Geographic Eligibility For A Usda Mortgage

You can check your area on the USDA Eligibility Map to see if it qualifies for a USDA Mortgage. Some states are completely eligible, like Wyoming. Note that, at least 97% of the U.S land mass is eligible for the loan, about 109 million people. Some suburban areas qualify since the maps havent been updated for a while but you need to apply for the loan before the boundaries change.

Most people looking to buy homes in the suburban areas assume that their homes are not eligible. When you do a proper search, you will find eligible locations within 30 minutes of your workplace. For a town to be eligible it must meet the following.

- Have a population of less than 20,000 people

- Located in a rural place with rural characteristics

- Have lack of available credit

Some of the new rules classify an area to be rural if the population is below 35,000 but the newest census will determine the rules. Currently, cities with a huge population are still eligible for the Rural Housing loan. Note that USDA loans offer a lot of value in the home buying market today.

They were created for people who make a modest income. As such, the underwriting standards are very lenient. If you have always wanted to own a home, you can do so with the USDA loan program. Check your eligibility today and get your dream house without a down payment.

How To Apply For A Usda Loan

Applying for a USDA loan is easy. To find out additional information about the USDA loan and to see if you can qualify, you can contact your local USDA Rural Development field office for more information.

Additionally, for residents of Kansas and Missouri interested in securing a USDA loan for a purchase of a rural home, you can simply contact your local Landmark National Bank location. Our dedicated loan and mortgage officers will work directly with you to help you determine if you and the home of your dreams qualify for a USDA loan. Even if thats not the case, we can help you with other home loans at competitive rates.

Homeownership is the American dream, and its achievable with the help of the right financial institution. Landmark National Bank is here to help.

Usda Income And Property Eligibility

Here is a rundown of income and property eligibility requirements:

- Income limits: Your income cant exceed 115% of area median income

- Household income of all adults: The USDA examines your households income to ensure it doesnt exceed area limits.

- Employment requirements: The USDA looks for a stable employment history of two years.

- Debt-to-income ratio: Your DTI ratio calculates how much of your monthly income goes into monthly debt payments. The maximum DTI the USDA allows is 41%.

- USDA property eligibility: The USDA allows single family homes, planned-unit developments, condominiums, modular and manufactured homes and new construction for homes that have never been occupied. For USDA direct loans, properties need to be 2,000 square feet or less and cannot have an in-ground swimming pool.

- Occupancy: You can only use single family USDA loans for a primary residence, not a second home.

- Residency: You must be a U.S. citizen, U.S. non-citizen national or qualified alien

Recommended Reading: Can You Refinance Your Auto Loan

Options For The Rural Housing Service Guaranteed Loan Program

The Rural Housing Service , a division of the U.S. Department of Agriculture and formerly known as FmHA, runs two home loan programs. This section describes options for the program that guaranties loans made by private lenders. For more detail, see chapter 18 of RHS Handbook HB-1-3555, available at www.rd.usda.gov/files/hb-1-3555.pdf. The next section describes options for the RHS program that makes government loans directly to borrowers.

Due to the COVID-19 emergency, the USDA issued a pause on foreclosures that applies at least until June 30, 2021, to help people who have struggled with the pandemic. If you have a financial hardship because of the pandemic, talk to your servicer about available options.

Special Forbearance. An RHS special forbearance is an agreement between you and the servicer to temporarily reduce or suspend payments for one or more months, followed by a repayment plan which may be combined with a loan modification. There is no time limit on the repayment plan, so long as, during the term of the plan, the amount past-due do not exceed an amount equal to twelve monthly mortgage payments. To be eligible for a forbearance plan you must have experienced a loss of income or increase in expenses and your payment must be at least thirty days past-due .

© Copyright, National Consumer Law Center, Inc., All rights reserved. Terms of UseNational Consumer Law Center and NCLC are trademarks of National Consumer Law Center, Inc.

What Is The Minimum Credit Score For Usda Loans

Most lenders will lend people with a minimum of 620 as their credit score under the USDA loan program. However, if you have a lower score, you are not completely banned. According to the fine print, your loan might be approved if you experienced an extenuating circumstance that lowered your credit score.

Some of the acceptable extenuating circumstances include the following.

- Medical emergency

- Layoff due to reduction in workforce

- Other events outside your control.

Note that the extenuating circumstance must be a one-time event that will not recur. It should not be caused by your inability to manage your finances. If you have an extenuating circumstance but are not sure whether you qualify, talk to a lender.

USDA loans are not limited to buyers who have challenged credit scores. They offer fantastic value and the lowest interest rates for all types of borrowers. If you have a credit score of at least 680, you will enjoy a streamlined approval process. You dont need to provide verification of rent at this point.

