Need Help Considering Your Options

Whether you are attempting to remove transferred student loans from your credit report or to correct a mistakenly applied missed payment, a goodwill letter can go a long way toward preserving your credit. Sending a company such as Navient a goodwill letter cannot hurt, and hopefully, it will help you in your journey to credit or student loan repair.

Are you feeling overwhelmed about going through the process described above? Youre not alone. Nearly 80% of Americans have accumulated some type of debt during their lifetime. This can be a daunting predicament to get out of for any layperson. Fortunately, there are that can sit down with you, help you analyze your options, or even take care of the problem for you!

Some of the best repair companies are listed below.

- Lexington Law Owner of the #1 app clients use

- Has the best record for challenging inaccurate reports

Can You Remove Accurate Student Loans From Your Credit Report

If your complaint was accepted, there is a possibility that your student loan entry will be corrected or even deleted from your credit report. However, if the entry was verified to be accurate, it will stay put on your credit record until the 7 years are through. This is obviously unfortunate for you because having a student loan in default on your credit report can hurt your credit score.

The good news is that while you cannot completely remove the student loan from your credit report, there are ways that you can try to remove the default status on your student loan. If youre concerned about improving your credit score, the student loan itself is not the main problem.

In fact, positive payment history will actually help your credit. However, if you have a student loan in default or you have missed monthly payments, these mistakes are whats really hurting your score. To improve your score, what you want to happen is to remove the default status or late payments from your student loans to improve your credit report.

If you have already tried sending a dispute and failed, here are some other options that you could try out to get your student loans out of default or remove late payments from your credit record.

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Read Also: How To Compare Mortgage Loan Estimates

How To Dispute Accurate Information In Your Credit Report

Accurate items in your record can’t be removed before the term set by law expires, which is seven years for most negative items. For example, if you truly missed payments on your credit card, your dispute to remove that information will be denied. However, the information will automatically fall off your credit report seven years from the time you missed the payments.

If you do have valid negative items on record, here are some things that might help:

Types Of Students Loans

Once you have determined that you have no choice but to take out a loan to fund the degree you seek, you have two main options. You can acquire private student loans. These come with all types of nuanced contingencies though and may prove to be more of a hassle than they are worth later on. The alternative is to obtain a federal student loan, which comes in four different varieties:

- Subsidized Your eligibility is based on need and status as an undergraduate student

- Unsubsidized Status as a higher-education student is still required, but it is not based on economic need

- PLUS These are available to graduate and professional students or the legal guardian of a dependent undergraduate. They exist to cover expenses that are otherwise uncovered by aid and

- Consolidation This lets you combine all of the loans you have taken into one sum with a single loan servicer .

Most of these federal routes do not require pulls on your credit to determine whether you have sufficient standing to receive assistance. The big exception to this is the PLUS option. A demonstration of need is not required for this option, but you will have to go through the credit check process to prove eligibility for PLUS. Having a substandard credit history is not always a nail in the coffin if this is the route you need to take. However, it will make obtaining a PLUS more difficult, requiring you to meet additional standards if it does not bar you altogether.

Don’t Miss: What Kind Of House Loan Can I Get

Cares Act Automatic Federal Student Loan Forbearance

If you have a student loan owned by the U.S. Department of Education, the government has granted you automatic forbearance on this loan under the Coronavirus Aid, Relief, and Economic Security Act. The forbearance was set to expire on Jan. 31, 2021, under the previous administration, then it was extended under the Biden administration until Sept. 30, 2021.

The administration extended the forbearance period again on Aug. 6, 2021, allowing loans to stay in forbearance until Jan. 31, 2022.

Between March 13, 2020, and January 31, 2022, no interest will accrue, and you dont need to make any payments. No late fees will apply if you stop paying during this period. Youll know you have this benefit if you see a 0% interest rate when you log in to your student loan account. On March 30, 2021, the Department of Education extended this benefit to defaulted privately held loans under the Federal Family Education Loan Program.

Under normal circumstances, you cant make progress toward loan forgiveness during forbearance. But under the CARES Act, you can. Youll receive credit toward income-driven repayment forgiveness or public service loan forgiveness for the payments you normally would have made during this period.

There may be tax obligations tied to any loan forgiveness.

