Consolidating Your Student Loans To Reduce Student Loan Payments And Interest

A Direct Consolidation Loan allows you to combine one or more of your federal student loans into a single loan with one monthly payment. This kind of loan can be helpful if you want to reduce your interest rate, you don’t qualify for another payment plan program, you qualify for another payment program but still can’t afford the payments, or you want to get out of default.

Apply Every Raise And Tax Refund Toward Paying Off Your Student Loans

What do most people do when they get a raise? They blow through it like its nothing. And then they wonder why it felt like they didnt get a raise.

As you keep growing in your career and getting promotions as you go, put your extra income toward paying off those student loans. Dont move to a bigger house. Dont buy a new car. Dont buy any designer threads. And dont upgrade your smartphone. You were living without that extra money before, and you can keep living without it a little while longer. Now is not the time to upgrade your lifestyle. You can do that later when you dont have a payment in the world! Use your income boost to make major progress in your fight against student loan debt.

The same goes for your tax refund. How many people do you know who take that free money and burn it all on new furniture, clothes or a 55-inch flat-screen TV? One extra deposit into the bank account, and suddenly a little voice in your head yells, Treat yourself!

Heres a not-so-fun fact: Your tax refund isnt free money from the government. Theyre just giving you back your own money because you paid them too much. They were just holding onto your money all year long with zero percent interest earned! If you really want to treat yourself, take that refund and put it directly toward paying off a big chunk of your student loans!

Do Not Give Out Personal Information

When you first get a call from a debt collector it is common for them to ask questions such as who you are, and if you own the debt. These are collection tactics. You do not need to answer anything. Instead, you can ask them to communicate only through the mail.

Be sure to avoid giving any more information such as your Email, employer, family information, and any type of credit card, social security, or bank account information. Although you might feel like you can trust a debt collector, the only way to win a lawsuit against them is to never admit responsibility for the debt. It will only get you into trouble later.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

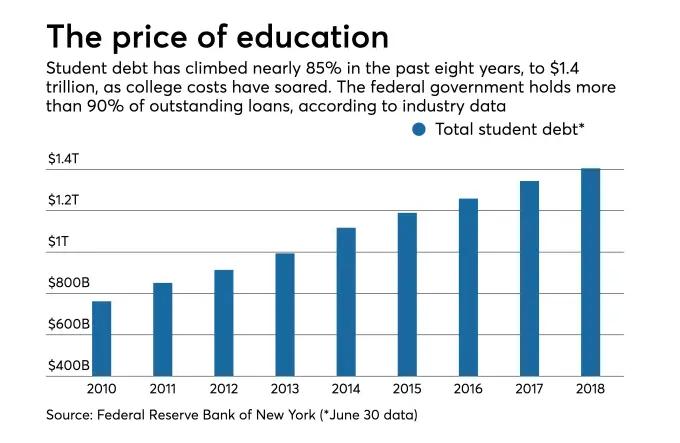

The Claim: The Federal Government Would Have More Money If It Canceled Student Loan Debt

Since President Joe Biden took office, his administration has canceled billions of dollars in student loan debt. Most recently, in early October, the Education Department announced sweeping changes to its Public Service Loan Forgiveness program, immediately erasing the debt of 22,000 borrowers.

Now some social media users say it’s in the federal government’s best financial interest to go ahead and cancel all student loan debt.

“Wait was nobody going to tell me that US student loans cost the government over $60B more to service than they bring in a year???” reads text in . “They could literally be cancelled this second and the gov would have *more* money.”

The post, shared more than 500 times within a few days, stems from an Oct. 21 tweet with more than 4,500 retweets. Similar claims have racked up thousands of interactions on Facebook, according to CrowdTangle, a social media insights tool.

Fact check:Cargo backlog due to supply chain snags, not executive order

But experts say canceling student loan debt wouldn’t actually make money for the government. Quite the opposite.

“This idea is ridiculous,” , senior vice president and senior policy director for the Committee for a Responsible Federal Budget, told USA TODAY. “The federal government is owed more than $1.5 trillion.”

Withhold Your Tax Refund

In some cases of federal student loan default, the government may take your tax refund.

Some states also have laws in place where state guaranty agencies are allowed to take your state income tax refunds as well.

This can be a considerable financial blow if you depend heavily on your tax refund.

Note: Collection agencies are currently prohibited from wihtholding a borrowers tax refund due to the COVID-19 student loan relief effort. This is in effect through at least September 30, 2021.

