What Credit Score Do You Need For An Fha Loan

FHA loans can be easier to qualify for, especially with poor credit. Here are the specifics.

For borrowers who can’t qualify for a conventional mortgage or whose prevent them from getting a competitive annual percentage rate on a mortgage loan, a mortgage guaranteed by the Federal Housing Administration — also known as an FHA loan — can be an excellent way to open the door to homeownership at a reasonable cost.

There are two major advantages to FHA loans versus other common types of mortgages. First, the borrower doesn’t need a large down payment, since 3.5% of the purchase price is all that’s required — even with borderline credit qualifications. Plus, the down payment funds can come from a gift or assistance program, and most other costs associated with obtaining an FHA mortgage can be rolled into the loan, minimizing out-of-pocket costs to the buyer.

The second big advantage is the flexible FHA loan credit score requirements. Here’s a quick guide to the current credit score requirements for obtaining an FHA loan, as well as some other things to consider before deciding if it’s the right type of mortgage for you.

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

Improving Your Credit Score For An Fha Loan

If your credit score isnt where you want it to be, there are steps you can take to improve your score. There are several factors that contribute to your credit score, each with their own weight. Lets take a closer look below:

- Payment History . Your payment history is the single biggest factor that contributes to your credit score. This shows potential lenders how often your payment have been on time or if they have been late or missed.

- While this may sound complicated, your credit utilization is simply the percentage of your total available credit that you are currently using. This number is expressed as a percentage and, to keep the best score, youll want to keep your number below 30%.

- The age or length of your credit history also contributes to your score. To make the most of this factor, make sure to keep your oldest accounts open and in good standing.

- Potential lenders like to see a mix of different credit types on your report, such as credit card accounts and an auto or mortgage loan.

- Number of Inquiries . While checking your credit score wont hurt your account, hard inquiries, such as when you apply for a new credit card, will. Limit the number of hard inquiries on your credit to keep your score high.

Also Check: Is It Easy To Get Loan From Credit Union

Fha Lenders Look At More Than Just Your Credit Score

Keep in mind that lenders look at more than your credit score when approving an FHA mortgage application. Theyll also evaluate your employment record, income history, and your assets. Your income must be stable and consistent, and you must have sufficient cash reserves to cover your down payment and closing costs.

What Is An Fha Loan

FHA stands for Federal Housing Administration, a government agency that insures mortgages. FHA loans are designed for low- to moderate-income borrowers, and require at least a 3.5 percent down payment.

can come in the form of a gift from a relative or a close friend of the family, explains Robert E. Tait of Motto Mortgage Elite Services in Bucks County, Pennsylvania.

This aspect of FHA loans is one of many reasons why theyre attractive to homebuyers. Compared to conventional loans, FHA loans have more relaxed underwriting, including a higher debt-to-income ratio and flexibility if youve have had financial difficulties like a bankruptcy in the past.

FHA loans are also appealing to buyers who dont have a lot of cash because of the FHAs flexible standards on who pays for closing costs.

FHA loans are targeted for people who might have marginal credit and who need the maximum seller assistance in the form of seller credits at closing, Tait says. With the seller credits, you can effectively cover 100 percent of your closing costs.

While FHA loans have a lower credit score requirement, if your score is below 600, be prepared to find a lender who can put your application through manual underwriting, since getting approved can get more challenging the lower your credit score, Tait says.

There are different types of FHA loans, including:

Also Check: What Is The Lowest Auto Loan Interest Rate

How To Calculate Your Dti Ratio

There are two ways to calculate a DTI ratio. Most loan officers call one the front-end ratio and the other the back-end ratio. The FHA uses different terminology to express the same ideas. Your loan officer might use either set of terms to describe your DTI.

How does your DTI measure up? Use our quick and easy calculator to find out.

Conventional or conforming lenders call the typical maximum ratio the 28/36 rule. For FHA loans, its the 31/43 rule.

How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.

