Equation For Mortgage Payments

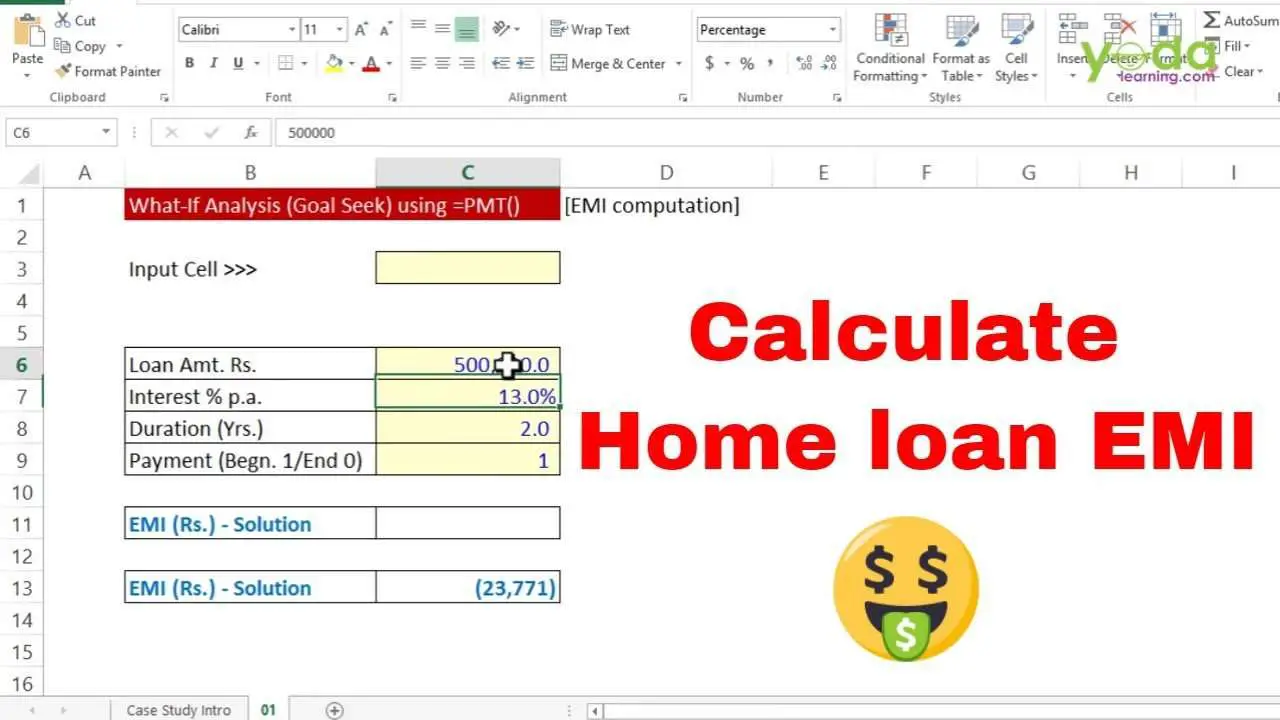

M = P

- M = the total monthly mortgage payment

- P = the principal loan amount

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

This formula can help you crunch the numbers to see how much house you can afford. Using our mortgage calculator can take the work out of it for you and help you decide whether youre putting enough money down or if you can or should adjust your loan term. Its always a good idea to rate-shop with several lenders to ensure youre getting the best deal available.

My Bank Says I Have Zero Eligibility

From my experience many banks do not understand how to calculate eligibility for a second VA loan. Additionally, when banks try to look up your VA certificate it will sometimes appear that you have zero eligibility remaining.

I initially tried to get a second loan with Pentagon Federal and they were adamant that I had already used my VA loan. I even talked to a supervisor and could not convince them of the process for a second VA loan. I finally cut my losses and went with Navy Federal who understood it completely.

How Much Will My Va Loan Payment Be

There are a variety of factors that play into the calculation of your monthly loan payment. Typically, the factors affecting your monthly payment include the home price, down payment, interest rate, and if you have to pay the VA funding fee.

As with any mortgage calculator, these numbers are estimates. To get exact figures, contact Veterans United Home Loans and speak with a home loan specialist.

Don’t Miss: How To Transfer Car Loan To Another Person

The Remaining Closing Costs

The last thing you add to the loan amount is the closing costs the lender charges. The VA does oversee these fees, so you know they will not be out of hand. Of course, you can always shop around with different VA approved lenders to see which lender offers the best deal. As was the case with your original VA loan, you can wrap these costs into your new loan amount on the VA IRRRL.

