Pros And Cons Of Usaa Car Loans

USAA offers competitive financing rates for military families interested in buying a car or refinancing a vehicle they already own. But its not the only lender aimed at servicemembers Navy Federal Credit Union, for example, offers a lower starting rate and a car-buying service. If you dont have military connections, it may be impossible to qualify for an auto loan at either organization.

| Pros | Cons |

| No hidden fees, including no application fees and no prepayment penalties.

Flexible loan terms that extend up to 84 months, with no payment due for up to 60 days after your loan is approved . Rate discount of 0.25 percentage points when you sign up for automatic payments. This is included in the rates shown above. USAA auto loans may be a good fit for those who already bank with USAA or plan to. Take your vehicle with you. If youre deploying, moving or traveling overseas, your USAA car loan allows you to take your vehicle along. |

Membership is required to apply for a USAA car loan or refinance loan.

Refinancing rates arent spelled out online youll need to play around with the USAA car loan calculator to get an idea of what rates you might qualify for. No refinancing for existing USAA Bank loans, but USAA will help you find the right refinancing option. Few branches. USAA has just a handful of financial centers where you could meet with a representative face-to-face. This wont be a good fit if youre hoping for an in-person borrowing experience. |

USAA auto loan reviews

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Highlights Of Usaa Rv Financing

The biggest advantage for service members seeking an RV loan from USAA is working with a financial organization thats solely military-focused. However, its not the only organization that focuses specifically on military families Navy Federal Credit Union and PenFed Credit Union are two other financial institutions that also focus on the military though USAA had lower starting RV loan rates, as of publication. You may be able to find even lower rates from an online lender such as Lightstream, which offered RV loans starting as low as 4.29%, as of publication.

Other pros of USAA RV financing include:

- No down payment for those who meet its credit requirements.

- Long loan terms, up to 20 years, which may be useful if youre considering a particularly expensive motorhome or other type of RV. This could also be considered a lowlight see below.

Recommended Reading: Can You Transfer Car Payments To Another Person

Re: Auto Loan With Usaa Questions

My rent is $500 a month. I don’t have a lot of bills at all. VERY little credit card deb total around $300, no other loans. Just rent, car payment, cable and electric. I pay my Auto and renters insurance upfront for the 6 month policy. DTI isn’t too tight. Gross income of $5000, and about $1300 a month in bills.

Best Trusted Name: Bank Of America

Bank of America

Bank of America is a good choice for an auto loan refinance for borrowers looking to work with an established brick and mortar bank with widespread availability.

-

Discount for Preferred Rewards members

-

Car must be fewer than ten years old

-

Minimum loan amount of $5,000

-

Car must have fewer than 125,000 miles

If you opt for an auto loan refinance from Bank of America, you get a trusted financial institution â and a decision in less time than it takes you to tie your shoes. Thereâs no fee to apply, and you can help yourself to all of their helpful online tools once you are a member of the Bank of America family. To qualify, your car will need to be fewer than ten years old and have less than 125,000 miles on it, and you will also need to have $5,000 or more remaining on your loan. Bank of America’s current APR for refinancing a vehicle is 4.13%. It is smart to pay off your existing loan with proceeds from a new loan to take advantage of lower monthly payments, lower interest rates, or save on financing costs. Compare prices and use a car loan calculator to help determine the savings.

Don’t Miss: What Credit Score Does Usaa Use For Auto Loans

Does Usaa Offer Bad Credit Loans

Quick Review: USAA personal loans are only available to USAA members, and theyre best suited for people with subpar credit scores. Since the highest interest rate on USAA personal loans is 17.65% and USAA accepts applicants with bad credit, they may be a cheaper option than many other lenders.

Usaa Insurance Rates Comparison With Their Top Competitors

USAA vs Allstate

When comparing these two companies, it should be noted that USAA is not available for everyone.

However, if you have an option to choose between USAA and Allstate, the former is the way to go. They offer lower prices, better customer service, and those additional benefits of being a USAA member should not be taken for granted.

Allstate gets some momentum with their Guaranteed Claims Satisfaction, but they quickly wane when all other parameters are considered.

USAA vs State Farm

We were able to find a direct comparison between the prices of these two companies, and USAA comes as a more affordable option in every single scenario. Add to that the top-notch customer service, USAA club members perks, and polished online tools, and we have a clear winner.

Those with newer vehicles should check State Farm, but in the end, if you are eligible, reviews show the company winning by a landslide.

USAA vs Progressive

Progressive manages to at least put up a fight against USAA by offering discounts for electric/hybrid vehicles and excellent options for new car owners. It has a wider network of local agents and decent online tools as well.

