The Maximum Amount Of The Va Loan No Longer Exists

If you are lucky enough to qualify for a VA loan, you get some serious benefits.

With no down payment requirements, no mortgage insurance, and some of the lowest interest rates on the market, a VA loan is one of the best mortgage products you can find.

More, VA loan changes adopted earlier this year introduces another advantage: there is no longer a maximum amount of VA loan.

Now, to be clear, that doesnât mean you can get a VA loan for whatever amount your heart desires.

There are still limits to what you can buy â they just depend more on your unique financial situation, rather than a national limit.

How This Va Loan Change Helps Veterans

The new law repealed loan limits on VA loans. That means veterans buying in pricey metros can get a large loan amount with no down payment.

Before 2020, a loan over the limit required a down payment equal to 25% of the amount over the limit.

For example, a veteran buying a $600,000 in a location where the limit is $500,000 would need to make a down payment of 25% of the $100,000 overage. That comes out to a $25,000 down payment.

The new bill says the veteran can get that same house with zero down, saving significant out-of-pocket expenses.

Now, veterans can shop for more expensive homes, especially in high-priced cities, without worrying about upfront costs.

Va Loan Limit Calculator

VA loan limits no longer apply to qualified Veterans with their full VA loan entitlement. Veterans with reduced VA loan entitlement must still follow VA loan limits. Keep in mind, VA loan limits are not a maximum on how much you can borrow but help determine how much you can borrow without needing to factor in a down payment.

Enter your city and state below to find your area’s VA Loan limit amount or learn more about VA loan limits changes in 2021.

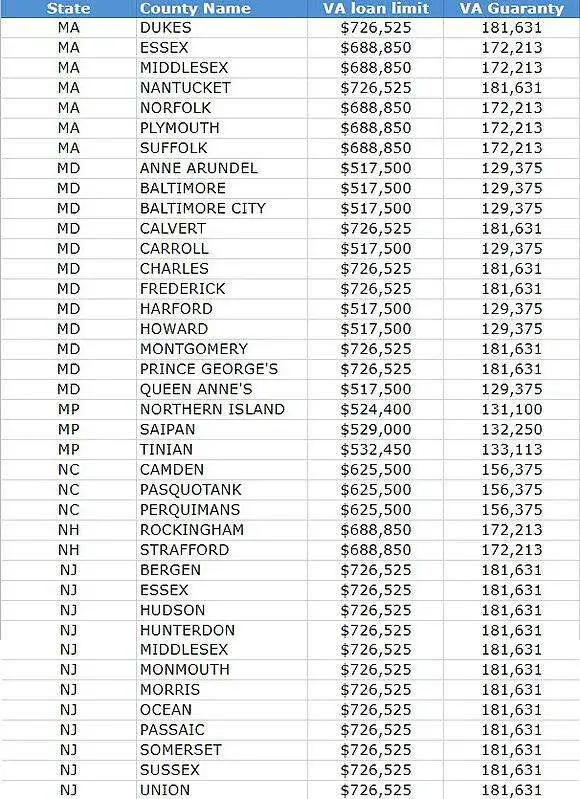

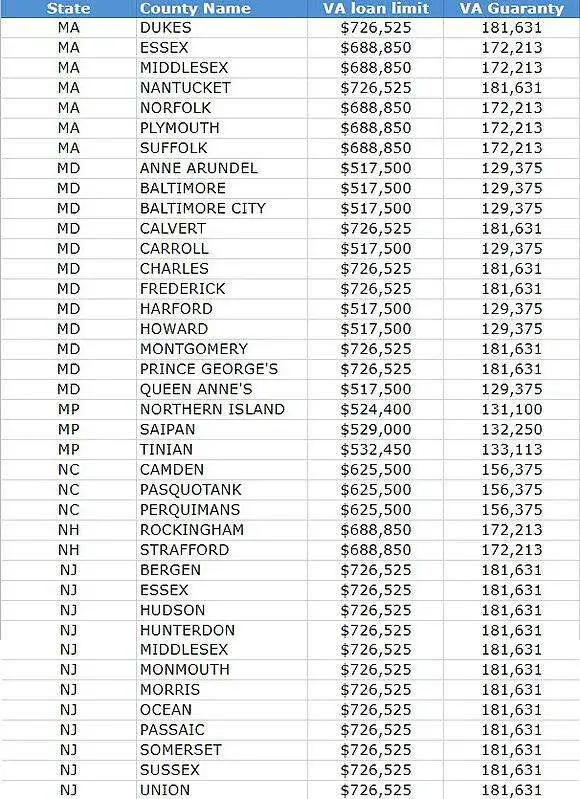

VA loan limits determine how much a Veteran with reduced entitlement can borrow before needing to factor in a down payment. VA loan limits vary by county and currently range from $548,250 to $822,375.

