Can You Refinance Your Auto Loan With Your Existing Lender

The rules for refinancing an existing loan with the same lender vary by financial institution. PenFed Credit Union, for example, does not allow refinancing for cars already financed with the credit union. Other lenders do allow borrowers to refinance an existing loan.

Keep in mind that it may not always be beneficial to refinance with the same lender. You might find a better deal by refinancing with another institution.

Have You Taken Out An Auto Loan To Pay For Your Car You May Be Able To Refinance That Loan To Lessen Your Financial Burden

Refinancing acar loan involves taking on a new loan to pay off the balance of your existingcar loan. Most of these loans are secured by a car and paid off in fixedmonthly payments over a predetermined period of time usually a few years.

Peoplegenerally refinance their auto loans to save money, as refinancing could scoreyou a lower interest rate. As a result, it could decrease your monthly paymentsand free up cash for other financial obligations.

Even if youcant find a more favorable rate, you may be able to find another loan with alonger repayment period, which might also result in a lower monthly payment .

Possible Outcomes When Refinancing Your Car

Not all car loan refinance deals are the same, but customers who choose to refinance often seek one of the following goals :

Lower Your Monthly Car Payments

Most of the time, people seek car loan refinancing to lower their monthly payments. This priority is understandable since monthly car loan payments can have an immediate impact on a households monthly finances. However, your monthly payment should not be the only consideration when refinancing

There are two ways to lower your car loan monthly paymentsyou can get a lower interest rate, you can extend your loan term, or both. Usually, the best way to lower your car loan payments dramatically is to extend the number of months over which you pay for your car. However, when you extend your loan term, you may end up paying more for your car in total than you would without extending it. Still, if your lender allows you to extend your loan term and gives you a lower interest rate, you may benefit by both lowering your monthly payments and paying less in total for your car. The example below will illustrate how this outcome can occur.

Change the Length of Your Car Loan Terms

Sometimes refinance customers seek refinancing to change the length of their loan terms. However, this goal usually has more to do with lowering monthly payments than changing how many months in which a customer pays for his/her car.

Remove or Add Someone as a Co-Signer to Your Loan

You May Like: How To Get An Aer Loan

Understand The Costs Of Refinancing

Sometimes you can refinance with a lower interest rate, but because the loan is extended, you will actually pay more over the length of the loan. Use a loan calculator to make sure you are saving money overall. Getting the lower monthly rate might be what you are looking for, but if you really want to pay less overall, it is important to do the math.

For example, if you have a $5,000 loan with a 10% interest rate paid throughout two years, you will pay $5,537 in total. However, that same loan extended throughout five years will end up costing you $6,374. Thats $837 that could have been spent on something else. So make sure you extend your loan only if you need to do so.

Freeing up cash quickly is sometimes the only reason for refinancing a car loan. Beware of higher interest rates, though, because most lenders charge higher rates on older vehicles. When you’re looking to refinance your aging car, you might be surprised at the interest rate available to you compared to what you received when the car was new or almost new.

Many banks, including USAA Bank and Bank of America, do not charge an application fee for an auto loan refinancing.

Things To Watch Out For When Refinancing A Car Loan

Just like with any financial arrangement, it is important to keep your eyes out for red flags. Ensure that the lending agency is reputable and offers a reasonable interest rate. Make sure that you are dealing with a proven institution and be sure to read all the fine print. If you are unsure as to the meaning of a phrase, it is better to ask.

Take a look at the cost of refinancing the vehicle. Are there any upfront expenses? Are you going to be paying more down the line? If so, how much more? Make sure that you have all of the information above before making your decision. As always, avoid deals that seem too good to be true. Understand your rights and the responsibilities of the lender. Be certain that you are comfortable with the arrangement and that it is in your best financial interests.

You May Like: How Much Do Mortgage Officers Make

How Can An Automobile Trade In Perform Your Credit File Will Likely Be Taken

A Brand New Loan Is Established

Your brand-new loan provider takes the quantity due from the old loan, adds this new interest and amortizes it underneath the regards to the brand new loan. Lets state you purchased a vehicle for $20,000 Georgia title loan at 8% interest for 60 months along with been spending $406 every for a year month.

You are actually right down to 48 months and $15,000. Your new lender has provided mortgage loan of 3.5per cent. Your brand new repayment is only going to be $335 four weeks. Instead, both you and your loan provider might consent to terms that are different. You could expand the mortgage right back out to 60 months and only be spending $273 four weeks.

