California Fha Loan Limits

Every county in the United States has specific maximum loan limits that are set for single family homes, as well as 2-4 unit properties. The limits are set based upon the average home sales value in that county. The base FHA loan limit for single family residences in California for most counties is $420,680. Use this FHA loan limit lookup tool to see what the FHA loan limits are in your county.

| County Name |

|---|

| $809,450 |

Californias 2022 Conventional Conforming County Loan Limit

For 2022, the FHFA set the baseline conforming loan limit for 1 unit properties at $647,200 for Conventional financing and up to $970,800 in California high cost counties.

What is a Conforming loan? A conforming home loan must meet, or conform to certain criteria or guidelines set forth by Government Sponsored Entities Freddie Mac and Fannie Mae. The loan amount is just one of those criteria needed to be classified as a conforming loan.

What is a High Balance or high-cost county loan limit? Loan limits are derived by median home prices in a particular county and have a ceiling of 150% of the baseline mortgage limit. Loan amounts between $647,200 and $970,800 are referred to agency High Balance or Super Conforming loans because they exceed the baseline limit.

California Fha Loan Limits For 2022

The Federal Housing Administration home loan program is a popular option among home buyers seeking a low down payment. These loans offer a down payment as low as 3.5% of the purchase price or appraised value. They can also be easier to obtain, when compared to conventional mortgage loans.

But theres a limit to how much you can borrow when using an FHA-insured home loan. The maximum mortgage amount varies by county, because its based on median home values.

Here are the 2022 California FHA loan limits by county:

| County | |

| YUBA | $420,900 |

Note: The FHA loan limits shown above apply to regular single-family homes. There are higher limits for multi-family properties like duplexes, along with three- and four-unit properties. You can find those figures on the HUD.gov website. Weve limited this table to the single-family column since that category applies to most home buyers and mortgage shoppers.

Don’t Miss: Usaa Pre Qualify Home Loan

Key Takeaways From This Update

As mentioned earlier, the FHA loan limits for 2020 were increased for all 58 counties in the state of California.

Thats an important point, because they werent raised in every county across the U.S. In fact, a dozen or so counties nationwide were assigned lower FHA loan limits for 2020.

But in California, the caps will be rising across the board.

Its also important to realize that these limits vary from one county to the next. You can see this clearly in the table above. Home prices are the main reason for this variance. Conforming and FHA loan limits are based on median home values, which can vary from one county to the next.

As you can see in the table, the highest California FHA loan limits for 2020 are found in those counties that fall within the San Francisco Bay Area. In those areas, the limit was increased to $765,600 for 2020. That applies to the following counties: Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma.

Los Angeles and Orange counties also fall within that maximum or ceiling threshold range.

The rest of the state has lower FHA loan limits for 2020, as low as $331,760 in many counties. So theres a pretty broad spectrum between those floor and ceiling amounts.

Mortgage Backing Fannie Mae And Freddie Mac

Fannie Mae and Freddie Mac are financial services corporations established by Congress, also known as government-sponsored enterprises . They were created to promote the flow of credit, which in turn makes home ownership accessible to more Americans. They do this by creating a secondary mortgage market, which increases the supply of money available for mortgage lending.

How it works: After lenders make a mortgage to purchase or refinance a home, Fannie Mae and Freddie Mac buy the mortgage from the lender, so that the lender can have more money to lend out for another mortgage. Fannie Mae and Freddie Mac take the mortgages they have bought, pool them, and then sell them as mortgage-backed securities on the open market. They do this over and over again.

This is how the secondary mortgage market increases the supply of money available for mortgages: private investors provide cashflow for banks to continue to lend money. To learn more about the 2007 mortgage security meltdown, which created the 2008 worldwide financial crisis, read this Investopedia article.