While qualified Veterans with their full entitlement can borrow as much as a lender is willing to extend, those with reduced or diminished entitlement are bound to VA loan limits. Less-than-full entitlement is typically due to having one or more existing VA loans or because of default on prior VA loan.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

If You Have Remaining Entitlement You Do Have A Home Loan Limit

With remaining entitlement, your VA home loan limit is based on the county loan limit where you live. This means that if you default on your loan, well pay your lender up to 25% of the county loan limit minus the amount of your entitlement youve already used.

You can use your remaining entitlementeither on its own or together with a down paymentto take out another VA home loan.

You may have remaining entitlement if any of these are true. You: Have an active VA loan youre still paying back, or Paid a previous VA loan in full and still own the home, or Refinanced your VA loan into a non-VA loan and still own the home, or Had a compromise claim on a previous VA loan and didnt repay us in full, or Had a deed in lieu of foreclosure on a previous VA loan , or Had a foreclosure on a previous VA loan and didnt repay us in full

Va Loan Limits For High

In 2021, the Department of Veterans Affairs does not cap the size of a loan a veteran can get with no money down. This information is provided for historical purposes, as this change was made by the Department in 2020.

Previously, the VA loan guaranty program limited the amount they would loan to prospective homeowners to a maximum amount determined by the Federal Housing Administration. This no longer applies.

In 2019, the maximum amount the VA would loan for most of the nation was set at $484,350, however higher cost areas had exceptions. The exceptions are listed below.

These limits apply to all loans closed Jan. 1, 2019 to Dec. 31, 2019.

Still doing your research? Whether you are in a high-cost county or not, discuss your VA loan benefits, down payment options, and loan limits, plus get no obligation rate quotes to help you plan your familys future.

Recommended Reading: Usaa Refinancing Car Loan

How Does A Va Loan Differ From A Conventional Mortgage

VA loans differ from conventional mortgages in many important ways.

The VA warns that adding the funding fee and closing costs to your loan, rather than paying for them upfront, could leave you owing more than your house is worth or could reduce benefits of refinancing because your payments wont be lowered by as much.

Applying For A Va Loan

Applying for a VA loan is different from applying for a conventional mortgage, and this affects the home-buying process.

The VA recommends working with a real estate agent whos familiar with VA loans and getting prequalified with a lender before making an offer.

There are a number of steps to applying for a VA loan, including

- Obtaining a certificate of eligibility, which verifies to the lender that you meet minimum eligibility requirements.

- Comparing offers from different VA lenders to find the best interest rate and most affordable fees for you.

- Submitting a loan application and providing financial information, including pay stubs and bank statements.

- Obtaining a VA appraisal, which is ordered by the lender.

Your credit information, income and the value of the home will be reviewed, and then the lender will either approve or deny your loan. Make sure your purchase agreement has a clause called a VA option clause, which allows you to avoid financial penalties if the home doesnt appraise high enough.

When your loan is approved, the lender will choose a representative to conduct a closing, during which the money can be released and the property transferred to you.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Max Va Loan Limit Calculator

There are a a lot of variables that effect how a VA loan limit is calculated. In order to get an accurate number you need to go thru the process of applying. Click the link below to contact one of out VA loan specialists to get you pointed in the right direction and get you the best rate on your VA home loan.

Why Do Sellers Seem To Dislike Va Loans

The VA has what are called minimum property requirements. These include non-negotiable items like construction defects, termite infestation, leaks, decay, dampness, and continuing settlement in or near the foundation. While sellers engaged with buyers who bring a non-VA loan to the purchase can negotiate the repair costs of these types of items, the VA program requires these items to be fixed before they will give the lender the approval to back the lenders mortgage loan to the borrower. That puts pressure on the seller to fix these issues primarily at their cost if they want to be able to sell their home to the buyer who presents with a VA loan in their pocket.

You May Like: Usaa Personal Loan With Cosigner

When Do Va Loan Limits Apply

Service members and veterans who have one or more active VA loans, or who have defaulted on a VA loan, will still be subject to loan limits.

For a single-family residence in a typical U.S. county, the limit in 2021 is $548,250. Thats the maximum a VA loan borrower subject to the limit can finance for no money down in those counties.

Higher limits are established in high-cost areas, such as Honolulu, New York and San Francisco counties, where the one-unit residential limit in 2021 is $822,375.

Va Loan Limits In : Additional Commentary

For most of the country, the 2019 VA loan limit was increased $510,400 for 2020. This change was made in response to significant home-price increases that occurred during 2019. In certain higher-cost areas, such as San Francisco and New York City, VA loan limits can be as high as $765,600. Those are the floor and ceiling amounts for VA-guaranteed mortgage loans in 2020.

Its important to realize that these caps vary by county, since the value of a house depends in part on its location. As a result, home buyers who are considering this program must determine the maximum loan amount for their specific counties. For your convenience, these county limits can be found in the two documents provided at the top of this page.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Va Loan Limits: No Maximum Loan Amounts In 2021

If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers, and others with their full entitlements, can borrow as much as lenders are willing to approve.

So the size of your VA loan now depends more on your financial credentials than on the local housing market.

VA loan limits still come into play for homebuyers who currently have VA loans and have partial entitlement available.

If youre a qualifying veteran, active-duty military servicemember, or an eligible surviving military spouse, now may be a great time to buy, with a shot at a 0% down mortgage and no loan limit on the type of home you can buy.

Are There Any Restrictions To Va Loans

If you have not used or restored your VA entitlement:

- No down payment

- Lenders may impose their own loan restrictions

If dont have full entitlement:

- The amount of entitlement is capped by the FHFA loan limit

- A down payment may be required if you exceed the FHFA loan limit

Entitlement is the amount of guaranty or insurance that the VA will provide the lender for the loan. This determines the maximum loan amount the lender will approve.

There are some other restrictions on VA loans. For instance, if you include anyone other than you and your spouse on the loan or title, then the amount of entitlement may be impacted. Also, you can only purchase a home that will be your primary residence.

Additionally, the home you purchase must meet the minimum requirements related to physical condition. For example, the home you purchase should have the following:

- A roof in adequate condition

- A functional means of heating and cooling the home

- A clean and continuous water supply

- A structure and foundation free of termites and fungi

- Walls free of lead-based paint, often found in homes built prior to 1978

Another restriction relates to condominium purchases. If you plan to buy a condo, you must make sure it’s on a list of condominium developments approved by the VA. If it isn’t on the list, your lender can request approval from the VA.

Read Also: Genisys Credit Union Auto Loan Calculator

Borrowing More Than The Max

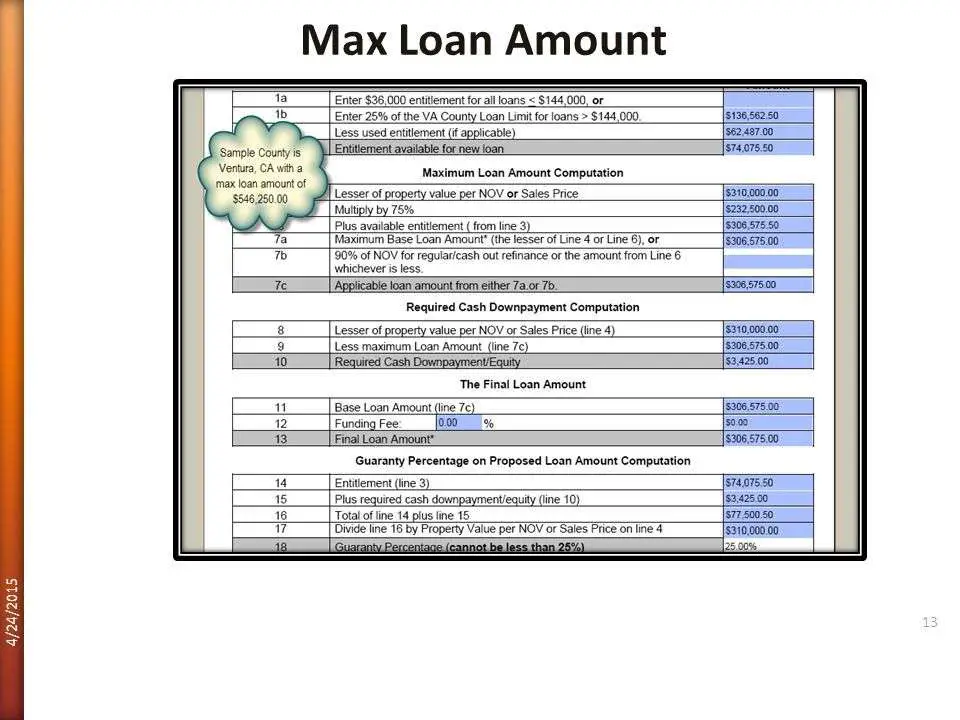

In a previous article, we explained how eligible home buyers could borrow more than the maximum VA loan amount by making a down payment. In short, borrowers in these scenarios are typically required to make a down payment equaling 25% of the difference between the loan limit for the county and the amount being borrowed.

