Check Your Refinance Options Even If Youre Not Sure Youd Qualify

According to Black Knights September Mortgage Monitor, nearly 12 million homeowners could still qualify to refinance and cut their interest rate by at least 0.75%.

And yet, many homeowners hesitate to refinance because they dont think theyd be eligible or because refinance closing costs are too high.

Lenders recognize these challenges. And Fannie Mae and Freddie Mac are working to address homeowners refi concerns.

Two new refinance programs, Fannie Maes RefiNow and Freddie Macs Refi Possible, are expanding refinance opportunities to low- and moderate-income homeowners.

If you make average income for your area and have a high mortgage interest rate, you might qualify to refinance with reduced closing costs.

To learn more about these programs and check your eligibility, read:

Why Are Federal Student Loan Interest Rates Going Up In July

In July of 2021, undergraduate federal student loan interest rates will increase from 2.75% to 3.73% for the 2021-2022 school year.

This is mainly because certain federal student loan interest rates are influenced by the sale of10-year Treasury notes, a type of debt security the U.S. government issues to investors. These notes are an extremely stable investment, paying interest to their holders every six months. At the end of the 10-year term, holders are repaid the face value of the note.

In 2020, people sought safe ways to invest their money as the COVID-19 pandemic began to spread, and these low-risk investments were an obvious choice. Because so many people invested in this option, interest rates fell significantly, causing student loan interest rates to drop, as well.

As the economy slowly normalizes, investors are now willing to take slightly more risk, andfewer people opt for 10-year Treasury notes. Their interest rates are on the rise, and federal student loan interest rates are following suit.

Nicole Bachaud Is An Economist At Zillow

Mortgage rates are likely to experience continued volatility but stay low, according to Bachaud. One of the main reasons for is the increase in COVID cases that weve seen, she says. At the same time, inflation has been higher, which typically puts upward pressure on mortgage rates. These counterbalancing factors contribute to the swings well see in mortgage rates this month and beyond.

For anyone buying a home, what is happening with mortgage rates doesnt have to drive your decision. There are a million things that are going to influence when they decide to buy, why they decide to buy, Bachaud says. But, low rates have helped keep mortgage payments affordable as the price of homes has escalated. Bachaud recommends focusing on your monthly payment and paying attention to how rate changes impact how much house you can afford.

You May Like: Va Second-tier Entitlement Calculator

How Is The Bank Of England Base Rate Set

The Bank of Englands monetary policy committee sets and announces UK interest rate decisions eight times a year roughly once every six weeks.

In a series of meetings, the nine members of the MPC, including governor Andrew Bailey, debate and vote on what monetary policy action to take.

The bank rate decision and the minutes of the meetings, are published at midday on a Thursday. These are scrutinised for clues that might suggest rate cuts or rises are on the way.

The UK inflation rate increased to 5.1% in the year to November 2021, up from 4.2% the month before. This put pressure on the Bank of England to increase interest rates to try to slow down rising inflation. Find out how inflation affects interest rates.

At its meeting on 4 November, the MPC voted 7:2 to keep the base rate at 0.1% and 6:3 to leave its quantitative easing programme unchanged.

However, the committee changed its tune on 16 December and voted for an increase in rates. The MPC voted by a majority of 8:1 to increase bank rate by 0.15 percentage points to 0.25%.

You can find details of the MPCs decision dates on the Bank of England website.

If You Have A Fixed Rate Loan Interest Rate Changes Wont Affect You

If you obtained a loan during a period of low interest rates and can easily make your monthly payments , theres not much more you can do to positively affect your financial picture. The opposite is also true: If you borrowed when rates were higher, your payments will be higher.

Bottom line: Consider refinancing higher interest rate loans to help lower your monthly payments. In addition, you may be able to roll a higher-rate loan together with a lower-rate loan if youre refinancing so you have just one payment. Bonus: If you refinance, consider putting the difference between payments toward the principal loan balance to pay it off more quickly.

