Fannie Mae Homeready Mortgage Guidelines And Requirements

This Article Is Amout Fannie Mae HomeReady Mortgage Guidelines And Requirements

There are two types of home loan programs:

- Government Loans which are home loans insured by government agencies

- FHA, VA, USDA are government loans

In this article, we will cover and discuss the Fannie Mae HomeReady Mortgage Guidelines And Requirements.

With the overwhelming variety of mortgage products available, many Americans do not know about the Fannie Mae HomeReady mortgage program by Fannie Mae.

- This is an amazing mortgage product designed to help low-to-moderate income borrowers

- It also gives lenders the confidence to make these loans

- There are some advantages to using the Fannie Mae HomeReady mortgage program over FHA financing

- Some benefits include such as able to cancel mortgage insurance

In this blog, we will go over more details about the Fannie Mae HomeReady product and some of the requirements.

Can Fha Loans Be Refinanced

Of course! Any loan can be refinanced if it meets the eligibility requirements for the program. Its also up to your lender to make sure that refinancing makes financial sense for you. There are many reasons to refinance and if youd like to learn more about them, look at the information we have available.

- Downers Grove, IL – 246-4777

- Pulaski Office, IL – 649-4800

- Bucktown, IL – 688-9998

- Old Irving, IL- 938-4848

- Grand Rapids, MI- 828-4165

- Gilbert Office, AZ – 571-8008

- Peoria Office, AZ – 246-4777

Fannie Maes Homeready Vs Freddie Macs Home Possible

The HomeReady and Home Possible programs each allow you to make a small down payment on your home purchase. The programs have slightly different requirements.

Perhaps the most significant difference is each programs credit score requirements a 620 score for HomeReady and a 660 score requirement for Home Possible which could significantly impact your eligibility.

Read Also: Capital One Auto Loan Application Status

Fannie Mae Homeready Versus Fha Loans

There are plenty of options for people that do not qualify for standard conventional loans to obtain a mortgage today, even though the days of no doc and stated income loans are behind us. The HomeReady and FHA loans are two of the best options for people with less than perfect credit or unique income situations. Both loans require a very low down payment and flexible qualification guidelines. Understanding the differences between the programs can help you make the right financial choice for your needs.

What Are The Terms On Homeready And Home Possible Loans

Your mortgage term refers to the length of time you pay on your mortgage.

Fixed-rate mortgages are loans that have a set rate you pay off over a predetermined length of time. Typically, the longer your term, the more interest youll pay. Longer-term mortgages also tend to have smaller monthly payments, since the repayment plan is spread out over a longer period.

Rocket Mortgage® does not allow adjustable-rate mortgages with these programs and does not offer them on second homes or investment properties.

Recommended Reading: Avant/refinance/apply

What Attributes Are The Same Between The Two Loans

Both loan programs have some pretty similar requirements including:

- Low down payment requirements There is only a .5% difference between the FHA required down payment and the HomeReady required down payment

