Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Factors That Impact The Interest Rate

You’ll. be a more informed car shopper if you know the factors that can affect the interest rate on your car loan. We’ve listed some of the most important ones below.

- Current Interest Rates: In a strong economic environment, interest rates tend to be higher. In weaker periods, they can be lower. If rates are high, consider putting off your purchase until they drop.

- Good are attractive to lenders and can mean lower interest rates. Conversely, lower credit scores can mean offers of loans with higher interest rates.

- Down Payment: The amount you can pay upfront for a car can affect your loan’s interest rate. The more you put down, the lower the rate you may get because less is at risk for the lender. With small down payments, lenders may charge higher rates due to the risk of default on a larger loan amount.

- Term of Loan: Rates vary depending on a loan’s term. Longer-term loans can come with higher interest rates.

- Lender Type: If you have a choice, consider a car loan from a . Normally, credit unions offer more attractive rates on car loans than banks. Similarly, take a look at what’s on offer in the finance department of the carmaker. It may offer specials that include lower interest rates.

- New or Used Cars: Whether a car is new or used can affect the interest rate on a loan for it. Rates on loans for used cars are typically higher than on loans for a new car.

Read Also: Best Loan For Small Business

How Do You Get The Best Interest Rate

What is a good car loan rate? If you are looking to get the best rate possible, a little planning ahead can go a long way. The first step is to take a look at your credit history and credit score. As your credit score increases, your interest rate decreases. Another important step is to prepare for a negotiation. Depending on your credit score, a good interest rate for you can range from 3.17% to 13.76%.

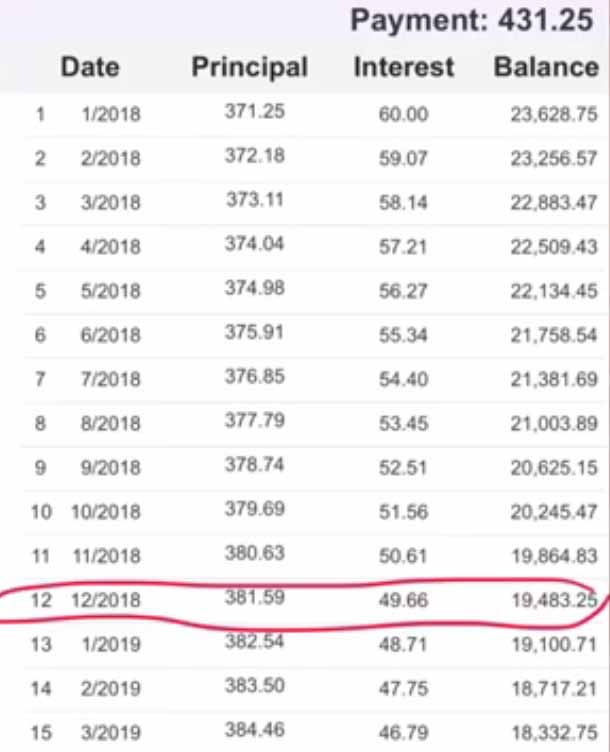

The chart can be a helpful tool in the negotiation process. Before you accept what you are offered, be sure to carefully look at the entire offer, not just at what you will be paying each month.

Buying Used Could Mean Higher Interest Rates

Buying a new car may be more expensive, all in all, than buying used. But, new and used auto loan interest rates are significantly different, no matter your credit score. Based on Experian data, Insider calculated the difference between new and used interest rates. On average, used car financing costs about four percentage points more than new financing.

| Super Prime | 1.31% |

The gap between how much more a used car costs to finance shrinks as credit scores increase, but even for the best credit scores, a used car will cost over 1% more to finance than a new car.

Used cars are more expensive to finance because they’re a higher risk. Used cars often have lower values, plus a higher chance that they could be totaled in an accident and the financing company could lose money. That risk gets passed on in the form of higher interest rates, no matter the borrower’s credit score.

Recommended Reading: What’s The Smallest Car Loan You Can Get

Bigger Earnings For Savers

If you dont have a savings account, nows the time to open one to build your emergency fund.

Interest rates on savings and CD accounts are rising because of the Feds rate hikes, which means greater earnings on your savings balances and a few more dollars back into your pocket.

Having an emergency fund can help you if unexpected expenses and periods of financial instability arise. Experts generally recommend saving anywhere between three to six months worth of expenses, but even saving just a few dollars a week can go a long way over time. If you already have a well-stocked emergency fund, consider increasing your savings if you can afford to. Your money isnt going as far right now since inflation keeps pushing prices higher.

You should also be strategic about where you keep those savings. High-yield savings accounts offer solid returns on your savings and allow you to easily pull that money out for emergencies. Online-only banks, neo-banks, or divisions of regional banks tend to offer more competitive savings rates because they dont have to factor in the costs of physical branches.

Shop around for rates and consider other important factors like fees, minimum deposit and balance requirements, and withdrawal options when choosing a savings account.

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what is known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Don’t Miss: Is There Any Loan For Unemployed

Whats The Interest Rate On An Auto Loan

The interest rate is set by the lender and it depends on many things, including the banks policy and market factors such as what other lenders are charging for their loans. On the customer side, the lender will look at your repayment history and credit score to determine how creditworthy you are. Lenders tend to offer their best rates to the most creditworthy customers who have a very high likelihood of paying back the loan in full and on time.

