How Much Do I Have To Pay In Interest On Student Loans

The amount of interest you pay on student loans depends on whether you have federal or private loans, among other factors. Federal student loans have fixed interest rates set by Congress, which will not change for the life of the loan.

The interest rate on direct subsidized and non-subsidized loans is 3.73% for undergraduate students and 5.28% for graduate or professional students. The interest rate on Direct Plus Loan is 6.28%.

Interest rates on private student loans vary depending on the lender and your credit. Some private student loans come with variable interest rates, so the amount paid each month can change over time. Other factors that affect interest include:

- loan amount The higher your loan amount, the more interest you will pay each month.

- repayment period The length of your loan tenure can affect the interest you pay the longer your loan term, the higher your interest rate. Most federal loans start on the standard 10-year repayment plan, but other federal payment plans can extend the payment up to 30 years. Private student loans typically have repayment terms of five to 20 years.

When Does Interest Accrue

Interest starts accumulating like this from the moment your loan is disbursed unless you have a subsidized federal loan. In that case, youre not charged interest until after the end of your grace period, which lasts for six months after you leave school.

With unsubsidized loans, you can choose to pay off any accrued interest while youre still in school. Otherwise, the accumulated interest is capitalized, or added to the principal amount, after graduation.

If you request and are granted a forbearancebasically, a pause on repaying your loan, usually for about 12 monthskeep in mind that even though your payments may stop while youre in forbearance, the interest will continue to accrue during that period and ultimately will be tacked onto your principal amount. If you suffer economic hardship and enter into deferment, interest continues to accrue only if you have an unsubsidized or PLUS loan from the government.

Those with federal student loans may encounter a gap in their requirement to pay interest: Interest on student loans from federal agencies and within the Federal Family Education Loan Program has been suspended until Sept 30, 2021, through an executive order signed by President Biden on his first day in office and an announcement by the Department of Education.

How Is Student Loan Interest Calculated

Federal student loans and most private student loans use a simple interest formula to calculate student loan interest. This formula consists of multiplying your outstanding principal balance by the interest rate factor and multiplying that result by the number of days since you made your last payment.

Interest Amount = × Number of Days Since Last Payment

The interest rate factor is used to calculate the amount of interest that accrues on your loan. It is determined by dividing your loans interest rate by the number of days in the year.

Don’t Miss: Refinance Car Usaa

Maximizing Your Student Loan Interest Claim

Student loan interest payment doesnt have to be claimed on the year it was paid. CRA allows you to accumulate 5 years worth of interest payments and claim them in one year. Because you cannot claim a refund for your student loan interest alone, do not claim it on a year when you dont owe taxes. Instead, save the claim and carry it forward to any subsequent year.

For example if the interest you paid on your student loans for the last tax year equals $500, but you owe nothing in taxes, dont waste the claim. Instead, save it for next year or the following year, and use it to offset your taxes owed for those possibly higher earning years.

How Do I Refinance My Student Loans

To refinance your student loans, shop around and compare a few lenders to see which one offers the best rate and repayment terms for your situation, getting prequalified where possible. When youre ready to apply, you can typically apply online, over the phone or in person. Once youre approved and have submitted the necessary documentation, the lender will pay off your existing loans, and youll begin making your new payments.