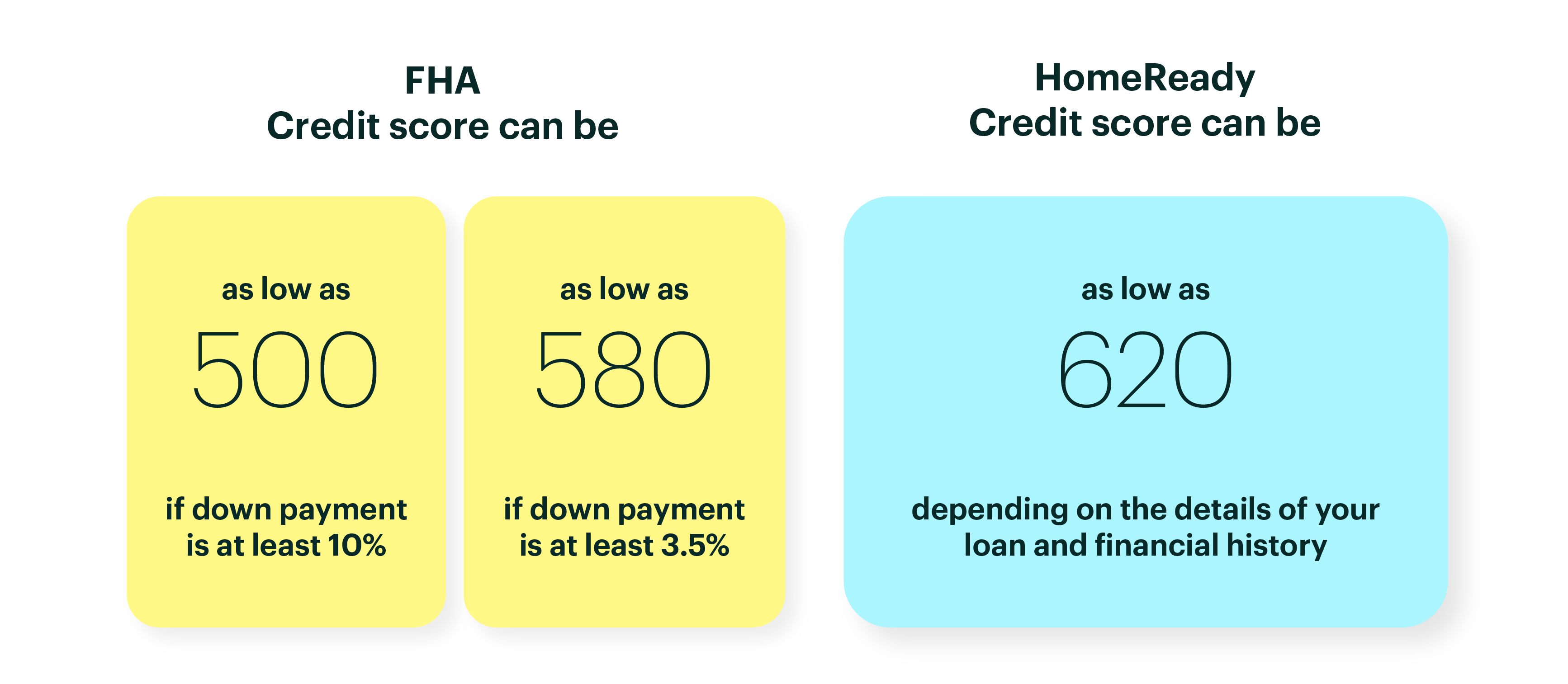

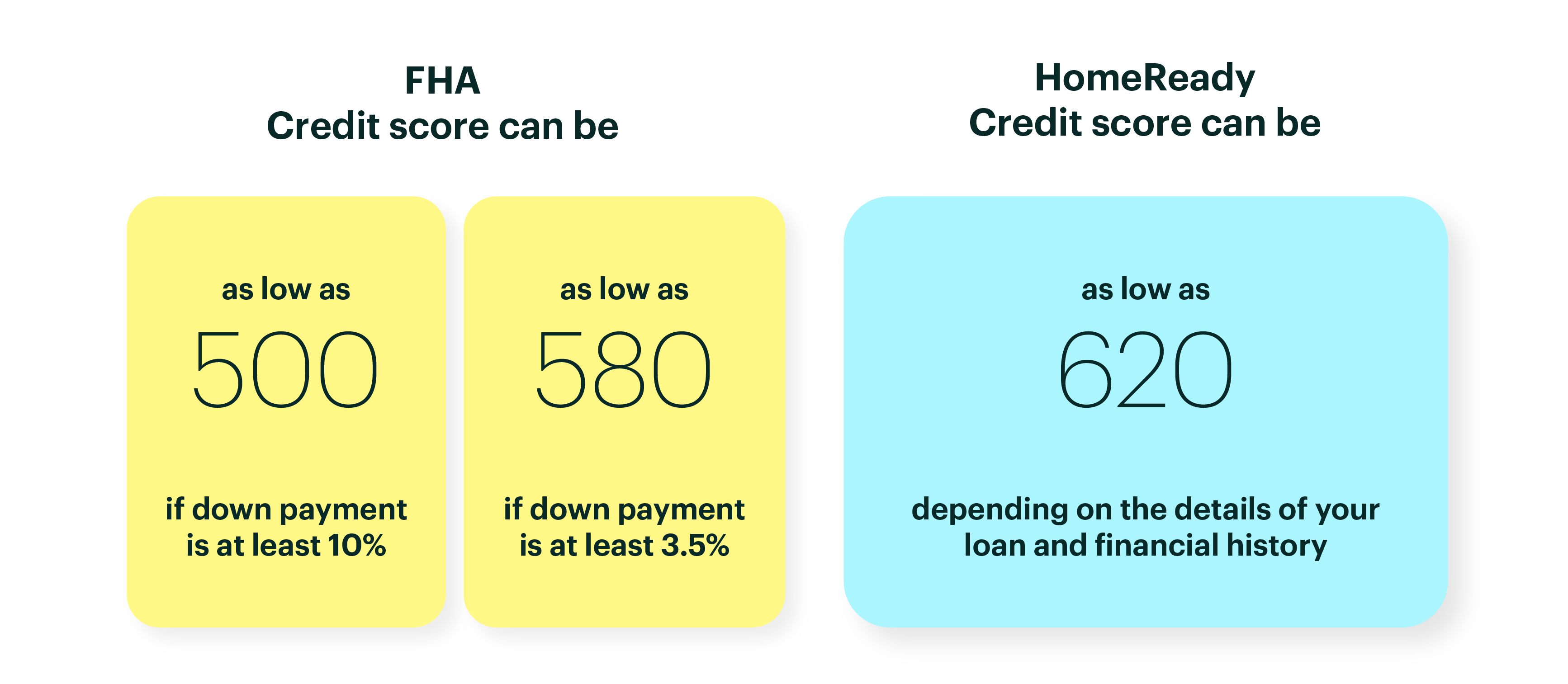

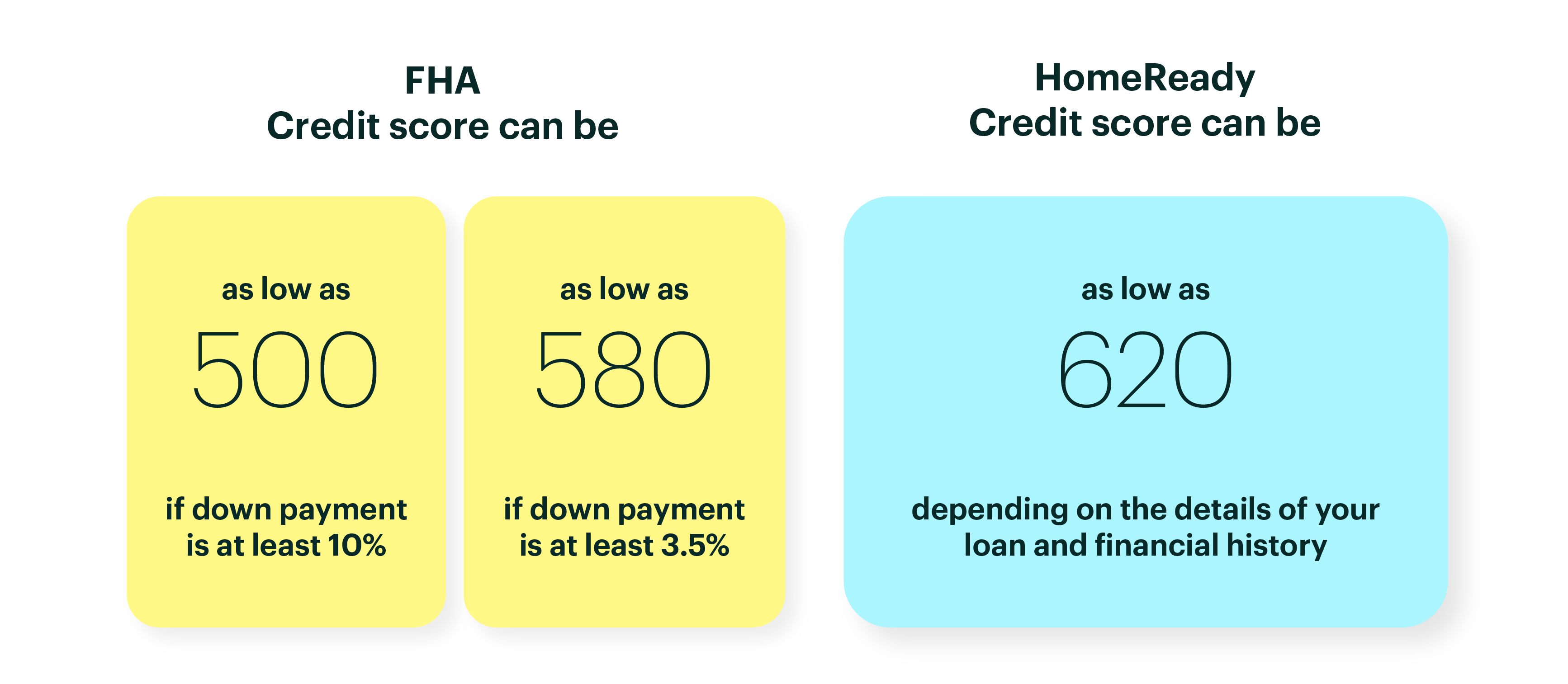

- Low and/or bad credit is often accepted with both of these programs as they have flexible credit guidelines. FHA loans can accept credit scores as low as 580 . HomeReady loans require a 620 minimum credit score.

- Maximum loan amounts are in place for each program The FHA limits are categorized by county and HomeReady loans are maximized by the conforming loan limits.

- Mortgage insurance is required Both loans require mortgage insurance premiums in order to obtain the loan in order to protect the lender if you were to default. HomeReady mortgage insurance is called PMI and FHA mortgage insurance is called MIP.

Who Qualifies For A Homeready Or Home Possible Loan

Youll need to meet certain criteria to qualify for either of these programs. Here are the three major requirements:

- Youll need a qualifying credit score. Your income can be on the low end, but youll still need to meet a minimum credit score requirement. A Home Possible loan requires a minimum score of 660, while HomeReady will accept a score as low as 620. Other conventional mortgages have higher credit score requirements, so the reduced score minimum helps you secure the financing you need, even if your credit isnt perfect. You