How To Get A Home Equity Loan

Applying for a home equity loan is similar to applying for a mortgage or refinance. Here are the general steps youll follow:

Whats A Home Equity Loan

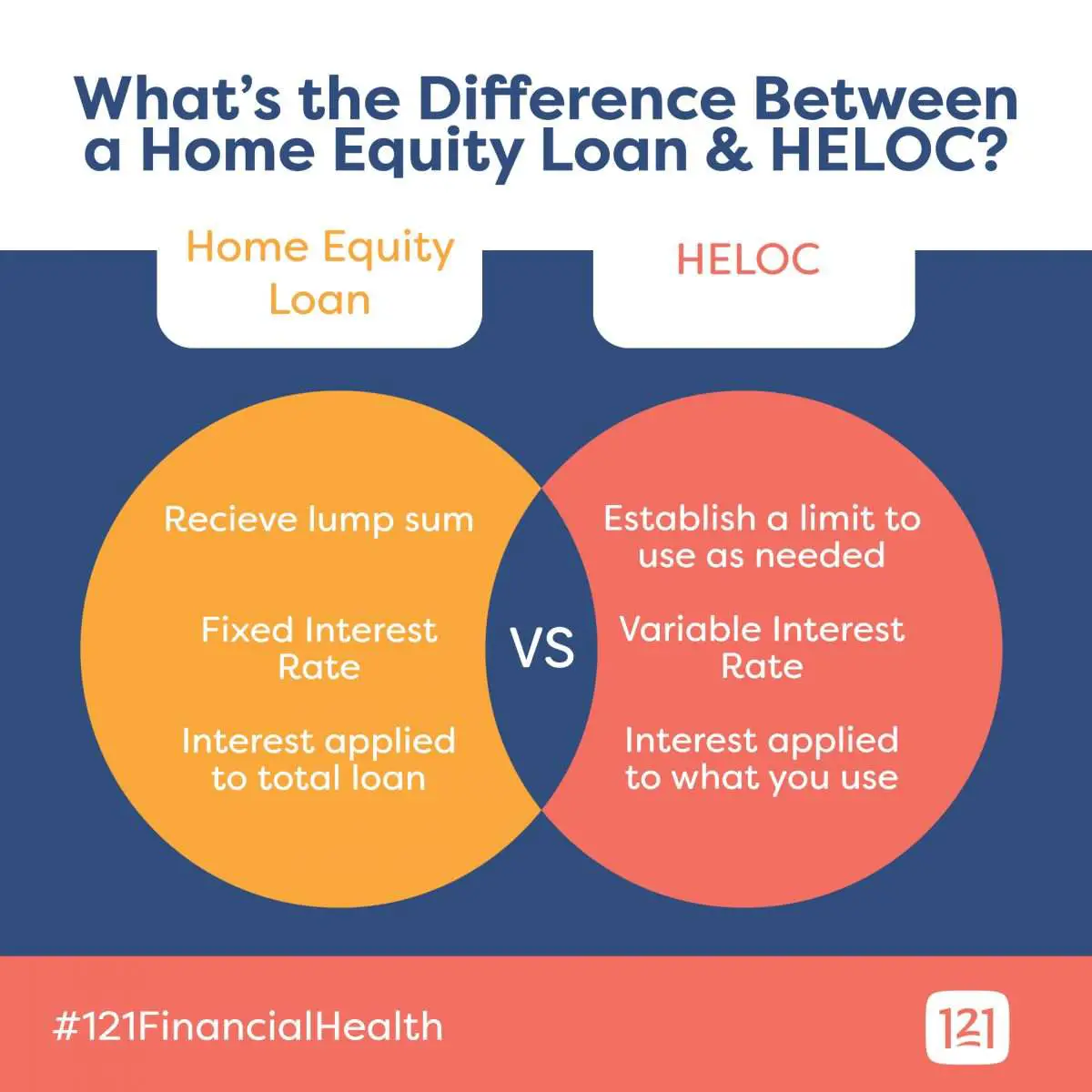

Before we go any further, we should clarify one thing that confuses people who are new to the world of HELOCs: home equity loans and home equity lines of credit are not the same thing.