Read Also: Government Grants For Minority Startup Businesses

You May Like: Becu Autosmart

Graduate Professional & Parent Rates

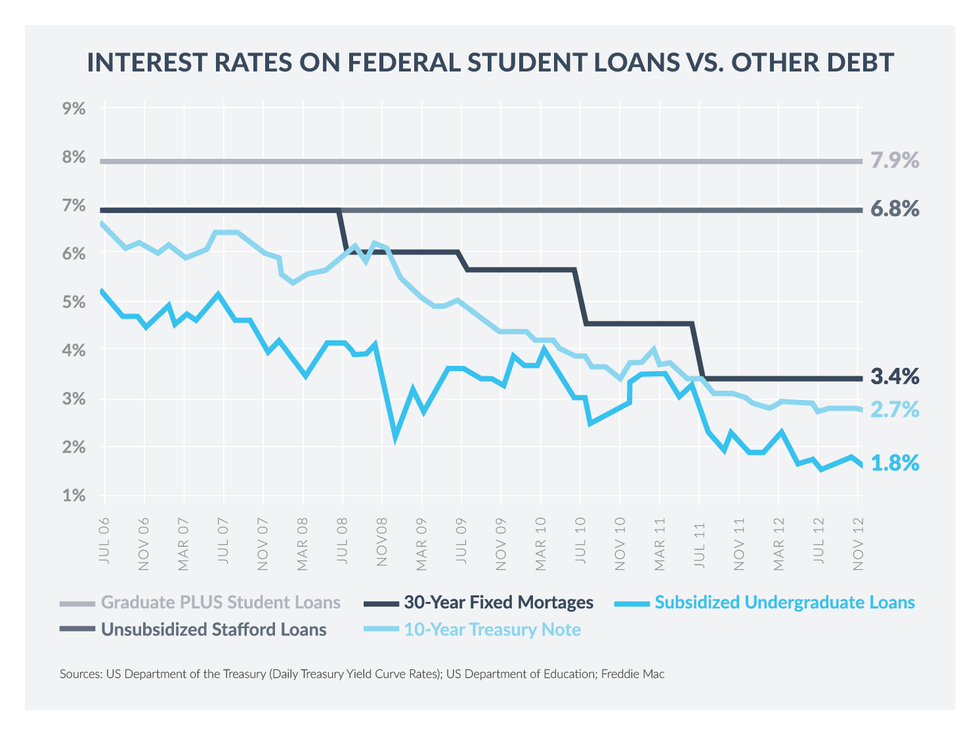

Interest rates for parents and graduate students havent fallen as quickly as loans for undergraduates.

- Direct loans for graduate and professional students declined 29.28% in the last year.

- PLUS loans for parents and for graduate and professoinal students declined 25.14%.

- Between the 2019-2020 and 2020-2021 academic years, interest rates for these loans saw their largest ever year-over-year declines.

- Graduate and Professional direct loan interest rates are decliing 38.27% slower than those for undergraduate loans.

- PLUS loan interest rates have declined 44.74% slower than those for undergraduates.

- Compared to Direct loans for graduate and professional students, PLUS loan interest rates have declined 10.48% slower.

- The now-defunct Federal Family Education Loan Program had a fixed interest rate of 8.5% for parents, graduates, and professional borrowers.

| Disbursement Period |

|---|

| 7.90% |

Review Your Eligibility For Pslf With Reduced Hours

If you were planning on applying for PSLF but lost your job or your hours were cut, you may think that youre no longer eligible. However, that may not be the case.

To qualify for PSLF, you must work full-time for a qualifying employer. But full-time employment for PSLF purposes may be different than you think the government defines full-time employment for PSLF as working 30 hours per week or what your employer considers full-time status, whichever is greater.

But what about if your hours were reduced, and you got a second job to make up the difference? You can meet the PSLF full-time requirement by working two or more jobs, as long as all of your employers are government agencies or non-profit organizations.

You can check your eligibility for PSLF with the Federal Student Aid PSLF Help Tool.

Also Check: How To Get An Aer Loan

What If My Award Letter Is Vagueand Just Says Direct Loans Or Stafford Loans

Oh man, we could rant for a while about why we think college award letters are awful. We have seen many instances where a college doesnt specify if the loan is subsidized or unsubsidized. In this case, we recommend you simply reach out to the financial aid office to clarify what youve been offered.

Choosing Federal Versus Private Student Loans

The interest rates we’ve discussed so far apply only to federal student loans. The other option is to take out a loan with a private lender. Unlike government-backed funding, private lenders use a risk-based approach to set student loan terms and interest rates, which may include your credit history and score, your income, existing debt and whether you have a co-signer.

Depending on those factors, you may find a private loan with a lower fixed interest rate. Keep in mind, however, that private loans don’t necessarily offer the same protections guaranteed with federal loans, including:

- Income-sensitive repayment: Your loan may qualify for up to eight repayment options depending on how much you owe and your income post-graduation. You can also extend the 10-year repayment period to up to 30 years if lower payments suit your budget.