may have the option to use alternative credit history to be considered to help meet this qualification. Alternative credit history includes factors like payments on rent and utilities. Check with your lender for more information.

- You must not own any additional residences in the country. You dont have to be a first-time home buyer to qualify, but you cant currently own a home with this mortgage type.

- You must attend homeownership education courses. Homeownership courses will help prepare you for the financial challenge of owning a home. These courses require participation in 4 6 hours of approved courses to help arm you with the education youll need as a homeowner.

Don’t Miss: How Much Land Can You Buy With A Va Loan

Income Limits On Fannie Mae Homeready Mortgage

Fannie Mae HomeReady Mortgage income limit caps will be different depending on where the subject property is located. Use this link to determine the income limits for Home Ready.

Fannie Mae and Freddie Mac created the Fannie Mae HomeReady Mortgage and Freddie Mac Home Possible Loan Program to promote homeownership for first time home buyers with lower to moderate household income. Both HomeReady and Home Possible are a great program for homebuyers with families who are living paycheck to paycheck and have little down payment towards a home purchase.

Homeready Mortgage Program Pros

- Allows a borrower to buy a new home with a low down payment and doesnt require borrower contribution

- Allows a borrower to include income from other non-occupant borrowers and non-borrower household members which allows the borrower to qualify for a bigger mortgage.

- There is no mortgage insurance premium or private mortgage insurance cost due up-front.

- This program offers more flexible mortgage qualification requirements.

Recommended Reading: Stilt Loan Calculator

How Do Fha Loans Work

FHA-backed mortgages follow the same standard contract as other U.S. mortgages. Home buyers borrow money, agree to monthly payments, and the loan pays off in either 15 or 30 years.

There is no penalty for selling your home while your loan is still active, and, as the homeowner, you retain the right to pay your mortgage off at any time.

FHA loans require a down payment of at least 3.5 percent of the purchase price, or $3,500 for every $100,000 in your home’s purchase price. There is no maximum down payment amount.

According to mortgage software company ICE, the typical FHA home buyer makes a down payment of 5 percent.

Fha Loans And Mortgage Insurance

To offset a lower required credit score, FHA loans will typically include mortgage insurance as part of the borrowers responsibility.

