Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Dti Formula And Calculation

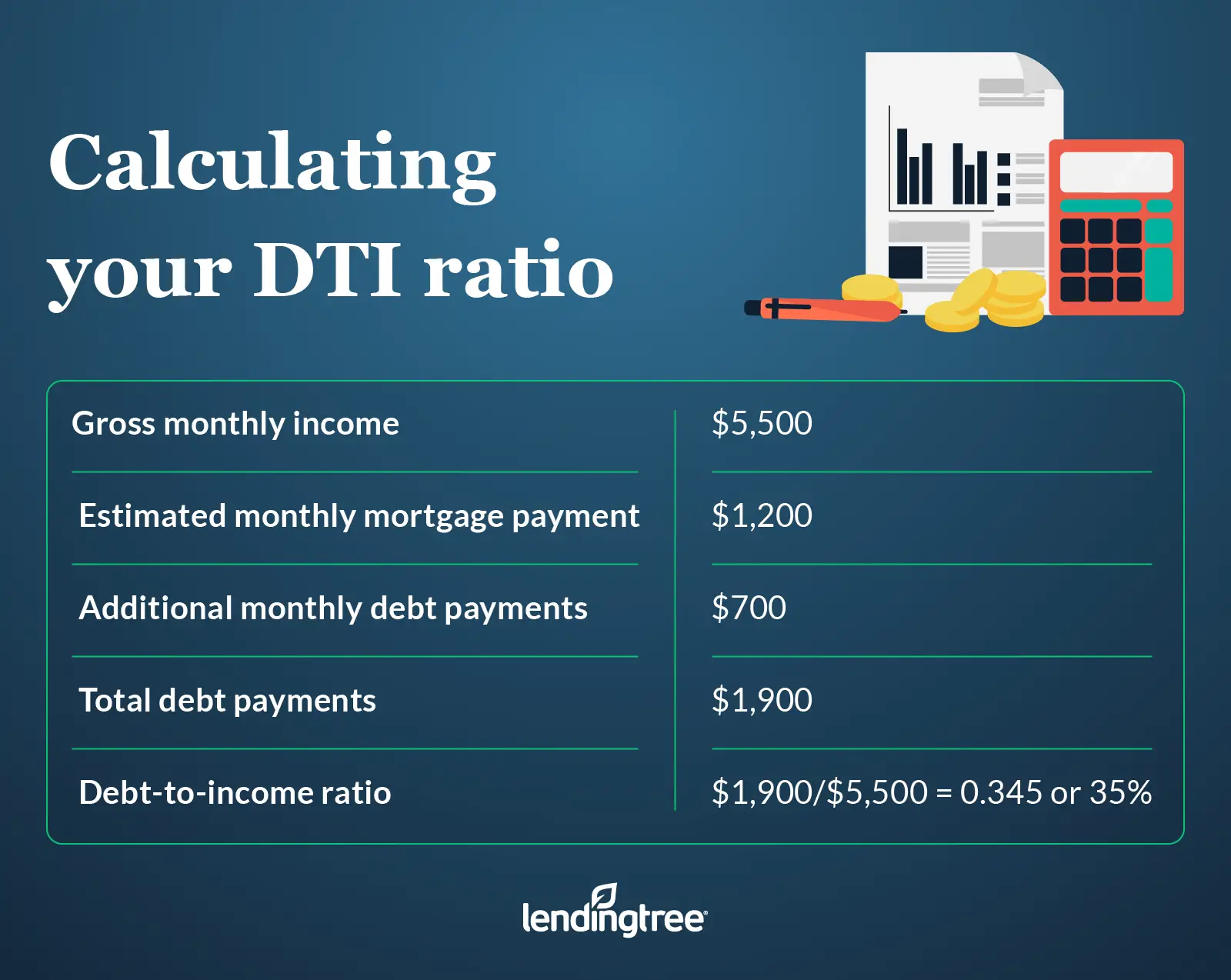

The debt-to-income ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individuals ability to manage monthly payments and repay debts.