Just like with personal loans and personal lines of credit, a HELOC is access to credit that you can dip into whenver you wish. Whereas a home equity loan is a lump sum of cash that you borrow upfront, with a set repayment period and fixed interest rate.

Home equity loans are often referred to as a second mortgage, since youre getting the money all at once .

Depending on how much home equity you have, you can qualify for a much larger loan and typically with a lower interest rate than with a personal loan, because youre using your house as collateral.

How Is A Home Equity Loan Different From A Home Equity Line Of Credit

An alternative to taking out a lump sum is to borrow from your home equity as you need funds. Home equity lines of credit provide a revolving credit line, similar to a credit card, with a credit limit based on your accumulated equity. You can tap into it for a specific number of years, called the draw period.

There are some notable differences between a HELOC and a home equity loan. With a HELOC:

- Interest is only applied to the amount you borrow, and not to the unused portion of the credit line.

- Interest rates are variable, and are based on the prime rate plus a fixed margin. If the index your rate is based on goes up or down, so, too, will the interest rate.

- Payments fluctuate according to the amount you owe and the interest rate.

- If a balance remains after the draw period, a fixed repayment period begins, which is generally 20 years.

The downsides to HELOCs are similar to those you’d experience with home equity loans: The debt depletes your home’s equity, and you could lose your home if you miss too many payments. What makes HELOCs unique, however, is the ability to use your credit line like that of a credit card, which could result in overuse. In addition, if the interest rate rises, the debt will be more expensive than you expected. If you make only minimum payments, you may end up with a large bill at the end of the draw period, and the new payments could be uncomfortably high.

Also Check: How To Use Va Loan For Investment Property

Its Like A Personal Loan

Its the same as going to the bank and saying Ide like a $20,000 personal loan and they give you $20,000.

Yes you get $20,000 cash, but now you owe $20,000 to the bank. They cancel each other outthere is no gain.

The same is true for equity loans.

Even though people say they are accessing equity all they are doing is getting a new loan.

The only difference to a personal loan is that interest rates are lower because the bank believes if you default they can sell the house and get their money back.

DISCLAIMER No Legal, Financial & Taxation AdviceThe Listener, Reader or Viewer acknowledges and agrees that:

How Much Are Home Equity Loan And Heloc Closing Costs

As with a mortgage or refi, there will be fees.

Ellen Chang

Ellen Chang is a freelance journalist based in Houston. She has covered personal finance, energy and cybersecurity topics for TheStreet, Forbes Advisor and U.S. News & World Report as well as CBS News, Yahoo Finance, MSN Money, USA Today and Fox Business.

A home equity loan and a home equity line of credit are two options for a homeowner to tap their home equity to finance such big-ticket expenses as home improvement projects or to pay down credit card debt.

Financing a remodeling project through a home equity loan or HELOC can be costly, however, due to a slate of fees similar to those associated with taking out a mortgage. But these fees will vary depending on the lender, so it’s a good idea to shop around before signing anything.

Here’s what you need to know about the closing costs and fees associated with home equity loans and HELOCs.

Also Check: Can You Loan Money To Your Business

Where To Apply For A Home Equity Loan

If youre considering getting a home equity loan, the first order of business is to shop around and compare offers from various lenders.

Most large banks and financial institutions offer home equity loans, so its always a good idea to solicit a few quotes and compare the terms, especially the interest rate and other fees, to make sure you get the right loan for you, Pepper says.

A good starting place is with the bank or credit union you are already a customer of. Working with your existing bank could get you a lower interest rate, says Russ Ford, financial planner and founder of Wayfinder Financial. Some banks offer interest rate discounts if borrowers set up automatic payments from an existing checking or savings account with that bank.

Understanding The Difference Between Home Equity Lines Of Credit And Home Equity Loans

Home equity lines of credit and home equity loans have become increasingly popular ways to finance large or unexpected expenses. Interest rates are often lower than credit card rates, and both provide access to funds by allowing you to borrow against the equity in your home.

