Marcus By Goldman Sachs

This is an online lender offering unsecured personal loans. You must have a credit score of at least 660. They have loan amounts from $3,500 and up to $40,000, with interest rates ranging from 6.99 percent to 28.99 percent. They have repayment plans from 36 months to 72 months. Your credit score and income are what they look at when making decisions about loans. Their application takes only 5 minutes and they guarantee no fees. They do not have origination, prepayment, or late fees.

What Are Considered Good To Excellent Credit Scores

When you are looking for a personal loan for good to excellent credit, it is important to understand credit scores and how they impact you. Credit scores range from 300 to 850. Most credit scores fall between 600 and 750. The higher your credit score, then the better your credit is. A credit score of 749 or higher is considered a great credit score. A credit score of 670 to 739 is considered good. Your credit score is one of the most important factors when is about your average personal loan interest rate.

Credit is something you build over time. It takes consistent work to build up your credit, but only a few missed or late payments will cause it to fall. Your credit score is listed on your credit report. This report lists all of your credit histories, including the debt you have or had in the past. It shows how you have repaid that debt and if you have had any late or missed payments. It shows how much debt you have balanced with your income to show your debt to income ratio. Also, it shows personal information about you, including marriages, addresses, and jobs that you have held. While your credit report shows all of this information, but it does not tell the story of why your credit score looks the way it does.

How To Choose The Best Personal Loan

Here are things to consider as you shop around and compare personal loans.

Soft credit check. Most online lenders let you check your estimated interest rate by performing a soft check of your credit during pre-qualification. This wont affect your credit score, so it pays to take the steps to pre-qualify for a loan with multiple lenders and compare rates and loan features.

Annual percentage rates. Because APRs include interest rates and fees, they offer an apples-to-apples cost comparison for borrowers deciding between personal loan offers. Use our personal loan calculator to see estimated rates and payments based on credit scores.

Repayment terms. Having a wide variety of repayment term options gives you the option to get a shorter term and pay less interest or a longer term and have a low monthly payment. Based on your budget, one may make more financial sense than the other.

Loan amount. Depending on how much money you need, one lender could be more attractive than another. Some lenders offer small to midsize loan amounts, like $2,000 to $40,000, while others provide loans up to $100,000. Determining the amount you need ahead of time will help you compare and decide.

Special features. You may benefit from features like autopay rate discounts, unemployment protection or financial coaching. See if the lender youre considering offers any perks that could help you reach your financial goals.

» MORE: Personal loan features to compare

You May Like: What Are Current Mortgage Loan Interest Rates

What Is An Unsecured Personal Loan

Most personal loan lenders offer unsecured loans. Unsecured loans don’t require collateral that is, the borrower doesn’t have to put up valuable assets as a guarantee of payment. However, this also means that unsecured loans usually have higher interest rates as they present more of a risk for lenders.

Unlike with a secured loan you won’t lose any assets if you were to default on an unsecured loan however, your credit will take a hit, hindering your ability to get another loan in the future.

Best Personal Loans For Borrowers With Good Credit

Having good credit can help you qualify for lower interest rates on a personal loan as well as higher loan amounts.

