Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score; some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts; the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Kate Wood writes about mortgages, homebuying and homeownership for NerdWallet. Previously, she covered topics related to homeownership at This Old House magazine.Read more

What Credit Score Do You Need To Buya House

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

Set Up Automatic Payments

Setting up automatic payments is the ideal thing to do if you dont want to forget that you have to make a payment every month, or if youre scared of spending all that amount by mistake. It only takes a single missed payment to give you more interest to pay and negatively affect your credit score. So, setting up automatic payments comes as a great solution to this problem.

Make sure you set up the payments so youre being charged during days when you know for sure you will have money in your account. Double-check everything after you set up the automatic payment system.

Don’t Miss: Can You Pay Off Mortgage With Home Equity Loan

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

Maintain Good Habits And Be Patient

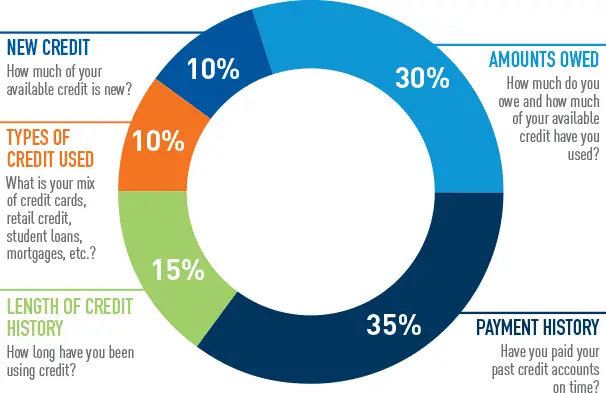

If you feel like youre doing everything right and your credit score hasnt yet passed 800, you might simply have to wait. Fifteen percent of your credit score comes from the length of your credit historywhich means that even if you have been practicing responsible credit habits since you opened your first credit card, it might take a while for those habits to earn you an exceptional credit score.

It might also be hard to achieve an 800 credit score until you have a mix of credit under your name. Were not saying you should take out a mortgage or a car loan just to get your credit score over 800, but if the only credit accounts on your file are credit cards, you might struggle to reach that 800 credit score. If thats the case, dont worryhaving excellent credit is just as good, and youll receive nearly all of the benefits that come with a near-perfect credit score.

Read Also: Is There Any Loan For Buying Land

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- ;;;;;Cleaning up your credit report

- ;;;;;Paying down your balance

- ;;;; Negotiating outstanding balance

- ;;;; Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Also Check: Do Pawn Shops Loan Money

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan; one insured by the U.S. Department of Veterans Affairs, known as a VA loan; or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans®;requires a minimum score of 580 for an FHA loan. |

|

VA loan |

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history; the amount of debt you have; and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Don’t Miss: How Do I Get My Student Loan Number

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO;Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Now You Qualify For The Lowest Interest Rates And Best Credit Cards

Thomas J. Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If youve earned an 800-plus credit scorewell done. That demonstrates to lenders that you are an exceptional borrower and puts you well above the average score of U.S. consumers. In addition to bragging rights, an 800-plus credit score can qualify you for better offers and faster approvals when you apply for new credit. Heres what you need to know to make the most of that 800-plus credit score.

Also Check: How To Make Personal Loan Agreement

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.;

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

What Are The Average 800 Credit Score Car Loan Rates In 2021

For those that have excellent credit scores, they can ensure that they will qualify for just about any type of loan that they wish to take out, whether it is an auto loan or a mortgage. Personal loans are also something that are easier for them to borrow with such a high credit score. It is important to provide proof of your income when applying for any loan, though.

| FICO Credit Score |

|---|

| 3.34% |

All the calculation and examples below are just an estimation*.Individuals with a 800 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO scores were charged 14.8% in interest over a similar term.

So, if a vehicle is going for $18,000, it will cost individuals with excellent credit $326 a month for a sum of $19569 for more than five years at 3.4% interest. In the meantime, somebody with a lower credit score paying 14.8% interest rate without an upfront installment will spend $426 a month and wind up burning through $25584 for a similar auto. That is in excess of a $6015 distinction.