FHA loans require two types of mortgage insurance payments:

- An upfront mortgage insurance premium of 1.75% of the loan amount, either paid when you close on the loan or rolled into the loan amount.

- A monthly MIP as part of your regular mortgage payments.

If your down payment was less than 10%, youll continue to pay monthly mortgage insurance for the life of the loan.

If your down payment was 10% or more, youll only have to pay mortgage insurance for the first 11 years of the loan before you can remove it.

Don’t Miss: Using Va Loan For Investment Property

Rental Income From Accessory Dwelling Units

If you are trying to buy a home that already has a rental space built into it, the potential rental income from that unit could help you qualify for a HomeReady® mortgage.

You can use the proposed income from an additional unit in thequalification process even if you do not yet have a roommate or renter linedup. That means that the 12-month shared residency history required forboarder/roommate income is not required here.

Your potential home must be classified as a 1-unit home with an ADU rather than a multi-unit home. When this is true, you can use rental income to qualify for your mortgage without any landlord experience or training. If you are buying a home with two or more units, it may still be possible to use rental income, but it is more likely that your lender will want to see education or experience that supports your suitability as a landlord.

Criticism Of A Homeready Mortgage

While HomeReady mortgages have multiple benefits, there are a few drawbacks. When you purchase a home using HomeReady, you will have limits on the amount you can borrow. This program uses FHFA’ss conforming loan limit, which as of 2022, is $647,200 for a single unit property in the contiguous United States. If you buy a property in Hawaii, Alaska, Guam, or the U.S. Virgin Islands, the amount jumps to $970,800. The challenge of the conforming loan limit is that in some parts of the U.S., especially on the coasts, housing prices, even for affordable homes, are much higher than the conforming limit as set by the FHFA.

However, it is worth noting that in some areas where 115% of the median home value exceeds the conforming loan limit, it will be higher than the baseline limit. The loan ceiling in these areas for one-unit properties in high-cost areas rises to $970,800. However, just because you can borrow this amount, if you are living on a low-to-moderate income, it may be risky to take out a loan that you may not be able to afford even if you do qualify for it on paper.

You May Like: Fha Refinance Mortgage Insurance

Freddie Macs Home Possible Vs Fannie Maes Homeready: Which Is Better

If you want to buy a home without a large down payment, there are plenty of government-backed programs available. But the opportunities dont end there. Fannie Mae and Freddie Mac also offer homebuyers low down payment options.

Both Fannie Maes HomeReady and Freddie Macs Home Possible loans allow you to buy a house with just 3% down and lenient credit requirements.

Although similar on the surface, there are some key differences that you should be aware of when considering the HomeReady or Home Possible programs. Lets dive into the details below.

Who Should Consider A Homeready Loan

Ultimately, the HomeReady loan program is a good option for borrowers with a credit score of at least 620 who earn less than 80% of the areas median income. If you have the means to come up with a 3% down payment with any kind of assistance available, then the ability to add a renters income could make buying a home a real possibility.

Also Check: Usaa Used Car Loans

What Are Fha Loan Limits

The FHA only insures mortgages of certain sizes. It’s upper-limits vary by region and are known as the FHA loan limits.

Nationwide, the 2022 FHA loan limit is $420,680 except in areas where the cost of living is higher than typical such as San Francisco or Brooklyn. In these high-cost areas, FHA loan limits can range as high as $970,800.

Limits are also higher for 2-unit and multi-family properties.

The FHA provides a loan limit table which you can use to check the maximum allowable loan size in your county. Limits vary by property type, starting with single-family homes, followed by two-units homes, then three- and four-unit homes.

If you have difficulty finding or understanding the loan limit in your county, watch this helpful video:

Review And Compare The Loan Benefits

Look before you leap on a loan! Be sure youve reviewed all of the benefits of HomeReady and Home Possible loans carefully. These mortgages have higher interest rates than other conventional loans because of their lenient down payment policy.

There might be other mortgage options that will provide you with lower rates if you can afford a larger down payment. Research the options available to you. If you decide that a lower down payment mortgage has the most to offer, proceed to Step 2.

Don’t Miss: Usaa Used Car Refinance Rates

Flexibility Around Eligible Income Sources

The HomeReady® program has generous policies around qualifying income. It benefits home buyers who think their salary is too low to qualify for a mortgage loan.

