Rental Equity Line Of Credit

All right, so RELOC may not be a term, but its still a thing. Landlords can take out lines of credit against their rental properties, rather than against their homes, if they have sufficient equity.

As with mortgages, expect the interest rates and fees to be higher on credit lines against an investment property compared to a HELOC. Thats because the risk to lenders is higher, as borrowers are more likely to default on investment property loans than on their home loans.

You can also expect the maximum LTV to be lower, with RELOCs compared to HELOCs. That means that lenders will lend you less of the propertys total value, again because their risk is higher.

Like HELOCs, rental property lines of credit make for flexible sources of financing for new investment properties if you have the equity.

You can also use LendingTree to compare quotes for rental property lines of credit.

Another option if you have equity in your home or other rental properties is cross-collateralization.

Wait, cross-collata-what?

You can offer to let your lender put a lien against your home or another rental property, as additional collateral. Say you apply for a loan to buy a new rental property, and they require a 20% down payment . You dont have enough cash, but lets say you do have another property with $100,000 in equity in it.

Free Masterclass: Financial Independence in 5 Years with Rental Properties

% Down Payment Mortgage Programs: Which Is Best

Imagine you want to buy a home priced at $500,000. That may sound like a lot of money and it is! but in many real estate markets, its only an average price tag.

That makes it tough for the average buyer to save up the recommended 20% down payment before making a purchase. You would need $100,000 in cash before you even start attending open houses.

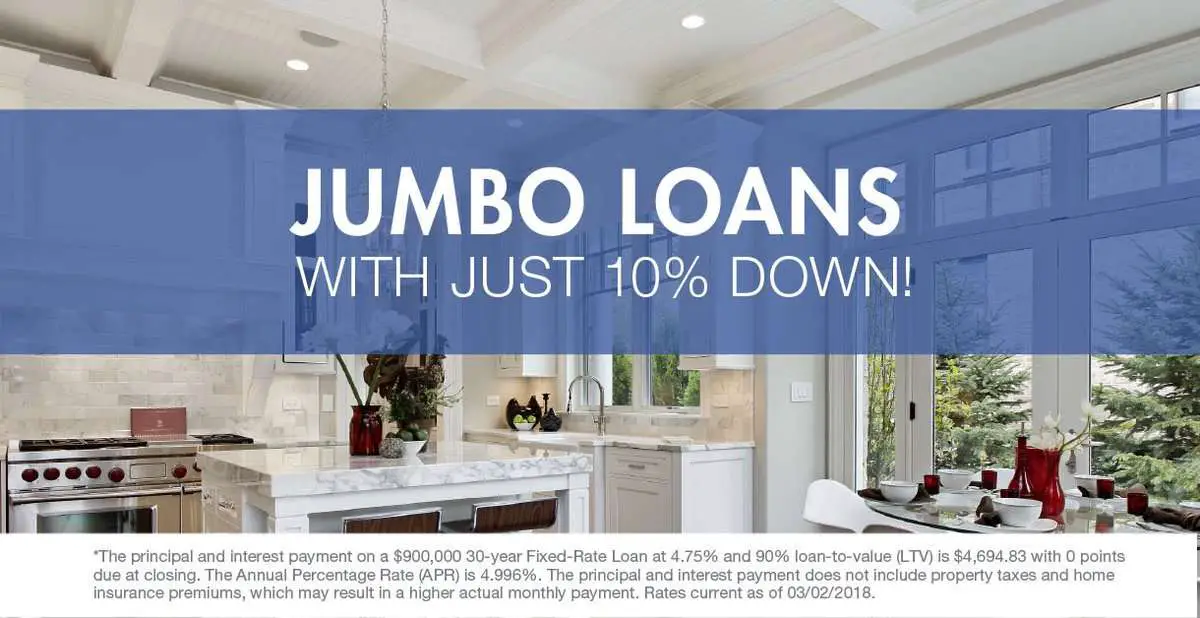

The good news is you dont have to save a full 20% of a homes purchase price before you get a mortgage. There are plenty of options for hopeful homebuyers who only have enough cash to put 10% down .

Of course, these options come with their own upsides and drawbacks. It can get confusing to sort through the differences, so in this blog post well explain some of the most popular choices and why it could or could not work for you.

Intro To Investment Property Mortgages

When you buy an investment property, you need an investment property mortgage. The first thing to know is what other names these mortgages go by, so you know them when you hear them.

A lot of consumers and real estate agents will call this kind of loan a rental property mortgage.

Lenders, on the other hand, will call this a non-owner occupied mortgage.