Edited byAshley CoxUpdated September 7, 2022

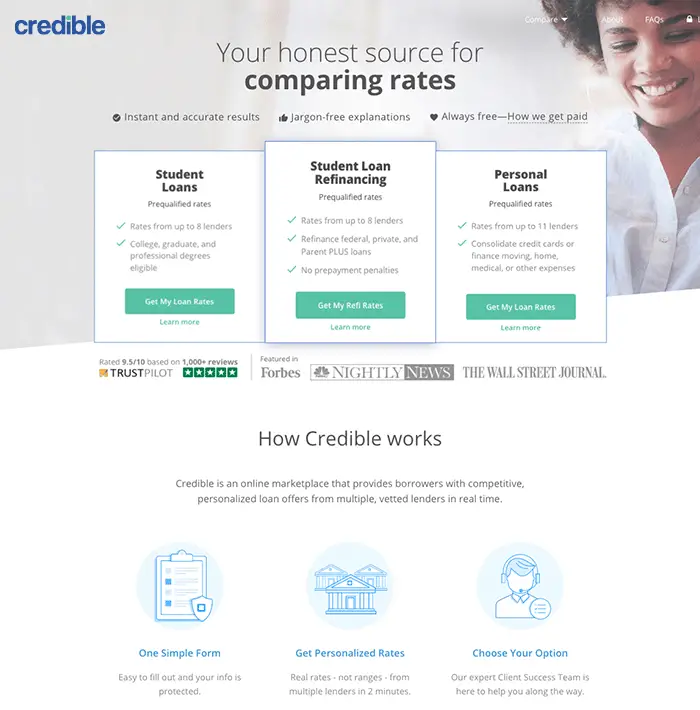

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Having good credit often makes it easier to get approved for personal loans as well as qualify for low interest rates. A good credit score is considered to be 700 or higher, while anything above 750 is excellent.

Keep in mind that the best personal loans for good credit provide competitive interest rates, a wide selection of loan terms, and inclusive eligibility requirements.

Heres what you should know about personal loans for good credit and where to find them:

You May Like: How To Remove Name From Home Loan

What Is A Good Credit Score For A Loan

Lending institutions consider several things when offering personal loans. Thus, no specific threshold guarantees that your credit scores will make a lender approve your loan.

Generally, borrowers with a VantageScore 3.0 or 4.0 of 661 or above or FICO® Score 8 or 9 of at least 670 are considered to have excellent credit, meaning they can qualify for a loan easily.

How Much Can I Borrow With A Personal Loan

Personal loans vary widely in size. They can run as high as $100,000 like with lenders such as SoFi and Wells Fargo or low as a few hundred dollars like with institutions such as Navy Federal Credit Union and PenFed Credit Union. To get a large loan, lenders typically have stricter requirements that youll need to meet such as credit history, income and credit score.

Also Check: Best Student Loan Refinance Companies

If I Apply For A Personal Loan Will It Hurt My Excellent Credit Score

There are two primary types of credit checks: a soft check and a hard check.

A soft check is like a preliminary check in which your lender lets you see what youd qualify for with them, based on the financial information youve provided. This doesnt affect your credit score.

When you submit your full application, the lender will do a hard check, which then shows up on your credit report and may affect your credit score. If you are approved, this dip in your score will only be temporary.

Try not to apply for too many different loans at once. While its natural to shop for the best rate, each hard search may cause your score to drop by up to 5 points, so its worth keeping these to a minimum. Only apply for loans youre seriously considering.

Upgrade: Excellent Customer Service

Upgrade Pros

- Term lengths: 24 to 84 months

- Min. annual income: N/A

About Upgrade

This young fintech platform has been in business for only 5 years in which it has helped over 1,000,000 customers in America. It offers perks other platforms don’t, such as a credit card, a no-fee checking account with 2% cashback, and even a bitcoin reward.

Upgrade is one of the best options for personal loans with an excellent credit score. It offers personal loan funds up to $50,000. The application process takes minutes to complete, and candidate borrowers can choose among multiple loan options, including credit card debt, debt consolidation, home improvement, and major purchases.

Eligibility requirements

The minimum borrower requirements can vary as the company considers many factors when determining loan eligibility. Yet, to be eligible for a loan through Upgrade, you must be:

- A U.S. citizen or permanent resident, or living in the U.S. on a valid visa

- At least 18 years old

- Able to provide a verifiable bank account

- Able to provide a valid email address

Loan fees and repayment terms

Personal loans made through Upgrade feature . All personal loans have a 1.85% to 8% origination fee, which is deducted from the loan proceeds. Loans feature repayment terms of 24 to 84 months.