Don’t Miss: Mortgage Loan Signing Agent

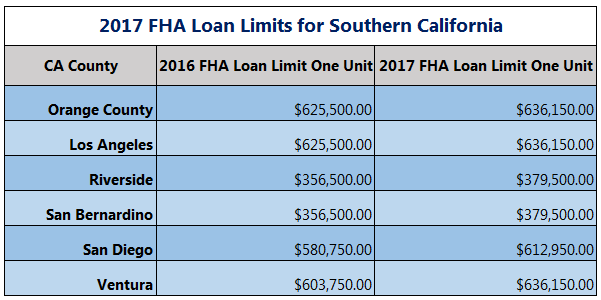

Loan Limits In Other Southern California Counties

Loan limits in other Southern California Counties also increased. The areas that could benefit the most are Riverside County and San Bernardino County. These two areas had been stuck at lower loan limits for years and many buyers or homeowners in those areas where not able to take advantage of lower rates over the last several years due to the low loan limits. If these new loan limits will help you, please feel free to give me a call at 619-312-0612. You can also fill out the Free Quote form on the right of the page.

How Are Mortgage Rates Determined

Borrowers applying for a mortgage loan should compare rates and terms among multiple lenders because mortgage rates can vary substantially. Each individual lender uses both economic factors and the borrower’s credentials to set rates.

Mortgage rates are affected by the federal funds rate, which is the rate set by the Federal Reserve . Banks use the federal funds rate when making overnight loans to other banks. Rates are also affected by what investors are willing to pay for mortgage-backed securities, which are groups of mortgage loans put together by institutional investors who buy loans on the secondary mortgage market. Because investors looking for fixed-income investments tend to compare mortgage-backed securities with 10-year Treasury yields, the Treasury yield affects rates as well.

The financial credentials of each individual borrower also have an impact on what rates will be available. Lenders price loans based on the perceived level of risk that a particular borrower won’t pay back their debt. Some of the factors lenders consider when setting rates for individual borrowers include:

While you cannot change the broad macroeconomic factors that affect your rate, you can take steps to lower it by improving your credit, saving for a larger down payment, and choosing a mortgage with a shorter loan repayment term.

Don’t Miss: Car Loan Calculator Usaa

Terminology Guide For Borrowers

Not sure what these terms mean? Heres a mini glossary of loan limit terminology:

Conforming: A California conforming home loan is one that falls within the maximum size limits used by Fannie Mae and Freddie Mac. These caps are established by the Federal Housing Finance Agency . In short, if a California home loan falls within these conforming limits, it can be sold to Freddie and Fannie via the secondary mortgage market. Anything larger is considered a jumbo loan and cannot be sold into the secondary market. These limits vary by county, as shown in the table above.

Conventional: The term conventional is used to describe mortgage products that are not insured by the government. This distinguishes them from FHA and VA loans, which are insured or guaranteed by the federal government. California conventional home loans are originated within the private sector, with no government backing.

Loan limit: This is the maximum borrowing amount within a certain mortgage loan category. For instance, the maximum amount for a conforming single-family home loan in San Diego County is $879,750. There are caps for other products as well, including FHA and VA mortgage programs. They also vary by county and are based on median home prices.

Frequently Asked Fha Questions

Can I get an FHA loan with a bankruptcy?In general, you will need to wait two years before applying for an FHA loan after a bankruptcy. However, there are some exceptions which may allow you to apply sooner. Read our article on the bankruptcy waiting period.

Are all FHA lenders the same?Not all lenders who offer FHA loans are the same. They all do not offer all of the FHA programs and their rates and fees may also vary. Most importantly, the individuals who help to process and underwrite your loan will have a huge impact on your FHA loan experience.

Can I use gift funds for an FHA loan?FHA loans do allow for gift funds to cover your down payment as well as your closing costs. The gift funds must come from a relative or a close friend as approved by the lender. You will need to provide the lender with a gift letter that is signed by the donor.

Do I need an appraisal for an FHA loan?The FHA does require an appraisal and inspection before your loan can be approved. The FHA inspection has clear guidelines on what needs to be repaired before your loan can close. They want to make sure home buyers are moving into a home that is safe and operational.

