Which Lender Is Best For Ppp Loan

Best SBA Lenders for 2022

- Best Overall: Live Oak Bank.

- Best for Quick & Easy Process: Funding Circle.

- Best for Small Loans: United Midwest Savings Bank.

- Best for Large Loans: Bank of the West.

- Best for Real Estate: Byline Bank.

- Best for an In-Person Experience: JP Morgan Chase.

- Best for Startups: Fundera.

How Much Can You Expect To Borrow

For most independent contractors, calculating your PPP borrowing limit is a 3-step process:

Find line 7 on your 2019 IRS Form 1040 Schedule C . If the amount on Line 7 is over $100,000, write $100,000. Effective March 8, 2021, most lenders will now accept line 7 .

If line 7 shows $0 or less, you do not qualify for a PPP loan.

Divide the amount from Step 1 by 12.

Multiply the amount from Step 2 by 2.5 . For most borrowers, this will be your maximum PPP loan amount.

NOTE: If you received an EIDL loan between January 31, 2020 and April 3, 2020 you can refinance that as part of your PPP loan .

Eligble Uses Of Ppp Funds

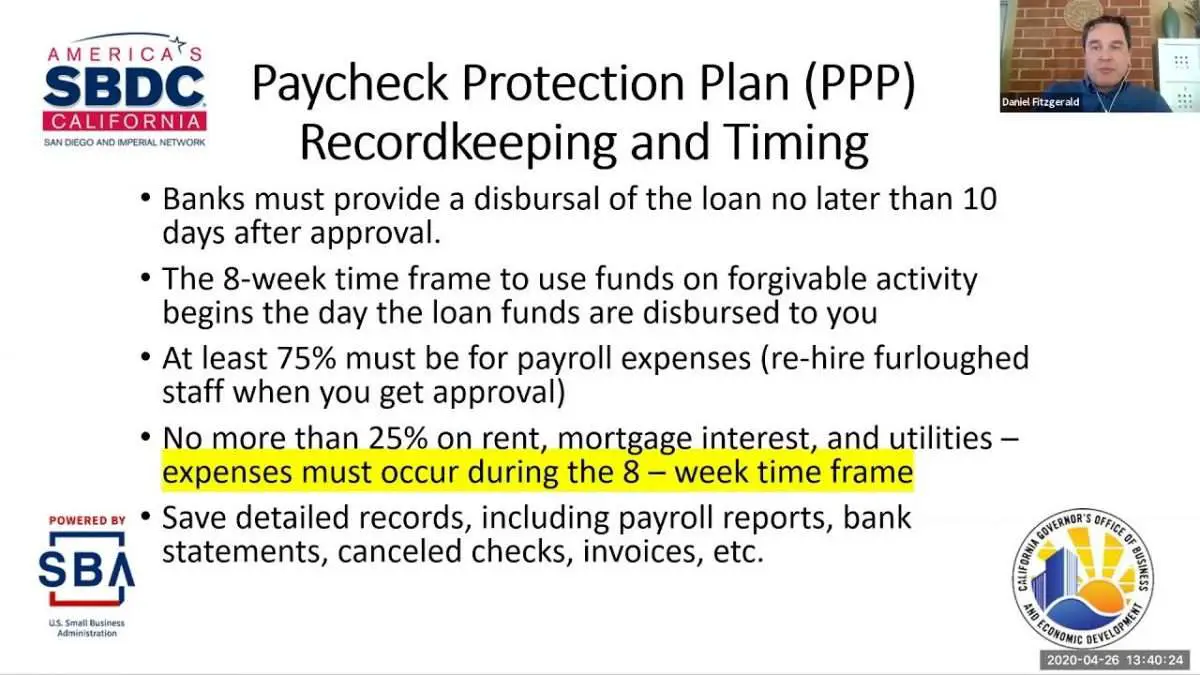

Initially, you could only use PPP loans on payroll, rent, and utility expenses, but the SBA has since updated the list of eligible spending. Here’s how you can spend your PPP funding in 2021:

- Payroll: Salaries, wages, tips, commissions, employee benefits, group insurance benefits, and paid leave.

- Rent: Payments on rental properties with a lease agreement that went into effect before February 15, 2020.

- Interest payments: Interest payments for mortgage obligations that went into effect before February 15, 2020.

- Utility payments: Water, gas, electricity, transportation, telephone, and internet service fees for agreements that went into effect before February 15, 2020.