An added benefit is that the interest you pay on the loan may be tax deductible. Talk to your tax advisor to see whether this applies to your situation.

Read Also: Current Apr For Car Loan

What Does It Mean To Use My Home As Collateral

You use your home as collateral when you borrow money and secure the financing with the value of your home. This means if you dont repay the financing, the lender can take your home as payment for your debt.

Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home equity financing. But if you cant repay the financing, you could lose your home and any equity youve built up. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you use your home as collateral.

What You Cant Do With A Home Equity Loan

- You cant get a home equity loan for more than your house is worth. In fact, your home equity loan amount plus your current mortgage balance generally must be less than 90 percent of your homes value.

- You cant use investment or commercial properties, or manufactured homes to get a Discover Home Loan.

Remember, a home equity loan uses your home as collateral. Make sure youre comfortable financially with the amount you borrow and the terms of the loan. Your Discover Personal Banking Specialist can answer all your questions to help you make the right financial decisions.

Find your low,

Related Article

- Main

-

- Home loans made by Discover Bank.

- ©2022 Discover Bank, Member FDIC | NMLS ID 684042

Read Also: Federal Public Service Loan Forgiveness

How Much Equity Do You Need For A Heloc

The amount of equity you’ll need for a HELOC will vary by lender, but usually needs to be at least 10% to 20%.

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

Equity is your homes value minus any loan balances against it, and its a requirement for taking out certain financial products, like home equity loans, cash-out refinances, and, in the case of this article, home equity lines of creditor HELOCs.

Exactly how much equity you need for a HELOC will depend on your lenders requirements, but generally speaking, youll need at least a 10% to 20% equity stake to qualify.

In this guide:

How Much Money Can You Get From A Home Equity Loan

The primary factor that determines how much money you can borrow with a home equity loan is the amount of equity youve built in your home. The more equity that you have, the more you can borrow.

Typically, lenders will let you know how much you can borrow using a loan-to-value ratio. This is the ratio of how much you can borrow compared to your total equity. Most lenders limit your borrowing to 80% to 90% of your equity. For example, if a lender has an LTV limit of 90% and you have $100,000 in equity, you can borrow up to $90,000. You can use our home equity calculator to get an estimate of how much you can borrow.

With a home equity loan, like a mortgage, you will need to pay closing costs. Closing costs usually range from 2% to 5% of the amount that you borrow. You might also have to pay pointsan extra fee that chips away at the interest rateto secure the rate that you want. Work with your lender to figure out the exact amount that youll pay in fees and keep those costs in mind when comparing different home equity loans.

Recommended Reading: Where Can I Apply For Student Loan Without Cosigner

How To Calculate Home Equity

If you are thinking about getting a home equity loan, make sure to calculate your home equity first. Down below, we have listed two simple steps to calculate your home equity.

- Step 1: First of all, you will have to get your homes estimated current market value. Your home is not of the same value as it was when you first bought it. You will find many price estimator tools online but it is always best to talk to a real estate agent to get a more accurate estimate of your homes market value. In most cases, a lender might even order a professional property appraisal to determine your homes market value.

- Step 2: Make notes of the amount that you still owe on your mortgage or any other debts secured by your home. Once you have got the correct estimate of your homes market value, subtract the outstanding mortgage and loan balances from that value. The resulting difference is your home equity.

Why Use The Term Equity At All

Its important to understand that equity is a mental concept and never ACTUALLY exists in a physical way that you can see and touch.

You rarely hear people talking about equity when investing in stocks. So why talk about it when investing in property?

Stocks People mainly use their own money to buy stocks

Property People mainly use the banks money to buy property

Because investors want to get access to more money without selling, and because banks and lenders want to create more loans the concept of equity was invented.

The concept of equity serves two major functions

1. As an investor is allows you to access money as your property grows in value.

2. For lenders equity gives them security for their loans.

If this doesnt make sense yet dont worry I will explain that in more detail below.

You May Like: What Kind Of Loan Can I Get For Home Improvements

Are There Other Requirements To Take Out A Heloc

Having home equity is the most basic requirement for a HELOC, but its just one of many factors a lender will look at when you apply for one. Lenders also consider things like your debt-to-income ratio and credit score. Check out our guide for more details on the home equity line of credit requirements you may need to meet to qualify.