Jumbo Va Loan: How It Works

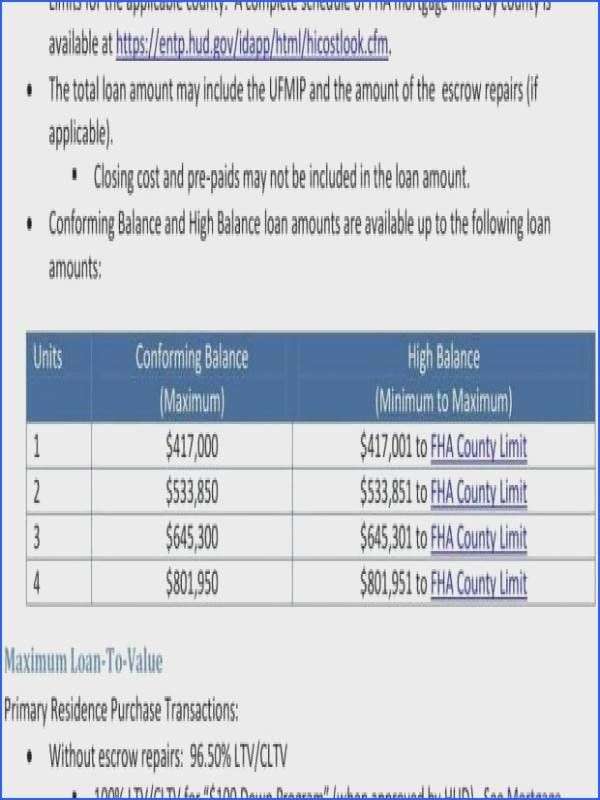

There are also parts of the country where the median home values are much higher compared to other regions. In these high cost areas the maximum limit for the area will be 115 percent of the median home value of the area but not to exceed the highest possible limit of $726,525. This number is found by taking 150 percent of the conforming limit. These are all calculations mandated by the Home Equity Recovery Act of 2008. But how can someone use their VA eligibility to finance a home whose sales price exceeds the maximum VA limit? There are calculations for that as well.

You can still take out a VA loan and come to the closing table with less money compared to a conventional loan, but you will need to be prepared to come to your closing with some down payment funds. Lets say you found a home listed at $600,000 and you want to use your VA eligibility to buy and finance the property. First, youll subtract the conforming loan limit from the $600,000 price. This figure is $115,650. Now, because the VA loan carries a guarantee of 25 percent of any loss should the property go into default, multiply $115,650 by 25 percent to arrive at $28,912 rounded to $28,900. This is the amount of down payment youll need. Not a zero down VA loan but very close to it. More like 5.0 percent down.

Read Also: How Much Interest Will Accrue On My Student Loans

Who Qualifies For A Va Loan

3.You must meet theVA minimum property requirement and occupancy requirements:

The property you want to purchase MUST meet the VA’s structural, sanitary, safety standards, and building codes, and must be your primary residence within 60 days of purchase. You can’t use a VA loan for an investment property or vacation home.

Before we get into the details on how to apply for VA loan, let’s learn how to use the VA loan calculator.

Why Should I Use The Va Mortgage Calculator

Why should you use a VA home loan calculator? The simplest answer is that you will want an estimate of your monthly mortgage payments before you commit to the purchase of property.

That sounds fairly simple, but what isnt so obvious are the things that go into that calculation. Some VA loan applicants, especially those who are new to buying a home, tend to overlook some crucial details when trying to calculate the monthly VA mortgage payment.

Using an online VA loan calculator eliminates this problem as you will be required to enter all the specifics to arrive at your estimateyou wont be able to overlook or forget key data.

In addition to what is mentioned above, the most important reason to use an online mortgage loan calculator to estimate your VA home loan payments has a lot to do with determining your ability to afford the loan.

Buying a home is a complex process and there are up-front fees, costs that are paid by the seller , and there are charges that are issued by the VA intended to offset the taxpayer burden of the VA loan program.

The problem is, not all VA borrowers are required to pay the same costs and not all the costs associated with your loan may affect your mortgage payment. But sometimes they do. What does this mean?

And there are other variables including whether you choose a 15-year or 30-year loan term, and whether or not you choose to make a down payment.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How The Va Loan Limit Is Set

Although VA loan entitlement amounts vary, the term refers to the amount of money the VA guarantees to the lender to finance a VA loan. Veterans may be entitled to two different types of entitlement, which ultimately set the VA loan limit. Your “basic” entitlement amount, which many veterans see on their Certificate of Eligibility , is $36,000 making the maximum VA loan guaranty $144,000 . But you, like many other VA borrowers, may qualify for a “bonus” entitlement of $68,250, in addition to the basic amount. Your total entitlement could be $104,250 and a maximum VA loan guaranty of $417,000.