Recommended Reading: How Long Is Car Loan Pre Approval Good For

Usda Vs Conventional Loans

Unlike a USDA loan, a conventional loan isnt backed by the government. A conventional loan requires a down payment, but doesnt have strict income or geographic requirements. Below is the breakdown of the difference between the two loan programs.

| Loan requirement | ||

|---|---|---|

| 1% guarantee fee 0.35% of loan amount for annual guarantee fee | 0.15% to 1.95% annual premium | |

| Income limits | Up to moderate household income limit based on area | Income maximum is 80% of area median income for HomePossible program and HomeReady Program |

| Property location limits | Rural areas designated by the USDA | No restrictions |

How Can I Qualify For An Rhs Loan

Loans are available to those with low to moderate incomes. Income limits vary based on the area where the borrower lives. For a single-family home loan, the home must be a primary residence and be located in an area with a population of 35,000 or less. Borrowers must be U.S. citizens or legal nonresident aliens and cannot be delinquent on any federal debt.

Read Also: What Are The Best Home Loan Lenders

To Find Out If You Qualify For The Program You Can Check The Full List Of Requirements Here Here Are Some Of The Basic Qualifications:

You must be a U.S. Citizen, U.S. non-citizen national or Qualified Alien.

You must agree to occupy the residence as your primary residence.

You must have adequate and dependable income.

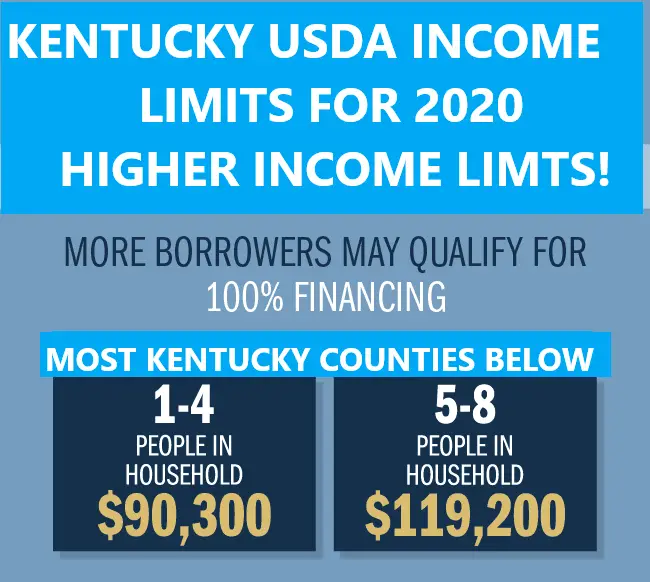

Your annual household income cannot exceed the program limits. The average annual limit for most areas of Ohio, Indiana, Kentucky, and Florida is approximately $103,500 and $136,600 .

You must purchase a property that meets the criteria set by the RHS and USDA. The property must be located in an eligible rural area.

You must not have been debarred from participating in federal programs.

If you are ready to get started with your USDA loan application, contact us at or apply online!

How Usda Loans Work

Using a USDA loan, buyers can finance 100% of a home purchase price while getting access to better-than-average mortgage rates. This is because USDA mortgage rates are discounted as compared to other low-down payment loans.

Beyond that, USDA loans arent all that different from other home loan programs.

The repayment schedule doesnt feature a balloon or anything non-standard the closing costs are ordinary and, prepayment penalties never apply.

The two areas where USDA loans are different is with respect to the loan type and down payment amount.

- With a USDA loan, you dont have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available via the USDA rural loan program

Rural loans can be used by first-time home buyers and repeat home buyers alike. Homeowner counseling is not required to use the USDA program.

Also Check: How To Reduce Interest On Car Loan

Do Usda Loans Have Pmi

No, USDA loans do not require private mortgage insurance, or PMI, as PMI only applies to conventional loans. However, USDA loans do have two types of fees that function similarly to PMI.

The first is called an upfront guarantee fee, which equals 1 percent of the total loan amount. The second fee is called the annual fee, which equals 0.35 percent of the loan amount. The upfront fee is paid at closing and is rolled into the loan amount, while the annual fee is calculated once per year and then divided into monthly payments along with other monthly costs.

These fees are levied no matter if you pay 0 percent down or 20 percent down. However, these fees are usually cheaper than PMI attached to a conventional loan.

Which Loan Is Right For Me: Fha Va And Usda/rhs Loans

Not all mortgages are created equal. They are crafted to meet the needs of certain homebuyers. The mortgage your brother swears is the best deal may not be the best option for you. Its important to understand the differences in loans to ensure you are making a wise financial decision. Dont fear, you arent alone a qualified mortgage professional will be there to help answer your questions.

Weve already covered the differences between fixed- and adjustable-rate loans, and conventional and government-insured loans. Today, we will be covering FHA, VA, and USDA/RHS loans.

FHA Loans

These mortgages are insured by the Federal Housing Administration and can be obtained at any FHA-approved lender.

They are very popular for first-time homebuyers as they have more flexible qualification requirements than the average mortgage. The typical down payment is much lower than usual at 3.5% of the home price. The loan also allows the seller, builder, and lender to pay off some of the closing costs. There is even a special product that can be added to the loan allowing the buyer to borrow extra cash to complete repairs on the home.