Don’t Miss: Usaa Auto Loan Eligibility Requirements

Is The Fha Program Right For You

FHA loans are insured by the federal government. Theyre similar to the VA loan program, in that regard. But unlike the VA program, you dont have to be a military member or veteran to qualify for an FHA loan. Anyone who meets the basic requirements can use an FHA-insured mortgage loan.

This program requires a down payment of 3.5%. Additionally, borrowers must have a credit score of 580 or higher to qualify for the 3.5% down payment. These requirements come from the Federal Housing Administration, which manages the FHA loan program.

As a result of the government insurance backing, FHA loans are generally easier to qualify for when compared to non-government-backed conventional mortgages. This makes the program popular among borrowers with less-than-perfect credit or other issues.

Aside from the increased California FHA loan limits for 2022, we do not expect any other major changes to the program. At least not in the near future. Credit score requirements, down payments, mortgage insurance, and other aspects of the program remain unchanged for now.

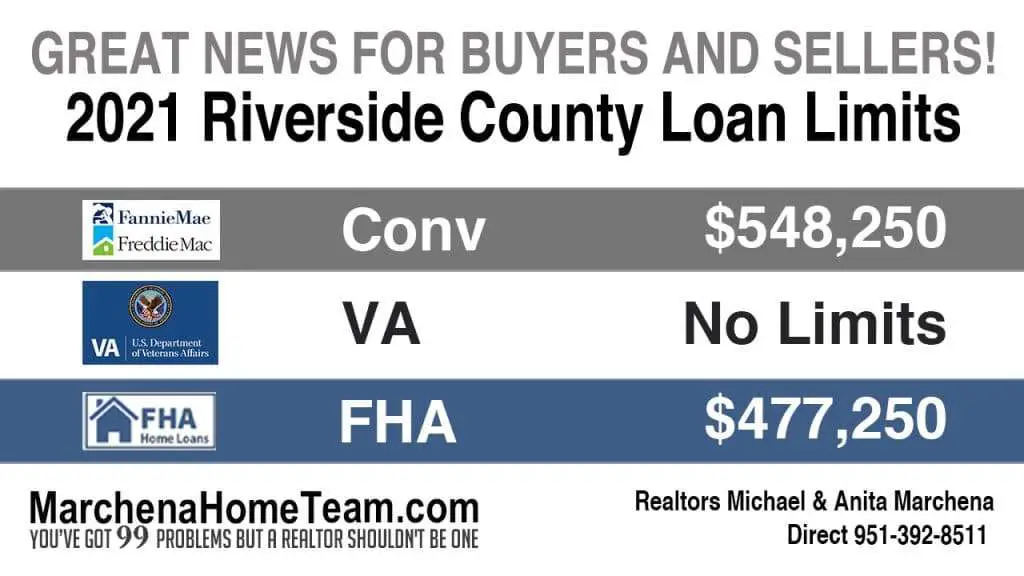

Conforming Loan Limit In Riverside County

Conforming Conventional loan limits refers to loans secured and underwritten to the FHFA or Fannie Mae/Freddie Mac guidelines and standards. The term Conforming is often used to refer to Conventional financing.

2018 Riverside County Conforming loan limit is $453,100

This means if your loan amount exceeds $453,100, it will not conform to Fannie/Freddie guidelines and require 1 of 2 options.

You May Like: Usaa Car Loans Review

Other Changes To Va Loans In Riverside County

There are also several small changes that took effect regarding the VA Funding Fee. The Funding Fee rose for most active duty Veterans. On the other hand, most Reservists are set to see a small drop in the cost of VA Funding Fees. Additionally, Purple Heart Recipients are exempt from the fee regardless of disability status.

About The 2022 Fha Loan Limits

In order to get approved for an FHA loan, your mortgage must be within the maximum loan amount the FHA will insure. Known as FHA loan limits, these maximums vary by county.

In 2022, the Department of Housing and Urban Development is increasing FHA loan limits in 3,188 counties while just 45 counties will remain the same.

