How Much Of A Down Payment Do I Need

In Canada, the minimum down payment requirement is 5% for houses under $1 million. However, borrowers who put down less than 20% require mortgage default insurance, which is added to your mortgage balance and accumulates interest. Mortgage default insurance makes your mortgage more expensive. Also, your mortgage interest rate is heavily influenced by the size of your down payment. The larger the down payment the better. Try to provide at least 20% to avoid expensive mortgage default insurance. There is no maximum down payment, more is usually better. It will help you secure a better rate, your mortgage balance will be lower, and you will pay your mortgage off faster while saving on interest charges.

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

What Credit Score Do I Need For A Mortgage

In Canada, the minimum credit score to qualify for a mortgage with a traditional lender is about 650. However, it differs from lender to lender based on your unique financial profile. There are private, alternative lenders who will approve mortgages for those with low or bad credit, but the interest rate will be significantly higher with less favourable terms. Things that impact our credit score are your payment history, balances on credit cards and lines of credit, the age of your credit file, how many times you have applied for credit in the recent past, and the different types of loans you have. If you have bad credit you can still get a mortgage. However, if you want to qualify for the best mortgage interest rates and terms you will need to work on increasing your credit score to at least 700.

Recommended Reading: Va Handbook Manufactured Homes

Look For Jobs That Can Help You Pay Off Your Debts

Research loan forgiveness plans to determine if they exist in your sector when you begin your job search. Then, when contemplating opportunities, make sure you look into possible student loan forgiveness alternatives.

For example, the Public Service Loan Forgiveness program can forgive your education debt after ten years of service in a nonprofit, government agency, or other qualifying organization. Other occupations, including teaching, law, and medicine, may also be eligible for loan forgiveness or repayment aid.