VA Loans

VA loans are for service members, veterans, and eligible surviving spouses. This program was created in 1944 to help returning service members purchase homes. Since the program began, it has helped place more than 20 million veterans and families.

USDA/RHS Loans

Don’t Miss: What Loan Option Is Recommended For First Time Buyers

Business Is Always Personaltm

At Finance of America Mortgage, we dont see customers as numbers and paperwork. For us, doing business is about making human connections. We listen to the people we serve. We find the right mortgage solution for their specific needs. And we help them achieve their dreams of homeownership. Youll see it in everything we do.

©2022 Finance of America Mortgage LLC is licensed nationwide | | NMLS ID # 1071 | 1 West Elm Street, Suite 450, Conshohocken, PA 19428 | 355-5626 | AZ Mortgage Banker License #0910184 | Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act | Georgia Residential Mortgage Licensee #15499 | Kansas Licensed Mortgage Company | Licensed by the N.J. Department of Banking and Insurance | Licensed Mortgage Banker NYS Banking Department | Rhode Island Licensed Lender | Massachusetts Lender/Broker License MC1071. For licensing information go to: www.nmlsconsumeraccess.org

Loans made or arranged pursuant to a California Finance Lenders Law license.

A preapproval is not a loan approval, rate lock, guarantee or commitment to lend. An underwriter must review and approve a complete loan application after you are preapproved in order to obtain financing.

This information is provided by Finance of America Mortgage. Any materials were not provided by HUD or FHA. It has not been approved by FHA or any Government Agency.

Complaints? Email us at

How Does An Usda Rd Loan Work

A USDA RD Loan works like most any other home loan program with a few different caveats. The USDA RD home loan program provides borrowers with an opportunity to buy with no money down, so 100% financing. Also, USDA RD Loans have low monthly PMI or Mortgage Insurance added to payment the factor is .35%. There are income and property eligibility restrictions. Some lenders will finance with a Credit Score as low as 620.

Recommended Reading: Where To Loan Money Online

How Much Are The Closing Costs With Usda Loans

With USDA mortgages, there is no down payment necessary. Note that, with FHA loans, you need a down payment of 3.5% while conventional loans require 3 to 5% down payment. Therefore, if you want to buy a home worth $200,000 the following down payments would be applicable.

- No down payment is required for USDA loans. FHA loans the down payment is 3.5%which is $7,000. Conventional 97 loans have 3% down payment which is $6,000 and conventional 95 loans have 5% down payment which is $10,000. Note: for USDA loans, you dont need any down payment but you need to pay the following closing costs that will add up to a few thousands. Closing costs are divided into

- Costs to acquire the loan and the transfer title

- Expenses associated with the property

The costs to acquire the loan and property will vary depending on the company and lender. However, the expenses associated with the property will not change regardless of where you get the loan.

What Is A Usda Loan And How Do I Qualify For One

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

USDA loans can help you with buying or improving a home in a rural area with no down payment. The U.S. Department of Agriculture offers several programs to help low- to moderate-income borrowers, but there are strict income and geographic eligibility requirements to qualify.

Recommended Reading: How To Refinance Your Car Loan

Cons To The Usda Rural Development Loan

- Geographic restrictions

- Mortgage insurance included

- Single family, owner occupied only – no duplex homes

If you’re wondering if you and your proposed property qualify for a USDA Rural Development loan, contact a branch close to you. Or maybe you have a few questions about the loan process and just want to have a friendly conversation. Just click the button below and we’ll get back in touch. We’re always happy to help!

Using A Mortgage Calculator

If you would like to calculate whether or not your debt to income ratio is an acceptable one, it is a good idea to use a mortgage calculator prior to applying for any mortgage. Many of which can be found online. Key in the mortgage amount requested, down payment amount if any, and your income. The calculator will figure a debt to income percentage for you. Many lenders use this number to determine if you are within the acceptable range to qualify for a mortgage, or any other type of loan for that matter.

Follow us on and .

Don’t Miss: How To Change Name On Auto Loan

Usda Rural Housing Service Mortgage Insurance

- Definition of a USDA Section 502 Loan

- No PMI required

- Difference between 502 Direct and 502 Guaranteed

Are USDA Rural Housing Service mortgages required to have mortgage insurance?

My father just passed away and his mortgage was with USDA Rural Housing Service Farmer’s home. I was wondering if it was mandatory to have mortgage life insurance.

A mortgage insurance policy protects a lender against some or most of the losses that can occur when a borrower defaults on a mortgage loan.

You do not mention if the mortgage in question is a “Section 502” loan. I will assume that it is. However, the USDA has been offering loans for several years, and the terms of the loan in question may be different from what the USDA offers today. The USDA Rural Housing Service offers guaranteed and direct housing loans.

What Are Usda Loan Requirements

Here are the requirements:

Read Also: Best Personal Loans For Excellent Credit