Lending amount

Recommended Reading: What Kind Of Car Loan With 600 Credit Score

What To Do Next

Personal loans for very good to excellent credit are easy to get. Youll be approved with no problems and youll be offered excellent terms. If youre in the lower end of this range you may not get the very best terms, but youll still be well above those with lower scores.

Of course, youll want to keep that score where it is. That means making every payment on that personal loan on time! Keep an eye on your credit report, watch for errors and signs of identity theft, and enjoy the privileges youve earned!

More Like This

* Annual Percentage Rates , loan term, and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information. All loan information is presented without warranty, and the estimated APR and other terms are not binding in any way. Lenders provide loans with a range of APRs depending on borrowers credit and other factors. Keep in mind that only borrowers with excellent credit will qualify for the lowest rate available. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. All loans are subject to credit review and approval. When evaluating offers, please review the lenders Terms and Conditions for additional details.

Zippyloan: Quick Personal Loan With Excellent Credit

Zippyloan Pros

- Term lengths: 6 months to 72 months

- Min. annual income: N/A

About Zippyloans

Whether you need a few hundred dollars to cover unexpected medical expenses, or you are looking for options for auto loans or debt consolidation Zippyloan can hook you up with a wide range of personal loan lenders quickly enough.

Yes, money should be available “as soon as tomorrow” to quote from the platform.

All you need to do is to fill in a 5 to 10-minute form and instantly receive a loan offer. Everything can be done from your mobile phone since the platform is optimized for both iOS and Android browsers.

The company accepts all types of credit scores, and, like MoneyMutual and PersonalLoans, it offers a high standard of security as an OLA member.

Eligibility requirements

According to the company’s website, to request a loan, all you need is:

- Income Information

Loan fees and repayment terms

Repayment terms on personal loans are generally either monthly or once every 2 weeks, depending on the lender’s terms.

Lending amount

- Min. annual income: Proof of a steady job

About Funds Joy

Offering a quick and easy experience on a user-friendly and well-designed platform, Funds Joy wants to streamline and speed up the loan approval process. Yes, prospective borrowers can have their loan forms submitted within minutes.

FundsJoy is an excellent option for people with all types of credit history who need small and quick loans with a fairly low-interest rate.

Eligibility requirements

Recommended Reading: Can I Buy Two Houses With Va Loan

Where To Get A Personal Loan For Very Good To Excellent Credit

If youre looking for a personal loan with very good to excellent credit youll have lots of options. Youll still want to choose the best one! Choosing the best options is probably part of why you have such good credit in the first place.

There are three keys to getting the best deal on a personal loan .

- Look in more than one place. Borrowers who solicit multiple offers get better deals.

- Compare offers and read the fine print.

- Clarify your goals and pick the deal that best fits your personal needs.

Remember that the best deal for one person is not always the best deal for another!

Here are some places to start looking.

What Is Considered An Excellent Credit Score

Personal are typically 300 to 850, with higher scores considered better. In the simplest terms, your credit score indicates how risky it is for a company to lend you money or provide other services .

Higher credit scores indicate that youve effectively managed your credit and paid your loans on time, so you are considered lower risk. Excellent credit is typically a FICO credit score of 800 to 850.

According to research by Experian, the average FICO score in the United States in 2021 was 714, which is considered good credit. FICO score ranges are typically defined as follows:

- Excellent credit : 800 to 850

- Very good credit: 740 to 799

- Good credit: 670 to 739

- Fair credit: 580 to 669

- Poor credit: 300 to 579

Understanding where you stand in terms of your credit score is important. It can mean the difference between a loan with an interest rate in the double digits or one just a few percentage points above prime . Other benefits to having a higher credit score include the ability to borrow higher loan amounts and longer repayment terms.

Don’t Miss: Where To Refinance My Car Loan

Our Top Picks For The Best Personal Loans

- LightStream Best Variety of Loan Options

- Qualifying applicants need good or excellent credit

- No pre-approvals

- All loans are amortized and no deferment period is offered.