Are you considering a HELOC? Reach out to a few lenders before applying. How much equity you need for a HELOC can vary from one company to the next, so shopping around can help you find the best fit for your situation and budget.

Home Equity Loan Interest Can Be Tax

The IRS allows a tax deduction for people who borrow money to purchase a home. Depending on where you originated your loan, you can deduct interest on loans of up to $750,000 if youre filing as a single person or $1,000,000 if youre filing jointly with a spouse.

Typically, this applies to mortgages, but you may also be able to deduct home equity loan interest. The IRS says that home equity loan interest is deductible if you use the funds only to buy, build or substantially improve your home.

Read Also: Where To Refinance Auto Loan

You Must Repay Your Equity Loan In Full:

- at the end of the equity loan term

- when you pay off your repayment mortgage

- when you sell your home

- if you do not follow the terms set out in the equity loan contract and we ask you to repay the loan in full

The amount you pay back is worked out as a percentage of the market value at the time you choose to repay.

If the market value of your home rises, so does the amount you owe on your equity loan. And if the value of your home falls, the amount you owe on your equity loan falls too.

Please go to our homebuyers guide for more information on how to repay your Help to Buy: Equity Loan.

Repaying A Home Equity Loan

After you receive your loan amount, get ready to start paying it back. Your monthly payments will be a consistent amount throughout the term of your loan and include both principal and interest.

You may think its best to choose a shorter loan term, so you can pay off your debt faster. Remember, a 10-year term will have higher monthly payments than a 15- or 30-year term.

Recommended Reading: How Much Home Loan Can I Get On 90000 Salary

Investment Secured Line Of Credit

The Investment Secured Line of Credit is a securities based loan/line of credit from Ameris Bank. The ISLOC requires a minimum Ameris Bank management

An LMA account is a secured line of credit that uses your eligible securities, such as stocks and bonds, as collateral. There are no fees to establish,

The general idea of a secured business line of credit is that a lender will put a lien against one of your assets. Theyre also known as asset-based lines of

You could use the equity in your home or your investment portfolio as collateral to secure a higher credit limit at a lower interest rate. · Limits are available

How secured cards work A secured card is nearly identical to an unsecured card in that you receive a credit limit, can incur interest charges and may even

With a secured loan, you can pledge collateral, such as cash, stocks or bonds, in the event you may not meet underwriting requirements for an unsecured loan.

What does it mean to use my home as collateral? You use your home as collateral when you borrow money and secure the financing with the value of your home.

Secured loans typically come with a lower interest rate than unsecured loans because the lender is taking on less financial risk. Some types of secured loans,

Under The Rule Can I Waive My Right To Cancel The Contract

If you have a personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel. That eliminates the three-day waiting period so you can get the money sooner. To waive your right:

- You must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel.

- The statement must be dated and signed by you and anyone else who also owns the home.

Your right to cancel gives you extra time to think about putting your home up as collateral for the financing to help you avoid losing your home to foreclosure. If you have a personal financial emergency, you can waive this right, but be sure thats what you want before you waive it.

Also Check: How To Get Denied Parent Plus Loan

Applying For A Home Equity Loan Is A Multi

If you are ready to apply, compare the best home equity loans.

Home Equity Loan Versus A Heloc

If you recall, a home equity line of credit is very similar to how a borrower uses a credit card. The HELOC offers an open line of credit that the borrower can continuously draw from and repay the balance at any time during the draw period of the loan.

The interest rates for HELOCs are often variable rate loans and the monthly principal and interest payments change based on the monthly balance on the HELOC.

Home equity loans are just the opposite. Instead of an open line of credit, the borrower receives an upfront lump-sum payment. As far as repayment, a home equity loan uses a fixed interest rate with a fixed monthly principal and interest payment. A HELOC on the other hand offers a variable interest rate during the draw period and a fixed interest rate during the repayment period.

You May Like: How Much Va Home Loan Can I Get