Why A Business Elite Signature Card

The Business Elite Signature Card is a credit card for established businesses with annual sales over $1 million. It offers more purchasing power, enhanced benefits and added security to control employee spending. You can also choose to earn rich rewards points or cash back. Please view details for more information on rates, fees, and features.

Why a Wells Fargo Unsecured Business Loan?

These loans allow businesses to finance one-time expenses with the flexibility to pay over a short or longer term. One easy application to get options.

Why an Equipment Express Loan?

This loan provides buying power for established businesses to purchase new or used vehicles or equipment at competitive rates with flexible terms.

How A Business Loan Works

A business loan is a lump sum amount that you receive on the day the loan term begins. It comes with a schedule of regular repayments, and there may be restrictions on whether the full amount can be paid back early. Typically, you will need to pay interest on the outstanding debt throughout the term of the loan. Business loans will usually be higher amounts than lines of credit, and some do not require collateral. Larger business loans may require collateral.

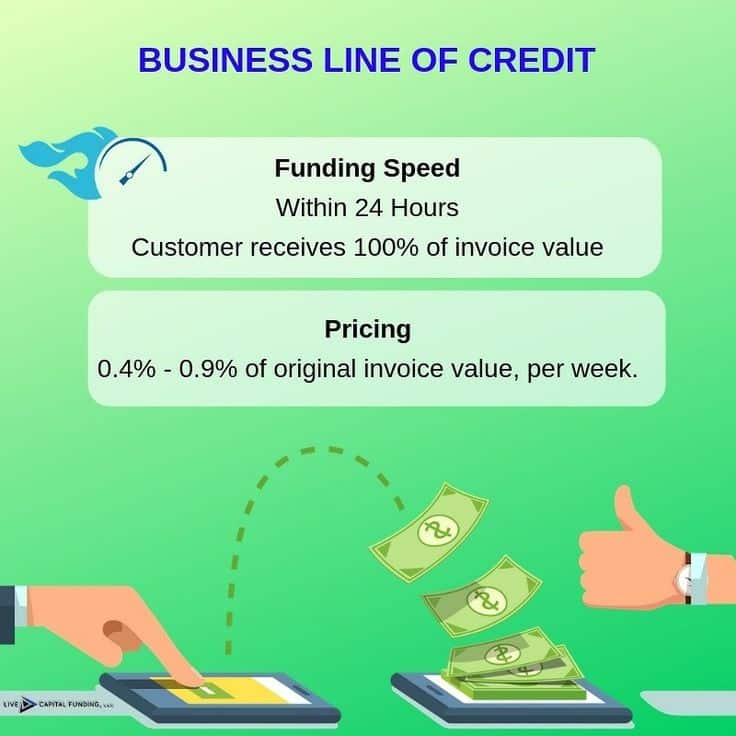

Understanding Business Line Of Credit

- Interest accrues as credit is accessed, unlike term loans.

- Secured and unsecured lines of credit are available.

- Interest rates rise and fall with the prime rate.

- Available from both banks and non-bank lenders.

Every small business owner encounters situations where they need quick access to extra capital. Traditionally, one of the most popular options for handling day-to-day cash flow needs has been a business line of credit.

Also Check: How Much Will My Student Loan Monthly Payment Be

Example Of A Line Of Credit

A bank gives you a line of credit with a limit of $50,000. You withdraw $10,000 to buy inventory. Youll only pay interest on the $10,000 and can still use the remaining $40,000 if you want. You then need $5,000 for new shop fittings. You can withdraw that before youve paid back the $10,000. Interest is charged only on whatever amount youve borrowed.

Are There Other Alternatives Besides Self Liquidating Loans

What if a self liquidating loan is not the right financial option for you? Good news, there are other financial options for you to consider.

However, when looking for an alternative loan, be mindful to stay away from predatory lenders. For example, some lenders market easy payday loans online as a convenient financial solution when in fact, these types of loans typically have high-interest rates and inconvenient payback terms. Before you apply for any kind of loan, do some lender research first, so you know you are going with the smartest option.