Total of Monthly Debt Payments Gross Monthly Income \begin & \text = \frac } } \\ \end DTI=Gross Monthly IncomeTotal of Monthly Debt Payments

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences.

The debt-to-limit ratio, which is also called the , is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Things Not Included In Dti Calculations

Now that we have examined how to calculate the DTI ratios, lets look at items that are not covered by the calculations.

The following items generally are ignored when determining a DTI ratio for a mortgage loan

- monthly utility costs for items like electricity, water, internet, etc.

- food costs per month, whether dining out or eating at home or some other combination

- money spent on traveling to work such as subway fees, bus fares, or other similar charges

- Money spent on entertainment

- Items deducted from pay for saving or investing to a retirement account

- Monthly insurance costs for automobiles, accident coverage, or medical coverage

- Subscriptions to items such as internet-based entertainment or gym memberships, or other similar monthly items.

These items are supposed to be covered by the amount of money remaining from the DTI calculation. That is why the ratios are set up in such a way to ensure the borrower has adequate money left over after paying the mortgage and other debt.

Also Check: Advantage Auto Loans Legit

How Can You Lower Your Debt

To put it simply, there are two ways to lower your DTI ratio. You either need to lower your debts or increase your income. You can lower your monthly recurring debt by paying off existing debts and by not taking on any more debt than you have currently.

Another way to lower your DTI ratio is to increase your gross monthly income, perhaps by working as a freelancer in your spare time or by finding a new job that pays more than your current job.

If youre interested in learning more about mortgages, our Loan Officers are a great resource who can help you with any questions that you may have.

Contact our team today. Were here to help you every step of the way through your loan process.