Also Check: How Much Is Va Loan Entitlement

Interest Rates Change When The Prime Rate Changes

First, a quick overview on how and why interest rates change.

The Federal Reserve setsand adjuststhe federal funds rate. Thats the rate that banks charge each other to borrow money for short amounts of time, usually overnight. The Fed raises the rate when the United States economy is doing well to help prevent it from growing too fast and causing high inflation. It lowers it to encourage growth.

You feel the pull of the federal funds rate because it influences the prime rate, which banks charge or give their customers on loans or savings.

Bottom line: A rate increase or decrease is neither good nor bad. Its more like an indication of the overall U.S. economy. Instead of panicking when it changes, focus on fulfilling your long-term saving and debt payoff goals one at a time.

Learn more about the basics of interest rates.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Mortgage Interest Rate Forecast

Mortgage rates have fluctuated consistently over the past year. The rate on a 30-year fixed-rate mortgage dipped as low as 2.65% in January 2021 and reached a high of 3.18% on April 1.

So, what can we expect over the next year?

As long as the economic expectations of a strong rebound and an increase in inflation continue to pan out, the risk will be toward the side of higher interest rates rather than lower rates, says Greg McBride, Chief Financial Analyst at Bankrate.com. But with a much slower growth pace expected in 2022, that might trigger a pullback at some point in the second half of the year. Either way, expect mortgage rates to remain in the 3% 3.5% range throughout.

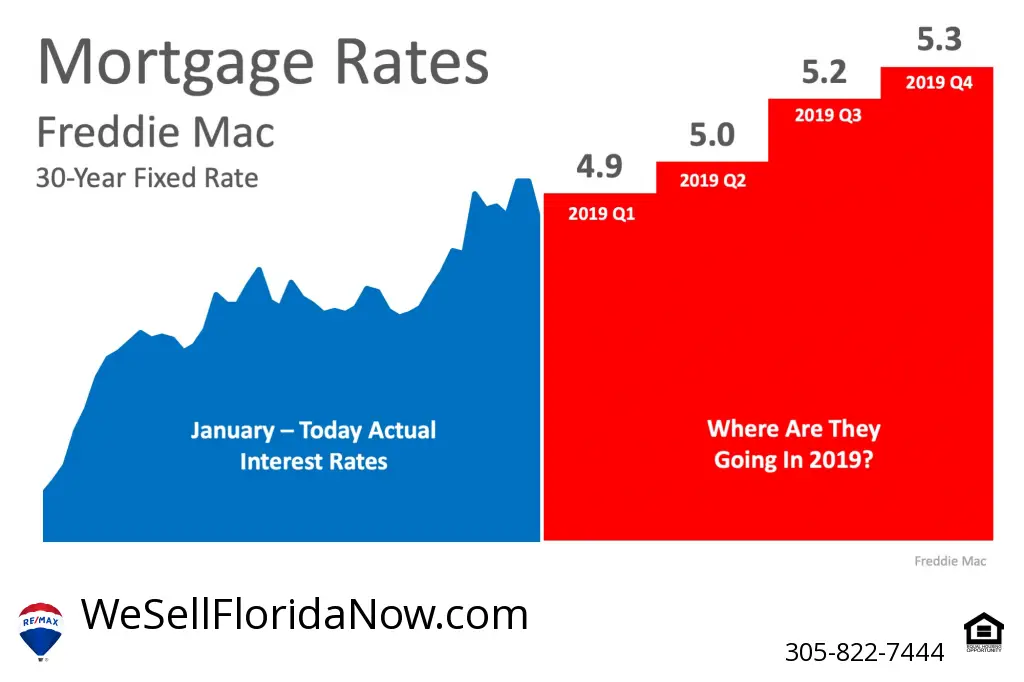

According to Freddie Macs most recent quarterly report, rates are expected to rise slowly but consistently throughout the year. Reaching 3.2% in quarter two, 3.3% in quarter three, and 3.4% in quarter four.