Check out more information below on other ways you can fund your business besides via self liquidating loans.

Also Check: Can You Have More Than 1 Loan With Onemain Financial

Best Business Line Of Credit For Startups: Fundbox

- Rates: 4.66% – 8.99%

- Term: 12 – 24 weeks

Why we like it: Many lenders only work with established businesses, which can make getting funding harder if you’re a startup. Fundbox is different and works with businesses that have at least three months of business transaction history in a business checking account.

Drawbacks: Fundbox has a very short repayment period â either 12 – 24 weeks, with weekly payments and an interest rate that changes depending on which option you select . In addition, it’s best to wait to apply until you know you’ll need your first draw, as Fundbox states that “if you do not draw funds at least once, close to the date you are approved, we may need to close your account.”

Advantages And Disadvantages Of Business Lines Of Credit

A business line of credit can help your small business in a time of need, but there are some factors to consider that can potentially negatively impact your business.

Advantages:

A small business line of credit can offer near-immediate relief of a cash flow for your small business, solving for a variety of needs, including covering operating expenses through a slow period, helping your business to scale in a time of growth, or investing in new supplies or equipment. The rates for borrowing a small business line of credit may be lower than charging expenses to a credit card, and the repayment terms can be flexible, allowing your small business to access the small business line of credit funds as you need them.

Disadvantages:

Like with any financing, a small business line of credit can post challenges for your business and credit Defaulting on your small business line of credit can negatively impact your business and even personal credit, and make it harder for you to get approved for loans in the future.

Also Check: Can You Use Fha Loan For Investment Property

What Is A Business Line Of Credit

A business line of credit is a revolving loan that gives business owners access to a fixed amount of money, which they can use day-to-day according to their need for cash.

LOCs are specifically designed to help businesses finance short-term working capital needs, such as:

- Purchasing inventory or repairing equipment

- Financing marketing campaigns

What You Should Know Before Opening A Loc

Before opening a business LOC, make sure you understand your lenders qualifications, loan conditions, interest rates, and fees.

- There may be charges for account set-up, transactions, and annual fees. For example, a bank may charge an opening fee of $150 with no annual fee for the first 12 months, but then an annual fee beginning in the second year.

- In order to reduce risk, some lenders require that businesses pay down their outstanding LOC balance to $0 at some point during the year, often for at least 30 days. This assures a lender that the borrower is generating sufficient cash flow to operate independent of the lenders funds, and not relying on the LOC as a substitute for the owners capital.

- Due to the unpredictable nature of the market, the lender always reserves the right to call a LOC payable immediately. This means your full balance would have to be paid, and your LOC reduced to zero without warning. If your business depends on the line of credit, this can be a critical issue, so the business should always be prepared to either replace the LOC or scale back to weather the loss of credit.

Read Also: How To Loan Money To Family Legally

Special Benefit For Veterans:

- Take advantage of a 25% discount on loan administration or origination fees.

- Offer valid for veterans of the U.S. Armed Forces on new credit facility applications submitted in Small Business.

Small Business Administration collateral and documentation requirements are subject to SBA guidelines.

You must be 18 years old or otherwise have the ability to legally contract for automotive financing in your state of residence, and either a U.S. citizen or resident alien .

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Commercial Real Estate products are subject to product availability and subject to change. Actual loan terms, loan to value requirements, and documentation requirements are subject to product criteria and credit approval. For Owner-Occupied Commercial Real Estate loans , owner occupancy of 51% or more is required. Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Subject to credit approval. Some restrictions may apply.

Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Loan terms, collateral and documentation requirements apply. Actual amortization, rate and extension of credit are subject to necessary credit approval. Bank of America credit standards and documentation requirements apply. Some restrictions may apply.