The reason for this is that lenders categorize loans by the occupancy, and there are three kinds of home loans:

Recommended Reading: Does Collateral Have To Equal Loan Amount

Conventional Investment Property Loans Vs Homeowner Loans

After extolling the virtues of house hacking, live-in flips, and other techniques for buying investment properties with homeowner financing, what are some of the other options available for investment property loans?

The first and most obvious option is conventional investment property financing. You simply call up your regular mortgage broker and ask them about their investment property loan programs.

Conventional investment property loans have their pros and cons. The biggest advantage? They tend to be priced reasonably.

Disadvantages include a slow, tedious underwriting process, stiff income requirements, and they report on your credit report.

Brian why is that a problem? Im not a deadbeat, Im going to pay the mortgage on time!

Heres the thing about conventional investment property lenders, and homeowner lenders, for that matter: theyll stop lending to you if you have more than a few mortgages on your credit report.

That means you have a ceiling of around three or four mortgages before youre no longer eligible for conventional investment property financing. This is why people can only pull the old Borrow an FHA or HomeReady mortgage, move in for a year, then move out and keep it as a rental trick a few times before it stops working.

Ways To Come Up With A Down Payment For An Investment Property

Not scared away yet? Good, because despite the high cash requirements for buying investment properties, you have plenty of options to come up with the cash for a down payment on a rental property. You may even be able to buy your next rental property with no money down!

Before we dive in, its worth pausing to note that the best source of funds for a down payment was, is, and always will be cash from your savings. When you borrow a down payment from someone else, you leave yourself vulnerable to overleverage, to slimmer cash flow margins and returns, and to possible rate hikes or called loans.

This is why were so big on boosting your savings rate and cutting your spending, and even going so far as living on half your income. The more of your own savings and cash you can invest with, the better position youre in to earn high returns from your rental properties.

All right, Im finished proselytizing, lets dive into some alternative ideas for coming up the down payment for an investment property!

Don’t Miss: Conventional 97 Loan Vs Fha

Whats The Maximum Mortgage Amount For A Multifamily

Conforming loan limits for conventional loans are generally capped $510,400 nationwide in 2020, with higher limits for counties with higher housing costs. If youre buying a multifamily property, there are higher loan limits.

The maximum loan limits increase in areas without a high-cost add-on to $635,550 for two-unit homes, $789,950 for three-unit homes and $981,700 for four-unit properties.

Rental Property Investor From Omaha Ne

Originally posted by :

Sorry to bust your bubble man, but 20% is usually only for SFRs, a multi-family is gonna cost you 25% down. I know this because i just did my first deal this year, it was a duplex and i used conventional financing — i searched and searched for a bank that would do 20% because 25% down would leave me almost no money. Long story short, 25% it was… BUT, the property is making me about $800/mo in positive cash flow, so still worth it

I was going to mention that as well. I had the same issue when buying my first property before I decided to start using creative techniques to bypass that amount. I bought my second property with an FHA loan and 3.5% down. My third property I am buying with owner financing and 20% down.

I am now looking into doing more deals with owner financing, or portfolio lenders. Also I will likely use another FHA loan to purchase my next property because I have enough equity to refinance into a conventional mortgage on my second property.

You May Like: When Can I Apply For Grad Plus Loan 2020-21

Do You Have To Put 20% Down On A Rental Property

With all that being said, do you have to put 20% down on a rental property? Even with all the benefits mentioned, a 20% down payment on rental property is not an absolute must. Instead, you can explore the many methods of buying an investment property with less than 20% down. The viability of each method will ultimately depend on a real estate investorâs goals and resources. Be sure to weigh the pros and cons of each method to see what best works for you.

What Affects My Investment Property Interest Rate

Fannie Mae and Freddie Mac guidelines arent the only things that affect your investment property mortgage rate. All the personal factors that determine mortgage rates are in play, too.

That includes:

- Your cash reserves

- Loan-to-value ratio on the investment property

In fact, your personal finances including your credit reportand possibly your tax returns will be put under even stricterscrutiny when you buy an investment or rental property than when you buy a hometo livein.

It will take a more robustfinancial profile to qualify for your investment mortgage and to score a competitive rateon top of that.

Investment property loans require larger down payments

Most rental property buyers will finance their homes via conventional loans. Following are down payment requirements to buy a rental property.

| Loan type | |

| 15% down | 25% down |

A down payment of 15 to 25 percent is a considerable amount, especially compared to the 3 percent you could put down on a conventional mortgage for a primary residence or the 0 percent down payment for homebuyers qualifying for the USDA or VA mortgage loan programs.

Bigger down payment requirementsare just another way lenders protect themselves against risk when writing loansfor realestate investing.

