When Will Your Student Loans Be Disbursed

In most cases, youll receive your loans at least 10 days before classes start. If youre a first-time borrower, you could have a waiting period of 30 days after your first enrollment period.

Typically, student loans are disbursed in two payments a year once per semester. To confirm this is the case at your school, reach out to your colleges financial aid office for more information.

Depending on whom you borrowed from, your lender might send the money to your schools financial aid office, where it will be applied to tuition and fees. If theres a difference left over, the school will then return that money to you to use on books, food or other living expenses.

That said, the process might be different, depending on whether you borrowed federal student loans from the Department of Education or private student loans from a bank or credit union.

Can I Cancel My Student Loans

Federal student loans may be canceled under the following circumstances:

- Your college closed down while you were a student there or within 90 days after you withdrew.

- Your school owed you or your lender a refund after you withdrew but never provided it.

- The loan was a result of identity theft.

- The student borrower dies.

- You become totally and permanently disabled.

Q Who Is Doing All This Borrowing For College

A. About 75% of student loan borrowers took loans to go to two- or four-year colleges they account for about half of all student loan debt outstanding. The remaining 25% of borrowers went to graduate school they account for the other half of the debt outstanding.

Most undergrads finish college with little or modest debt: About 30% of undergrads graduate with no debt and about 25% with less than $20,000. Despite horror stories about college grads with six-figure debt loads,only 6% of borrowers owe more than $100,000and they owe about one-third of all the student debt. The government limits federal borrowing by undergrads to $31,000 and $57,500 . Those who owe more than that almost always have borrowed for graduate school.

Where onegoes to school makes a big difference. Among public four-year schools, 12% ofbachelors degree graduates owe more than $40,000. Among private non-profitfour-year schools, its 20%. But among those who went to for-profit schools,nearly half have loans exceeding $40,000.

Among two-year schools, about two-thirds of community college students graduate without any debt. Among for-profit schools, only 17% graduate without debt .

Don’t Miss: Usaa Home Loans Credit Score

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

Student Loans Vs Credit Cards And Auto Loans

In the past decade, total U.S. student loan debt has surpassed credit card debt and auto loan debt. In the third quarter of 2018, Americans owed $840 billion on their credit cards and $1.21 trillion in auto loans. Currently, U.S. student loan obligations are larger than both, trailing only mortgages in scope and impact.

Don’t Miss: Usaa Auto Loan Credit Score Requirements

How Much Spending Money Does The Average College Student Need

This survey sampled 150,000 college students in California from varying regions, ages, and races/ethnicity. Students in California spend about $2,020 per month or $18,180 annually per nine-month academic year for expenses outside of tuition.

See The Faces Of The Student Debt Crisis

But a provision that was worth a fortune to Sallie Mae and other issuers of private student loans was slipped into the bill with no debate and with bipartisan support.

At a 1999 hearing, then-Rep. Lindsey Graham, R-S.C., proposed barring debtors from discharging private student loans via bankruptcy, a transcript shows. Rep. John Conyers, D-Mich., who was leading Democrats opposition, said he had no objection. Grahams amendment passed by a voice vote and eventually became part of the law.

Rep. Jerrold Nadler, D-N.Y., said the private student loan issue wasnt really on the radar screen for opponents.

In retrospect, it should have been part of the debate, he said, although there were ample other reasons to oppose that bill.

The measures practical effect was to put student debtors in the same category as drunken drivers, fraudsters and deadbeat dads and moms seeking debt relief. From then on, it was easier to go bankrupt if you were a playboy whod run up credit card bills living large in the Caribbean than if you were a former student whod gotten sick or lost your job.

The law gave lenders tremendous leverage over student debtors, no matter how dire their circumstances, said Daniel Austin, a bankruptcy law professor at Northeastern University.

Its really awful what weve done, he said.

Over the next few years, bills were introduced in the House and Senate to overturn the bankruptcy exclusion.

Don’t Miss: Refinance Conventional Loan

What About Private Student Loans

These come from banks, credit unions, and other financial institutions. The limits vary by lender but generally max out at the total cost of attendance at the school you or your child attends. In addition, most private lenders have a maximum loan amount that cant be exceeded no matter how costly your school is. Contact lenders directly to apply.

Average Student Loan Debt In The United States

The average college debt among student loan borrowers in America is $32,731, according to the Federal Reserve. This is an increase of approximately 20% from 2015-2016. Most borrowers have between $25,000 and $50,000 outstanding in student loan debt. But more than 600,000 borrowers in the country are over $200,000 in student debt, and that number may continue to increase.

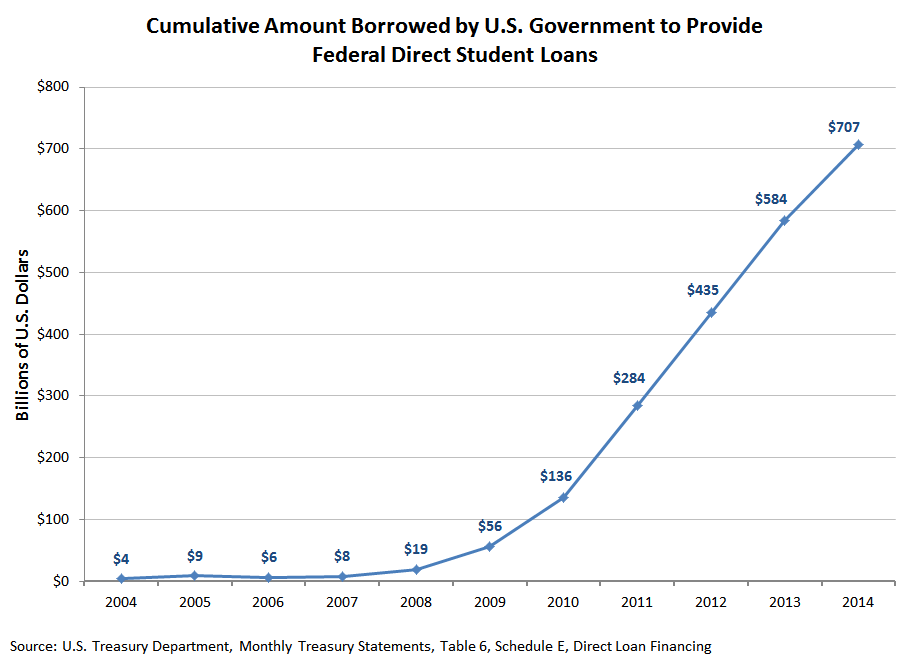

In total, the student loan debt outstanding in the country was $346 billion in 2004, and has ballooned to $1,386 billion as of late 2017. This represents a 302% increase in the total student loan debt in just 13 years. On average, the total student loan balance has increased by $80 billion each year since 2004.

| Year |

|---|

Average Student Loan Debt By State

- Connecticut has the highest average student loan debt for the Class of 2017 at $38,510.

- Utah has the lowest average student loan debt balance at $18,838 and the lowest percentage of residents with student loan debt, 38%.

- 74% of students in New Hampshire, South Dakota and West Virginia from the Class of 2017 have student loan debt.

According to data from The Institute for College Access and Success, the average student loan debt in each state for the class of 2017 is $28,650, ranging from $18,838 to $38,510. And in almost every state, 45% or more students are in debt, besides Utah. The table below shows the average college debt by state with their corresponding rank based on their average debt.

| Rank |

|---|

*Not enough useable data to calculate averages.

| Year |

|---|

Also Check: California Loan Officer License

Federal Student Loan Limits

Using standard federal student loan limits, the cost of attendance and your Free Application for Federal Student Aid information, your school determines how much youre eligible to borrow in federal student loans. The amount you can take out is based on:

- The cost of attending the school.

- Your year in school.

- Your status as a dependent or independent student .

There are three main types of federal student loans:

Each of the different types of federal student loans has its own loan limits.

How To Get The Most Financial Aid Per Semester

Federal financial aid is calculated a little differently by each school, but they all use your FAFSA number to determine your specific financial need. You should always provide accurate and truthful information on your FAFSA. Lying about income or moving money around can cause you to lose your award and be barred from receiving federal financial aid for the rest of your education. There are several ways to get enough financial aid to cover the cost of your post-secondary education, either from the federal government, your state government, and/or your school.

- Find merit-based scholarships to apply for, both through your college and from nonprofits or for-profits.

- Complete your FAFSA information early since some money is first-come, first served.

- Research other sources of income, like private student loans.

Need-based aid and federal student loans are the major sources of monetary support for students all over the United States, but they are not the only options to help you get through school. You could qualify for state-based grants and scholarships, which also use the FAFSA to determine your eligibility. Hobbies, good grades, and many other skills can help you qualify for merit-based scholarships through your college or from businesses outside your institution.

Don’t Miss: 650 Credit Score Interest Rate

Which Graduate Degrees Are Students Borrowing The Most For

Of all graduate degrees, a medical degree takes longest to earn and costs the most. Doctors emerge from their training with an average debt load of $161,772. Lawyers follow with $140,616 worth of student loans, and educators rack up an average of $50,879 in outstanding loans. Of all degree seekers, the least indebted after graduation tend to be those earning MBAs, with an average student loan debt of $42,000.

How Much Is The Typical Student Loan Payment

The average monthly student loan payment was $393 in 2016 , which is like buying the newest Apple Watch every two months. That puts the average monthly payment nearly 55% higher than it was a decade ago.

Student loan payments have increased more than two-and-a-half times faster than the rate of inflation. If the typical $227 monthly bill student loan borrowers received in 2005 had kept pace with consumer prices, the cost would only have risen by 22.9% to $279. Paying off student loans is significantly more challenging today than it was in the past, but there are strategies borrowers can use to cut their interest rates and lower their monthly payments.

Recommended Reading: Usaa Pre Approved Loan

Fafsa Says How Much You Can Pay For College Its Often Wrong

The form opens the door to student aid. But its a terrible measure of what people can actually afford, one expert said. And many families will be asked to pay more, anyway.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

- Read in app

Like millions of other parents, Julie Phipps filled out the federal form last November that determined her college-bound daughter was eligible for financial aid. She also learned how much the federal government figured her family could contribute to the bill: $14,000.

That figure, known as the expected family contribution, was generated immediately after she completed the Free Application for Federal Student Aid, or FAFSA. But with every dollar from their solidly middle-class income already accounted for, Ms. Phipps, 53, said she and her husband, Andy, were stunned at what they were expected to pay.

That was just the start.

The real shock came later, when they learned that the expected contribution was only about half of what their daughters chosen school expected the family to pay. If we were paying our expected family contribution, we would be thrilled, said Ms. Phipps, of South Portland, Maine. But we are paying twice our expected family contribution, so it means absolutely 100 percent nothing.

A $14,000 expected family contribution meant the Phippses were eligible for an aid package of about $33,000.

Undergraduate Loans Always Lose Money

No matter which way you do the math, the loans offered to undergraduate borrowers do not make money for the government. Any profit comes from loans made to graduate students and parents, which charge higher interest rates.

The interest rates on undergrad loans are usually low, plus the government also pays the interest on subsidized loans for some low-income undergraduates while they’re in school.

If you borrow a student loan from the government this year, you’ll be charged a fairly low interest rate.Undergraduates currently pay 3.76%, while graduates pay 5.31% and parents pay 6.31%.

The Obama Administration has tied the interest rate to the 10-year Treasury note, plus a margin, which varies depending on the loan type. That rate is locked in for the lifetime of the loan.

Read Also: Transfer Loan To Another Person

How To Find Out If Your Student Loan Money Is On Its Way

In most cases, your student loan disbursement is sent straight to your college. After subtracting the costs of tuition and fees, youll get the remaining money to use at your discretion.

But student loan disbursement involves a lot of moving parts, and your experience might be different than someone elses. If youre not sure what to expect, reach out to your schools financial aid office to point you in the right direction.

And if you borrowed private student loans, contact the bank or credit union for information on its policies. By staying up to date on your student loan disbursement schedule, you can prepare your finances before the start of the semester.

When Do You Pay Back Your Loans

Federal Direct Stafford loans require that you begin loan repayment six months after you graduate, leave school, or drop below half-time enrollment. Although Federal Direct PLUS loans previously entered repayment within 60 days of full disbursement, since 2008 borrowers have been able to defer repayment until six months after the student graduates or drops below half-time enrollment.

Private loan repayment depends on the terms set by the lender. You may find that your lender requires you to make loan payments while still in school, though there may be options to defer making loan payments. Interest continues to accrue during an in-school deferment and grace period.

If you dont have the money to pay for college, student loans are a great option to help you finance your education. But its important to understand how loans work so there arent any surprises when its time to begin loan repayment.

Recommended Reading: Used Car Loan Rates Usaa

If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan 2 threshold of £2,274.

Your income is £317 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £28 and repayments will go towards both plans.

When Do Student Loan Payments Start

Good news for student loan borrowers. You wont have to start repaying student loans until the moratorium expires, which is at least September 30, 2021.

For graduating students, there is also something called a grace period that can be anywhere from six months to nine months. This provides a period of adjustment after you graduate, drop out, or slip below half-time status. The grace period is designed to provide a chance to find a job, select a repayment plan, and begin earning an income before youre swamped with bills.

Are you unemployed? You may be eligible for an unemployment deferment. For federal loans, if you qualify, you could suspend monthly payments for as many as 36 months. However, borrowers must reapply every six months, demonstrating proof of unemployment benefits and an active job search.

For private loans, any variety of deferment is at the discretion of the lender.

The following types of loans have six-month grace periods:

- Direct Subsidized/Unsubsidized Loans

- Some private student loans

PLUS loans have no grace period, and you must begin repaying them as soon as they are fully disbursed. However, those who receive PLUS loans as a graduate or a professional student get an automatic six-month deferment after graduation, leave school, or dip below half-time enrollment.

Similarly, parents who secure PLUS loans for their childs education may request a six-month deferment under the circumstances mentioned above.

Also Check: Usaa Rv Loan Terms

How Much In Federal Student Loans Can I Get

The first type of loan that students should consider is federal student loans, which are offered and guaranteed through the Direct Loan Program, also known as the William D. Ford Federal Direct Loan Program. This program offers four types of Direct Loans for in-school students, and caps how much you can borrow with each under the following rules:

- Annual limits: The maximum amount that the borrower can take out in an academic year.

- Aggregate limits: The maximum cumulative amount that a borrower can borrow in student loans.

- Cost of attendance: In addition to annual and aggregate limits, the federal government also limits loans by your costs. It will not allow borrowers to take out more student loans than their college program costs.

How much student loans you can get, specifically, will vary by your student status. For example, the Direct Loan program lends less to students who are dependents , or who are in their first or second year of college. For independent students and upperclassmen, the borrowing limits are higher.

Below are the federal student loan limits for different types of Direct Loans, as of March 9, 2021.

*Subsidized loan amounts will also count toward these limits.

So as you want to know how much student loans you can get, pay attention to this letter. It will list the types and amounts of federal student loans youre being offered.