- Worker protection expenditures: Costs for investments in protective equipment and workplace changes to help make your restaurant safer and comply with COVID-19 protection measures.

- Operations expenses: Payments for cloud computing, accounting, human resources, and remote workforce-enabling software.

- Property damage costs: Costs for damages incurred from 2020 civil unrest that your insurance didn’t cover.

- Supplier costs: Necessary expenses incurred to a supplier before you obtained a PPP loan.

Read Also: What Is Fha And Conventional Loan

Heres How You Can Spend Your Ppp Loan

-

Replace your compensation

-

Pay interest payments on a mortgage or loan you use to perform your business*

-

Make business rent payments*

-

Make business utility payments*

-

Make interest payments on any other debt incurred before February 15, 2020

-

Operations expenses for business software and cloud computing services and other human resources and accounting needs that facilitate business operations

-

Payments to a supplier for goods that are essential to the operations of the borrower pursuant to a contract or purchase order in effect before the PPP loan is disbursed or with respect to perishable goods

-

Property damage costs related to looting due to public disturbances in 2020 that are not covered by insurance or other compensation

*You must have claimed a deduction on your 2019 or 2020 taxes for expenses described in 2, 3, and 4 above.

What Expenses Are Eligible For Forgiveness

In summary, your loan funds can be used for the following business-related expenses:

- Payroll, including benefits, to retain employees, excluding amounts above a prorated annual salary of $100,000 for employees who make more than that amount.

- Mortgage interest payments for mortgages originated prior to February 15, 2020.

- Rent payments on leases in force before February 15, 2020.

- Utility payments, as long as the services began before February 15, 2020.

- Refinancing an SBA Economic Injury Disaster Loan made between January 31, 2020 and April 3, 2020 .

- Payments for any business software or cloud computing service that facilitates certain business operations.

- Costs related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that were not covered by insurance or other compensation.

- Payments made to suppliers of goods essential to the operations of the business under contracts in effect before the origination of the loan.

- Expenditures made to facilitate compliance with federal, state or local guidance pertaining to sanitation, social distancing or any other worker or customer safety requirement related to COVID-19 during the period between March 1, 2020 and the end of the national emergency declaration.

Don’t Miss: How Hard Is It To Get An Rv Loan

Who Is Eligible For The Second Round Of Ppp

The SBA has issued guidance for this latest round of funding, and there are a few caveats compared to the first go-around.

First-time borrowers only: The first two days of PPP funding, January 11 and 12, will only be available through community-based lenders focusing on underserved and minority communities. You will only be eligible to receive a loan during the first two days if you didnt receive a Payroll Protection loan in 2020.

Second-time borrowers: Beginning on Wednesday, January 13, the PPP program will open up and become available to second-time borrowers who meet certain criteria:

- 300 or fewer employees

- must prove, prior to applying for a loan, business saw a 25% reduction in gross receipts during a quarter in 2020 compared to the same quarter in 2019 unless seeking a loan under $150,000, at which point you can prove the reduction when applying for forgiveness

Not much has changed in the latest batch of funding. Businesses will still be required to use at least 60% of the funds on qualifying employee expenses and the remaining 40% on operating expenses to qualify for forgiveness.

The program will be open until March 31, 2021.

Should I Fill Out The Sba Paper Application

No. We request that you do not attempt to submit the paper forms from the SBA. Through our digital forgiveness application portal, we are able to auto-populate and pre-fill fields from your loan. You will be notified when you are eligible to apply for forgiveness and provided directions on how to access our forgiveness portal. Please contact your banker if you have questions or would like to submit a request for early access.

Read Also: Disaster Loan Assistance Sba Gov

Getting Started With The Forgiveness Application

How will the PPP forgiveness process or application work?The Synovus forgiveness process for uploading documentation, providing required certifications, and submitting the application for processing is all online. Once processed and bank approved, the completed 3508 form will be e-mailed from Docusign for your electronic signature and then Synovus will submit the application to the SBA via the portal.

Its important to note the SBA, and not Synovus, sets the criteria for loan forgiveness, including the eligibility criteria and the parameters that determine how much of a loan may be forgiven.

How do I begin my online application? to access our portal or reset your password.

What should I do now to prepare?We encourage you to begin reviewing and gathering materials that may need to be attached to your application, and to review the Schedule A Worksheet if it is needed for your application. Weve listed more information in our FAQs below in the Gathering Information and Required Documents section. Applications must be submitted through our online portal. We will not accept paper applications.