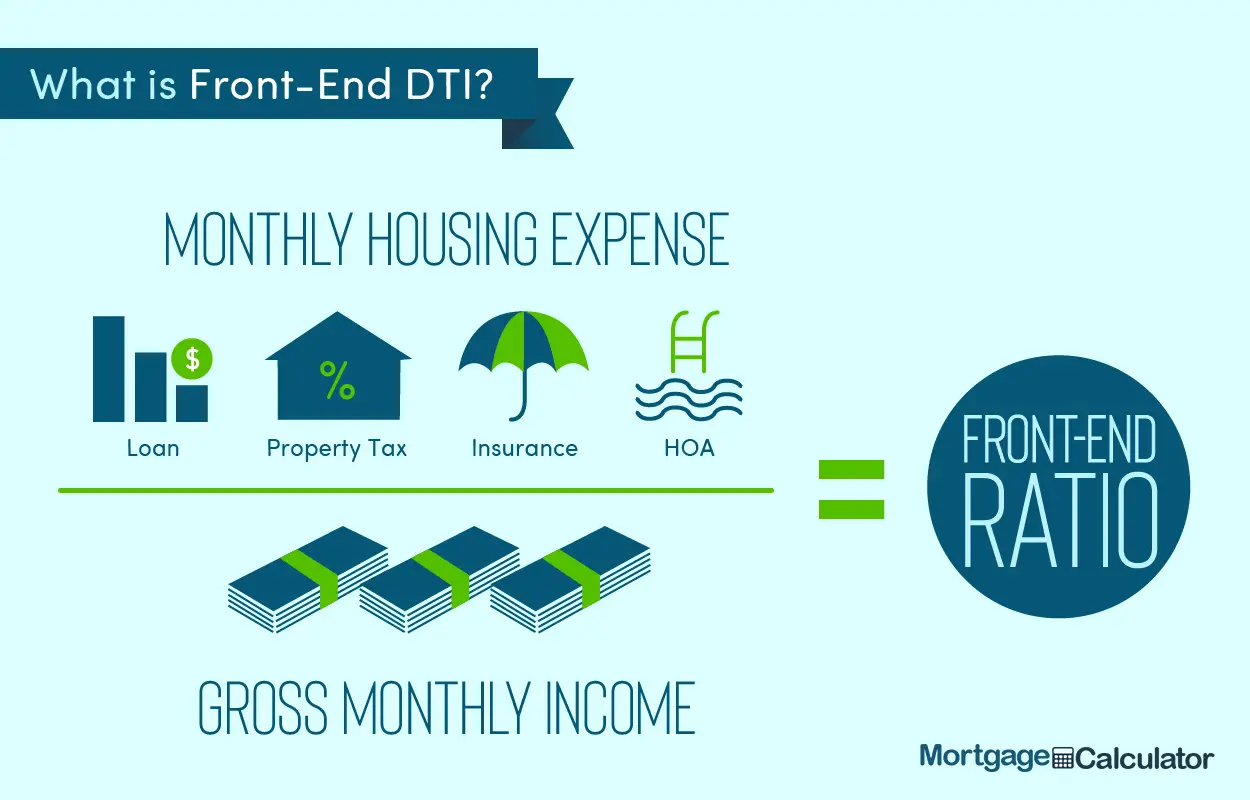

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Recommended Reading: Capital One Auto Loan Apr

Can You Get Denied For A Refinance

Why Lenders Reject Refinance Applications A lender may reject a home refinance application for a multitude of reasons. Chief among them: Weak credit score and credit history: Lenders don’t like to see late payments and collection accounts on a credit report, since they may be indicators of financial irresponsibility.

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Also Check: Cars You Can Afford Based On Salary

What Is The Ideal Debt

A low DTI ratio indicates a good balance between debt and income. In general, the lower the DTI percentage is, the more likely you are to get the loan amount that you want. If your DTI ratio is on the higher side, you may have too much debt for your income .

Lenders typically say the ideal front-end DTI ratio should be no more than 28%. For the back-end ratio, lenders say it should be 36% or lower.

Its important to keep in mind that lenders may accept higher DTI ratios depending on what type of loan youre trying to apply for and other factors like what your credit score is, how much savings you have, and the amount of down payment youre going to provide.

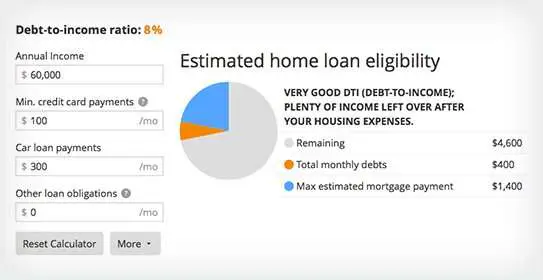

Of course, if your DTI is on the lower end of the scale, you have a better chance of being approved for a mortgage. You may also be more likely to qualify for a lower mortgage rate. You can use our home affordability calculator to help estimate how much house you can afford based on your income and monthly expenses.

What Should You Do To Improve The Dti Ratio

- You can increase your EMIs toward a personal loan that you have availed. Though this will temporarily increase your DTI ratio , it will, in the long run, bring down your total debt considerably. This, in turn, will reflect well on your DTI ratio.

- Do not acquire more debt.

- Postpone a few large purchases if you can. This will give you more time to save and help you make a larger lump sum payment in time.

- Dont forget to keep track of the debt-to-income ratio every month. This will make it easier for you to notice deviations if any, and take corrective measures.

Availing of the financial assistance you need is easier with pre-approved offers on personal loans from Bajaj Finserv. All you need to do is share a few details and get your pre-approved offer.

*Terms and conditions apply

Also Check: Can You Refinance An Fha Loan

How Is Dti Calculated

To determine your back-end DTI ratio, add up all those monthly expenses listed above and any other recurring monthly expenses that arent listed and divide that number by your gross monthly income. If youre unsure about what gross monthly income is, its the amount that you earn each month before taxes and other deductions are taken out of your paycheck.

Its very important to know that your DTI ratio does not include or acknowledge how much you spend each month on items that dont appear on your credit report, including living expenses like groceries, and entertainment.

