Home Equity Line Of Credit Faqs

Why do I need a home equity line of credit?

Everybody has unexpected expenses or cash shortfalls sometimes. Or maybe you want to consolidate high-interest debts, complete home improvements, or make a large purchase. Instead of emptying your savings accounts or cashing in stocks or other investments, you can use the equity in your home to open an Alliant Home Equity Line of Credit . Alliant HELOCs have low interest rates and the flexibility of low monthly payments, too.

How much equity do I need in my home to take out an Alliant HELOC?

The amount of equity you currently have in your home will determine your Home Equity Line of Credit limit. You must retain at least 10% of the value of the equity in your home . You can make a ballpark estimate of your HELOC maximum by calculating what 90% of your homes value is, then subtracting your existing mortgage balance from that number.

Can I pay more than the minimum monthly payment on my HELOC?

Yes! You can pay more than your minimum monthly payment to pay back your loan faster. In fact, its a smart money move to do so, as youll save on the interest you pay over the course of your loan! And Alliant wont penalize you for paying back your loan earlier than scheduled.

How do I transfer money from my HELOC to my checking account?

You can transfer money from your HELOC in Alliant online banking, our mobile app or by phone.

How can I order a checkbook for my HELOC?

How Much Can I Borrow With A Home Equity Loan

This loan allows you to access the equity in your home or property but to decide whether you deserve one, the home equity loan lenders must calculate the LTV . This is done by dividing the value of debts on a property by its current selling price to achieve a score that should be under 75% for our home equity lenders to approve your request for a mortgage in Richmond Hill. LTV may be the most important factor to get you a home equity loan but note that some lenders in this city are also sensitive to and job history among other factors.

Home Equity Loans In Richmond Hill

Home equity loans as the name suggests are given against the equity of a property. Equity is a simple measure obtained by the value of a home minus its debts. The main difference between home equity loans and bank loans is that approval for them does not depend on credit score or job security. Our team has years of experience in providing various home equity loans in Richmond Hill helping people who were turned down because of low credit.

Don’t Miss: What Happens If You Consolidate Student Loan Debt

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Borrow Home Equity %aprapr Is Annual Percentage Rate As Of 11/18/22 Interest Rate Quoted Assumes A First

Wanting to tackle a home project, fund a vacation, consolidate debt, or even plan a dream wedding? With Arkansas Federal, using the value of your home couldnt be easier or more affordable. Even if you have no intention of selling your home right now, todays hot housing market can lead to increased equity that you can use for a variety of projects or other financial needs.

Theres no cost to get pre-qualified. Thats a savings of $500!

Recommended Reading: How To Eliminate Pmi Insurance On Fha Loan

How To Get A Home Improvement Loan

To get a home improvement loan, first compare lender offers with other options, check your rate and monthly payments, prepare documents and apply.

Let’s break down those steps:

Compare options. Compare the best home improvement lenders against each other and with other financing options, like credit cards and home equity financing. You’re looking for the one that costs the least in total interest, has affordable monthly payments and fits your timeline.

Check your rate and monthly payments. Try to set your project’s estimated cost before this step. Many online lenders and some banks let borrowers pre-qualify to see potential personal loan offers before applying but you’ll be asked how much you want to borrow. The process involves a soft credit pull.

Prepare documents. Once you’ve chosen a lender, gather the documents you’ll need to apply. This can include things like W-2s, pay stubs, proof of address and financial information.

Apply. You may have to apply in person at smaller banks and credit unions, but larger ones and online lenders usually offer online applications. Many lenders can give you a decision within a day or two of applying. After that, expect to see the funds in your bank account in less than a week.

What To Expect When You Apply

1. Submit an online application

Answer a few questions and apply for a HELOC in minutes with our easy, breezy online application.

Note: If you are not an Alliant member already, you will be directed to the member application page prior to the HELOC application process.

2. Sit back and relax while we review

You’ll get a completion confirmation, and an initial loan decision email will follow soon after. If your HELOC is conditionally approved, well ask you to provide a few more documents before a final decision is made.

3. Sign your loan documents

We’ll send your closing documents via DocuSign and FedEx. Once we get your final autograph, we will fund your HELOC!

4. Use your funds whenever you want

Youre set to start using the money from your HELOC any time during your draw period.

You May Like: When Should I Refinance My Home Loan

Home Improvement Loans Vs Equity Financing

A home improvement loan makes sense if you dont have enough equity in the home or dont want to use it as collateral. Equity is the difference between the homes value and the amount owed on your mortgage.

If you have equity, you could get a lower monthly payment on a home equity loan or line of credit, but the lender may require an appraisal before approval.

» MORE: Personal loans vs. home equity loans

How To Know If Its Right

If youre using a home equity loan or line to consolidate high-interest credit card debt, pay for emergency medical expenses, or increase the value of your home, you can wind up coming out ahead. If youre planning on a big remodeling project, make sure its a project thats going to increase the value of your home, and only work with reputable contractors, Ken advises.