Recommended Reading: How Do I Refinance An Auto Loan

What Is Student Loan Settlement

If you have a large student loan balance, settling loans is a way to reduce what you owe and eliminate any future obligation to repay the loans.

Student loan settlement is a process where you negotiate with your loan servicers or collection agencies and agree to make a lump-sum payment. If the loan servicer or agency agrees to the terms, you will pay an amount that is lower than what you owe in outstanding loans, collection fees and interest charges.

Once youve followed the terms of the settlement, the loan is marked as settled, and your obligation for the loans is satisfied. The default status will be removed from your credit report, but the settlement can still affect your credit.

Student Loan Forgiveness And Discharge Options

In some cases, federal student loans can be forgiven in full or in part. Conditions for loan forgiveness include:

- Becoming a teacher or other public service professional under specific guidelines.

- Service in the U.S. Armed Forces.

- Closure of a college before completion of studies.

- Fraud or malfeasance on the part of an educational institution.

- False certification as a result of crime or identity theft.

- Total and permanent disability.

Though it is extremely rare, another way in which a student loan can be completely discharged is through a declaration of bankruptcy, although a borrower must be able to prove undue financial hardship in a bankruptcy court.

Courts use different tests and may consider some or all of the following criteria:

- You cannot maintain, based on current income and expenses, a minimal standard of living, if forced to repay the student loans.

- Additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the loan.

- You have made good-faith efforts to repay your loans.

7 Minute Read

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Pay In Installments Rather Than Loans

If you choose to pay the college directly without a loan, its best to know about their payment plans. Most colleges offer installment plans that are interest-free and might have only a small fee. Choosing to pay in installments rather than by loan can help avoid debt. That is, if you have the money but just not all at once.

Contact The Collections Agency

If your loans are in default, your lender has likely sent your account to collections. The collections agency is responsible for contacting you and attempting to get repayment. If the agency has contacted you, you can call or email them. You can contact your lender or federal loan servicer if you arent sure of the collections agency.

Not sure who your loan servicer is? You can find out with the National Student Loan Data System or by reviewing your credit report at AnnualCreditReport.com.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Getting Help With Your Federal Student Loans

To learn more about options for federal student loans, visit theU.S. Department of Education’s Federal Student Aid website. You can also call your loan servicer. If you have a Federal Perkins Loan, contact your school.

To get assistance in dealing with your servicer or to get help understanding the different repayment, deferment, forbearance, and forgiveness options for federal student loans, consider consulting with a student loan attorney or debt negotiation attorney who deals with student loans.

Estimate Your Monthly Payments

The interest rates on your first payment date are used to figure out the monthly payment for your loan .

If interest rates change, your monthly payment stays the same. However, the amount applied to your loan balance will change.

With your account, you can:

You May Like: Can You Transfer Car Payments To Another Person

Getting A Forbearance To Temporarily Stop Paying Off Student Loan Debt

With loan forbearance, your loan holder gives you permission to stop making payments for a set amount of time or permits you to temporarily make reduced payments. Common reasons supporting a forbearance include poor health, unforeseen personal problems, your inability to pay the loan within ten years , or monthly loan payments that are more than 20% of your income.

Next Steps To Consider

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Fudget: Budget And Expense Tracking App

This application is one of the most recommended by financial companies for daily use. The reason why over half a million people have installed and are using Fudget is because of its simplicity. Enter and correct any data in just a few seconds.

Like others, this platform is used by students to track the spending of money. It has never been so easy to check which sphere of life takes the most of your budget.

Regional Adjustment Bureau Student Loans How To Win

Chloe Meltzer

Summary: Is the Regional Adjustment Bureau coming after you for past due student loans? Find out how to win against them in court.

If you are receiving calls from a debt collector then it can feel like you have nowhere to turn. Especially if you are being pursued by an organization called the Regional Adjustment Bureau , you most likely are behind on paying your debt. RAB works primarily with those who are behind on student loan payments and work to collect on those debts. This organization also uses a predictive dialer which allows them to make thousands of phone calls each day to consumers.

Having been working in this industry since 1971, there have been many cases filed against them for violations of the Fair Debt Collection Practices Act. If you are receiving calls from the Regional Adjustment Bureau then you need to know your rights and how to respond.

Debt collectors have always purchased your debt from the original creditor who loaned you money. Whether that is credit card debt or student loans, a debt collector only cares about one thing, getting their money back. Although it might seem scary, dealing with Regional Adjustment Bureau Student Loans can be very easy if you know what to say and what to do.