I completed a paper application, what should I do?If youve already completed a paper application, youre well positioned to enter the information into our online application.

When did my covered period begin?Your covered period began on the date your loan funds were provided to you.

How Do I Calculate The Maximum Amount For My Ppp Loan

For first-time PPP loans, businesses and nonprofits generally can request a maximum loan amount of 2.5 times the average monthly 2019 payroll. Insurance payments can also be included in payroll costs. The SBA has also that outlines calculations for different types of businesses.

For second-draw PPP loans, the maximum loan amount is calculated as 2.5 times average monthly 2019 or 2020 payroll costs for a maximum of $2 million. For borrowers in the accommodation and food sectors, they may qualify to use a higher calculation of 3.5 times average monthly 2019 or 2020 payroll costs, but the maximum amount remains at $2 million. Work with an accountant or financial advisor to make sure you calculate the loan amount correctly.

Notably, in March 2021, the SBA changed the maximum loan size sole proprietors and independent contractors can apply for, basing it on gross income instead of net income. This means if you are self-employed or run a business solo, you should use the new formula if applying for a new PPP loan. If you have a loan already, you should check with your lender to see exactly how much your PPP loan is for and if you can increase the size of it to match the new formula.

Don’t Miss: What Is Teacher Loan Forgiveness

Community Reinvestment Fund Usa *

The national non-profit organization is a non-bank SBA-approved lender that supports mission-driven organizations in historically underinvested communities. It has temporarily halted taking inquiries about PPP loans. Once its online application is available, it will email people who have already submitted an inquiry. If you havent already submitted one, check here for updates for when the application will be available.

Do I Qualify For A First Or Second Ppp Loan

For first-time PPP loans, the majority of small businesses with fewer than 500 employees and select types of businesses with fewer than 1,500 employees are able to apply if they experienced revenue declines in 2020. Many 501 non-profits, 501 veteran organizations, tribal business concerns and self-employed workers/sole proprietors are eligible to apply. As of December 2020, 501 nonprofits, local news media companies and housing cooperatives were added to the list of organizations that could apply. All publicly traded companies are prohibited from receiving PPP loans.

Businesses can apply for a PPP loan as long as they were operational on February 15, 2020, and had paid employees at that time . The SBAs 500-employee threshold includes all types of employees: full-time, part-time and any other status.

Lenders will also ask for a good faith certification that 1) the uncertain economic conditions make the loan request necessary to support operations, and 2) the borrower will use the loan proceeds for specific purposes like payroll and approved expenses.

Recommended Reading: What Homes Qualify For 203k Loan

Paycheck Protection Program Loan Forgiveness

Eligible clients can apply now for PPP loan forgivenessOur PPP loan forgiveness portal is now open and includes a simplified forgiveness application for PPP loans of $150,000 or less. We will email clients with a link to access our loan forgiveness application over the coming weeks, when the application becomes available to them.

When can I apply for PPP loan forgiveness?

The simplified SBA Form 3508S is now available, in addition to the revised SBA Form 3508EZ and SBA Form 3508 applications. Eligible clients will receive an email with a link to access our loan forgiveness application when it becomes available to them.

As a reminder, based on the latest updates from the SBA, you now have more time to gather your documents and prepare your application. The timeframe for applying for loan forgiveness in the promissory note no longer applies.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

Is Bank of America participating in the SBA Direct Forgiveness program for applications equal to or less than $150,000?

The Small Business Administration announced on July 28, 2021 a new initiative that will allow borrowers of participating lenders with loans less than or equal to $150,000 to apply for forgiveness through the SBAs direct forgiveness online portal.

Do I need an Online Banking ID to access my PPP loan forgiveness application online?

Yes, you need a profile set up for Business Advantage 360, our small business online banking.

What Is Included As Covered Worker Protection Expenditure

An operating or capital expenditure to facilitate the adaptation of the business activities of an entity to comply with requirements or guidance issued by HHS, CDC, or OSHA, or any equivalent requirements issued by state or local government from March 1, 2020 until the President declares and end to the national emergency for COVID-19. Expenses may include the purchase, maintenance, or renovation of assets that create or expand:

- A drive-through window facility

- An indoor, outdoor, or combined air or air pressure ventilation or filtration system

- A physical barrier such as a sneeze guard

- Expansion of additional indoor, outdoor, or combined business space

- On- or offsite health screening capability

- Other assets relating to the compliance with requirements or guidance from HHS, CDC, or OSHA, including personal protective equipment

Recommended Reading: How To Lower Student Loan Payments

First American Bank **

This local independent community bank primarily operates branches in New Mexico. Its website says that it has helped more than 600 businesses receive a total $123 million in loans. The bank says for small businesses in need of financial assistance, presumably in its community but not necessarily existing customers, to contact them to apply for a PPP loan. For more information, go here. Consolidated assets: $5.32 billion.

