How To Verify External Bank Account After Linking It

After adding your external account information, you can follow the given steps to verify it for transfers:

- Within two business days subsequent to linking your account on the web, Capital One will put aside two little test installments into your external account, trailed by one withdrawal for the aggregate sum of the two test deposits.

- Survey the activity on your external financial records, and distinguish the little test deposits.

- When you know the sums, sign in to capitalone.com, and select the Capital One account you are connecting your external account to.

For Capital One 360 accounts, select your client profile at the upper right corner of the screen, and then select Settings, and go down to the External Account segment. In the External Account segment, select Verify Account to affirm your link.

For every other account, click on the Account Services and Settings link under your balance data, and afterward go to Manage External Accounts to affirm your link.

It would be ideal if you keep in mind that if this is a joint external account, with a similar shared account holder, you should both sign in to capitalone.com with your individual sign in details and complete the steps mentioned above.

When you affirm the link, you will have the option to move cash between accounts. When you verify your external account, any cash you booked to be stored to a Capital One account that was recently opened, will be transferred.

Recommended Reading: Prosper Loan Denied After Funding

Capital One Auto Finance Application Requirements

To qualify for a Capital One auto loan, youll need a minimum credit score of 500. Depending on your credit score, you will also need a minimum monthly income of at least $1,500 to $1,800. Capital One auto loans are available to residents of all states except Alaska and Hawaii. However, you cant use these car loans to purchase Oldsmobile, Daewoo, Saab, Suzuki, and Isuzu vehicles.

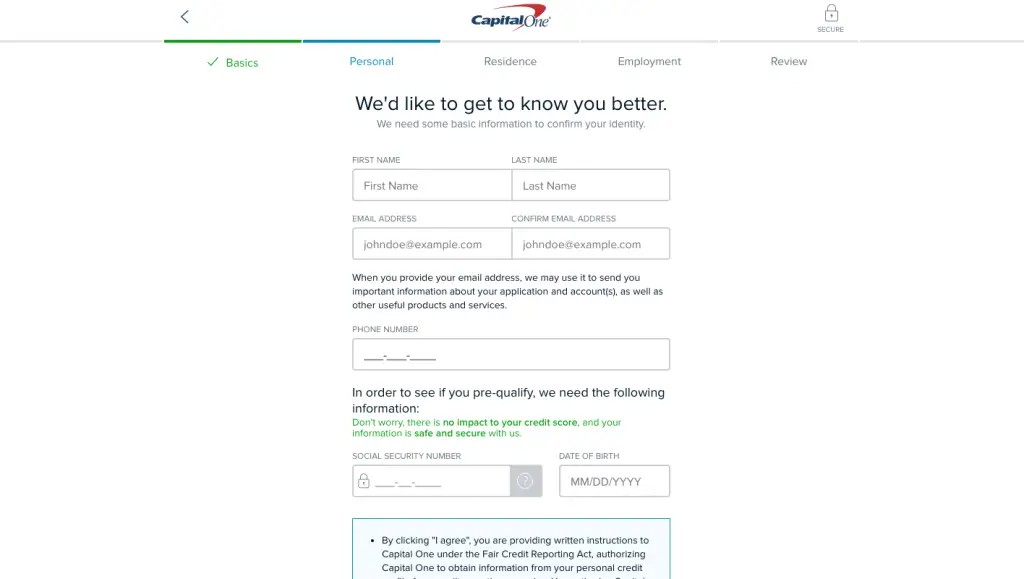

When youre ready to apply for a car loan, youll need to provide the following information:

- Personal information, including your address, email address, your drivers license, and your Social Security number

- Financial information, including your annual gross income and contact information for your employer

- Proof of residence, like a copy of a utility bill or a mortgage statement

- Proof of income, like a copy of a pay stub or three recent bank statements

Capital One does allow cosigners, which can increase your chances of being approved if you have poor credit. If you are applying for a Capital One car loan with a cosigner, they will need to be prepared to provide all of the above information, too.

Is Refinancing Your Auto Loan Worth It

If you qualify for a lower interest rate than your current loan, it makes sense to consider it. As long as you maintain the same payment amount or increase it, youll set yourself up to pay off your vehicle sooner. It also makes sense to consider refinancing while your loan is still relatively new and not about to be paid off. This way you can save as much as possible.

For example:

Say the balance on your existing car loan is $10,000, your current interest rate is 20%, your current monthly payment is $372, and you have 36 months left on your 60-month car loan.

If youve improved your credit a bit and now qualify for a subprime rate instead of a deep subprime rate, you could refinance your current car loan at 17.11% for 36 months, or $357 a month. While saving $15 a month in the form of a lower monthly payment doesnt seem like much, it can add up. Youll save $524 total.

Use a refinance calculator to check your numbers before you commit to a new loan provider.

Read Also: How Long Do Sba Loans Take To Get Approved

Auto Refinance And Your Credit Score

Refinance lenders typically conduct a soft pull on your credit for pre-qualification, and then a hard inquiry or hard pull on your credit when you actually apply. The former will have no effect on your score, but the latter will drag you down by a few points.

To minimize the drop, make sure to loan shop within a 14-45 day window, as credit bureaus and the VantageScore vs FICO Score systems will count these as one single pull.

Unauthorized hard inquiries arent unheard of, so make sure the lender is trustworthy. If you find unauthorized inquiries on your report, here are steps you can take to remove negative items on your credit report.

Your credit score will also drop slightly after finalizing the loan because a refinance counts as new debt. Since this new account is effectively replacing an older debt, the credit drop should be negligible.

In any case, remember to keep making your payments on your current loan until the refinance has gone through. Otherwise, your credit could be affected.

How to refinance a car loan with bad credit

Even if your credit score has gone up, if its still under 640, getting the best rates on an auto refinance is unlikely. There may be, however, some cases in which refinancing may be beneficial:

Is Cap Onethe One For You

Capital One auto loans are, quite frankly, some of the most difficult loans to figure. Their computer scoring system either likes what it sees or it doesnt.

If you dont meet certain requirements, then it may be best to save yourself the credit inquiry. On the other hand, if you do meet their minimum requirements, they could very well be your best approval.

Capital One Auto Finance had recently gotten out of the prime lending business and were not loaning money for auto loans to A+, A, and B tier credit customers.

Apparently their losses far exceeded their gains for these credit tiers and they backed off for nearly 6 months. Well, guess what?Theyre Back!!! But only at participating dealerships. Again, a bit confusing!

Heres whats below

Recommended Reading: Usaa Car Loan Credit Score

Don’t Miss: Capitalone Com Auto Pre Approval

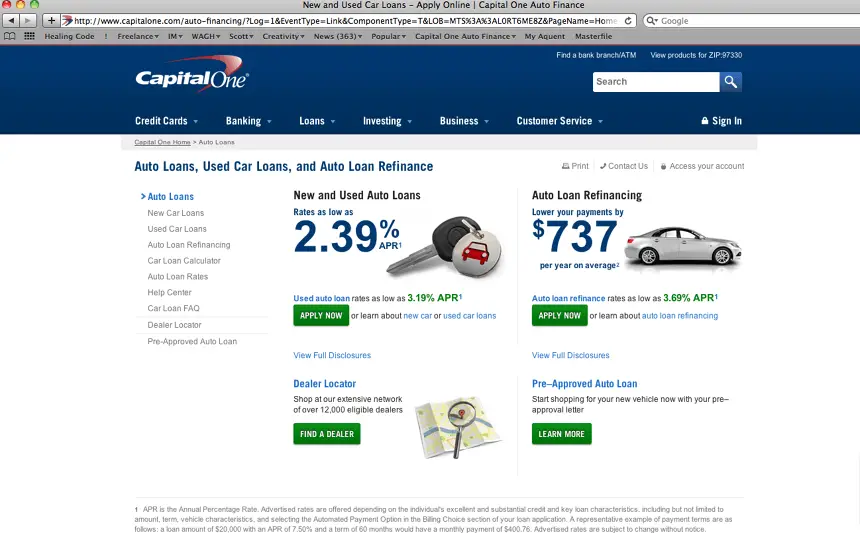

Capital One Auto Financing Options

Capital One offers a variety of auto financing options, including loans for new cars and used cars, but they do not finance lease buyouts or cash-out refinancing.

- New Car Loans: New car loans start at 2.99% for customers with excellent credit.

- Used Car Loans: Used car loans startup 3.39% with minimum loan requirements of $4,000.

- Auto Refinance: Auto refinance loans start at 4.07% and go up to 24.99%, with minimum loans starting at $7,500.

Dont Miss: Does Va Loan Work For Manufactured Homes

Capital One Credit Card

Just think of credit cards that are anything but difficult to utilize, miles that are absolutely easy to reclaim and remunerates that are easy to cherish. Capital One has this and that is only the tip of the iceberg. You will discover travel cards, money back cards and items for the consumer who is simply starting out, all sponsored by one of the countrys biggest banks.

The best Capital One Visa is the Capital One Venture Rewards Credit Card. This card offers a heavy sign-up reward of 10,000 miles for burning through $20,000 on purchases in the initial year or you can procure 50,000 miles for burning through $3,000 in the initial 3 months. The reward is worth either $1,000 or $500 separately when reclaimed for travel. You will likewise acquire 2X miles on all passing buys. Capital One offers adaptable reclamation alternatives as you can recover your miles with any hotel or airline.

Read Also: Auto Refinance Usaa

Negative Capital One Auto Loan Reviews

Many Capital One customers complain about not finding the same offers they were quoted after prequalification when they visited a participating dealer or financial institution.

I had to sit out of work due to the . I asked for them to put one payment on the end of my loan so it wouldn’t hurt my credit or have me stressed out. To no avail, they basically said no, you need to find a way to make the payment and maybe it won’t get reported to the credit bureaus.

– L.T. via Trustpilot

Don’t ever think about applying for an auto loan from them. Its a total nightmare. They basically damage your credit, and when you walk into the dealership with the approval you will find completely different numbers Stay away

– via Trustpilot

Capital One Auto Finance Restrictions

Keep in mind that auto loans from Capital One are available only for:

- New or used cars, trucks, minivans, or SUVs for personal use

- 2010 models or newer

- Vehicles with less than 120,000 miles

- Vehicles sold by participating dealers

Capital One has a minimum loan amount of $4,000. Pre-qualifications are good for 30 days, giving you time to shop. If youre pre-qualified, that doesnt guarantee that youll be approved for the loan. Your final loan terms may also change based on the hard credit pull performed when you officially apply for the loan.

In addition to car loans for new purchases, Capital One also offers to refinance for current auto loans. By refinancing your loan, you may be eligible for a lower interest rate and lower monthly payments. According to Capital One, customers save an average of $50 per month by refinancing. Refinancing options range from $7,500 to $50,000. Refinance loan applications are usually processed in 24 hours.

Recommended Reading: Fha Loan Limits Fort Bend County

Best Credit Union For Auto Refinance: Penfed Credit Union

PenFed Credit Union

- Minimum credit score: Not stated

- Loan terms : 36 to 84 months

PenFed Credit Union is our top choice for auto loan refinancing from a credit union. The lender features widespread availability and competitive rates.

-

Offers a wide range of options

-

Competitive rates

-

Loan amounts from $500 to $100,000

-

Online application

-

Borrow up to 100% of the vehicle’s value

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Members of PenFed get access to very competitive refinance rates with an average monthly savings of $108 per month. There’s a convenient online application for refinances, and borrowers can finance up to 100% of their vehicle.

Key Information

- : As low as 1.79% APR

- Minimum loan amount: $500

- Repayment terms: 36 to 84 months

- Recommended credit score: Not disclosed

- Availability: All 50 states

For credit union members, PenFed provides a wide range of loan terms and very competitive rates. Refinance rates for 2020 or newer model years start as low as 1.79% for a 36-month loan for loan amounts ranging from $500 to $100,000.

Rates and minimum loan amounts at PenFed increase as the refinancing term increases. For example, an 84-month refinance loan with a model year of 2020 or newer comes with a rate starting at 4.49%, up from 1.79% on a 36-month loan. As with most lenders, borrowers need excellent credit to get the lowest rates.

Easy Online Application For Pre

Shopping around for an auto loan and comparing offers is the best way to know that youâre getting a good deal. With Capital One, itâs easy to pre-qualify online and walk into a dealership with an idea of what you might pay.

If you pre-qualify in advance, you have more bargaining power with the dealership when it comes to talking interest rates. The interest rate on your auto loan is negotiable, and you could use your pre-qualification offer to beat an offer or be confident that youâve got the best deal.

Recommended Reading: Va Manufactured Home 1976

You May Like: Usaa Rv Loan Calculator

How Capital One Auto Finance Works

Capital One Auto Finance is a versatile auto lender that offers new car loans, used car loans, and refinances of existing all alone.

Capital One is very accessible to many consumers because they will work with applicants with credit scores as low as 540, but those with lower credit scores will usually have to pay a higher interest rate.

Customers who are familiar with Capital One will enjoy the simple and straightforward application process online, but the ultimate interest rates will not be available until they submit a formal application at the auto dealership.

Cons Of Refinancing An Auto Loan

Potential downsides of refinancing an auto loan include:

-

Lowering your credit score: A lender will pull a hard credit check before making an official auto loan refinancing offer. The hard credit check affects your credit score whether or not you choose to refinance.

-

Paying more in the long run: While monthly payments may be more budget-friendly in the short term, refinancing a car may entail a longer loan term. As a result, lower monthly payments can result in paying more in interest over the life of the loan.

-

Risking your vehicle: If you used your car as collateral for a personal loan, as described above, falling behind or stopping payments could result in the lender repossessing your vehicle.

You May Like: Becu Ppp Forgiveness

Hear From Our Editors: The Best Auto Refinance Loans And Rates Of 2021

This date indicates our editors last comprehensive review and may not reflect recent changes in individual terms.

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affectour editors opinions. Our marketing partners dont review, approve or endorse our editorial content. Its accurate to the best of our knowledge when posted.

How To Get A Personal Loan From Capital One

Personal loans are loans you can get without offering any collateral, which is handy if you need to borrow small amounts of money and dont want to worry about losing an asset like your home. However, like many banks, Capital One does not currently offer personal loans. This means you will have to work with another lender if you need a loan to pay for planned or emergency expenses. Luckily, there are plenty of alternatives that offer reasonable fees, flexible payment terms and competitive rates.

Also Check: Usaa Auto Lease Calculator

Time Remaining On Your Loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

If your answer to When should I refinance my car loan? is Soon, review our current refinance rates and take a look at our auto loan refinance calculator to get a better understanding of whether refinancing makes sense for you.

You may also like

Finalize Details At Dealership

Although the prequalification tool can be very helpful, customers will not receive their final loan terms until they are at the dealership and submit a full application to Capital One.

Although the final loan terms are usually similar to the prequalification terms, they may change slightly once you submit the application and Capital One performs a hard credit inquiry.

Read Also: Usaa Car Loan Refinance Rates

What Do You Need To Qualify For Capital One Auto Refinance

To qualify for auto loan refinancing with Capital One Auto Refinance, applicants need a minimum annual income of $18,000 or higher. Capital One Auto Refinance only considers borrowers who are employed and meet the minimum income requirement. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members and their covered dependents are eligible to apply for a loan via Capital One Auto Refinance. Their rates fall within the limits of The Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by Capital One Auto Refinance. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Proof of income

Bottom Line On Capital One Auto Refinance

We give Capital One auto refinance a score of 7.6 out of 10.0. Since it is part of an established and reputable bank, the financial institution offers large loan amounts to refinance your car. However, the company has many negative reviews on the BBB. Note that this number is low compared to the number of consumers it serves, and reviews encompass all of Capital Ones financial products.

Don’t Miss: Usaa Auto Refinance Rates

Here Are Some More Details About Penfed Credit Union

- Membership required You must be a member to qualify for an auto loan from PenFed Credit Union. Joining is easy, and you dont necessarily have to be a member of the military.

- Large loan range PenFed Credit Union offers auto loans ranging from $500 to $100,000, depending on your loan term.

- Doesnt refinance its own loans If you got your current car loan from PenFed Credit Union, it wont refinance your loan. The lender only refinances auto loans from other lenders.

Here Are Some More Details About Rategenius

- Lending platform RateGenius is an online platform that partners with more than 150 lenders to provide refinance offers to people who qualify for a loan.

- Eligibility requirements Your vehicle must be no more than 10 years old and have fewer than 150,000 miles. Plus, your existing auto loan must have a balance of at least $10,250, and you must have a combined household income of at least $2,000 per month. Keep in mind that this lender may offer different terms on Credit Karma.

- Range of credit histories considered Lenders in the RateGenius network consider applicants with less-than-perfect credit, though interest rates could be significantly higher than someone with good or excellent credit would get.

Read Also: How Much House And Car Can I Afford