Mortgage rates are largely tied to the economy. And as the economy continues to improve from the pandemic, mortgage rates will rise. First, the American Rescue Plan Act of 2021 helped increase consumer confidence, as well as the amount of money that families had in the bank.

The early months of 2021 have also seen an increase in the labor market and a decrease in unemployment, helping move the economy in the right direction. And with the most recent CDC updates regarding vaccination numbers and mask guidelines, Americans can see the light at the end of the tunnel for the pandemic.

Mortgage Interest Rates Forecast For 2021

The past year and a half has been a record-breaking time for interest rates. When COVID-19 hit, the Federal Reserve slashed interest rates to help stimulate the economy. Throughout 2020, mortgage interest rates hit their lowest levels ever and remained low throughout the year with some fluctuation, according to the Freddie Mac primary mortgage market survey. In the first part of 2021, rates have increased somewhat, but have maintained a low range .

As we move further into 2021, many prospective home buyers are likely asking themselves what rates will look like through the rest of the year. Should you buy sooner rather than later, or will the low rates persist?

In this article, were sharing expert predictions on what will happen with mortgage rates throughout 2021 and what home buyers can do with that information.

You May Like: Ussa Car Loans

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

Will My Mortgage Go Up

Only if you have a variable rate mortgage typically a tracker that follows the base rate, or a loan on a lenders standard variable rate. A tracker mortgage will directly follow the base rate the small print of your mortgage will tell you how quickly the rise will be passed on, but next month your payments are likely to increase and the extra cost will fully reflect the base rate rise. On a tracker currently costing 2.1% the interest rate will rise to 2.25%.

On a standard variable rate it is less straightforward these can change at the lenders discretion. Most commentators say there is no reason for banks and building societies not to pass on the full increase, so you should expect a rise. If your lender wanted to, it could increase rates by more. As an example, HSBCs standard variable rate is 3.54% if it passes on the full rise borrowers paying it will move to a rate of 3.69%. On a £150,000 mortgage arranged over 20 years that will mean monthly repayments go up by £11.66.

Most borrowers are, however, on fixed-rate mortgages. Interest rates have been so low in recent years that locking in has been attractive, and since 2019, 96% of new mortgages for owner-occupiers have been taken on fixed rates. In total, 74% of outstanding mortgages are fixed, and these borrowers will not see any immediate impact from the change.

Don’t Miss: How To Get Loan Officer License In California

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

How The Overnight Rate Works

Think of the banks as a group of friends. The banks don’t like to hold cash and like to lend out their money whenever they can. Sometimes, Bank A might have a lot of cash on its hands while Bank B might have less. Since they’re friends, Bank A is more than happy to lend money to Bank B. But they’re banks, so they don’t want to lend their money out for free. So they charge an interest rate.

Everyday, the banks come together and make offers to borrow and lend money. The rate that they settle on is called the “overnight rate” because it’s the interest rate for borrowing cash “overnight”. The Bank of Canada is the “mom” of the group. The Bank of Canada has a “target overnight rate” and tries to keep the overnight rate close to the target. If the rate gets too low because there’s too much money, the banks can lend their money to the Bank of Canada instead. If the rate gets too high because there’s a shortage of money, the Bank of Canada acts as a “lender of last resort” and will lend out money.

Don’t Miss: Refinance Car With Usaa

Interest Rates And The Federal Reserve

Job number one for the Fed is managing monetary policy for the United States, which means controlling the supply of money in the countrys economy. While the Fed has multiple tools at its disposal for the task, its ability to influence interest rates is its most prominent and effective monetary policy tool.

When people talk about the Fed raising interest rates, theyre referring to the federal funds rate, also called the federal funds target rate. At its regular meetings, the Federal Open Market Committee sets a target range for the federal funds rate, which acts as a reference for the interest rates big commercial banks charge each other for the overnight loans.