First Vs Second Draw Ppp Loans

Weve touched on this subject, but lets review the most significant differences between the first and second draw PPP loans. While you could borrow a maximum of $10 million for the first draw, the limit has been lowered to $2 million for the second draw.

Likewise, for a second draw, your business must have experienced a 25% decline in gross revenue in any quarter of 2020 compared with the same quarter in 2019. This requirement did not exist for the first draw . Likewise with the new requirement that your business does not have significant operations in China .

Also, the loan forgiveness process has been greatly simplified this time around for those borrowing $150,000 or less. Well discuss PPP loan forgiveness in a moment.

Read Also: How To Calculate Debt To Income Ratio For Mortgage Loan

Are There Exceptions To Fte Reductions

Yes, there are several situations where a reduction in FTE would not be counted against you. These include:

- Any positions for which you made a good-faith, written offer to rehire an individual who was an employee on February 15, 2020 but were unable to hire similarly qualified employees for unfilled positions on or before one of the following:

- For loans made before December 27, 2020,December 31, 2020.

- For loans made after December 27, 2020, the last day of the covered period.

You should refer to the SBA Form 3508 instructions for details about FTE reduction exceptions.

Qualifying For Ppp Loan Forgiveness

You’ll need to follow a few rules to qualify for 100% loan forgiveness. The SBA’s regulations control how, where, and when your restaurant spends PPP funds to ensure the loan gets used appropriately. Here are the rules:

Recommended Reading: How Much To Put Down With Fha Loan

Things To Keep In Mind

Its essential to understand that the loan will only be forgiven if the borrower follows the guidelines outlined in the CARES Act. The Paycheck Protection Flexibility Act passed in June updated some of the original guidelines. One of those stipulations is that your company maintains the same number of employees during the covered period as it did during the previous year. In basic terms: You cannot qualify for loan forgiveness if you lay off your employees.

- Related:Your Guide To PPP Forgiveness Rules, Qualified Expenses, & How To Apply For PPP Loan Forgiveness

General Questions About Forgiveness

I dont have enough PPP funds to cover my payroll expenses. Can I deposit into my PPP account to cover an upcoming payroll expense?Yes, you can make a deposit into your deposit account that was used for funding your PPP loan.

What happens if I only spend 55% of the total loan amount on payroll, will the full loan amount be forgiven?No. If only a portion of the loan is forgiven, any remaining balance due on the loan must be repaid by the borrower on or before the maturity of the loan, in accordance with the terms of your loan note. Please see the SBA Website for additional guidance.

Would interest be due on the full amount or an adjusted amount?The amount of loan forgiveness can be up to the full principal amount of the loan and any accrued interest. See the SBA Website for additional guidance.

If I only have to use 60% of my funds directly for payroll, how do I qualify the remainder of the funds? My rent, mortgage, interest, and other expenses will not cover the other 40%.No more than 40% of the total forgiveness amount may be used for nonpayroll expenses including mortgage interest, rent, and utilities. Note that the 40% threshold is a maximum, not a minimum. Borrowers must use at least 60%, but up to 100%, of the total loan amount for qualifying payroll expenses. The relief bill enacted on December 27, 2020 also allows funds to be used on additional forgivable expenses. Please see the SBA Website for additional guidance.

Recommended Reading: What Is The Current Va Loan To Value Rate

If I Have Already Submitted A Loan Forgiveness Application Do I Need To Reapply Using Sba Form 3508s

If you have an application in process that has not yet been submitted to the SBA, we will continue to process your application unless you inform us that you would like to withdraw your application and reapply using Form 3508S. We have sent an email to those customers impacted with instructions on how to notify us.

First National Bank Of Alaska*

This community bank has headquarters in Anchorage and operates branches throughout the state. It has stopped accepting new PPP loan applications. On its site, its not clear if it was or will restrict applicants to current customers. For updates and more information, go here. Consolidated assets: $3.8 billion.

Don’t Miss: How To Transfer Parent Plus Loan To Child