However, USAA scores better where it matters most by offering more affordable policies and better customer service. If you qualify to be a member of USAA, you can proceed freely, knowing that you are buying auto insurance thats among the best in the market.

You May Like: Usaa Used Car Interest Rates

Compare The Best Auto Loan Refinance Banks

| Company | |

|---|---|

| LightStreamBest for Great Credit | 2.49% |

| Capital OneBest for Checking Rates | Varies |

| Bank of AmericaBest Trusted Name | 3.39% |

| AutoPayBest for the Most Options | 1.99% |

| USAABest for Members of the Military | 3.04% |

| LendingClubBest for Peer-to-Peer Loans | Varies |

| Consumers Credit UnionBest Credit Union | 2.24% |

How Does An Auto Loan Refinance Work

An auto loan refinance is when you replace your current auto loan with a new one, intending to receive a lower interest rate. Your new loan will pay off the old loan, and you will sign new paperwork, have new terms and conditions, and a new interest rate.

You typically choose to refinance your auto loan if youâre unhappy with the rate or terms, or your credit score has gone up significantly since your original loan. Usually, refinancing is to save money, but keep an eye out for refinancing fees.

You May Like: What Do Mortgage Loan Officers Do

How The Application Works

The easiest way to apply is online. You can even apply on your phone while youre at the dealership. Once you have an offer, you have 45 days to shop around before you sign the loan.

Once you sign your loan documents, you have the option to defer payments for up to 60 days. Just know that interest, also called finance charges, will still accrue during this deferral period.

You should also consider signing up for autopay to qualify for a 0.25% rate discount.

USAA car buying service no longer available

USAA discontinued its car buying service through TrueCar on September 30, 2020. While it was running, USAA members could get a 0.5% discount on financing for a car through this service.

There are other banks that offer car buying services through their loan programs. But unlike USAA, most dont offer a discount when you use these programs.

Best Online Refinance Loan: Lightstream

LightStream

- Minimum credit score: Not stated

- Loan terms : 24 to 84 months

If youre looking to apply to refinance an auto loan online, LightStream is a great option. With low rates that reward borrowers with good credit, LightStream also features a fast online application and same-day funding.

-

0.5% discount with auto pay

-

Same-day funding

-

No restrictions on make, model, or mileage

-

Online application only

LightStream offers competitive rates, a wide range of refinance options, and an entirely online process for refinancing. It also gets strong customer service ratings, receiving a top score in the J.D. Power 2020 Customer Lending Satisfaction Study.

Read Also: What Bank Has The Lowest Home Equity Loan Rates

How Usaa Compares To Other Lenders

PenFed and Carvana are two solid alternatives to USAA. Not only do both get better customer reviews than USAA, they also offer more competitive loan terms for more people.

PenFed works with current and former military members in addition to their families although anyone can qualify for membership. Like USAA, it offers auto loans up to 84 months. And new auto loans start at a low 1.79%. Plus you can borrow as little as $500, which makes it perfect for those looking to finance less expensive vehicles.

Carvana only offers financing for its inventory of used cars. While this can be limiting, its service is completely online and transparent. Its interest rates are higher than both USAA and PenFed, but its also more upfront. People who have lower credit scores or less income may still qualify for a loan. Thats not the case with many other lenders.

Usaa Auto Insurance Policies

People seem to be pretty upset about USAA policy prices. If youre only getting car insurance through USAA you will pay more. Your best option is to bundle, this is how you save. Also, the longer youre with USAA, the more youll save. Unfortunately, If you have a low credit score, you might end up paying more than a low credit score with other insurers.

Recommended Reading: Usaa Auto Loan Refinance

Positive Usaa Insurance Reviews

Looking at USAA auto insurance reviews, its clear how the majority of customers feel.

I’ve had USAA insurance, home and auto, for over 20 years no problems. Last accident forgiveness. They were very courteous and no problems at all.

-D. Thomas via BBB

Ive been a USAA customer since 1980. My premiums appear to be less than most other companies and, whats more important, Ive had several claims. USAAs claims department is without peer in the industry. They are, without question, exceptional.

-Jim T. via Quora

Should You Refinance Your Car

Whether you should refinance your car loan depends on your situation.

Here’s when it’s beneficial to refinance your auto loan:

- If interest rates have dropped. Refinancing into a lower rate can reduce the overall interest costs on your loan.

- If you want to lower your monthly payments. Getting a new loan can help you free up cash for bills and other costs.

- Your credit has improved since you purchased the vehicle. If your credit score has jumped up since you first purchased your vehicle, you might be able to get a better loan.