The vast majority wont fall in the highest or lowest class, so heres a breakdown of how an extensive variety of FICO scores can influence the aggregate sum paid through the span of a five-year loan:

| FICO Range | |

|---|---|

| $7,582 | $25,584 |

Don’t Miss: How Is Mortgage Loan Amount Determined

Is That High Score Worth The Effort

The good news is that many lenders consider 760 the cutoff for excellent credit. With a credit score above that number, you’ll receive most of the same benefits as someone with an 800 credit score. You’ll just have to work a little harder and wait a little longer if you also want the bragging rights.

How Good Is An 800 Credit Score

Lenders tend to evaluate , and a credit score between 800 and 850 falls in the excellent range. People who achieve such a high score have generally shown they pay back borrowed money on time and dont miss payments

Here are just a few advantages to having an 800+ credit score:

- You have a better chance at getting approved for a home loan

- You may qualify for a low mortgage rate

- You have more power to negotiate your interest rate and closing costs

Learn More: What Is a Mortgage Rate and How Do They Work?

Don’t Miss: How Long Does It Take To Get Student Loan Money

Lower Your Credit Utilization Rate

A high ratio of debt to credit can negatively affect your credit score. You can either pay off this debt or apply for a credit increase to reduce your utilization rate. Another way to do this is by paying your credit cards off early each month so that your posted balance is lower than your spending for the month.

Increase Your Credit Limit

An easier way to boost your credit score is to decrease your credit utilization. Remember, this is the percentage of credit available to you that youre currently using.

The best way to do this is to talk to your credit card provider and get them to increase your limits. This can usually be done by demonstrating that youre borrowing well within your means already.

Don’t Miss: Which Student Loan Accrues Interest While In School

The Benefits Of A High Credit Score

Simply put, the higher your credit score, the better offers and interest rates youll get.

For example, if you have a score of 700 youre sitting in the good range for most lenders. This means that youll be accepted for a wide range of loans and credit cards.

Achieving a credit score of 800 puts you firmly in the excellent range, and will only increase your options.

Not only will you be accepted for the vast majority of loans and credit cards, but your squeaky-clean track record will often qualify you for lower interest rates on whatever you take out.

In other words, the higher your score, the less youll have to pay back when borrowing because youve proven that youre a safe option for lenders to get their money back.

What It Means To Have A Credit Score Over 800

Is 800 a good credit score? Having a credit score over 800 isnt just goodaccording to the FICO credit scoring system, its exceptional. Although both the FICO and VantageScore credit scoring systems go all the way up to 850, you actually dont need to hit 850 to reap the same benefits as those with a perfect credit score.

If you have an 800 FICO score, you have an extremely positive credit history. There are no missed payments or to lower your credit score from its exceptional ranking. Its likely that you have been using credit successfully for many years, and you probably have a healthy mix of credit accounts that includes both revolving credit and installment credit . In short, you are the ideal credit consumerresponsible, financially savvy and unlikely to default on your credit obligations.

Essentially, having a credit score over 800 means that there isnt anything else you can do to make your credit score better. All you can do now is maintain the healthy credit habits that got you your 800+ credit score in the first place.

You May Like: What Type Of Loan Is Needed To Buy Land

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

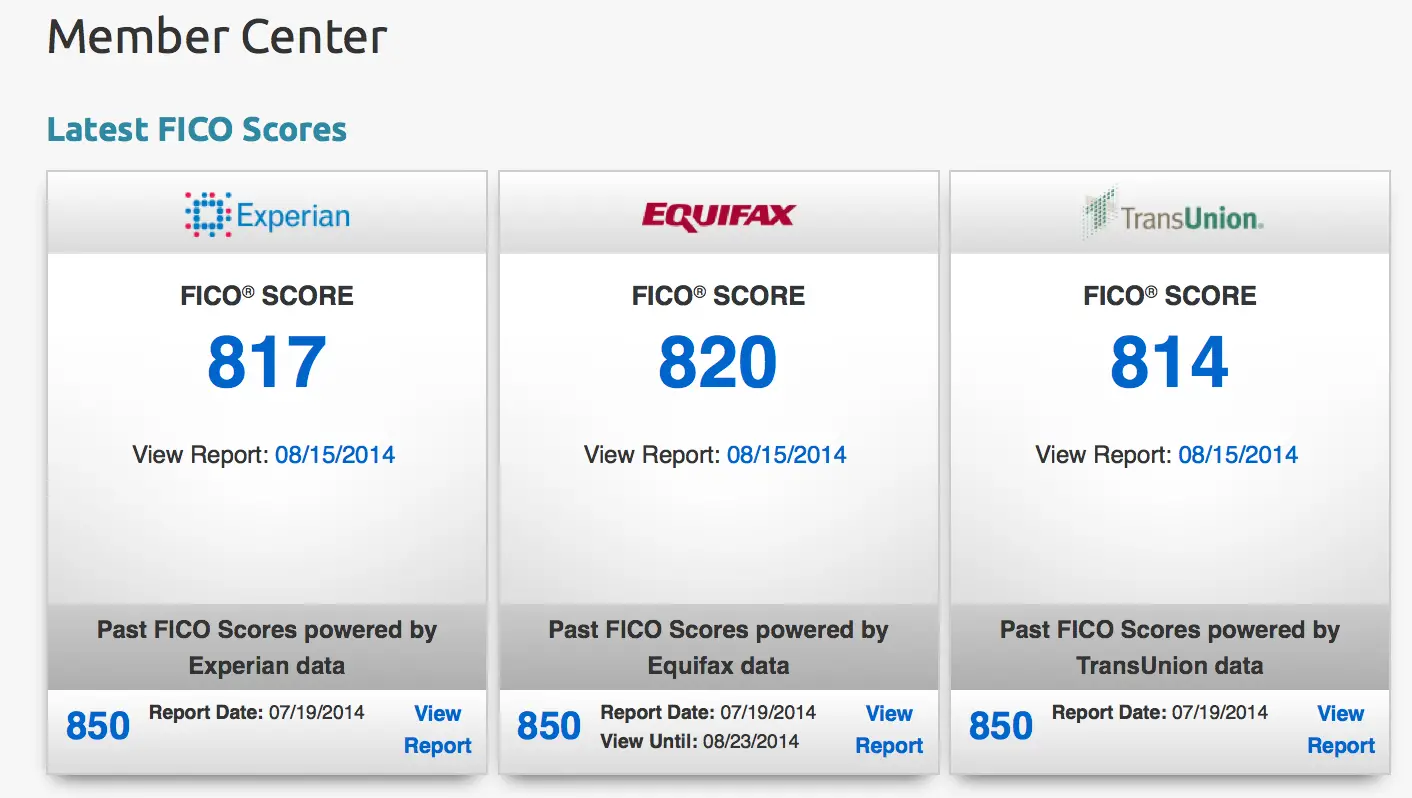

Is An 800 Credit Score Really An 800 Credit Score

Well, yes, your score is your score, but your score can vary between the different bureaus. Weve had clients where, when we pull their credit, theyve got 800 from one of the bureaus but something lower from one of the other ones. The takeaway is that its important to remember that your credit score is not just the one score you might see on credit karma or your banks free credit monitoring report. As a mortgage lender, we look at the three different bureaus and we take the middle score.;

Don’t Miss: Who Can Qualify For An Fha Loan

Make Sure Your Credit Utilization Ratio Remains Low

The total amount of credit you have available compared with the amount you’re utilizing counts for 30% of your score. Lenders typically like to see borrowers using no more than 30% of their available credit. For example, if you have a credit card with a $5,000 limit, don’t utilize more than 30% — $1,500 — of it.