibility from the VA if applying for a VA loan. You can access this by logging in to the VA portal or asking your loan officer for assistance.

- How much home can I afford? +-

- Should I rent or buy? +-

- Which mortgage loan is a better fit for me? +-

- How much will my mortgage payments be? +-

What Is A Good Fha Interest Rate

Many factors influence the mortgage rate youre offered, from forces that are pretty much out of your control to your personal financial details. The best way to find out if youre being offered a good FHA loan interest rate is to apply with multiple lenders. That way, you can compare loan offers and determine which has the best combination of rate and fees.

Recommended Reading: How Much Commission Do Loan Officers Make

Us Department Of Veterans Affairs Loans

VA housing loans are granted specifically for active-duty military members, veterans, and eligible family members. It is also available to servicing staff in the National Guard and Reserves.

As an incentive for their service, active duty members and military veterans can get flexible, low-interest housing rates. Downpayments are also not required for this type of loan. And unlike FHA and USDA loans, it does not impose private mortgage insurance .

Qualifying for VA Housing Loans

Of course, you must be an active-duty member or a retired service member to apply for this loan. Qualified members must have a minimum credit score of 620 to obtain VA loans. As for DTI ratio, it primarily uses back-end DTI ratio for qualifying basis. Your back-end DTI should be no higher than 41 percent. Some borrowers with residual income can qualify with a higher back-end DTI.

Though theres no PMI required, qualified borrowers are charged a VA funding fee to compensate for taxpayers costs. This fee is paid upfront, in closing, or is rolled into your monthly payments. Some qualifying members may be exempted from paying it. VA funding fees vary for members you may check this VA funding fee table for full details.

VA housing loans do not charge prepayment penalties. You can keep making additional payments to pay off your mortgage early. Likewise, paying your loan early saves a significant amount of interest costs.

How Rates Have Changed For 30

Historically speaking, mortgage rates for 30-year fixed loans have been gradually declining. If we take a look at average rates from 2000 to 2020, it shows points were average rates have significantly decreased. The graph below is taken from the Federal Reserve Bank of St. Louis. We also compiled a table showing average rates from January 2000 to January 2020.

Based on the FRED graph, the 30-year fixed mortgage started with an average rate of 8.15 percent in January 2020. Over the next couple of years between 2001 to 2008, it fluctuates between 7.07 percent and 5.85 percent.

| 3.72% |

By January 2008, youll notice a substantial drop down to 5.01 percent. During this period, the effects of the subprime mortgage crisis gravely affected consumers and lending institutions. According to historical accounts, the mortgage crisis aggravated the U.S. recession in December 2007 to June 2009.

In January 2009, the average 30-year fixed mortgage rate dropped by 1.06 percentage points from 2008. It increased to 5.09 percent in 2010, but went down to 4.77 percent in 2011. Between January 2012 to 2017, the average rate ranged between 3.34 percent to 4.53 percent. In 2017, it reaches 4.20 percent, but continues to fluctuate downward to 3.95 percent in January 2018.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Federal Housing Administration Loans

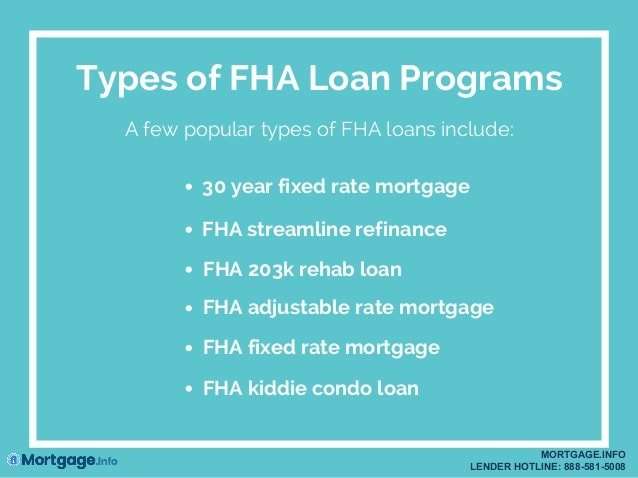

The FHA provides housing programs suitable for first-time homebuyers. It allows borrowers to qualify even if they have low credit scores. With FHA loans, you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage. This makes it a popular financing option for buyers with tight finances. FHA loans come in 15 and 30-year fixed terms, as well as 20-year terms.

Qualifying for FHA Loans

Under the FHA program, if your credit score is 500, your downpayment should be 10% of the loan amount. But if your credit score is at least 580, your downpayment can be as low as 3.5 percent.As for DTI ratio requirements, your front-end DTI should not be lower than 31 percent. Your back-end DTI should not exceed 43 percent, though some borrowers qualify at 50 percent with compensating factors.

In the beginning, FHA loans are affordable for homeowners because of low rates. But after several years of payments, it gets costly because of mortgage insurance premium . In an annual basis, the MIP cost is around 0.45 percent to 1.05 percent of the loan amount. The rates increase as you gain more home equity.

How to Remove Mortgage Insurance Premium

Conventional Loan Mortgage Insurance

If you dont put at least 20% down for a down payment, youre required to pay for private mortgage insurance , which can come in several forms:

- The most common is that you pay a monthly premium, which is an annual rate divided by 12.

- A single premium policy is another option, which involves an upfront payment.

- A split premium is an upfront payment as well as a monthly premium, and ideally, a seller will pay the upfront premium.