Here’s when it’s not beneficial to refinance your auto loan:

- If you’re going into negative equity. You don’t want to owe more on the car than it’s worth. If refinancing will put you upside-down on your car loan, consider other options.

- Extending the loan term. Lengthening the term of your car loan typically will cause you to pay more interest over the life of the loan and more for your car. Though longer terms can lower your monthly payment, long-term loans are generally more expensive.

Refinancing your auto loan can help you decrease your payments and the amount of interest you pay over the life of the loan. But whether you should refinance depends on your situation. If you decide that refinancing is the right move for you, seek out a lender and loan terms that meet your needs and help improve your overall financial picture.

Also Check: Do Loan Companies Verify Bank Statements

The Higher Your Credit Score The Less It Will Cost To Borrow

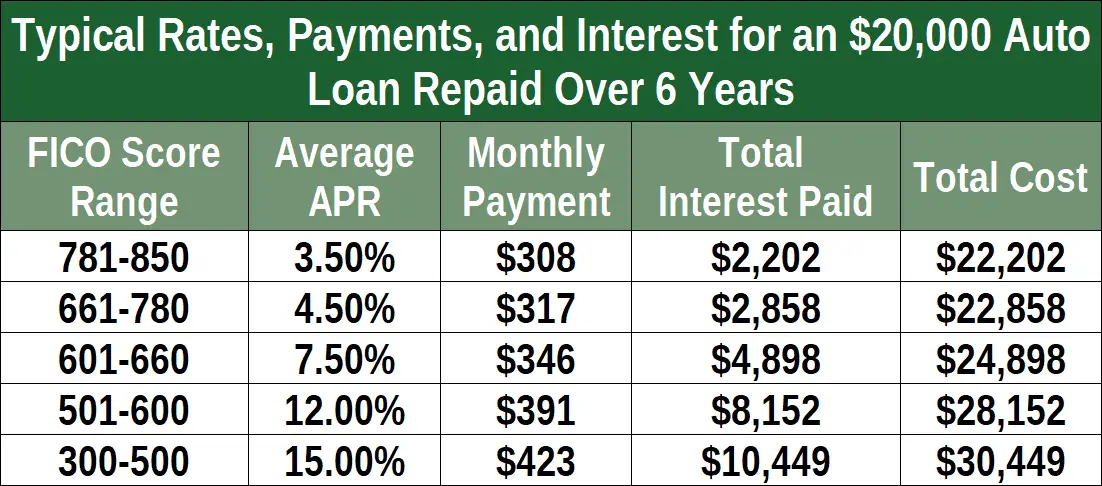

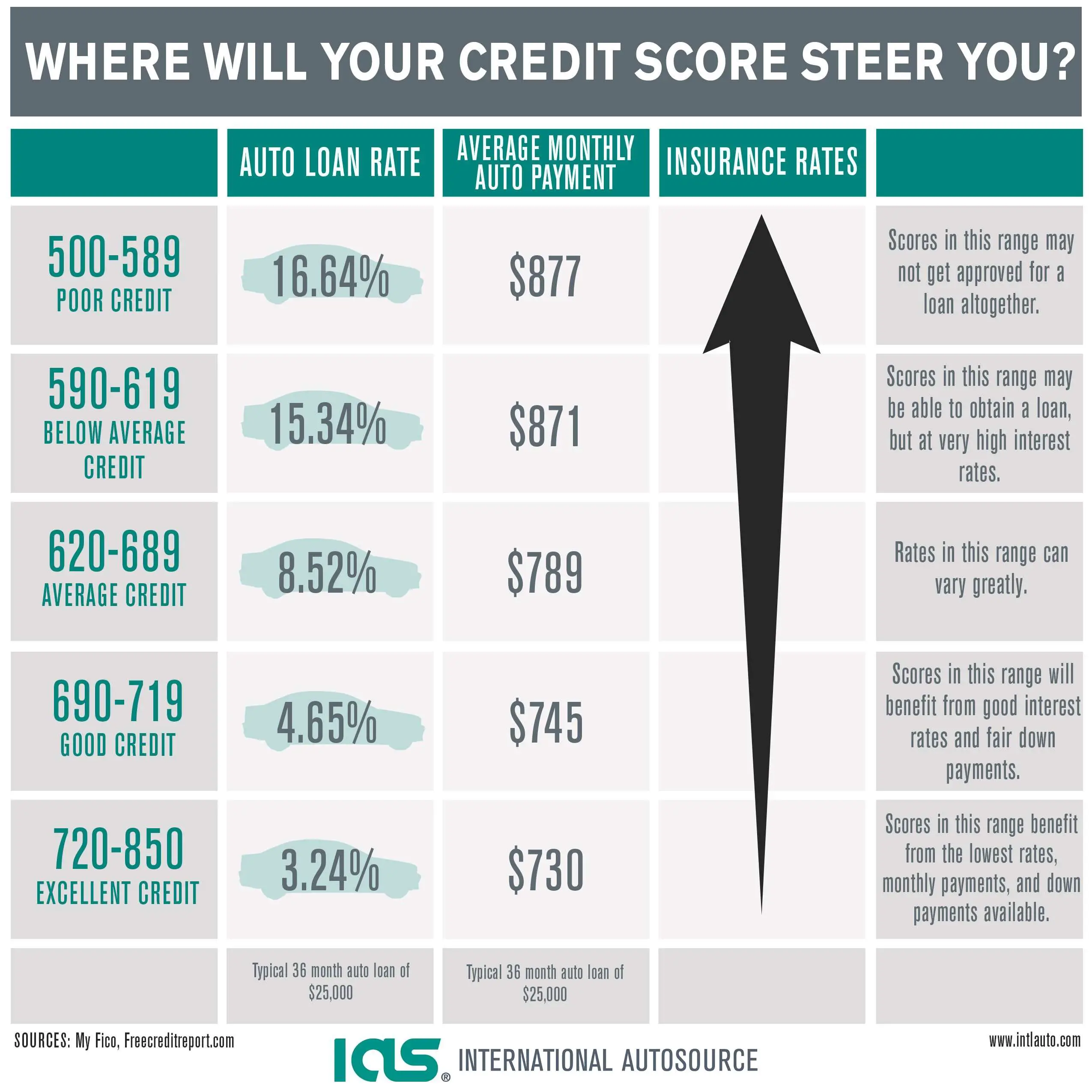

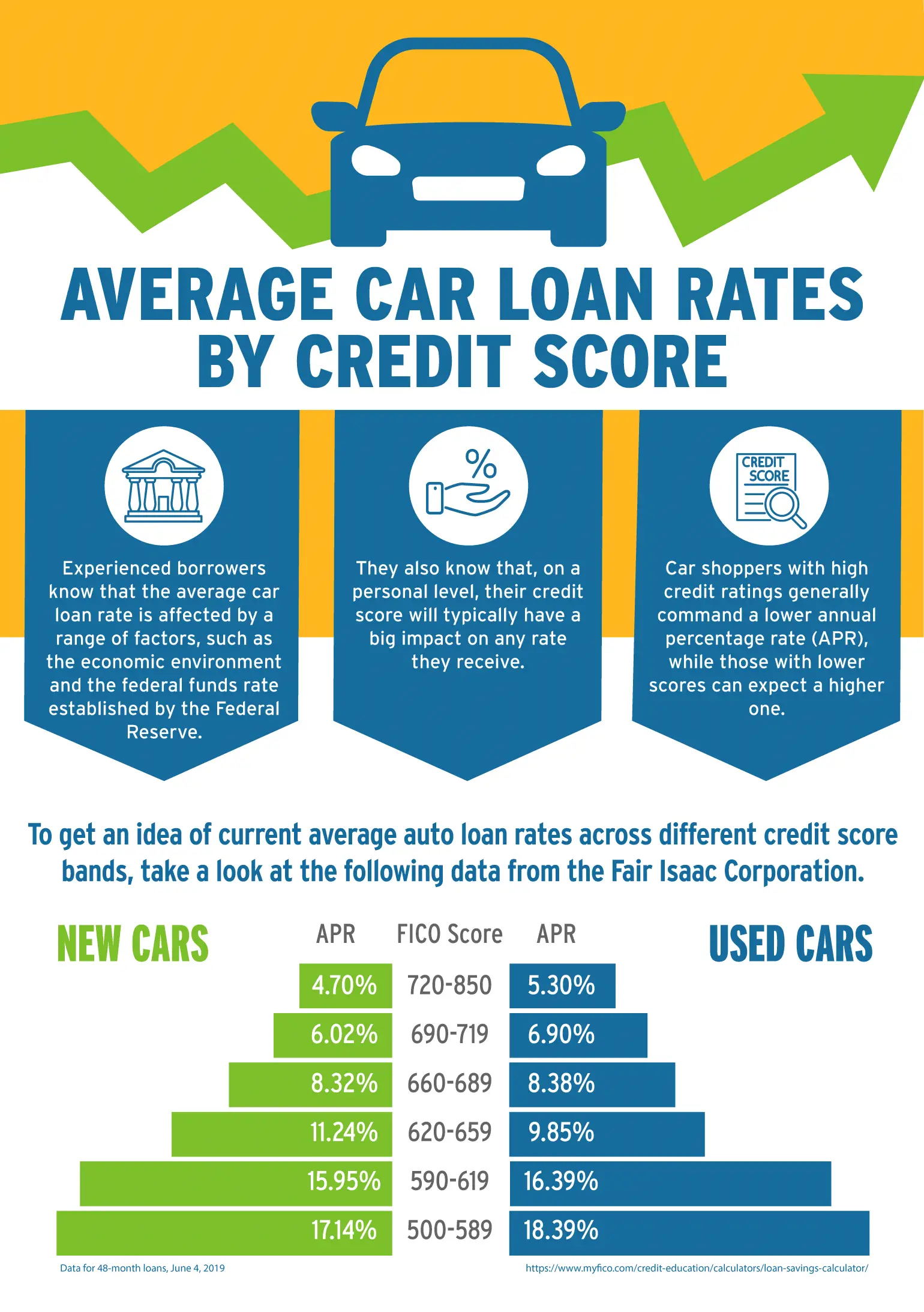

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.

Usaa Auto Loans Features And Benefits

USAA doesnt hide any fees. They help you buy your lease if you want to keep it. You can get a specialized loan for cars designed for you if you are disabled.

There are no prepayment penalties. You can buy from a private seller. The rates are competitive.

You can apply on your phone. The terms are flexible. They give payment deferment if there is a natural disaster.

Also Check: How Long For Sba Approval

Check Your Financial Documents