- Minimum credit score required

- 660

Why we chose it: LightStream offers a wide variety of loan options and terms ranging from two to eight years, which is longer than most competitors. Additionally, LightStream offers a low starting APR , with a discount option for AutoPay.

LightStream, a division of Truist Financial Corporation, has a wide range of loan options, a low minimum APR and loan terms that can range from two to eight years, some of the longest repayment terms available in the market. You can take out a personal loan for any service, product or purchase such as home improvement projects, medical bills, vacations, big purchases, K-12 education, recreational vehicles or family planning.

LightStream offers some of the lowest rates in the industry with a starting APR rate of 3.99%. Borrowers benefit from an additional 0.50% discount to their APR if they sign up for AutoPay. Additionally, Lightstreams Rate Beat program offers a 0.10% discount if a borrower is offered a lower APR offer by a competing lender .

As part of their customer satisfaction guarantee, LightStream will pay you $100 if youre not satisfied with your experience after closing the loan.

- Minimum Credit Score Required

- Depends on lender

- Minimum Credit Score Required

- 680

- Minimum Credit Score Required

- Undisclosed

Nice Loans For Good Credit:

- MoneyMutual -Best Loan for Good Credit Overall

- PersonalLoans – Take Out Short-Term Loans With Good Credit

- FundsJoy – Quick Processing of a Personal Loan

- Upgrade– Top-Notch Discounts on a Loan for Good Credit

- CashUSA – Fewer Fees on Loans for Good Credit Borrowers

- Zippyloan – Best Debt Consolidation Personal Loan

- BadCreditLoans – Bad Credit Personal Loans With Guaranteed Approval

- 24/7DollarLoan – Small Loan Amounts for Good Credit Borrowers

- 24/7CreditNow – Get Loan for Good Credit for Building Credit Score

- LendingTree – Great APR on Good Credit Score Personal Loans

Also Check: Where To Apply For Small Business Loan

The Best Personal Loans For Excellent Credit

The list of things you can use personal loans for is nearly endless. Personal loans can be a great way to generate income in the future you can fund your small business or invest in career development. Personal loans are often used to cover large expenses like home renovations or repairs. They are also a popular option for debt consolidation and credit card refinancing. Whatever your financial need, the wide variety of lenders and loan comparison services coupled with your great credit guarantee you can find the perfect loan.

How To Calculate Your Personal Loan Savings

Compare your existing debt information to see how lowering your interest rate and monthly payments can help you save on total interest. Simply input the amount of your current personal loan or debt, your current interest rate, and the term of the loan. If you have multiple loans or credit cards, enter your average rate into the payoff calculator. Then see a side by side comparison of your loan or debt vs a SoFi personal loan.

Enter Your

Calculated payments and savings are only estimates. All rates shown include the SoFi 0.25% AutoPay discount. Using the free calculator is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments and savings will depend on the actual amounts for which you are approved, should you choose to apply.

Also Check: What Is An Fha House Loan

Are Personal Loans Better Than Credit Card Loans

Yes. While the spread is much narrower than the difference between personal and payday loans, credit card loans are also less attractive. For example, you need to repay your balance each month, or youâll incur interest. As a result, the terms are much less flexible than personal loans. Furthermore, even if you have good or excellent credit, the APR on your credit card likely ranges between 13% and 20%.

Conversely, personal loans have long-term maturities, and if you have good or excellent credit, you should obtain an APR in the 5% to 10% range. As a result, the interest rate is lower, and the time horizon is longer, and both should help with your budgeting process.

Finally, most credit card limits fall in the $5,000 to $20,000 range. And while higher limits are obtainable, it may be cumbersome to qualify for a credit card with a $50,000 or $100,000 limit. On the flip side, many personal loan providers extend credit upwards of $100,000 or more, and if you have an outstanding credit score, youâre their target demographic. As a result, personal loans have attractive qualities that credit cards usually canât match.