Investment and insurance products:

Using A Small Business Line Of Credit

The number-one reason to open a business line of credit is to gain access to short-term funding. Most businesses use these funds to support financing for operational expenses like supplies and payroll or for increasing inventory. Cyclical businesses often rely on an unsecured line of credit as a source of off-season working capital.

Unlike many small business loans, an unsecured line of credit is not designated for a specific purpose or purchase it’s a good choice for small businesses looking for ways to better manage cash flow. Funds are typically drawn from the line of credit by using a business checking account, a small business credit card or even a Mobile Banking app.

Read Also: Best Interest Rates On Car Loans

Tips To Compare Startup Business Lines Of Credit

When youre running a startup, its necessary to access capital to fund day-to-day operations and grow the company. A line of credit is one way to get that funding, and it can be a helpful tool for managing cash flow and covering unexpected expenses. But with so many options out there, it can be tough to determine which line of credit is right for your business.

Here are a few tips to help you compare lines of credit and choose one that fits your needs:

Wells Fargo Business Line Rewards Program

Applies to both Wells Fargo BusinessLine line of credit and Wells Fargo Small Business Advantage line of credit products.

Wells Fargo unsecured business line of credit includes exclusive rewards with no annual program fee, no cap or categories to keep track of. Use your Mastercard access card to make purchases from your line of credit. See how easy it is to earn points and redeem them for thousands of great items.

- Earn 1 point for every $1 in qualifying purchases using your Mastercard access card.

- Receive 1,000 bonus points every monthly billing period you have $1,000 or more in qualifying purchases.

- Get a 10% points credit every time you redeem online .

- Redeem your points for travel, gift cards, merchandise, and much more.

The Wells Fargo BusinessLine line of credit is available for businesses in operation for two or more years. If this requirement is not met, you may be eligible for a Wells Fargo Small Business Advantage® line of credit.

Offer valid 10/01/2022 12/31/2022. For a BusinessLine® line of credit, the annual fee is waived for the first year only. The annual fee of $95 or $175 will be assessed on your anniversary month in subsequent years.

Terms for credit products are subject to final credit approval of the business and its owners. A physical address is required to receive a Wells Fargo business credit product. You must be an owner of this business and not already have this product. See Terms and Conditions for details at account opening.

Also Check: Mortgage Loan Originator License Texas

How To Apply For A Business Line Of Credit

Sure, you can go the bank route with a long application process and 75% rejection rate. But if youre looking for financing in this lifetime, Lendio offers a faster, easier application process.

Fill out the 15-minute online application.

Its secured with bank-grade encryption and SSL technology, so you know your information is safe.

Receive matches.

We pair you with loan options from our network of 75+ lenders. Our dedicated funding managers can help you weigh the pros and cons of each option.

Get funded.

Once youre approved, youll be able to access your capital in as little as 24 hours.

The Lendio process was amazing

Sterling Hannemann

Lendio literally saved my business.

Chloria Chandler

How To Get A Startup Business Line Of Credit

Getting a line of credit for your startup is similar to applying for other types of financing. Startup owners can apply online or, in some cases, at a brick-and-mortar bank or credit union. However, the process varies by lender.

To qualify for a startup business line of credit, you will may need to meet theseor similarrequirements:

- Minimum personal credit score of 600

- Annual revenue of at least $100,000

- Have been in business for at least six months

After completing a formal application, prospective borrowers also must provide a range of documents demonstrating the financial stability of their startup. These documents vary but often include:

- A business plan illustrating the startups ability to generate revenue

- Copies of business registration documents and other legal documents

- Personal and business bank statements and tax returns

- Profit and loss statements and balance sheets showing sufficient cash flow to make monthly debt payments

You May Like: Same Day Personal Loans Bad Credit

How To Use A Line Of Credit

When you apply for a business loan, youre given money for a specific purpose . But since lines of credit are a form of revolving credit that are not tied to one specific purpose, you can use them for all sorts of needs, such as:

- Purchasing equipment or inventory

Lendio is our favorite source for business lines of credit. So why does it deserve the top spot? Easybecause its not a lender, but a lending marketplace.