Generally, the right credit score depends on whether youre buying a new or used car and the lender youre interested in. According to the consumer credit reporting agency Experian, buyers in the market for new car financing had an average score of 722 in 2017. For used cars, the average credit score dropped to 682. However, a bunch of loans will go to borrowers with credit scores below those figures it depends how much the car dealer wants to sell the car to you.

Since the interest charge represents the lenders profit, its fair to say that most lenders will charge the maximum rate they think you will pay. For most people, cars are indispensable you need one to get to and from your job and wherever else you need to go. If your credit is weak, then you may have slim pickings when shopping for loans. Auto lenders know this, and that is why they fix the highest rate they can get away with.

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. They function as a grade for your borrowing history ranging from 300 to 850, and include your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be.

A lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.40% | $656 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $656 a month, while a person with a score in the lowest category would pay $831 a month, or $175 more for per month for the same car.

Also Check: Debt Consolidation Loans Bad Credit

Other Ways To Lower Your Interest Rate

Improving bad credit isnt an easy or quick process but its also not the only way to get lower interest rates. There are a few other things you can do to help get more competitive rates on a car loan:

- Get a shorter term:Longer loan terms, like 84-month terms, generally come with higher interest rates. If you can afford higher monthly payments, consider a shorter loan term.

- Get a discount:There arent a huge number of rate discounts when it comes to auto loans, but there are some. Many lenders offer a discount for signing up for automatic payments, usually around 0.5%.

- Make a larger down payment:One factor in your interest rate is the loan-to-value ratio. This is how much you are borrowing compared to the value of the vehicle. Making a bigger down payment will lower your LTV ratio and could lower your interest rate too.

- Bargain down the sales price:You can also lower the LTV ratio by reducing the purchase price of the vehicle. Car dealers typically have some wiggle room on prices, so you may be able to negotiate a lower sales price.

- Get a co-signer: If you have a family member or friend who would qualify for a good credit auto loan, you can see if they are willing to co-sign an auto loan with you. When you have a co-signer, you piggyback on their credit, which may help you find better rates. This is a sensitive situation, so be cautious who you ask.

Good Credit Auto Loans: Lowest Rates And Top Lenders

- Customers save an average total of $2,225

- 90-second secure application process

Up to 722.94%

- Low rates for good credit customers

- Strong industry reputation

- A leading provider in refinance loans

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- Average monthly savings of $145

- Online Application

- No SSN required to see pre-qualified rates

- Offers auto refinancing and lease buyouts

Up to 72Varies

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

- Average annual savings over $1,200

- Lending platform that partners with banks

- Approval and loan terms based on many variables, including education and employment

Up to 72Varies

- Great for customers with limited/no credit

- Offers special military rates

All APR figures last updated on 7/6/2022 – please check partner site for latest details. Rate may vary based on credit score, credit history and loan term.

Your credit score is the single most influential factor in your car financing interest rates. So, you can expect good credit auto loans to come with some of the lowest rates available. But theres more to car loans than just interest rates and annual percentage rates .

We at the Home Media reviews team researched which lenders offer the best auto loan rates and best auto refinance rates for borrowers with good credit. We name our top five recommendations, as well as explain how your credit score works and how it impacts car loan rates.

You May Like: What Is The Best Debt Consolidation Loan Company

What Is The Average Interest Rate On A Car Loan

Auto loan interest rates vary based on a number of factors, including the amount you are borrowing, the loan term, loan type and your credit history. The average interest rate for a new car is 4.33 percent, and the average interest rate for a used car is 8.62 percent according to the Experian State of Automotive Finance Market report from the second quarter of 2022.

What About My Job

Some economists argue that widespread layoffs will be necessary to slow rising prices. One argument is that a tight labor market is fueling wage growth and higher inflation. In August, the economy gained 315,000 jobs. There are roughly two job openings advertised for every unemployed worker.

“Job openings continue to exceed job hires, indicating employers are still struggling to fill vacancies,” noted Odeta Kushi, an economist with First American.

As a result, some argue higher unemployment might cool wage pressures and tame inflation. Research published earlier this month by the Brookings Institution stated that unemployment might have to go as high as 7.5% to reduce inflation to the Fed’s 2% target.

Also Check: How To Get Sba 7a Loan

Where To Find The Best Auto Loans

There are many different avenues you can use to find the best auto loan.

- Banks. If you already have a relationship with a bank and have a high credit score, your bank may provide one of the most competitive interest rates. But read the entire agreement before you sign some banks write in a clause that allows them to take from your checking or savings.

- Like a bank, if youre a member of a credit union, it may offer a competitive interest rate. And if you have less-than-perfect credit a credit union may be willing to look past that and still extend a reasonable rate.

- Online lenders. There are several online lenders that offer auto loans you can prequalify for. As with most direct lenders, youll likely get a better rate than you would by applying with a dealership.

- Car dealers. This is one of the biggest ways that you can get stuck with a higher interest rate. Dealers add markups to interest rates provided, which means youll be stuck paying more than if you went to the lender directly. Check with several different lenders before going to a dealership to get the best deal possible.

How To Get An Auto Loan

Once you find the right auto loan for your situation, follow these steps:

1. Shop around. It is usually best to compare rates and terms from at least three lenders before moving forward with an auto loan.

2. Prequalify. Prequalifying with lenders lets you see your potential rates without a hard credit check.

3. Complete your application. To complete your application, you will likely need details about your car, including the purchase agreement, registration and title. You will also need documentation like proof of income and insurance, proof of residence and a driver’s license.

4. Make payments. Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

You May Like: How Do Loan Officers Get Leads

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |