Jumbo Loan Requirements And Qualifications

Each year, the Federal Housing Finance Agency reviews home prices to determine the conforming loan limit. The ceiling is based on home price increases, as well as where the homes are located, usually by county. Any mortgage above the conforming loan amount is considered a non-conforming loan a jumbo loan. For 2021, the limit for most conforming loans is $548,250. However, there are some areas of the country that have a higher conforming loan limit amounts up to $822,375 in the most expensive areas.

Keep in mind: the sale price of the property doesnt really affect whether or not you need to get a jumbo loan; its all about how much you have to borrow. So, you can purchase a multimillion-dollar home, and if you only finance a small portion of it you can still get a conforming mortgage.You can find the non-conforming loan limits for every state and county here.

Before you apply for a high-dollar mortgage, find out if you live in one of those high-cost areas. The FHFA offers an interactive map of all the counties in the United States, along with the conforming limits in those counties. If your mortgage exceeds the conforming loan limit, its a jumbo loan, and youll need to take that into account as you move forward.

Youll have to meet certain qualifications to get a non-conforming loan.

Other Considerations For Mortgage Shoppers

Mortgage rates are an important consideration for anyone shopping for a home loan. And generally speaking, jumbo loans tend to have higher interest rates than conforming .

But there are other important factors to consider as well.

In addition to sometimes having a higher rate, jumbo loans tend to have stricter qualification criteria for borrowers. The reason for this is somewhat obvious. A larger loan carries a higher level of risk to the lender, especially if they are unable to sell it into the secondary mortgage market. To offset this increased risk, lenders often impose more stringent requirements.

Banks and mortgage lenders often require larger down payments for borrowers who are seeking a jumbo loan compared to those who use the smaller conforming products. Credit score requirements can be higher as well. Youll also have to document your ability to repay the loan, on top of your other recurring debts.

How Hard Is It To Qualify For A Jumbo Loan

Conforming mortgage requirements are quite loose. Its often possible to qualify with just 3% down and a FICO score of 620 or higher.

You can take some of the pressure off by making a big down payment. If you put down more than 20%, lenders might be more forgiving about things like your credit score or debt-to-income ratio .

But, if thats not possible, expect to need excellent credit, not too much existing debt, and decent cash reserves.

Obviously, the more youre borrowing and the lower your down payment, the tighter your lenders qualifying criteria are likely to get. You can read more about jumbo loan requirements here.

Recommended Reading: How Much House Can I Afford Physician Loan

What Is A Jumbo Loan

A jumbo loan is one that exceeds the limits for conforming loans set by the Federal Housing Finance Agency . These conforming loans are those that can be serviced by Fannie Mae and Freddie Mac. Because a jumbo loan exceeds these limits, it’s also called a non-conforming loan.

When you get a jumbo mortgage, your lender cant rely on federally-backed insurance from Freddie and Fannie to reduce some of their risks. Many of the home loan programs provided by the government operate under the principle that lenders will be able to recoup some of their losses if a borrower defaults. At the very least, lenders know they can sell their loans to these government-sponsored enterprises, in part, to promote liquidity in the home loan market.

Top 5 Bankrate Jumbo Refinance Lenders

Methodology

Bankrate helps thousands of borrowers find mortgage and refinance lenders every day. To determine the top mortgage lenders, we analyzed proprietary data across more than 150 lenders to assess which on our platform received the most inquiries within a three-month period. We then assigned superlatives based on factors such as fees, products offered, convenience and other criteria. These top lenders are updated regularly.

Also Check: What Does Jumbo Loan Mean

How Are Mortgage Rates Set

Mortgage rates are set by lenders and vary based on such factors as the loans repayment term, the propertys characteristics, the borrowers , including credit score and debt-to-income ratio , as well as economic conditions and federal monetary policy.;

Borrowers with good credit scores and low debt-to-income ratios typically get lower rates, as do loans with shorter repayment terms. Loans to finance primary residences will typically carry better interest rates than loans to finance secondary residences or vacation homes, and rates are typically lower with larger down payments. These factors are considered less risky by lenders, so the mortgage rates you can get are lower. Its possible to get a better rate by working to improve each of these areas.

In addition to factors borrowers can control, mortgage rates are also influenced by economic conditions and the Federal Reserves monetary policies. The Federal Reserve uses monetary policy to influence whats happening in the market, primarily inflation and the level of employment.;

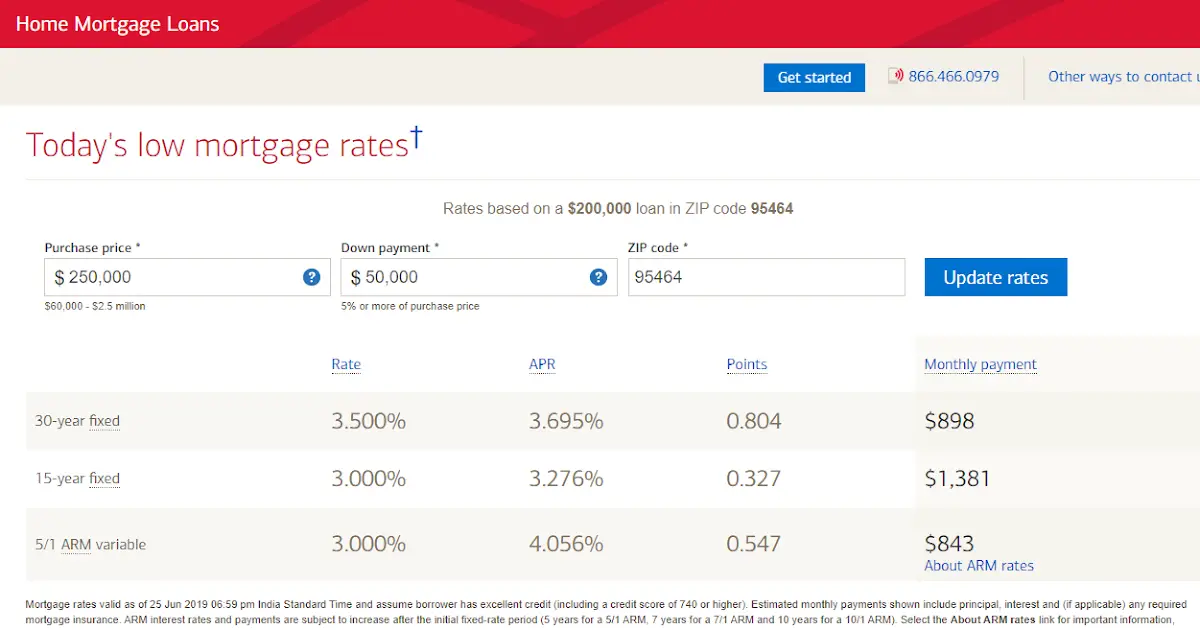

Current Mortgage Rates: 30

-

The 30-year rate is 3.265%.

-

Thats a one-day increase of 0.002 percentage points.

-

Thats a one-month decrease of 0.035 percentage points.

Fixed-rate mortgages are popular because the interest rate is predictable and the monthly payments wont change. The 30-year loan is the most popular of all thanks to its long payback time, which results in relatively low and affordable monthly payments compared to a shorter-term loan. The interest rate will be higher, however, so youll actually pay more interest over time.

Don’t Miss: Who Can Qualify For An Fha Loan

Why Jumbo Loan Limits Matter

If the amount you want to borrow goes beyond the limits of a conforming loan and you need to get a jumbo loan, your lender may require:

-

A stronger credit score. The minimum credit score for a jumbo loan is typically at least 680, but some lenders may require an even higher one. The higher your credit score, the lower your interest rate is likely to be.

-

More cash in the bank. Knowing you have cash reserves, and not too much debt, makes lenders more likely to approve your jumbo loan.

-

A larger down payment. Requirements vary by lender and depend on your financial history.

-

An extra appraisal. Some lenders may require a second opinion on the homes value to be sure its worth the amount youre borrowing.

-

Additional fees. Since youre borrowing a larger amount, there may be some extra steps in the loan process, leading to higher closing costs.

-

Higher interest rates. Although this can fluctuate based on market conditions and individual lender offerings, jumbo loan rates may be higher than those for conforming loans.

Jump To Jumbo Loan Topics:

Each November, the FHFA announces the conforming loan limit for the following year, based on annual home price changes from October to October.

If the housing market does well and home prices rise, the conforming limit will go up and so will the minimum loan amount for a jumbo. This is viewed as a good thing because borrowers tend to try to avoid the jumbo realm to receive better loan pricing.

Yes, jumbo mortgage rates tend to be higher than interest rates on conforming mortgages because they cant be purchased by Fannie Mae and Freddie Mac. Fewer buyers means less liquidity and higher interest rates.

So if youre in the market to purchase real estate or refinance an existing home mortgage, be sure to keep this key threshold in mind while shopping rates.

Recommended Reading: Does Fha Loan Require Down Payment

How Does A Jumbo Loan Work

Like conventional mortgages, you can get jumbo loans in a variety of terms or repayment schedules, and they can be fixed-rate or adjustable-rate loans. At this time, Rocket Mortgage is only offering fixed-rate jumbo loans.

However, jumbo loans work differently than conventional mortgages. These loans have stricter requirements than other types of mortgages, and youll have to meet very specific property type, down payment, credit score and debt-to-income ratio requirements to get one.

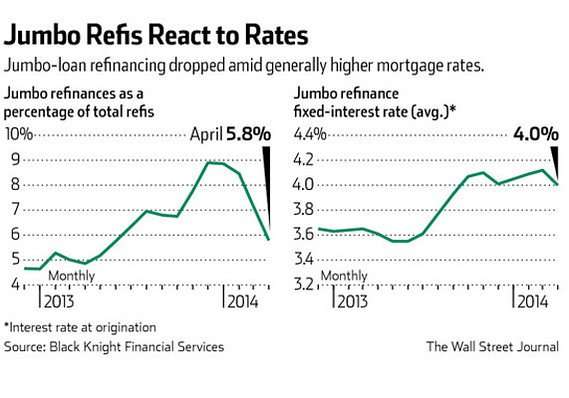

What About Refinancing A Jumbo

After youve gone through the mortgage and home buying process, it could be helpful to have information about refinancing. Some borrowers choose to refinance in order to secure a lower interest rate or more preferable loan terms.;This could be worth considering if your personal situation or mortgage interest rates have improved.

Refinancing a jumbo mortgage to a lower rate could result in substantial savings. Since the initial sum is so large, even a change of just 1 percentage point could be impactful.;Refinancing could also result in improved loan terms. For example, if you have an adjustable-rate mortgage and worry about fluctuating rates, you could refinance the loan to a fixed-rate home loan.

Read Also: How To Get Sba 7a Loan

Jumbo Loan Requirements For Each Loan Type

Some lenders break down their requirements by loan type, so youll need to meet different standards if youre buying a home, refinancing, buying an investment property, or doing a cash-out refinance.

Jumbo loan requirements can vary greatly depending on the lender you choose. Here are some typical examples of the requirements for each type:

Jumbo Mortgage Terms And Payment Structures

Jumbo loans can be paid in different terms, the most common of which are 15 and 30-year loans. You also have the option to choose from 10, 20, and 25-year terms. Expect shorter terms to have higher monthly payments, albeit with lower rates.

Only take the shorter payment term if youre sure you can afford it. The good news is a shorter term will save you thousands of dollars on interest charges. This allows you to pay off your mortgage sooner compared to a 30-year term.

Though its available in fixed-rate options, many borrowers tend to take jumbo loans as adjustable-rate mortgages . ARM terms usually have introductory periods for 3, 5, 7, and 10 years. They are commonly known as 3/1 ARM, 5/1 ARM, 7/1 ARM, and 10/1 ARM. ARMs account for at least a single digit percentage of the U.S. mortgage market.

How do ARMs work? The introductory period begins with a low interest rate. For example, if you have a 5/1 ARM, your interest rate will be the same for 5 years. After this, it will reset periodically depending on the market index. Your interest rate may increase of decrease for the succeeding years. For this reason, you must have adequate funds to pay for larger monthly payments in case rates get higher. This is risky for most borrowers, so many prefer fixed-rate mortgages.

Fixed-rate mortgages, meanwhile, maintain the same interest rate for the entire life of the loan. This is regardless of whether mortgages rate rise or drop throughout the term.

Recommended Reading: Are Va Loan Interest Rates Lower

Jumbo Loan Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you set your sights on a pricey home or an average home in a pricey area a traditional mortgage may not be enough. A jumbo loan could be the answer, but you may need a higher credit score and bigger cash reserves, among other things, to qualify.

Do you need a jumbo loan? You may if the amount you want to borrow exceeds the latest conforming loan limits set by the Federal Housing Finance Agency.

»;MORE:;The difference between conforming and nonconforming loans

How Big Is Jumbo

So how large does a loan have to be to be considered jumbo? In most counties, the conforming loan limits for 2021 are:

- $548,250 for a single-family home

- $702,000 for a two-unit property

- $848,500 for a three-unit property

- $1,054,500 for a four-unit property

The limit is higher in pricey areas. For 2021, the conforming loan limits in those areas are:

- $822,375, one unit

- $1,272,750, three units

- $1,581,750, four units

Given;rising home values;in many cities, a jumbo loan may be necessary to buy a home. Teton County, Wyoming, for instance, has a median home value of over $900,000 and a conforming loan limit;of $822,375.

Also Check: How To Get Loan Signing Jobs

Jumbo Mortgage Financing: Its Back

During the mortgage crisis a few years ago, jumbo loans all but went away. The ones that remained came with guidelines;that were nearly impossible for homeowners to meet.

High down;payments, high interest rates, and high credit standards made jumbo loans almost;obsolete.

But as the real estate market steadily recovered, jumbo loans re-entered;the lending landscape.

In fact, home buyers in the market for a larger loan may be pleasantly surprised to know that jumbo mortgage rates;are nearly as low as conforming rates.

The Process Of Getting A Jumbo Loan

To obtain a jumbo loan, youll need to go through the same application process as you would for a conventional loan. Your lender will determine if you qualify based on the information submitted. The application process will require:

- W2s to prove your income

- Proof of cash reserves

- Tax returns from the last few years including 1099s

- Bank statements;

- Information on investment accounts

Youll complete a formal application that also includes proof of your identification. Then, the underwriters will review this information and make a decision about whether or not to lend to you. The timeline for a jumbo loan decision is the same as a conventional loan, taking as little as a few days to much longer depending on the underwriters.;

Like other loans, the process of getting a jumbo loan with Dash Home Loans is much simpler than with other lenders. At Dash, we cut out the middleman to simplify and speed up the process. Learn more about our home loan process here.

Let’s get started

Also Check: How Much Do I Pay For Student Loan

The Impact Of Zirp On Asset Prices

The goals of the Federal Reserve’s zero interest-rate policy and quantitative easing programs after the 2007 economic crisis were to:

- drive down the cost of debt to make refinancing easier

- clean up the books of banks by over-paying for assets

- push investors out on the risk curve

- inflate asset prices like stocks, bonds & real estate

A decade after the crash housing prices have returned to the pre-crash peaks, but not when adjusted for inflation. A recovery driven by asset price inflation has drastically increased inequality. In wealthy areas like San Franciso the tech rebound was also boosted by hot money leaving China. This in turn led to many vital workers being pushed into long commutes to work. When China cracked down on capital flight, it left some neighborhoods in Los Angeles suburbs looking like ghost towns. In spite of the incredible absolute wealth in California the high cost of living means it has the highest poverty rate in the country.

Current Mortgage Rates: 5/1 Jumbo Adjustable

-

The 5/1 ARM rate is 2.187%.

-

Thats unchanged from Fridays rate.

-

Thats a one-month increase of 0.008 percentage points.

Adjustable-rate loans start off with a low, fixed, introductory or teaser rate, which becomes variable after a set number of years and adjusts on a regular basis. The monthly payments start off fixed as well and then change when the rate changes. For example, the interest rate on a 5/1 ARM will be fixed for five years before becoming adjustable and resetting annually. Besides a 5/1 ARM, you can opt for a 7/1 ARM or a 10/1 ARM.

Read Also: How Does Pre Approval For Auto Loan Work

Why Do Different Mortgage Types Have Different Rates

Each type of mortgage has a different rate because they have varying levels of risk. One of the primary sources of income for lenders is the money they earn from the interest you pay on your mortgage. For this reason, lenders consider the amount of risk associated with each loan when they set the interest rate. This is referred to as risk-based pricing and is premised on the idea that riskier loans like 30-year mortgages should carry a higher rate.

One of the reasons for this is that its easier to predict what will happen in the economy in the short-term than it is in the long-term. Similarly, theres more risk that something will happen to negatively affect your ability to repay the loan, for instance, if you lose your job or theres an economic downturn.

What Are The Benefits Of A Jumbo Loan

The main benefit for borrowers is that a jumbo mortgage lets you borrow more than the limits imposed by Fannie and Freddie. For instance, if youd like to borrow $1 million against a $1.5 million home, a jumbo loan makes it possible.

Some borrowers prefer to finance more of the homes cost rather than tying up cash, making the jumbo mortgage a helpful financial tool and part of an overall investment strategy. You can still get a competitive interest rate and finance the home of your choice without being restricted by the dollar limit on conforming mortgages.

Don’t Miss: What’s Better Refinance Or Home Equity Loan