- Debt forgiveness: There are a few paths to debt forgiveness for federal loans. If you have an income-driven repayment plan, the government may cancel the remaining balance on a loan you’ve paid for 20-25 years. Many federal loans are also forgivable if you work in teaching, nonprofit or public service fields. You can learn more about federal loan forgiveness on the Federal Student Aid website.

- Hardship options: Federal borrowers qualify for student loan forbearance or postponement in the event of job loss, illness, injury, returning to school or relief during a national emergency, like COVID-19.

Recommended Reading: How To Transfer Car Loan To Another Person

Refinance Loan Interest Rates

Federal and private student loans can only be refinanced through private lenders.

- One study found that if every eligible borrower refinanced their loans, the national average interest rate would drop to 4.2%.

- 52.8% of borrowers are eligible for refinancing.

- 33.3% of borrowers consolidate or refinance their loans.

For more information, see our report on Student Loan Refinancing.

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan. Temporary COVID-19 relief

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Also Check: Usaa Refinance Auto Loan Calculator

How To Calculate Your Student Loan Interest

For the example below, we use a 10-year standard repayment plan, an annual interest rate of 5.30% and a $30,030 principal balance .

It gets a little granular, but bear with us. We’ve assumed that you’re only making the minimum payments every month and that the interest rate is fixed .

Here’s what to do:

Step 1: Divide your annual interest rate by 365 days to determine your daily interest rate, or the amount of interest that accrues on a daily basis. Using the stats above, the first calculation would look like such:

0.053 / 365 days in a year = 0.000145, or 0.015% in daily interest

Step 2: Multiply your daily interest rate by your principal balance to determine how much interest you’re charged each day, or your daily interest amount. The second calculation would look like such:

0.000145 x $30,030 = $4.36 in daily interest

Step 3: Multiply your daily interest amount by the number of days in your billing cycle to determine how much interest you’re charged each month, or your monthly interest amount. The third calculation would look like such:

$4.36 x 30 days in billing cycle = $130.82 in monthly interest

In this scenario of an average public university student taking out a $30,030 loan with an annual federal interest rate of 5.30%, they would pay roughly $130.82 in interest alone each month. That’s an estimated $1,569.84 in total interest for the year. Paying off your loans more quickly would reduce this amount over time.

Private Student Loan Rates Could Rise As Well

Private student loans dont have one blanket interest rate like federal student loans do. Each private lender sets its own minimum and maximum interest rate, and the interest rate it offers to borrowers depends on the borrowers credit score and history.

Because private lenders set their own interest rates, theyre not directly affected by yearly changes to federal student loan interest rates. However, private lenders do tie rates to overall market trends, so rates tend to change when federal rates do. This was true last year as federal student loan rates dropped because of the pandemic, private student loan rates also dropped. The inverse is true as well: As the economy begins to recover in 2021, private student loan interest rates could start to rise.

Also Check: Can You Transfer Car Payments To Another Person

Apply For Forbearance Or Deferment

In some cases, you may not be able to afford your payments after the CARES Acts provisions end. Whether youre unemployed, have a medical emergency, or another financial hardship, contact your loan servicer to discuss your options.

Federal loan borrowers may qualify for loan forbearance or deferment, programs that allow you to temporarily postpone your payments while you recover.

Times When Refinancing Federal Loans Makes Sense

Refinancing your debt can be a smart idea, but its not for everyone. If you have federal loans, there are some major drawbacks. After you refinance, your federal loans become private ones, and youll no longer be eligible for federal benefits including the CARES Acts measures if theyre extended or federal loan forgiveness if that comes later on.

After weighing the pros and cons of refinancing, you may decide that refinancing makes sense. Below are four examples of situations where refinancing could be a good decision:

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Types Of Federal Student Loans

There are four types available, all of which are part of the William D. Ford Federal Direct Loan Program, also known as Stafford loans.

These four types include:

1. Direct Subsidized: Direct subsidized are intended for undergraduate students who demonstrate financial need. Interest on these does not accrue while you are still in school.