Investment property credit score requirements

When you finance an investmentproperty, lenders generally want to see a better creditscore thanthey do for primary residence buyers.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Will Your Down Payment Affect Your Return On Investment

All in all, 20% down on a rental property is worth it. Still, if you dont have enough cash on hand, you have other options. Ultimately, what matters with down payments is how they impact your return on investment . To learn exactly how a down payment influences your investment propertyâs ROI, try Mashvisors real estate investment tools. With our calculator, you can enter your mortgage terms and the tool will automatically calculate your returns.

What Are The Requirements For Getting A Loan

There are various types of investment loans with different parameters, like down payment options, interest rates, and the length of the loan term. Additionally, here are some general requirements for getting a loan.

- : You can achieve an excellent credit score by paying off bills, debts, and credit cards. Your credit score is usually higher if you pay above minimum payment amounts and use less of your available credit. Typically, you will need a credit score of at least 640 to secure an investment property loan.

- Funding a down payment: While down payment requirements vary depending on the loan type and the lender, the more money you decide to put down upfront, the better. This decreases the amount you will pay interest on down the road.

- Debt-to-income ratio: Lenders want to see that you have the income coming in each month to make your loan payment on time, so they may ask for pay stubs or income summaries.

Also Check: Does Va Loan Work For Manufactured Homes

Rental Income Counts Toward Mortgage Requirements

For those who are self-employed or experience seasonal or sporadic income, rental income that you will potentially earn from the property can be considered income when youre applying for the mortgage to purchase the home. This additional, steady income could help you qualify for a conforming loan with a better interest rate.

Why Is Your Investment Property Mortgage Referred To As ‘traditional’

A traditional mortgage has a minimum 20% down payment â and therefore doesn’t need mortgage default insurance. Also referred to as a conventional mortgage, it means that you’ll have more options and flexibility, compared to a high-ratio mortgage that requires insurance and comes with higher premiums.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Should You Buy Or Finance

Is it better to buy with cash or to finance your investment property? That depends on your investing goals. Paying cash can help generate positive monthly cash flow. Take a rental property that costs $100,000 to buy. With rental income, taxes, depreciation, and income tax, the cash buyer could see $9,500 in annual earnings, or a 9.5% annual return on the $100,000 investment..

On the other hand, financing can give you a greater return. For an investor who puts down 20% on a house, with compounding at 4% on the mortgage, after taking out operating expenses and additional interest, the earnings add up to roughly $5,580 per year. Cash flow is lower for the investor, but a 27.9% annual return on the $20,000 investment is much higher than the 9.5% earned by the cash buyer.

What Are Todays Low

Todays mortgage rates are low across the board. And many low-down-payment mortgages have below-market rates thanks to their government backing this includes FHA loans and VA and USDA loans .

Different lenders offer different rates, so youll want to compare a few mortgage offers to find the best deal on your low- or no-down-payment mortgage. You can get started right here.

Popular Articles

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Get A Hard Money Loan

Hard money loans are an alternative financing option commonly used to finance properties that won’t be approved for traditional financing, like a fix and flip. Investors can secure financing for a property up to a certain percentage of the property’s current or future value and will include the cost to renovate or repair the property into the loan.

This means if you negotiate a great deal with a super low purchase price, and you are within the hard money lender’s loan-to-value requirements, you could possibly purchase the property with no money or very little money down.

Hard money loans are normally short term, lasting anywhere from 6 to 18 months, with very high interest rates, around 5% to 10% higher than a traditional mortgage. So this method of buying a rental property with no money down is typically best if you have good credit and plan to do a cash-out refinance after the property is repaired and rented.

House Hack To Slash Your Down Payment

House hacking involves buying a home to live in, and finding a way to have someone else pay money put toward your mortgage.

There are plenty of approaches to house hacking, from buying a small multifamily and renting out the other units, to renting out bedrooms in a single-family, to living there for a year before moving out and converting it into a rental. Deni has found even more ingenious ways to house hack, by bringing in foreign exchange students and by renting out storage space in her house!

What does all this have to do with down payments? Simple: the down payment requirements for primary residences are far lower than for investment properties.

For example, instead of paying 15-30% in a down payment, most FHA borrowers pay 3.5%. And yes, they can still buy a two-, three-, or four-unit property.

Even conventional mortgage giants Fannie Mae and Freddie Mac now offer loan programs with as little as 3% down. Far, far less than you would need to come with for a minimum down payment on an investment property.

And, of course, you get someone elses rent to help you cover your mortgage payment. Definitely a win-win!

If you want more tips on house hacking and other ways to cut your expenses, Deni and I chat about ways to accelerate your savings for a down payment on an investment property here:

Don’t Miss: Usaa Refinance Auto Loan

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE:Get your credit score for free