Having said that, with regards to the loan provider, age while making of this vehicle and its own mileage, may very well not be capable of getting a reduced interest or a lengthier term, so that its crucial that you assess your funding choices in the 1st several years of your purchasing this vehicle.

There are numerous factors which can be enjoyed, from term to interest, towards the deposit. Much will depend on the chronilogical age of the car, your present credit rating and the debt to earnings ratio.

Unless youre along the way of having home financing or obtaining multiple other credit reports within a quick length of time, refinancing your car finance must not have impact that is negative your credit rating.

When Your Payment Modifications, Therefore Does DTI

How An Auto Refinance Can Save You Money

An auto refinance can be a great way to save money every month with lower loan payments and better rates.

For example, when you purchased your vehicle lets say you financed $26,000 over six years at 5.49% APR. Your monthly payment is $424.66. One year later, you’ve paid over $1,300 in interest. At the end of the six-year loan, you will have paid more than $4,500 in interest.

Loan ComparisonThe number one reason to refinance your auto loan is to simply save money. Maybe you didn’t get the best rate when you purchased your vehicle. Maybe your credit score has improved since your purchase and you can now command a lower interest rate.

Whatever the reason, securing better loan terms could improve your current financial situation.

There are several situations when refinancing your auto loan makes sense:

Applying for a refinancing loan could lower your credit score, but only temporarily. When you apply for any type of credit, a hard inquiry is made on your credit history. However, after six months, these “dings” to your score typically disappear.

When applying to refinance your auto loan, check your credit score so you know where you currently stand. Then, avoid any major credit inquiriessuch as applying for a new credit card or applying for other types of loansfor the next six months to minimize the impact on your score.

Call to see if your credit score could allow for better terms.

Don’t Miss: How Long For Sba Loan Approval

Youve Developed A Relationship With A Lender

Some institutions offer low rates for their good customers. And some have special deals to bring new customers in. For relatively new vehicles, some lenders will refinance your existing loan at their attractive new car rate. These rates can be better than what you initially took on when you first applied for the car loan. It pays to continually evaluate your loan and your payments to be sure that you are getting the best rate possible.

Benefits Of Refinancing A Car Loan

There are a few reasons to consider refinancing your car loan with a different lender. Here are some benefits to keep in mind:

- Lower interest rate: If your credit has improved since you first bought your vehicle or market interest rates have decreased, you may be able to get a lower interest rate than what you have right now.

- Lower monthly payment: If you keep the same repayment term, a lower interest rate will typically translate into lower monthly payments. If you want to lower your monthly payment even more, though, you may be able to get a new loan with a longer repayment term. This may mean higher interest charges over the life of the loan, but it can be worth it if your monthly budget is tight.

- Choose to pay off debt sooner: On the flip side, you could also choose a shorter repayment term. Shorter terms typically correspond with lower interest rates, which means you’ll save more money and eliminate the debt sooneralthough your monthly payments will be more expensive.

- Get cash from your equity: Some auto lenders offer cash-out refinance loans that allow you to refinance the original loan and get some cash to pay for other expenses. This option is typically limited to people who have a lot of equity in their vehicle.

As you consider these benefits, think about whether refinancing is right for you and take steps to refinance your auto loan.

Don’t Miss: Va Manufactured Home 1976

You Cant Afford Your Monthly Payment

Life happens. You might find yourself in a situation where you arent able to keep up with your payments. With a refinance, you could both lower your rate and extend the life of your term, lowering your current monthly payment. Be careful though. Extending the life of your term could cost you more in interest in the long run.

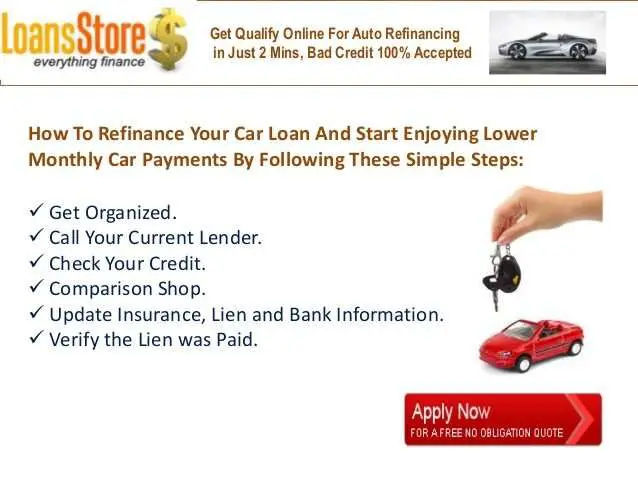

How To Refinance Your Car Loan

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Refinancing a car loan can help you save money by lowering your interest rate. The process involves replacing your current car loan with a new one, typically with a different lender. Your car will act as collateral on your new loan, just as it did on the original loan. Here’s how the auto loan refinance process works and what to think about before you apply.