You May Like: Does Refinancing Car Loan Hurt Credit

How To Boost Your Credit Score

Want to improve your credit score? These are a few steps you can take:

Make all your payments on time. Making timely payments will build your positive credit history. When you pay all your debts on time, your credit score should grow.

Pay down credit card debt. When youve got credit card debt, youre probably paying a lot of money just on interest charges on the debt. Paying down the credit card debt will cut down the total amount of interest you pay. It will also reduce your credit utilization ratio, which should lead to a higher credit score.

Dont close your credit card accounts. If youve got a credit card that you dont use, keep the account open. Closing it could shorten your credit history and lower your score. Plus, closing the account would decrease your available credit, which would harm your credit utilization ratio.

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE:;Facts about FHA home loans

Don’t Miss: How To Get Low Interest On Car Loan

Understanding Federal Housing Administration Loans

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lender, like a bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers that qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

While Federal Federal Housing Administration Loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is An FHA Mortgage Still A Bargain?

Fha Credit Score Standards

You credit score and credit history are different but related sources of information lenders use to decide whether to approve your loan application. Your score is a predictive statistic and guess at your likelihood of repaying a loan.

When it comes to credit scores, bigger is better. Why? Lenders offer the best rates to borrowers who have the highest FICO credit scores.

The FHA minimum credit score is 500. However, if you want a loan with a 3.5 percent down-payment, then you must have a credit score of 580 or higher.

If you have a FICO credit score between 500 and 579, you are still eligible for an FHA loan. Borrowers with low scores must come up with a 10 percent down payment.

The 580 credit score standard is a bit deceiving in practice. It is common for lenders to place the bar higher and require a 620, a 680 or even higher score. Lenders may not go below the FHAs minimum credit score, but are free to require higher scores.

These higher standards are known as lender overlays and they vary from lender to lender. Lenders add overlays as a precaution, especially on credit score requirements, because borrowers with low credit scores are more likely to default. Lenders worry about their overall FHA default rate. Lenders with high default rates are not allowed to stay in the FHA program and may receive financial penalties for making too many bad loans.

Dont Miss: Which Credit Score Is Accurate

Read Also: How Much Business Loan Can I Get

How Do Fha Loans Work

FHA loans can give people with lower incomes or those with lower credit scores the ability to become homeowners. In order to offer a more relaxed credit requirement and a lower down payment, FHA requires you to pay mortgage insurance. If you defaulted on your loan, FHA would be responsible for paying off the remainder of your loan. Mortgage insurance limits the amount of money the lender may lose.

Mortgage insurance is considered a closing cost. Closing costs are the upfront fees required when you close on a home, and they’re separate from your down payment. Lenders and third parties can cover up to 6% of closing costs on FHA loans, including attorney, inspection and appraisal fees.

FHA-backed loans allow for financial gifts from family, employers and charitable organizations to help cover closing costs.

The borrower is responsible for paying two FHA mortgage insurance fees:

What Is It Like To Get An Fha Loan Right Now

Although HUD’s minimum requirements for FHA loans havent changed,;FHA-approved lenders seem to favor applicants with higher credit scores. Nearly 74% of FHA borrowers had FICO scores of 650 or above in June 2021, with an average score of 677 for FHA purchase loans, according to data from ICE Mortgage Technology.

On average, it took longer to close an FHA purchase loan in June 2021 than in June 2020 54 days compared with 46 days a year earlier. Conventional purchase loans, meanwhile, closed in an average of 49 days in June 2021, according to ICE data.

HUD data shows that from April to June 2021, over 30% of FHA loans were for amounts between $250,000 and $399,000 by far the most common range. Nearly 70% of FHA loans issued during this period covered at least 96% of the homes estimated value, implying that most FHA buyers are making the minimum FHA down payment of 3.5%.

You May Like: How Much Loan Can I Get With 800 Credit Score

Pros Of A Small Down Payment

- Able to buy sooner: With a 3.5% down payment, you may be able to save up for a reasonable house in a few months or a year, even if youre paying for rent.

- Wont drain your bank account: If youve got significant savings, a 3.5% down payment wont drain your bank account. That extra cash can come in handy when you have to deal with repairs that inevitably come when buying a house.

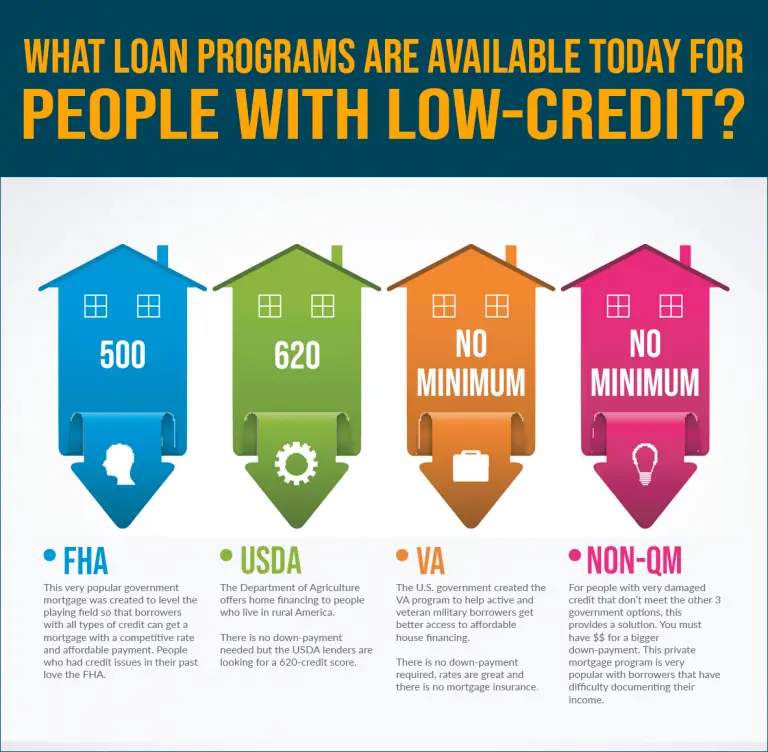

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO®;Score . FICO®;Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact;credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

Read Also: Is Prosper Personal Loan Legit

How To Get An Fha Loan

When you get an FHA loan, youre not borrowing money from the FHA itself. The agency insures loans from lenders around the country. Your loan comes from one of these lenders.;

So, how does this process work? When you submit your application to an FHA-approved lender, the application will be underwritten and then sent to the FHA for approval.;

But to get the loan, you have to go through a bank or other lender. This is the same process as any other mortgage application.;

There are many advantages to getting an FHA loan. But you should always shop around and discuss your options with lenders. This will help you get the best FHA loan for your needs.

Fha Lenders Dont Always Follow Fha Credit Score Minimums

Banks and mortgage companies that offer FHA loans are not required to follow FHA guidelines to the letter.

These are private, for-profit companies that simply approve loans based on guidelines provided by a government agency, namely the Federal Housing Administration, or FHA.

Most if not all lenders across the country impose tougher guidelines for FHA loans than does FHA itself. It doesnt seem to make a lot of sense until you realize that FHA penalizes lenders for approving too many bad FHA loans.

Yes, FHA actually penalizes lenders if they approve borrowers who default months and years later, even if the loan fits perfectly within FHAs published guidelines.

Heres an example.

A borrower applies for a loan and is approved based on FHAs guidelines. Six months later he loses his job and can no longer make his monthly payments. FHA records that bad loan on the lenders record.

Too many bad loans and FHA could revoke the lenders ability to offer FHA loans. That could put some mortgage companies out of business.

Statistically, borrowers with lower credit scores default more often. Thats why most lenders require a higher minimum credit score than does FHA.

Here are credit score minimums as stated by FHA:

Most lenders require a score of at least 620-640. But that number could drop closer to FHAs published minimums because of the new policy.

Also Check: What Is Fast Cash Loan