Read Also: Usaa Car Interest Rates

This Student Loan Memo Means Nothing For Student Loan Cancellation

Based on the heavily-redacted student loans memo that was released, the memo in its current form means nothing for student loan cancellation. The memo is all redacted, so its unreasonable to conclude anything regarding student loan cancellation. The title of the memo confirms the topic, wide-scale student loan forgiveness, and how it relates to legal authority. However, this isnt breaking news. White House Chief of Staff Ron Klain confirmed in April that the Education Department was preparing a memo on this very topic. However, since the memo is redacted, its unclear what are the content of the memo, including any potential recommendations for student loan forgiveness. .

Potential Pitfalls Of Forgiveness

The IRS likes to tax things, and forgiven debt is no exception. Public service loan forgiveness is not taxable. But any balance wiped out through an income-driven repayment plan can be counted as income and taxed. It’s important to prepare for this eventual tax bill. Consider setting aside money in a dedicated savings account.

Note that the American Rescue Plan , passed by Congress and signed by President Biden in March 2021, includes a provision that student loan forgiveness issued between Jan. 1, 2021, and Dec. 31, 2025, will not be taxable to the recipient.

Don’t Miss: How To Refinance An Avant Loan

What Happens If You Just Stop Paying Your Student Loans

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If your student loan payments seem overwhelming, you should know that youre not alone. Americans are shouldering a growing student debt burden In fact, US borrowers owe a combined $1.7 trillion in student loan debt, according to the Federal Reserve.

For federal student loans, if a borrower fails to make payments on a loan for more than 270 days, the loan will go into default. Having trouble paying off student debt is not uncommon. According to the latest figures as of the publication date of this article, 9.7% of the borrowers who started repaying federal student loans in 2017 defaulted within the next three years.

Find State Assistance For Your Student Loans

Many states also offer various student loan forgiveness programs for your student loans. 46 out of 50 states offer at least one program, with some states offering many different programs to cover a wide variety of loan types, employment, and more. In fact, Kansas offers student loan forgiveness of up to $15,000 for just living in certain parts of the state.

Before you give up on not qualifying for Federal loan forgiveness programs, check your state and see if they offer any incentives or assistance: Student Loan Forgiveness by State.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Are The Best Strategies For Paying Off Student Loans

Since student loan cancellation is not set in stone, youre still responsible for making payments when theyre due. And, importantly, if you have only private student loans, you likely wont be eligible for any kind of student loan forgiveness.

Here are some of the best ways to deal with your student loans as the administrative forbearance period continues:

If youre struggling to pay your private student loans now, youll need to reach out to your lender and see what options you have for your individual circumstances and needs. You might qualify for hardship assistance eligibility varies by lender, but many have coronavirus-specific options in place.

Attend A Community College First

Many recent high school graduates are eager to attend a four-year university, but attending community college can save you thousands of dollars per semester.

Community college classrooms are also much smaller than large university lecture halls and can provide you with more personal attention when taking your prerequisite classes.

After a year or two of racking up credits, you can transfer to the university you want to graduate from. Your resume will show your graduating college, not the community college, so employers will never know you hacked your education costs.

Just make sure all the credits youve earned fully transfer from the community college to the college you want to attend to avoid wasting time and money on useless classes.

In addition to far cheaper tuition, you can also save on room and board by living with your parents.

Also Check: How To Get Loan Without Proof Of Income

How Can I Get Rid Of Student Loans Without Paying

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Help for current students: Emergency COVID-19 relief for students

Theres no simple way to get rid of student loans without paying. But for federal student loans, there are forgiveness programs available after you make payments and meet other qualifications.

The most easily accessible student loan forgiveness programs include:

-

Public Service Loan Forgiveness: After 10 years of making payments while working full time for a qualifying government or nonprofit employer, the rest of your loan debt is forgiven. Its tough to qualify, and youll need to submit an employment certification form every year in the 10 years it takes to qualify so you stay on track.

-

Forgiveness through income-driven repayment: This is your best option to keep payments manageable. Your monthly bill amount is set at a portion of your income, and after 20 or 25 years, your remaining debt is forgiven.

-

Teacher Loan Forgiveness: After teaching full time for five consecutive years at a qualifying low-income school, you could see up to $17,500 of your loans forgiven.

Find out about additional forgiveness programs.

» MORE:What are the odds I’ll get student loan forgiveness?