Heres what that means: you apply to Lendio with a brief online application. Lendio then takes your application and matches you with lenders you qualify for. You then compare offers and choose the one that works best for you. And Lendio works with several of the other lenders on this list, so your application on Lendios lending platform gives you a shot at most of our favorite lines of credit.

Lendios marketplace approach lets it offer large lines of credit and competitive rates. So for most businesses looking for a line of credit, Lendio should be your first stop.

Bluevines business line of credit can compete with the big banks while offering the convenience of an online lender.

Even so, if you want low rates on your business line of credit, Bluevine is the place to start.

Fundbox might not offer the largest lines of credit, or the cheapest, but it does offer the most accessible.

Only Pay Interest On The Funds You Use

One of the coolest things about a business line of credit is that you only pay interest on the funds you use, not the full amount. For example, if youre approved for a $40,000 business line of credit and you use $20,000 for office upgrades, youll just pay interest on that $20,000. This could save you a bundle in interest. Pretty cool, huh?

Don’t Miss: What Is The Average Business Loan Term

How Do You Use Your Business Line Of Credit

Once your business credit line is approved, you can start drawing from your credit line, withdrawing as much as you want up to your limit. Every month, youll have to make a minimum monthly payment on your business line of credit. Once you repay the amount youve drawn from your credit line plus any interest youve accrued, those funds will once again be available for you to use.

While your line of credit offers flexible spending, get in the habit of using it only when needed. Limit usage to short-term expenses, paying used funds in full as quickly as possible. Paying off your line of credit quickly promotes responsible use, builds up your businesss credit and could lead to better financing options later. It also decreases the amount of interest youll pay on the funds you borrow.

How Business Lines Of Credit Work

When you get a business line of credit, youll receive a credit limit you can borrow against in the future. Instead of receiving the full amount upfront, as in the case of a business loan, borrowers get the ability to withdraw what they need over time, known as the draw period.

Unlike a traditional business loan, borrowers are only responsible for paying interest on the amount they borrownot the total credit limit. After the draw period, which typically lasts 12 to 24 months but can sometimes go up to five years, the repayment period starts and the borrower can no longer withdraw funds. The borrower must pay off the outstanding balance and any interest by a fixed date, which can range anywhere from six months to five years.

You May Like: Can You Reuse Your Va Home Loan

Traditional Unsecured Business Line Of Credit

Unsecured lines of credit dont need collateral, so you wont have to tie up any of your assets. You might also have a quicker approval time. Interest rates are often higher than secured lines of credit, and there might also be a maintenance fee that applies monthly or annually.

The SBA suggests that unsecured lines of credit might be better products than secured. They rely more on creditworthiness than years in operation, and the application process is often much less of a hassle.

Top Business Line Of Credit Providers

- Ideal for: Small businesses who need access to cash quickly.

- Funding Amounts: Up to $100,000 to be used at the borrowers discretion.

- Minimum Requirements: In order to qualify for a loan from OnDeck, you must have been in business for a year, have a credit score of 600+, and have $100,000 in annual revenue. You must be at least 18 years old and a citizen of the US.

- Repayment Terms and Fees: Repayment terms range from 6-36 months. There is a one-time origination fee as well as prepayment options if you choose to pay back your loan early.

- Funding Time: Applying to OnDeck is quick and simple. OnDeck is known for its customer service and easy online application. Once approved, you can receive your funding within 24 hours.

- Bottom Line: OnDeck is a trusted loan provider for small businesses and has an A+ BBB rating. You can apply online in minutes- or pick up the phone and speak with one of the highly-rated loan specialists.

Read our in-depth review of OnDeckto find out more about this lender.

Bestmoney is a dba of Natural Intelligence Technologies Inc.

Natural Intelligence Technologies Inc. NMLS # 2084135

CT: Mortgage Broker only, not a mortgage lender or mortgage correspondent lender.

Recommended Reading: Debt Consolidation Loans Bad Credit