- Lender-paid PMI is also another option, in which the lender purchases the insurance and you pay it back at a higher interest rate. You cannot cancel lender-paid PMI.

Don’t Miss: How To Transfer Car Loan To Another Person

How To Calculate 30

With the help of tools like a mortgage calculator, estimating your loans total cost is relatively simple.

First, youll have to note down the following information:

- The cost of the property

- The down payment amount

- The loan term

- The interest rate presented by your lender

Once plugged into the mortgage calculator, it will reveal information such as:

- Your monthly payments, with interest and optional costs

- The total interest you will pay over the life of the loan

- The total cost of the mortgage and interest over 30 years

Note that online mortgage calculators do not include the cost of mortgage insurance premiums.

Today’s National Fha Mortgage Rate Trends

For today, Sunday, September 12, 2021, the national average 30-year FHA mortgage APR is 3.640%, down compared to last weeks of 3.710%. The national average 30-year FHA refinance APR is 3.660%, down compared to last weeks of 3.720%.

Whether you’re buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less. Compare rates here, then click “Next” to get started in finding your personalized quotes.

Weve determined the national averages for mortgage and refinance rates from our most recent survey of the nations largest refinance lenders. Our own mortgage and refinance rates are calculated at the close of the business day, and include annual percentage rates and/or annual percentage yields. The rate averages tend to be volatile, and are intended to help consumers identify day-to-day movement.

Availability of Advertised Terms: Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. However, Bankrate attempts to verify the accuracy and availability of the advertised terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program.

Also Check: Which Bank Is Better For Personal Loan

Fha Loans Help Millions Who Need Help With Down Payments

Qualified borrowers enjoy affordable financing, low down payment requirements, and competitive mortgage rates

FHA home loans have been around since the 1930s, and it’s no wonder why they’ve stood the test of time. FHA mortgage lenders offer affordable financing, low down payment requirements, and competitive mortgage rates to those who qualify. Additionally, existing homeowners can take advantage by refinancing their current mortgage into an FHA loan.

An FHA loan is a federal assistance mortgage loan thats insured by the Federal Housing Administration . The FHA provides this mortgage insurance to specific FHA-approved lenders throughout the United States, including Homeowners Advantage, for single-family and multifamily homes. FHA is the largest insurer of mortgages in the world and has insured over 46 million properties since its inception in 1934. Originally created to regulate interest rates and mortgage terms, the agency allows approved banks to continuously issue loans without putting out substantial capital of its own.

Homeowners and borrowers who utilize FHA loans pay a fee, known as the FHA’s mortgage insurance premium . The FHA is the only government agency that operates on self-generated income. In return, FHA stimulates the housing markets and community developments considerably by providing affordable financing to homeowners across the nation.

Who Qualifies For An Fha Loan

The FHA publishes its loan requirements each year, providing information on required documentation as well as credit score and debt-to-income ratios needed to qualify. The FHA also sets maximum loan limits, which are based on where the property is located. In 2021, these limits for single family homes range from $356,362 to $822,375.

The credit score you need to qualify for an FHA loan varies depending on your down payment. With a minimum down payment of 3.5% of the purchase price you need a credit score above 580. If you bump up your down payment to at least 10%, the minimum credit score drops to 500.

Just keep in mind that each lender has its own additional guidelines, which are usually more stringent than the minimum requirements. So make sure to contact your bank or credit union to learn more about its requirements beforehand.

Also Check: Arvest Construction Loan

What Is A 30 Year Fha Loan

30yearFHA loanloan

Besides, what is the interest rate on a 30 year FHA loan?

FHA loan interest rates

| 3.375% | 4.443% |

how does an FHA loan work? An FHA loan is a mortgage that’s insured by the Federal Housing Administration . However, borrowers must pay mortgage insurance premiums, which protects the lender if a borrower defaults. Borrowers can qualify for an FHA loan with a down payment as little as 3.5% for a credit score of 580 or higher.

People also ask, is it a good idea to get a FHA loan?

There is one simple reason FHA mortgage loans are attractive to many buyers it is easier to get approved for an FHA loan. You can get approved for an FHA loan as long as you have: Decent credit with a score at least in the 600s. Three and a half percent for a down payment.

What is the current interest rate for FHA loan?

Current interest rates average around 3.5% but can go as low as 1% with payment assistance. Similar to an FHA loan, USDA loans require an upfront insurance fee as well as an annual mortgage insurance premium that is collecting monthly.

Piscataway Homebuyers May Qualify For A Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Don’t pay too much for your mortgage. Leverage our lender network to get a FHA loan at today’s historically low mortgage rates.

Read Also: Usaa Auto Loan Requirements

Managing Your Mortgage Payments

Purchasing a 30-year fixed loan means making consistent payments for three decades. Thats a long time, so you must stay on top of your payments. This is why its important to secure a stable career and build savings. You must keep paying your loan even during emergencies. The same goes even when youre retired and not yet fully paid on your loan.

Before you agree to any real estate deal, you should understand how mortgage payments work. One important document you should use is the amortization schedule. This breaks down your monthly payments so you know how much goes toward your interest charges and principal loan.

- Principal This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments.

- Interest This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

Calculate Your PITI Costs

Mortgage payments are not just comprised of interest and principal payments. You must also pay for real estate taxes and homeowners insurance. When taken together, this is called PITI costs or Principal, Interest, Taxes, and Insurance. If you check your PITI expense, you can calculate the total cost of your monthly payments. Finally, while principal and interest payments remain the same, your insurance and property taxes may change over the years.