If you do not have gap insurance through your dealership, lender, or car insurance company, you probably are not covered. But as a last resort, you can look through your financial records such as your online bills, credit card statements, and checkbook to try to find some clues.

Gap insurance, which covers the difference between your loan balance and the cars actual value, can come from a dealership, bank, credit union, or car insurance company. Its unlikely that you bought a stand-alone gap insurance policy without realizing it, so your first step should be to check with the obvious candidates.

Why is USAA so cheap?

USAA is cheap because the company is the largest insurer of the military community, and that volume allows USAA to offer more competitive rates. USAA captured 6% of the total private-passenger insurance market in 2019, despite only offering coverage to service members and their families. USAA ranked 2nd overall in WalletHubs cheap car insurance study of more than 40 major insurers, partly because it offers discounts for owning a new car, being a low-mileage driver, and more. Plus, USAA rewards customer loyalty with discounts for insuring more than one car or bundling multiple policies, such as home and auto. However, USAA only offers coverage to the U.S. military community.read full answer

To get a personalized quote from USAA, you can speak to a representative by calling 1 531-8722.

Do I need gap insurance if I have full coverage?

Loan Amounts And Terms

- Loan amounts. Loan amounts range from $2,500 to $20,000, depending on your loan term. For example, 12- to 36-month terms require minimum loan amounts of $2,500 48-month terms require a $5,000 minimum loan amount 60-month terms require a $10,000 minimum loan amount 72-month terms require a $15,000 minimum loan amount and 84-month terms require a $20,000 loan amount.