2. Direct Unsubsidized: Undergraduate, graduate, and professional degree students can borrow unsubsidized options each year to pay for school. Unlike subsidized, these do accrue interest while you are in school.

3. Direct PLUS: These are designed for parents who are paying for their childrens undergraduate education, or for students enrolled in a graduate or professional degree program. These can be used to pay for your schools total cost of attendance.

4. Direct Consolidation: Lastly, direct consolidation options are used to consolidate all of your federal debt into one balance with one monthly payment.

Together, these four federal options are designed to provide funding to any college student in need of financial assistance at lower costs than private student options.

How Is Student Loan Interest Applied

As you make payments on your student loan, your balance and the amount of interest you accrue will drop. With lower interest charges, more of your payments are applied to your principal.

Over the life of your loan, your interest paid will decline each month, which accelerates your principal payment. Thats how it works with student loan amortization basically a fancy way of saying paying down principal on a loan.

Remember, your payment amount goes toward interest and any outstanding fees before it reduces your principal.

If you have an unsubsidized loan or are past the subsidy period, your loan payoff date requires you to make the same minimum payment each month. If youre on a payment plan or have deferred payments, interest continues to accrue. This amount is added to your principal, increasing your student loan balance.

If youre able, it can make sense to pay at least the interest each month. If you dont, your loan balance will continue to grow, and you will owe interest on the interest you didnt pay in previous months.

In fact, if you have the ability, making interest payments while youre in school can save you money in the long run.

The difference is even more pronounced when you think of interest paid on a parent PLUS loan. Lets say you take $5,000 in parent PLUS loans each year your child is in school. Heres how the interest builds up with a 7% interest rate:

Don’t Miss: Where To Refinance Auto Loan

What If I Cant Afford Repayments

When life happens and unexpected circumstance hurt your ability to pay back your loans, you have options especially if you have government student loans. Making payments on time and in full is key to maintaining a good credit score, which helps you in many areas of life like getting a car, buying a home, supporting a family and travelling.

1. Negotiate a better repayment plan with your lender

One surprisingly effective but easily overlooked solution to managing debt is to contact your lender, explain that youre struggling financially and ask if theyll agree to a new payment arrangement thatll help you meet your obligations. Be sure to explain any specific factors or circumstances affecting your ability to pay .

Lenders would rather work with you than risk losing money, so you may be offered an extended term with lower monthly payments, a different interest rate, permission to make a late payment without penalty, deferred payments or some other solution. By doing this, you could protect both your wallet and your credit score.

2. Refinance your student loans

One drawback is that student loans already tend to come with lower interest rates than most credit products, so it may be difficult to find a loan that lets you save money. However, if you have non-student debt such as credit cards, car loans, personal loans or mortgages, refinancing those could save you money on interest, which can then be applied to your student loans.

3. Government repayment assistance plans

You Have A High Interest Rate

Depending on the type of loans you have and the year you took them out, you could have a very high interest rate. In the past, federal loans have had rates as high as 8.5%.

Such a large rate can cause you to pay thousands in interest charges, and it can be difficult to get out from under your debt.

Right now, student loan refinancing lenders are offering some of the lowest rates ever fixed-rate loans are as low as 2.5%. Refinancing your loans can allow you to secure a lower rate and save money.

For example, Janet had $30,000 in student loans at 8.5% in interest and a 10-year repayment term. By the end of her loan term, she paid $14,635 in interest charges.

Donna also had $30,000 in student loans at 8.5% interest and a 10-year repayment term. However, Donna decided to refinance her loans and qualified for a 10-year loan at 5% interest. With her lower rate, she paid just $8,184 in interest charges a savings of over $6,400 compared to Janet.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Private Loan Interest Rates

Private lenders have started to implement strategies similar to federal relief in order to keep default rates at historic lows the current private loan default rate is 2%.

- Official report estimates for the overall average private student loan interest rate generally range from 6% to 7%.

- Among major private lenders, 12.99% is the highest annual percentage rate .

- The lowest available APR among private lenders is 1.04% *.

- 93% of private undergraduate loans have a co-signer, which typically lowers a borrowers interest rate.

- 60% of graduate loans are co-signed.

*Both of these rates are from CollegeAve.