Most people who use VA loans to buy a home in California stay within those limits, so that they can enjoy 100% financing. In these cases, borrowers can purchase a house with no money down whatsoever. Thats the primary advantage of using a VA loan in the first place and thats why most borrowers try to stay within the limits.

Just know that you can borrow more than the maximum VA loan amount for your California county, if you are willing to make an investment of some kind. And there are still advantages to using this program, even if you do have to put some money down.

As mentioned above, loan limits vary from one county to the next because they are largely based on median home prices. And they tend to be the same across an entire metro area. Here are the maximum VA loan amounts for Californias major metro areas:

- Los Angeles: $636,150

Compare Va Loan Rates & Lenders

When shopping for a VA loan, you will want to get the best rate to save the most money. Keep the following in mind when comparing VA loan rates and lenders:

- Loan amounts: Know the loan limits and make sure the home you want to purchase fits within those parameters. You dont want to find a $1 million dollar home and realize the lender only offers loans upto $750,000.

- Minimum credit score: Does the lender have a minimum credit score required to qualify? Know what your credit score is so you know if you qualify, should look for another lender, or should improve your credit before applying.

- Interest rates: Rates fluctuate based on market conditions and vary based on your FICO score and overall financial profile. Know the rate up front so you can compare it to other lenders.

- Customer service: How can you contact customer service if you have a question? Find out their hours and how responsive they are. This is a big purchase and you want to be confident with who youre dealing with.

Recommended Reading: Bayview Loan Servicing Loan Modification

Whats The Maximum You Can Borrow

Theres no limit set by the VA on how much youre allowed to borrow for a home. But the VA does cap the amount of insurance provided to the lender, and most lenders limit the loan amount as a result. You can find out the limit in any U.S. county through the VA website.

The maximum loan limit varies from one lender to another, so this is another reason to shop around.

If youve already received a VA loan, the amount youre allowed to borrow with no down payment may be smaller.

Having More Than One Va Loan At A Time: Figure Out Your Reduced Entitlement Amount

If you receive PCS orders and need to keep your current VA loan while also taking out a new one for a home in the place youve been relocated to, its possible to have more than one VA loan at a time.

Remember that your entitlement will be limited by how much of it has been used by your current VA loan. To figure out how much entitlement you have left, take your maximum entitlement and subtract the entitlement being used by your current loan.

Then, multiply that number by four to see the maximum amount you can borrow without having to make a down payment. If you take out a loan for more than this amount, youll need to make a down payment of 25% of the excess.

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

What Is The Interest Rate On A Va Loan

Interest rates on VA loans can be fixed or adjustable.

- With an adjustable-rate mortgage, your interest rate is tied to a financial index or market interest rate, such as the Libor, and it can change periodically. If interest rates rise, your rate can go up and your monthly payments increase.

- With a fixed-rate mortgage, your interest rate and mortgage payment should stay the same for the life of the loan.

Interest rates on VA loans are typically lower than rates on conventional mortgages. But rates and fees vary among lenders, so be sure to shop around.

The Basics Of The Max Loan Amount

The VA makes it every easy to determine your max loan amount on the VA IRRRL. Because the program was designed to help veterans save money, you cannot take money out with this loan. You are able to refinance your outstanding principal balance, plus some select fees. These fees are those that the VA allows, which you can then roll into your loan. The fees you need to concern yourself with include:

- Origination fee

In some cases, however, you may be able to add the cost of energy efficient improvements, we will talk about this below.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Are Va Loan Limits

VA loan limits are the highest-value loans the Department of Veterans Affairs is allowed to guarantee without your making a down payment.

The limits match those set by the Federal Housing Finance Agency on conforming loans. They do not cap the amount you can borrow they set the maximum you can finance for no money down.

» MORE:What you need to know about VA loans

Va Is Usually Better Than Fha

If you compare the VA and FHA programs you can see the VA advantage.

An FHA borrower must pay 1.75% of the loan amount in upfront. This is the FHA up-front mortgage insurance premium . A regular military VA borrower is likely to pay 2.15%.

Since the FHA borrower faces a lower up-front fee that program seems more attractive. For a $300,000 mortgage, the FHA upfront MIP is $5,250. The vet will pay $6,450 for the upfront VA funding fee.

But the FHA borrower also has an annual mortgage insurance payment the annual MIP. For a 30-year, $300,000 loan the fee is $212.50 per month. Thats $2,550 per year or $25,500 over ten years.

And what about the VA annual charge? There is none. Its not an insurance plan. The VA borrower is ahead by several thousand dollars per year.

You May Like: Who Can Qualify For An Fha Loan