Read Also: Transfer Loan To Another Person

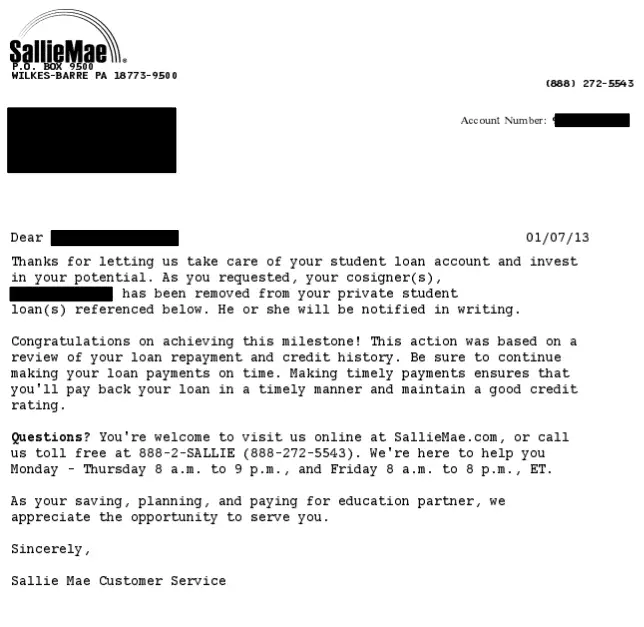

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Don’t Miss: How Do I Get My Student Loan Number

If Your Request Is Denied

Theres a chance your lender wont approve your request. If your credit score is negatively affected, youll have to take steps to rebuild your credit. The best way to do so is to keep making on-time payments, to be careful about closing old accounts, and to avoid maxing out your credit cards, among other steps.

If youre still struggling with making your student loan payments, contact your lender to see what can be done, such as adjusting your monthly payments or exploring your options for loan deferment or forbearance. You may be able to reach an agreement and prevent further damage to your credit.

Also consider refinancing through an organization such as Juno, which could help you save tens of thousands of dollars throughout the life of your loan. Juno negotiates with partner lenders on behalf of borrowers to help each student qualify for the best refinance rates they can given their financial situation.

How To Get Student Loans Off A Credit Report

Depending on whether you are the holder of a government or private loan, the methods for getting student loans off your credit report are going to vary. If you are a private holder, then your options are significantly more limited. Ultimately, it will come down to the details of your contract. You usually need to show the cases of extreme hardship to get bad marks off of your payment history.

If you went the government route, you are in a better position. While not all student loans on your credit report can be removed, there are a variety of categories that can be. Here are some examples:

- If you did not actually take the amount out, and it is in your account accidentally.

- If your account incorrectly reflects late payments.

- If your account fails to reflect a successful pleading of forbearance or deferment.

- If you already engaged in fixing defaulted student loans, and your institution failed to update your account to show this.

These are some common corrections that can be made, but it is not exhaustive. A good rule of thumb is as follows: If you are attempting to correct a mistake made by the credit bureaus, your bank account, or another third party, it is worth your time and effort to try to get it corrected. However, if the information you are attempting to challenge is genuinely your fault, there probably isnt much you can do. Removing late student loan payments is not usually possible unless there has been a misunderstanding or mistake.

Recommended Reading: Does Applying For Personal Loan Hurt Credit

Loans Listed As Delinquent

If your loans are in forbearance or deferment, itâs especially important to monitor your credit. Accounts could be wrongfully listed as delinquent when, in actuality, you had the loan servicerâs approval to pause your payments. Errors about your loan status typically occur due to a mistake by your servicer. They likely missed your payment status and submitted the delinquency by accident.

Can I Have My Payment Applied To Interest Or Principal Only

No. For loans in repayment status, once a portion of a payment is allocated to a specific loan group, payments are applied to individual loans proportionally to fees first *, then to interest, and then to principal. If you are on an Income-Based Repayment Plan , payments are applied to interest, then to fees *, and then to principal. For loans not in repayment status, payments are first allocated to outstanding interest and fees . * For more information about how payments are applied to your student loans, see How Payments are Allocated.

*The U.S. Department of Education does not assess late or returned payment fees. back

Recommended Reading: Usaa Auto Loan Credit Score Requirements

Read Also: How To Switch Student Loan Servicers

Forgiven Loans Listed As Delinquent Or In Default

If you qualified for loan forgiveness or loan dischargeâfor example, if you qualified for federal total and permanent disability dischargeâand your loans are still listed as open on your credit report, you can dispute the student loans. Loans that have been forgiven can be wrongfully listed due to errors on the loan servicerâs end.

Can Student Loans Be Removed From Your Credit Report

You can remove student loans from your credit report under two conditions.

If either condition applies to your student loan, then you can remove the inaccurate item from your report with a dispute.

Recommended Reading: Can I Refinance My Navient Student Loan

Remove Student Loans From Your Credit Report Now With Help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals are here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

What You Can Have Removed From Your Credit Report

While its not possible to make all negative entries on your student loans disappear, there are a few you can fix:

Number 4 is the most damaging, but it can happen even if youre making your payments on time. Sometimes payments are misapplied, or theres a clerical error on the servicer side, either of which can result in your student loan being placed into default status.

If youre facing any of these situations, youll need to do your homework, determine what the error is, and dig up any documentation you can to prove the negative information is incorrect.