There are four different pricing tiers for FHA loan limits: a standard tier, a mid-range tier, a high-cost tier, and a special exception tier.

In low-cost counties, FHA loan limits are now capped at $420,680 for a single-family home loan.

In high-cost counties, FHAs single-family loan limit is $970,800.

However, many counties fall in the mid-range category with limits somewhere between the floor and ceiling.

You can look up your local FHA loan limits using this search tool.

Don’t Miss: What Happens If You Default On A Sba Loan

The Ascent’s Complete Guide To Mortgages

Mortgages are a big decision. With all of the potential options on the market, where do you start? If you’re a first-time homebuyer looking for the best lender for you or a homeowner looking to refinance to take advantage of some of the lowest mortgage rates we’ve ever seen, we’ve got you covered.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Fha Building On Own Land

Home Price Trends And 2020 Outlook

The loan limits for Riverside County were increased from 2018 to 2019, in response to rising home values in the area. But we dont expect that to happen again, going into 2020.

The limits themselves are based on median home values within a particular area. So when house prices rise significantly over the course of a year, housing officials often raise the FHA, VA and conforming loan limits to keep pace.

Thats what happened in Riverside County. Home values in the area climbed steadily during 2018, so the conforming and FHA mortgage caps were increased for 2019.

At this point, we do not expect housing officials to increase the loan limits for Riverside, California in 2020. It could happen but it seems unlikely. Home prices in the area havent risen that much during 2019.

According to Zillow, the median home value for the county rose by around 1.9% over the past year or so . When this page was last updated, the median home price for the Riverside housing market was around $385,000. Thats below the current FHA and conforming loan limits for the county. So there doesnt seem to be any need to increase them in 2020.

Applies To All Cities In Riverside & San Bernardino County

FHA loan limits are established at the county level. This means different counties have different mortgage caps, and they range from $271,050 to $625,500 in most areas. This also means that the 2016 loan limits shown above apply to all cities within Riverside and San Bernardino County. In fact, these maximum mortgage amounts apply to the entire Inland Empire metropolitan area.

- The 2016 FHA loan limits listed above affect all cities in San Bernardio County, including Fontana, Rancho Cucamonga, Ontario, Victorville, Rialto, Hesperia, etc.

- They also apply to all cities and towns located within Riverside County, including Moreno Valley, Corona, Murrieta, Temecula, Jurupa Valley, Indio, Menifee, Hemet, etc.

Don’t Miss: Upstart Prequalify

Buying A Multifamily Home With An Fha Loan

As long as you plan to live in one of the units for a year after you purchase it, you can use the higher multifamily home FHA loan limits to buy a two- to four-unit home. Qualified buyers can purchase a multifamily home with a low 3.5% down payment and use the rental income to help qualify (conventional guidelines typically require at least a 15% down payment for multifamily purchases. In California, this gives you more than a million dollars worth of borrowing power in the most expensive areas:

- $1,243,050 for a two-unit home

- $1,502,475 for a three-unit home

- $1,867,275 for a four-unit home

California County Loan Limits 2022

California conforming loan limits have been increased for 20212. Federal housing officials announced this change on November 25, 2021. The table below has been fully updated to include the revised limits for all counties across the state.

Youll notice that most California counties have a conforming loan limit of $647,200 for a single-family home. Higher-priced areas like those in the San Francisco Bay Area have conventional limits of up to $970,800 due to higher home values. Other counties fall somewhere in between these floor and ceiling amounts.

See the table below for 2022 conforming loan limits in all California counties.

Don’t Miss: What Is The Fha Loan Limit In Texas

High Balance Conforming Loan Limit

The high balance conforming loan is in place for counties throughout the nation that are considered High Price by the Federal Housing Finance Agency. These loan limits can be different for each county. In San Diego, the 2018 high balance conforming loan limit is $649,750. This program allows buyers with as little down payment as 5% or homeowners to be able to refinance with as little as 5% equity in their house. Rates are typically .125% .25% higher on this program with good credit than the traditional conforming program.