- Loan terms. 12 to 84 monthsor one to seven years.

Also Check: What Is An Rv Loan

Usaa Auto Loans Vs Autopay

Autopay is designed for people who want to shop around for the right auto refinance loan for them.

Their APRs range from 1.99 to 17.99%. Their low APR is competitive with USAAs lowest APR, but USAA doesnt disclose their highest APR.

Their loan amount is $2,500 to $100,000 while USAAs is $5,000 to $50,000. You can prequalify with a soft credit check, which USAA doesnt offer. USAA also doesnt include multiple lenders.

Usaa Auto Loan Requirements

USAA isnt very specific about what you need to do to qualify for its loans. However, here are some general requirements most lenders have.

Personal requirements

- US citizen or permanent resident

- At least 18 years old

To become a USAA member, you must either be a member of the military or a military family. USAA considers factors like your credit score and income when you apply, though it doesnt advertise a minimum credit score for its auto loans.

Vehicle requirements

USAA also isnt clear about the criteria vehicles must meet to be eligible for a new or used auto loan. Beside borrowing at least $5,000 or more for longer terms youll need to reach out to USAA to confirm your vehicle qualifies. This is especially true for used vehicles and refinancing.

You will need to provide a few details to refinance your current loan, including:

- Vehicle model year and mileage

- 10-day payoff quote

- Current loan account number

Recommended Reading: What To Do If Lender Rejects Your Loan Application