Although $417,000 is a common VA loan limit for many counties in the United States, higher VA loan limits exist for counties in parts of the country with higher costs of living. In parts of Hawaii, for example, VA loan limits are more than $700,000. Veterans purchasing homes in those areas may be approved to finance a loan up to that amount, without a down payment.

The Basics Of The Max Loan Amount

The VA makes it every easy to determine your max loan amount on the VA IRRRL. Because the program was designed to help veterans save money, you cannot take money out with this loan. You are able to refinance your outstanding principal balance, plus some select fees. These fees are those that the VA allows, which you can then roll into your loan. The fees you need to concern yourself with include:

- Origination fee

In some cases, however, you may be able to add the cost of energy efficient improvements, we will talk about this below.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What If Ive Been Turned Down For Low Residual Income

According to the VA handbook, VAs minimum residual incomes are a guide. They should not automatically trigger approval or rejection of a loan. The VA underwriter should be looking at your entire loan file and determine whether there are compensating factors that would override low residual income.

That being said, if you are very short on the residual income requirement, the underwriter can use that as a basis to deny the loan.

If youve been rejected by one lender, and you think your residual income level is close to guidelines, try having another lender look at your scenario. Each lender and underwriter is different. Theres a chance you could be approved even if youve been turned down before.

Different Types Of Va Loan Entitlement

There are two parts to VA entitlement: basic and bonus. Most eligible service members and Veterans start with a basic entitlement of $36,000. Since the VA will guarantee a quarter of the total loan amount, this gives the majority of borrowers $144,000 to work with .

If youre looking to purchase a home priced higher than this , youll use your bonus entitlement next. This amount will vary based on where youre buying.

Ultimately, the VA will guarantee up to a quarter of the conforming loan limit in your county. So if the limit is $548,250, as it is in most counties, your total entitlement both basic and bonus would come to $137,062.

Heres a look at how youd run the number to determine your exact VA entitlement amount.

- To get your basic entitlement, take $36,000 and multiple by four. Thats the initial amount you could borrow using a VA loan.

- To get your bonus entitlement, take the conforming loan limits for your county and divide by four: $548,250 / 4 = $137,062. Then subtract your basic entitlement: $137,062 – $36,000 = $102,062. In this scenario, your bonus entitlement would be $102,062.

Your Certificate of Eligibility should show your basic entitlement amount. Youll have to calculate your bonus entitlement based on your areas loan limits and the home youre buying. An experienced home loan specialist can help here.

Our Lender

You May Like: Avant Refinance Loan Application

How Do Lenders Calculate Va Residual Income

You have probably heard of debt-to-income ratio, the calculation that looks at your monthly debt payments compared to your income.

The residual income calculation goes one step further and factors in other expenses like childcare, estimated utilities on the new home, child support , and Social Security and income taxes. This calculation attempts to determine, or at least estimate, all your real-life expenses each month.

Residual income is calculated by subtracting all these expenses from your gross monthly income.

Who Is Eligible For A Va Loan

Those who have served or are presently serving in the U.S. military may be eligible for a VA-backed loan. This includes:

- Veterans

- National Guard member

- Surviving spouses

In order to qualify for a VA-backed loan, your lender may require you to meet additional standards, such as having suitable credit, sufficient income and a validCertificate of Eligibility. Find a VA lender near you toget pre-qualified for a VA loan.

Read Also: Can You Refinance An Fha Loan

When Residual Income Helps You Qualify

The VA loan underwriter looks at your complete file to find compensating factors. If you have a low credit score, a high debt-to-income ratio, or other negative factors about your loan file, a high residual income might help you qualify.

The VA Loan Handbook states that a debt-to-income ratio of more than 41% requires close examination, unlessresidual income exceeds the guidelines by at least 20 percent. A high income compared to all your other regular expenses could push you over the top as far as qualification.

So if your residual income requirement is $1,003 per month, but you have at least $1,204 in residual income, the underwriter could approve your loan even if youre over the debt-to-income ratio limit.

It makes sense. If you have a lot of extra money each month after all your bills are paid, theres a lower chance of you defaulting on the loan in order to feed your family or take care of other necessities.

Yes, VAs residual income requirement can cause some stress and cause you to worry that you wont meet guidelines. But for many, this vital calculation can not only help them be approved for a VA home loan, but put their mind at ease that they can truly afford their new home.