Its important to remember that even though home equity loans and lines of credit offer a quick, efficient way to get large sums of money, theyre still a loan on your house. And, just like your mortgage, defaulting on a home equity loan or line of credit could result in the loss of your home.

Thats why its important to carefully evaluate whether you will be able to comfortably handle monthly loan payments. With a HELOC, it is wise to plan in advance for the repayment phase by understanding how much your combined principal and interest payments will be.

If it looks like variable rates may rise and remain higher over a longer period of time, members can save convert their HELOCs into fixed-rate home equity loans, which can help them save over the long term, Ken says. Plus, at UW Credit Union theres low or no closing costs on HELOCs or Home Equity Loans.

Also Check: Secured Loans Are Less Costly Than Unsecured Loans Because

Fixed Home Equity Loan

- Must have equity in your primary residence, second or vacation home

- Can be used for home improvement, refinance, debt consolidation, tuition and other reasons

- Fixed rate with flexible loan terms: 5-, 10-, or 15-year

- Minimum loan $10,000 Maximum loan $150,000

- Receive all funds up front, fixed monthly payment

- Financing up to 95% of value minus first mortgage balance

Bankrate Guide To Choosing The Best Home Equity Loan

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Bankrate analyzes loans to compare interest rates, fees, accessibility, online tools, repayment terms and funding speed to help readers feel confident in their financial decisions. Our meticulous research done by loan experts identifies both advantages and disadvantages to the best lenders.

When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Loan details presented here are current as of the publication date. Check the lenders websites to see if there is more recent information. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability.

Also Check: When Can I Sell My House Fha Loan

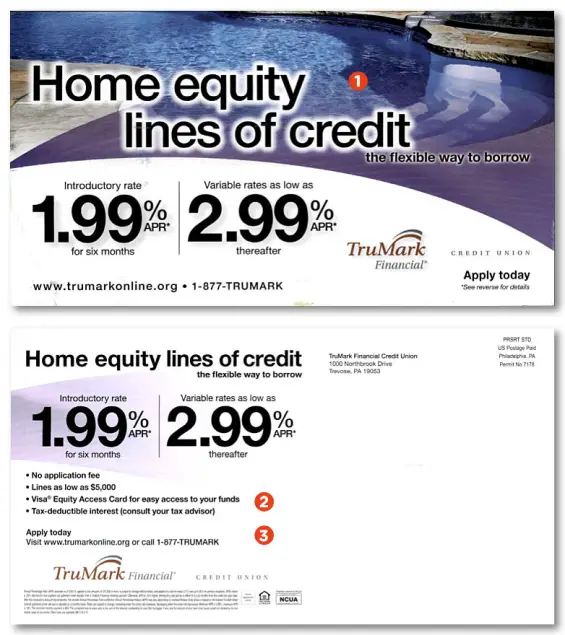

Home Equity Loan Vs Heloc

Home equity loans and home equity lines of credit are both loans backed by the equity in your home. However, while a home equity loan has a fixed interest rate and disburses funds in a lump sum, a HELOC allows you to make draws with variable interest rates, like a credit card.

Generally speaking, if you’re planning on doing multiple home improvement projects over an extended period of time, a HELOC may be the better option for you. If you’re thinking about consolidating high-interest credit card debt or doing a larger home improvement project that would require all of the funds upfront, a home equity loan may be the best option.

| HOME EQUITY LOANS | |

|---|---|

| Debt consolidation, large home improvement projects, major purchases | Ongoing home improvement projects, college tuition payments, medical expenses |

What Is A Home Equity Line Of Credit

A Home Equity Line of Credit, also known as a HELOC, is a variable-rate line of credit that uses your home as collateral. Members who apply for and receive a HELOC are approved for a specific amount of credit and can use the funds on an ongoing basis as needed.

Variable rates are based on the Prime Rate that is determined by the Federal Reserve. As the Prime Rate increases or decreases so will the rate which affects your monthly payment.

Read Also: When Will I Pay Off My Student Loan Calculator

What Is Home Equity

Home equity is the difference between how much you owe on your mortgage and how much your home is worth. You can build equity as you pay down your loan balance and as the market value of your home increases.

Heres an example of how you build equity in a home:

- You make a $20,000 down payment and take out a $180,000 mortgage loan to purchase a home with a sales price of $200,000.

- After 5 years, your monthly loan payments have reduced your mortgage balance down to $167,000.

- During this same time, your homes market value has increased to $230,000.

- To calculate your homes equity, subtract your mortgage balance of $167,000 from the current market value of $230,000.

- You have $63,000 in equity.

You may or may not be able to borrow your full amount of equity. Most lenders use Loan-to-Value , Combined Loan-to-Value , and Debt-to-Income ratios, along with other factors when determining your interest rate and how much you’re eligible to borrow.