You can give your qualifying income a boost by adding the income of other members of your household to the application. You can also use the income youve made from renting a room in your home for at least the past year.

MoneyFact

Not only can home buyers applying for a HomeReady® loan use supplemental income on their loan application it can be 100% of the income they apply with.

Is Homeready Only For First Time Homebuyers

With its new HomeReady mortgage, the giant mortgage backer looks to help first time home buyers and repeat buyers alike.

This new mortgage program is laser-focused on helping minorities, Millennials, and mixed families on their road to homeownership.

This program goes way beyond the flexibility of most other loan types, even ones considered ultra-flexible like FHA.

Read Also: Usaa Auto Loans

How Does The Program Work

The HomeReady program is available to both first-time and also repeat buyers. You can also use the program if you want to refinance an existing mortgage. You need to have a credit score of at least 620. If you have a score of 680 or higher, you can get better terms.

You may be eligible if your income is 80% or less of the area median income for the census tract where a property is located. This includes properties that are located in low-income census tracts.

You can have ownership interests in other residential properties and still be eligible as a borrower under HomeReady, but only one property can be financed when you close.

What Is A Home Possible Loan

Freddie Macs Home Possible mortgage program is geared toward low- to moderate-income borrowers who can afford a 3% down payment. PMI is required until your loan balance drops to at least 80% of the homes value.

The program is also a good option for borrowers who dont have a credit score because of a lack of credit history. In that case, the minimum required down payment increases to 5%.

Read Also: Stilt Interest Rates

Are There Downsides Of Homeready Mortgages

There are a few potential downsides to think about with HomeReady.

First, there are limits on how much you can borrow. Fannie Mae uses a conforming loan limit, and in some parts of the United States, housing prices on average might be much higher than this. This can include even affordable properties relative to the area theyre in.

In some areas, if 115% of the median home value is beyond the conforming loan limit, then theres a higher baseline limit. However, even though you can borrow a higher amount doesnt mean that it isnt risky to do so.

Special populations, including public servants, might have access to more flexibility if they use the program, and the loans dont require manual underwriting.

Similarly, there are flexibilities for people with disabilities.

All borrowers have to go through homeownership counseling through Framework, an online course approved by HUD.

The HomeReady program has advantages for some buyers if you meet the qualifications. Of course, if you can put more money down on a home, it can be better financially to do so because you start out right away with more equity. Not everyone has that option though, so HomeReady makes owning a home a reality when it might not otherwise be.

What Is An Fha Loan

The FHA loan is backed by the government, which means the lender has a guarantee that the FHA will pay them should the lender default. The down payment required for the FHA loan is just 3.5% and the qualification guidelines are very flexible. They typically have the lowest credit score requirements out of any of the Qualified Mortgages available in the industry. You do not have to be a first-time homebuyer or have any unique circumstances in order to qualify for the FHA loan.

Read Also: Usaa Auto Loan Rates

Qualifying For A Homeready Loan

To get a HomeReady loan, youll have to fall within the programs income limits, take a short online class about homeownership, and have decent credit.

Exact requirements might vary by lender, but Fannie Mae sets the minimum requirements for all HomeReady loan applications.

Basic requirements for HomeReady include:

If you meet these criteria, the HomeReady loan program may be just what you need to move from renting to homeownership.

What Are Homeready Income Limits

In order to be eligible for a HomeReady loan, Fannie Mae requires lenders to look up the area and property address to make sure it meets HomeReady income eligibility requirements. The income limit varies from each area. HomeReady borrowers are not allowed to exceed past the income limit for that area. To find the HomeReady income limit for a specific area, Fannie Mae created a HomeReady Income Eligibility Lookup tool that provides lenders and other housing professionals research the accurate allowed limit. When borrowers or professionals look up the property, a map will be displayed that shows the income limit for that specific area and address. The map data will also include the following:

- HomeReady area median income

- Eligibility status (either 100% of AMI or no income limit for low-income census tracts

- The city, county and state and

- The Federal Information Processing Standards code, which is a unique code assigned to all geographical areas

Also Check: Strongly Recommended For First Time Buyers