Read Also: How To Get An Aer Loan

Is It Easier To Refinance With My Current Lender

Can I refinance my car with the same lender? Can I refinance with a new lender? These kinds of questions are common among auto owners who are considering refinancing.

When you buy a car, you either shop around with different lenders for a loan or ask the auto dealer that you buy from to set up a loan for you. When you refinance, it is smart to engage in the same process of shopping around for the best possible option for you.

You are not locked into using the same lender that currently holds your loan. Your priority should be finding the most favorable loan terms possible, which typically means finding a lender that will offer you the lowest interest rate. In some cases, that may be your existing lenderin other cases, it will be a new lender. Rate shopping will give you a broader sense of the market and what constitutes a genuine deal.

While it may seem easier to stay with the same lender, any lender willing to give you a refinancing loan will work with you to make the process as seamless as possible. Theres no reason to be worried that switching to a new lender will make your journey with a loan more complex.

You May Have To Pay A Penalty

Most car loans have prepayment penalties or other fees that youll incur if you pay off your loan early and to go to another lender. And that may determine whether its worth refinancing, says Ryan Mohr, owner of Clarity Capital Management, a Oregon-based fee-only planning and investment firm.

The only way to determine how all of these factors will affect your decision to refinance is to do your homework. No matter how new your loan is, periodically check refinancing offers, especially if interest rates are declining or your credit rating, income or other circumstances have changed.

Don’t Miss: Aer Scholarship For Spouses

Process Of Refinancing A Car

The process of refinancing vehicles is actually fairly straightforward. It works in a similar manner to the original purchase. However, unlike haggling about the value of the vehicle, you are locked into the cost associated with the original purchase. Essentially, the new lender buys your debt and then lends that amount to you, typically at a lower rate and with an improved term.

There is some key information to gather before taking the leap. Approach the lender and discuss the interest rates available, along with any fees you will be expected to pay. Find out if there are penalties associated with refinancing and learn what the term of the new loan will be. Determine whether the costs of refinancing, both immediate and over the long term. From there, you can decide if it is amenable to your financial situation.

Time Remaining On Your Loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

If your answer to When should I refinance my car loan? is Soon, review our current refinance rates and take a look at our auto loan refinance calculator to get a better understanding of whether refinancing makes sense for you.

You may also like

Recommended Reading: Do Pawn Shops Loan Money

How Can You Refinance An Auto Loan

Each lender has its own process and requirements for refinancing auto loans. However, the steps to refinance are generally similar to taking out an initial car loan. Heres what the refinance process looks like:

Reduce Your Interest Rate

One of the best reasons to refinance a car loan is if you have an opportunity to reduce your interest rate. If you previously had no credit or bad credit, it is worth checking into refinancing your car loan after a couple of years to see if you receive better offers. Your credit score may have improved enough to qualify you for a lower interest rate. With a lower interest rate, you will be able to pay off your loan faster or lower your monthly payment while paying it off at the same pace. In either case, you’ll pay less over the life of the loan.

Read Also: Nslds.ed.gov Legit

Determine If You Qualify For Refinancing

Find out whether youd meet a lenders requirement for a refinancing. Capital One, for example, wont refinance loans for cars that are more than seven years old, and the payoff amount on your current loan must be between $7,500 and $50,000. Like many lenders, it also wont refinance a loan that it issued in the first place.

When Can You Refinance A Car Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you recently bought a car, you may wonder when you can refinance your car loan to reduce the interest rate or lower the payment.

Strictly speaking, you can refinance your auto loan as soon as you find a lender that will approve the new loan. That may be a challenge since most lenders wont refinance until the original car loan has been open for at least two to three months.

Delayed lender approval can be an obstacle to refinancing your car loan, but there are potential benefits to waiting.

Recommended Reading: How To Transfer Car Loan To Another Person

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.