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

Don’t Miss: Usaa Auto Loan Rates Used Cars

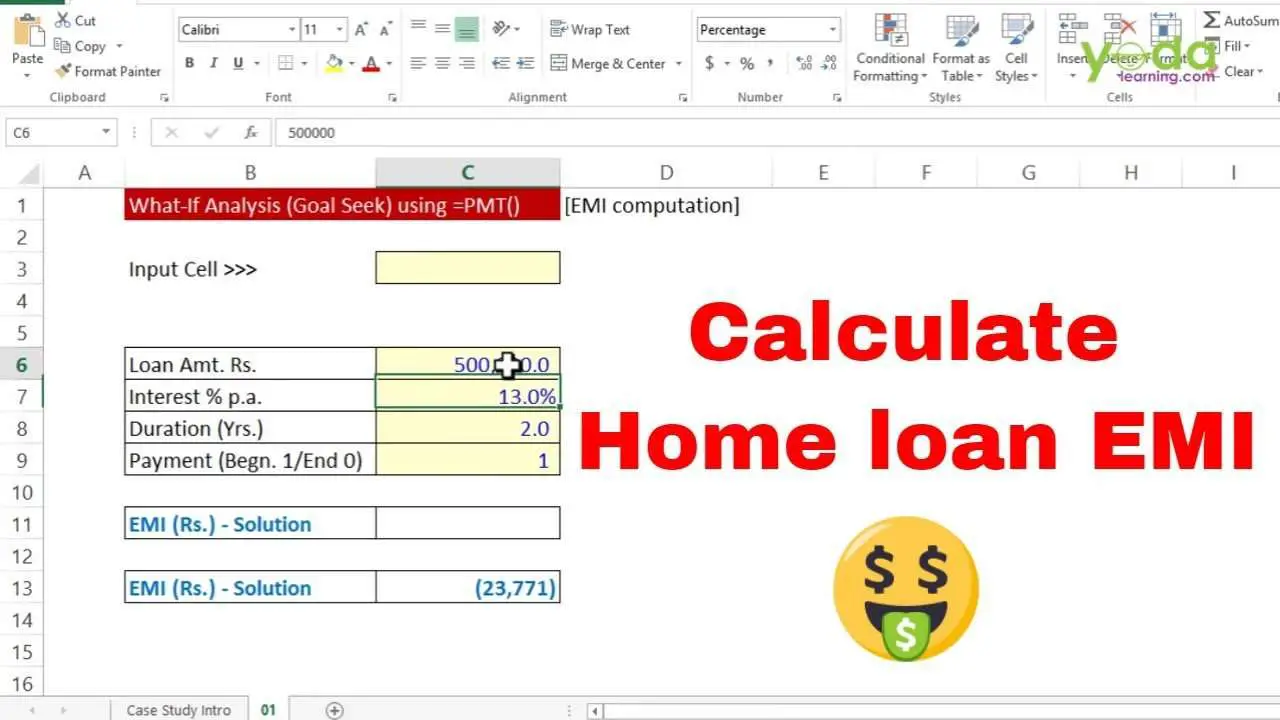

How Does This Loan Repayment Calculator Work

The easy-to-use loan calculator above works based on some pretty mundane math. Don’t worry, this isn’t going to turn into an algebra lesson. Just know that we’ve coded all the appropriate formulas to do the math for you.

So, all you have to do is enter three pieces of information: the amount of the loan, the loan term, and the interest rate.

- Loan amount. This is how much you’re intending to borrow. Remember that this includes the total amount you’re borrowing. Depending on the situation, the lender may include fees and or other expenses in that amount.

- Loan term. This is how long you will take to pay back the loan. For the purpose of this calculator, you need to enter the terms in months. So, if you’re borrowing money for 6 months, you would enter 6. If you’re borrowing for 2 years, you would enter 24. To convert terms of years into months, multiply the number of years by 12.

- Interest rate. Enter a hypothetical interest rate. This is how much the lender is going to charge for letting you borrow the money. The higher this rate, the higher the cost of the loan and the more you may have to pay back each month. Don’t include a percent sign when entering this number.

Once you enter all three pieces of information, click “Calculate” and the tool will return an estimated monthly payment. If you borrowed exactly the amount entered at the terms and interest you entered, that would be your monthly payment for the loan.

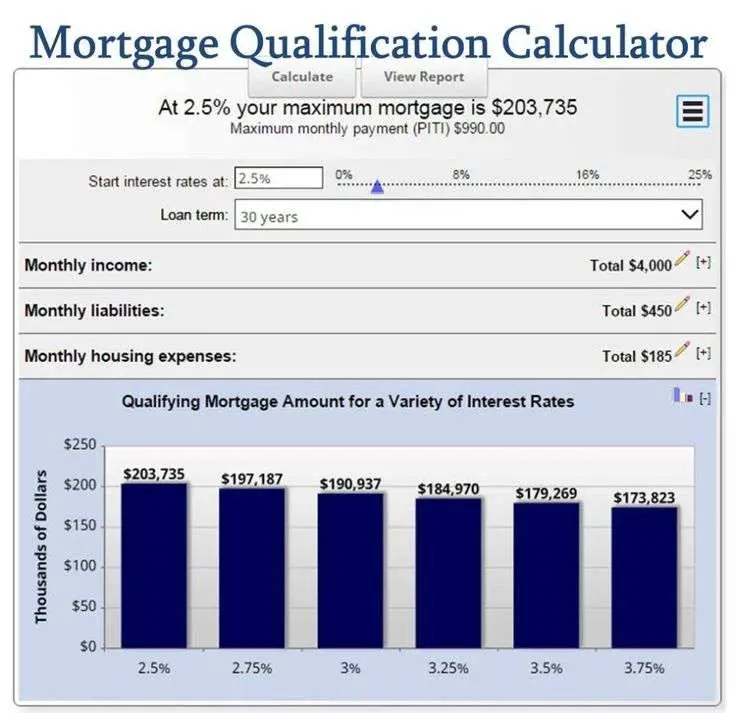

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

Recommended Reading: How Long Does Sba Loan Take To Get Approved

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage calculator

What Are The Advantages Of Home Loan Emi Calculator

When borrowing a home loan, it is important for the borrower to calculate the home loan EMI.

- Calculate the amount in just a few minutes

- Helps decide on the loan tenure the borrower should chosen keeping in mind his monthly expenses and other loan EMIs, if any

- Assists in better financial planning

- Helps the borrower determine the accurate EMI amount payable

Also Check: Va Mpr Checklist

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

How Much Do You Have To Put Down On A Commercial Loan

Your required down payment will ultimately depend on the purchase price, property or business cash flow, and loan program selected. However, you should typically expect to put down at least 10-15% on owner-occupied properties, 20-25% on apartment properties, and 25-30% on other types of investment properties.

Also Check: Cap One Auto Loan

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

How To Lower Your Monthly Mortgage Payment

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Don’t Miss: How Do Mortgage Loan Officers Make Money

Ready To Check Your Rate

See what your rate will be with a Discover personal loan. Its quick, easy and wont affect your credit score.

Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all requirements. Loans are unsecured. Loans are fully amortizing personal loans as long as you pay on time.

You must have a minimum household income of $25,000 to be considered for a Discover personal loan. It cannot be used to pay for post-secondary education, to pay off a secured loan, or to directly pay off a Discover credit card.

Your APR will be between 5.99% and 24.99% based on creditworthiness at time of application for loan terms of 36-84 months. For example, if you get approved for a $15,000 loan at 6.99% APR for a term of 72 months, you’ll pay just $256 per month. Our lowest rates are available to consumers with the best credit. Many factors are used to determine your rate, such as your credit history, application information and the term you select.

We may charge a fee if your payment is late.

Choose The Right Repayment Plan

If you dont choose a different payback plan when your federal loans mature, your payments will be based on a standard 10-year repayment plan. However, there are alternative options if the basic payment is too much for you to handle, and you can change plans at any time if you want or need to.

Extending your repayment duration beyond 10 years will cut your monthly payments, but youll pay more interest frequently a lot more throughout the loans life.

Income-driven repayment plans , such as the IBR plan and REPAYE, are essential options for student loan borrowers. And thats because they limit your monthly payments to a reasonable percentage of your annual income

Then, forgive any remaining debt after no more than 25 years of affordable payments. Borrowers in the public and nonprofit sectors may be eligible for forgiveness after just ten years of payments.

You May Like: Refinance Car Loan Usaa

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

Types Of Mortgage Interest

When you use a mortgage to buy a house, the lender charges interest. Interest is the price you pay to borrow money. Even a small difference in the interest rate could be the difference between paying or saving tens of thousands of dollars over the life of your mortgage. Your mortgage interest rate will fluctuate over time. That is because you and your lender renegotiate your interest rate every time you renew your mortgage term.

There are a few different ways a lender can charge interest on your mortgage. Understanding the different types of mortgage interest rates is one of the most important parts of becoming a homeowner.

Recommended Reading: Usaa Auto Loan Payment Calculator

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

Consider Student Loan Consolidation

Loan consolidation combines various loans into a single payment with a set interest rate. If this seems tempting, here are some advantages and disadvantages to consider. On StudentLoans.gov, you can apply to consolidate your federal student debts.

If youre looking for a private consolidation loan, browse around for a low or fixed interest rate, and study the tiny print.

Suppose you consolidate federal loans into a private student loan. In that case, youll lose all of the repayment alternatives and borrower perks that come with federal loans, such as jobless deferments and loan forgiveness programs.

You May Like: 600 Fico Score Auto Loan

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Read Also: Marcus Goldman Sachs Loan Reviews

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

What Is The Prime Interest Rate

The prime interest rate is a benchmark interest rate financial institutions use to set their own interest rates on the different types of loans they offer, such as lines of credit and variable-rate mortgages. Where does the prime rate come from? It is heavily influenced by the overnight rate set by the Bank of Canada our central bank responsible for carrying out monetary policy.

The overnight rate is the interest rate financial institutions use when lending and borrowing money amongst themselves. When the overnight rate changes, the prime interest rate usually changes within a few days. Financial institutions use the prime rate as a benchmark when setting the interest rates for mortgages, lines of credit, personal loans, car loans, student loans, etc.

If you have a variable interest rate mortgage, your lender will charge you an interest rate of prime plus or minus a certain amount. The posted rate is the mortgage interest rate that financial institutions advertise to the public. If the prime rate is 1.25% and the lenders posted rate is 2.25%, the lender may charge you a total mortgage interest rate of 3.5% prime + the posted rate.

Read Also: Usaa Bad Credit Auto Loans

What Is The Average Rate For A Commercial Loan

The interest rate you will receive on a commercial loan will depend on several factors, including the property type, location, leverage, debt service coverage ratio, personal financial strength, and how much of a financial relationship you are willing to establish with the lending institution. For an indication on current interest rates on commercial properties, please visit our page. For current apartment interest rates, please visit our .

How Is Interest Calculated On A Commercial Loan

This depends heavily on whether or not the loan is interest-only or amortizing. If it is interest only, the monthly interest is the rate divided by the number of periods in a year , then multiplied by the loan amount. If it is an amortizing loan, the calculations are slightly trickier, and we recommend using a calculator like the one provided on this page.

Recommended Reading: Fha Title 1 Loan