How Our Va Loan Calculator Works

Zillow’s VA loan calculator provides autofill elements to help you quickly estimate your monthly mortgage payment on a new home. Like most home loans, the mortgage payment on aVA loan includes the principal amount you borrowed and the interest the lender charges for lending you the money. Both of which are represented as P& I on the VA loan calculator breakdown. You can also choose whether to includetaxes and homeowners insurance in the total monthly payment amount. Learn more about the details used to calculate your va loan payment using the definitions below.

Also Check: Does Va Loan Work For Manufactured Homes

What Are The Specifics Of The Joint Va Loan

Typically, a Veteran/Non-Veteran Joint Loan is the type of loan you will want to apply for if you are looking to finance a Joint VA Loan. This simply means that at least one of the borrowers is eligible for VA benefits and the others are either not eligible for VA benefits or is not using them for this process.

Here are some examples of the Veteran/Non-Veteran Joint Loan:

- A veteran and their non-spouse partner who is not a veteran

- One veteran with VA entitlements and a veteran borrower who is not eligible due to service requirements

- One non-veteran borrower and three VA Home Loan eligible borrowers

- Two non-eligible borrowers and two borrowers using their VA Home Loan benefits

VA Joint Loan: who exactly is a borrower?

- A borrower not eligible for VA benefits and a borrower who is

- A borrower using their VA Loan benefits and multiple borrowers who have benefits but are not using them for the home purchase

- Several borrowers who all qualify for VA Home Loan benefits and who are all using them for the purchase

- A married couple who are both eligible for a VA Home Mortgage and who are both using their benefits for the purchase

Are the VA loan limits different with the Joint VA Loan?

When youre pursuing a Joint VA Loan, the loan limits you might be eligible for are different than if you are applying for a standard VA Home Loan. When considering joint borrowers, here is how the Department of Veteran Affairs figures how much it will guarantee:

÷ = Y

multiplied by Y = Z

| Loan Amount |

Restoring Your Va Loan Entitlement

If youve previously taken out a VA loan, you can have your entitlement fully restored by paying back the loan and selling the property attached to the loan. You may also qualify for a one-time entitlement restoration if youve paid back your loan but havent sold the property attached to the loan.

If you dont have full entitlement and dont qualify for a one-time restoration, you can figure out how much remaining entitlement you have by using the formulas we discussed above.

Essentially, you cant use entitlement thats already tied up in an active loan, but once your entitlement has been restored, typically by repaying your loan and selling your home, youre free to reuse your full entitlement benefit.

Don’t Miss: Does Va Loan Work For Manufactured Homes

How To Use The Va Loan Calculator

To use the mortgage calculator you will need to prepare a bit. The first thing youll need is an actual or hypothetical house sale price. If you have not started house hunting yet, you can estimate what you think you can afford and make adjustments from there. Once you have a sale price, you will also need the following details, which you enter into the appropriate field on the online VA mortgage calculator:

- HOA Dues

Things You Should Know

The amount of your VA loan funding fee will vary depending on whether you are a first-time VA loan applicant, a second-time borrower, whether you receive or are eligible to receive VA compensation for service-connected disabilities. Your participating VA loan officer can help you arrive at an amount for the VA loan funding fee if you arent sure what fee structure applies to you.

The Loan Term Is Important

The loan length for VA mortgages, according to the VA Lenders Handbook, is either 15 or 30 years. The same is true for VA refinance loans. Homeowners insurance will affect the amount of money you spend on your mortgage each month, but keep in mind that homeowners insurance and mortgage insurance are two different things.

Interest Rates

The interest rate issue can be a tricky one. Borrowers with excellent credit have fewer questions or concerns in this area than those who may have experienced credit trouble in their past and are worried about their ability to qualify for the mortgage.

Determining The Max Loan Amount Using The Va Irrrl Worksheet

March 20, 2017 By JMcHood

The VA IRRRL program allows you to refinance your existing VA loan with very little verification. Lenders do not need to check your credit, income, or employment to qualify for the loan. In fact, they do not even need to verify the value of your home. This means you can be upside down on the loan and still refinance. The lender can use the qualifying factors from your original loan application for the refinance. The one thing they must verify, however, is your mortgage history. If you have more than one 30-day late payment in the last 12 months, you will not be eligible for the program. Once you know you are eligible, the next step is figuring out the max loan amount you can receive. The VA is very strict about what you qualify to receive on this refinance because it is not a cash-out refinance.

Don’t Miss: How To Get Loan Originator License