Lets look at an example. Lets say your monthly gross income is $6,000 and your monthly recurring expenses are $2,000. To calculate your back-end DTI, divide $2,000 by $6,000 and you get a DTI ratio of 33.3%.

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Read Also: How Long Does Sba Approval Take

Can I Buy A Car With A High Debt

Yes. The best ways to improve your DTI would be to pay down your monthly debt, increase your income, or do both. … However, a high DTI ratio can mean the difference between getting a car loan and not getting one. So it’s wise to take care of your debts first, if possible, before applying for a car loan.

Formula For Debttoincome Ratio

Divide your monthly payments by your gross monthly income, and then determine your DTI percentage by multiplying the resulting figure by 100.

- Monthly debt payments / monthly gross income = X * 100 = DTI ratio

For example, your income is $10,000 per month. Your mortgage, property taxes, and homeowners insurance is $2,000. Your car and credit card payments come to another $1,000. Your DTI is 30 percent.

| Housing Costs | |

| $6,000 | 28% |

Lenders dont favor applicants who make more money. Instead, they approve those with a reasonable ratio of monthly debt compared to their income.

In the above examples, the applicant who makes the least is the most qualified for a loan.

Also Check: Fha Build On Own Land

Dti Ratio And Home Equity

DTI ratio affects how much of your home equity you can access. In addition to loan-to-value and combined loan-to-value ratios, lenders will consider your DTI when you apply for a home equity loan or line of credit.

Home equity loans have more stringent requirements than mortgages. Borrowers must have a 43% DTI or lower to qualify, in most cases, and some lenders may even require DTIs as low as 36%. Here are some examples:

- Because of the stricter requirements for home equity loans, Quicken Loans recommends that potential borrowers maintain a DTI of 43% or lower.

- Veterans United does not impose a maximum DTI ratio for Veterans and military members. However, those with a DTI above 41% may encounter additional financial scrutiny.

- Rocket Mortgage will not offer home equity loans to anyone with a DTI higher than 43%.

Overlooked Items To Include In Dti Calculations

While it is easy to understand a debt payment like a loan owed on a car or a , some other items are added to the DTI calculations that you may not be considering.

If you are or will be responsible for paying any of the following types of obligations, these items need to be disclosed to your lender to make the correct DTI calculations.

- Homeowners Association or HOA dues. These dues may be paid yearly or monthly, depending on the neighborhood.

- Child support due to a divorce decree or other legally binding agreement

- Alimony or similar spousal payment due to a legally binding agreement.

You may be asked by your lender to provide legal documents to verify the monthly amounts for the above items to get approved for the mortgage.

Recommended Reading: Maximum Fha Loan Amount In Texas

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

- Categories

Recommended Reading: Becu Fha Loan

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

How To Lower Your Debt

To get your DTI ratio under better control, focus on paying down debt with these four tips.

Also Check: Can I Refinance Fha Loan

Doing The Simple Math

Once you’ve calculated what you spend each month on debt payments and what you receive each month in income, you have the numbers you need to calculate your debt-to-income ratio. To calculate the ratio, divide your monthly debt payments by your monthly income. Then, multiply the result by 100 to come up with a percent.

Does Your Dti Ratio Affect Your Credit Score

The short answer is no, your DTI ratio doesnt impact your . However, there are factors on your credit report that play into your DTI ratio. Your minimum payments, which are reported to the credit bureaus by your creditors and lenders, are used to help calculate your DTI ratio. So the less debt you owe, the lower your DTI ratio is likely to be, which may even lead to a higher score.

What does affect your credit score is the amount of debt you owe accounting for 30% of your score calculation. Specifically, your , which is the percentage of your available credit thats in use, can impact your score. Similar to your DTI ratio, the lower your credit utilization ratio, the better. Its wise to use no more than 30% of your available credit on each account and altogether.

You May Like: Car Refinance Usaa

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required, and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay.For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI.Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Your homeowners insurance premium

- Student loan minimum payment: $125

- $100

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Also Check: Loan Officer License Ca