Once you do, contact your student loan servicer and see if you can get the situation resolved over the phone. But if you call, make sure you follow up with email contact, and request an email response. This will create the all-important paper trail in case there are any questions later on. Be sure to print copies of your email communication with your servicer. You may need those copies should the negative information mysteriously reappear .

Read Also: Where To Get Instant Loan

Student Loan Removal Ebook

Your CreditWise score is calculated using the TransUnion® VantageScore® 3.0 model, one of many credit scores. This may not be the model your lender uses, but it can be an accurate measure of your credit health. The availability of the CreditWise tool is dependent on our ability to obtain your credit history from TransUnion. Some checks and alerts may not work if the information you entered during registration does not match the information on your credit file with one or more consumer agencies .

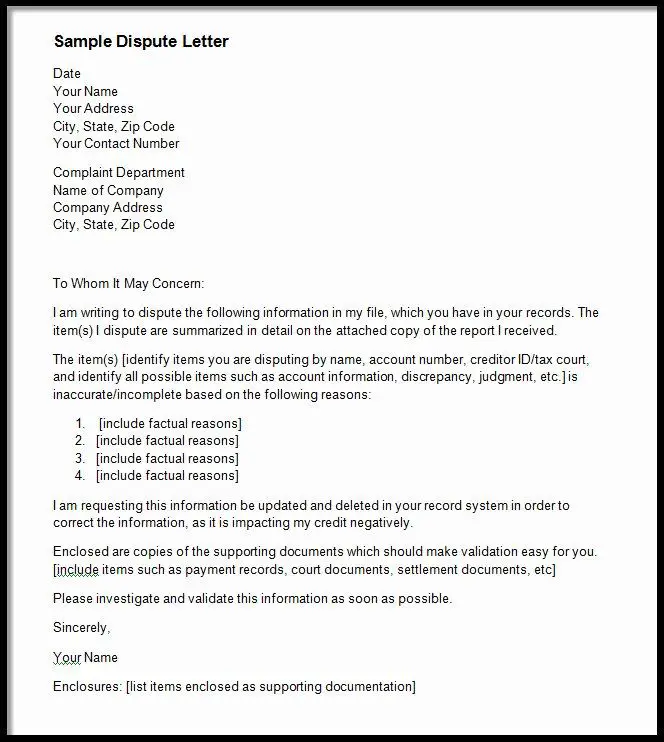

What Is A 609 Letter

The Fair Credit Reporting Act contains Section 609, which explains how consumers have a right to obtain copies of their credit file reports and related information. Section 609 requires credit agencies to disclose sources of information and other details that impact credit scores.

A 609 Credit Dispute Letter is a term forged by credit repair and credit score improvement companies describing a strategy that attempts to force a credit reporting agency to remove negative information.

The FCRA does not actually reference any 609 dispute letter or delete letters.

Oddly, the strategy is more closely based on Section 611 that allows for disputing credit report entries based on whether they are verifiable or substantiated. A 609 letter challenges the credit reporting agency, lender, or collector to produce documentation proving the validity of the debt.

A credit repair company will often market these dispute letter templates to consumers with bad credit or offer to send them on behalf of the consumer at a cost. Most 609 letters request original source information such as the initial signed contract or other documentation.

The 609-dispute letter strategy has traditionally produced mixed results in removing negative information. The likelihood of success may increase if the original creditor has sold the debt to a third-party debt collector that is less likely to have much of the original documentation on file.

Read Also: Do You Have To Repay Ppp Loan

How Long Do Student Loans Stay On Your Credit Report

If you default on a loan for the first time, it will stay on your credit report for 7 years from the last payment date.The default will be removed from your credit report after 1060 days if you pay off the debt in full before then. Rehabilitation of a loan might result in the removal of an outstanding obligation.

Other Resources To Resolve Student Loan Disputes

If youre interested in exploring student loan goodwill letters further and the results that others have had check out these websites:

- Ed.gov: They cover disputes, what to do about them and how to go about rectifying them here.

- ConsumerFinance.gov: If you have loans with a private lender, and your lender had reported you as late when you werent, you can file a complaint with the Consumer Financial Protection Bureau to see if they can help you.

- myFICO Forums: The forums on myFICO are populated with helpful individuals that might be able to give you contact information for certain servicers. There are some people reporting success with goodwill letters, and they may be willing to share their letters with others upon request.

Dings on your credit are there to stay for seven to 10 years. Thats a long time, especially if youre young and hoping to refinance your education debt or buy a house or a car in the near future. Its a battle worth fighting.

The post Sample Goodwill Letter to Remove a Late Student Loan Payment From Your Credit Report appeared first on MagnifyMoney.

Information contained on this page is provided by an independent third-party content provider. Frankly and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact

Also Check: Can Closing Costs Be Included In Refinance Loan