Banks borrow overnight loans to satisfy liquidity requirements set by regulators, including the Fed. The average of the rates banks negotiate for overnight loans is called the effective federal funds rate. This in turn impacts other market rates, like the prime rate and SOFR.

Thanks to this somewhat indirect arrangement, the federal funds rate is the most important benchmark for interest rates in the U.S. economyand it influences interest rates throughout the global economy as a whole.

Should I Lock My Mortgage Rate Now

A mortgage rate lock guarantees you a certain interest rate for a specified period of time — usually 30 days, but you may be able to secure your rate for up to 60 days. You’ll generally pay a fee to lock in your mortgage rate, but that way, you’re protected in case rates climb between now and when you actually close on your mortgage.

If you plan to close on your home within the next 30 days, then it pays to lock in your mortgage rate based on today’s rates — especially since they’re so competitive. But if your closing is more than 30 days away, you may want to choose a floating rate lock instead for what will usually be a higher fee, but one that could save you money in the long run. A floating rate lock lets you secure a lower rate on your mortgage if rates fall prior to your closing, and while today’s rates are still quite low, we don’t know if rates will go up or down over the next few months. As such, it pays to:

- LOCK if closing in 7 days

- LOCK if closing in 15 days

- LOCK if closing in 30 days

- FLOAT if closing in 45 days

- FLOAT if closing in 60 days

To find out what rates are available to you, compare rates from at least three of the best mortgage lenders before locking in.

Don’t Miss: What To Do If Lender Rejects Your Loan Application

Whats Been Happening With Mortgage Interest Rates In 2021

After the turbulence of Covid-19 all but wrote off forecasts for 2020, we didnt even bother guessing what was going to happen in 2021. But, touch wood, everything has gone smoothly so far and our economy seems to be a steady ship.

Heres what has happened in 2021 for mortgage interest rates. .

- 1-year interest rates were trending down in the first half of the year but from July to October shot up at a rate that not many predicted. In January 2020, the 1-year rate was typically around 2.39%. Until July, we had been seeing 2.19% regularly given for 1 year. Now the advertised rates are as high as 3.34%. This is back to December 2019 levels within 3 months.

- 2-year interest rates are up also, unsurprisingly, to ~3.7%, after dipping as low as 2.45% in April 2020.

- Longer-term rates are up quite a bit. For quite some time you could get a 2.99% rate for 5 years with a lucky few achieving 2.85%. That rate will now cost you ~4.39%%.

- We have seen some amazing specials for new-build mortgages as low as 1.68% and now sitting at around 1.83%. These are floating rates but can be discounted for up to 3 years. Note that although other rates have jumped up by over 1%, these discounted rates are only up 0.15%.

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Also Check: How To Get Mlo License California

National Association Of Realtors Forecast

The leading organization for real estate professionals predicts the 30-year fixed-rate mortgage will climb slightly throughout 2022, reaching 3.5% in the second quarter and averaging 3.6% for the year, according to Nadia Evangelou, senior economist and director of forecasting for the NAR.

She pointed to several factors behind the associations outlook.

First, recently pushed up its inflation estimates for this year, indicating that inflation will be around longer. The grace period for higher inflation seems to be coming to an end, as the Fed will likely raise interest rates by the middle of next year, Evangelou said. When the Fed increases its interest rates, banks do, too. And when that happens, mortgage rates go up for borrowers.

When the Fed increases its interest rates, banks do, too. And when that happens, mortgage rates go up for borrowers.

Nadia Evangelou, senior economist and director of forecasting for the NAR.

Additionally, the Fed recently announced that it will likely begin decreasing its purchases of long-term Treasuries and mortgage-backed securities starting this November. This strategy will also contribute to increased rates in 2022, Evangelou added.

Sixty basis points is the equivalent of 0.60%.

Rates could rise more slowly if poor job growth is observed next year. But if the Feds tapering starts earlier, mortgage rates could rise even faster in the coming months, Evangelou explained.