Borrow Only What You Need With A Heloc

An Alliant Credit Union HELOC could give you the opportunity to borrow money as you need it.

- Flexibility to access funds as needed

- Use for home improvements, vacations, debt consolidation, education or medical expenses, large purchases, and more

- Low, variable interest rates45

- 10-year interest-only draw period followed by a repayment period up to 20 years45

- No closing costs or appraisal fees for up to $250,000 line of credit97

- Available in most states

Meet your new top-of-wallet card

Spend less on credit card interest with Alliant Visa® Platinums competitive credit union rates and $0 in annual fees.

“Best Account Fees”

Also Check: Can You Ask For More Federal Student Loan

Same Car Better Payment

What are the advantages of a CUTX home equity loan?

There are many.

Our Home Equity Loans have much lower interest rates than other types of credit, such as credit cards or unsecured personal loans. They have fixed monthly payments which can be very low, with payment terms of up to 30 years.* Plus, there’s no prepayment penalties.

If you use your funds to pay for home improvements, your interest payments may be tax-deductible. Make sure you discuss this with your tax advisor to get complete details.

How much can I borrow?What are the fees associated with home equity loans?Are there restrictions on the types of property I can get a home equity loan on?

Aside from the list of guidelines and restrictions set by the state of Texas, there are few disadvantages to home equity loans. Borrowers that do not qualify for a home equity loan may still have other loan options available to them.

Some borrowers do not feel comfortable taking out a new loan against their home once they’ve already paid it down. But as long as you intend to repay the loan in full, there’s nothing wrong with using a home equity loan to get a lower interest rate.

What Is A Home Improvement Loan

A home improvement loan is an unsecured personal loan that you use to cover the costs of upgrades or repairs. Lenders provide these loans for up to $100,000. A home improvement loan comes in a lump sum, and you repay it in monthly installments, usually over two to 12 years.

Because you dont use the house as collateral for this type of loan, the interest rate is based on information like your credit and income. If you cant repay a home improvement loan, your credit will take a hit.

You May Like: How To Obtain Coe For Va Loan

What Can You Do With A Home Equity Loan

Maybe its time to finally clean up credit card debt, pay off medical bills or make those repairs around the house? A home equity loan can fund any of these or pay for tuition, a wedding or other major expense.

Interest rates are lower than credit cards and other unsecured loans, so its a smarter alternative. Plus, we can usually close in 15 days.

City CUs Real Estate team will determine your available equity, provide quick approval and help you through the whole process.

We offer homeowners insurance.

We’ve saved Members thousands of dollars by lowering their home insurance rate. Let’s find you a great insurance rate today!

What Is A Home Equity Loan And How Does It Work

A home equity loan is a lump sum that you borrow against the equity youve built in your home. Most lenders will let you borrow up to 80 percent to 85 percent of your homes equity that is, the value of your home minus the amount you still owe on the mortgage.

These loans have fixed interest rates and typical repayment periods between five and 30 years. Because your home serves as the collateral for a home equity loan, a lender can foreclose on it if you fail to make the payments.

Home equity loans are available at many banks, credit unions and online lenders. You can use these funds for a range of purposes, including debt consolidation, home improvement projects or higher education costs. The amount you can borrow depends on how much equity you have, your financial situation and other factors.

After reviewing your application and checking your credit, the lender will tell you how much you can borrow, your interest rate, your monthly payment, your loan term and any fees involved. Once you agree to the loan terms, the financial institution will disburse funds as one lump sum. You then repay the loan over time in fixed monthly payments.

Recommended Reading: Can You Get An Auto Loan After Bankruptcy

Rbfcu Home Equity Loan

With a home equity loan from Randolph-Brooks Federal Credit Union, you can borrow a single lump sum against your homes available equity. Youll pay this installment loan monthly over several years . Rates are as low as 4.961%, depending on the repayment term you choose.

As with HELOCs, RBFCU allows you to borrow up to 80% of your primary homes appraised value, but the actual dollar limit depends on factors including your credit score, current debt obligation, and remaining mortgage balance.

For loans up to $175,000, youll pay no appraisal or application fees. You can expect to pay higher upfront costs for loans over $175,000. RBFCU will disclose the exact amounts during the underwriting process.

| RBFCU home equity loan terms |

| Rates |

| 1.36 out of 5 stars | 50 |

Ratings collected on November 30, 2022.

Researching a lenders products, services, and company history is an important first step. Next, its wise to see what customers say about their own experiences with the company.

The Better Business Bureau is one of the most reliable consumer review and industry rating organizations. Randolph-Brooks Federal Credit Union is not accredited through the BBB, but it has issued the credit union an A+ rating.

However, between the 50 consumer reviews posted on the platform, RBFCU has a poor rating of 1.36 out of 5 stars on BBB. Most reviews center around negative experiences with customer service representatives, and many are from banking customers, not home equity borrowers.