Mortgage Loan Limits For Conventional Fha & Va Loans

Mortgage loan limits for every California county, as published by Fannie Mae & Freddie Mac, the Federal Housing Administration , and the Department of Veterans Affairs

Show My

This does not mean borrowers looking for luxury homes do not have financing options. In fact, jumbo loans are currently very popular financing options in San Diego and statewide. However, lenders dealing in jumbo loans lose the federal protections granted to them by adhering to conventional mortgage loan limits. In order to help you learn about the loan limits of each federally backed lender, lets take a look at the conventional mortgage loan limits for 2022 in California.

California Conventional Loan Limits 2022

Increased home prices and higher demand for more homes fueled a major surge in not only home values but also conforming loan limits. Government regulators realized the changes that were necessary to make homeownership possible for more borrowers. As a result, Californias 2022 conforming loan limits are increasing to $647,200, an increase of $98,950.

With the recent run-up in-home price appreciation affecting many markets throughout the country, we wanted to step in and provide support for borrowers, said Kimberly Nichols, Senior Managing Director of Broker Direct Lending at PennyMac. This will specifically help those trying to purchase a home or access equity in their property while rates are relatively low.

The industry is also predicting an increase for high-cost areas such as LA County and Orange County in California to be raised from $822,375 to $970,800 in 2022.

Even though the increase isnt official until 2022, several lenders have jumped the gun and are already writing loans exceeding the 2021 conforming loan limit of $548,250 because of the high increase in home values this year.

Higher conventional loan limits are only a month away, but right now we may be able to find you a lender that is already using the 2022 conforming loan limits until they become the norm for every lender in 2022.

Va Loan Limits In Sacramento County

VA Loans are similar to FHA Loans in that it allows you to buy a home with very little money down.However VA Loans are only available to veterans of the Armed Forces.With VA loans the Department of Veterans Affairs guarantees the loan on the veteran’s behalf.The maximum the VA will guarantee is set to the same amount as the single-family Fannie/Freddie Loan Limit.So the Sacramento County, CA 2022 VA Loan Limit is $675,050

Recommended Reading: How Much Land Can You Buy With A Va Loan

How Much Is A Jumbo Loan In California

4.3/5LoanCaliforniaJumbo loanCalifornialoancostjumbo loansloans

$484,350

Likewise, what is the jumbo loan limit in 2019 in California? $484,350

Also know, how much is a conforming loan in California?

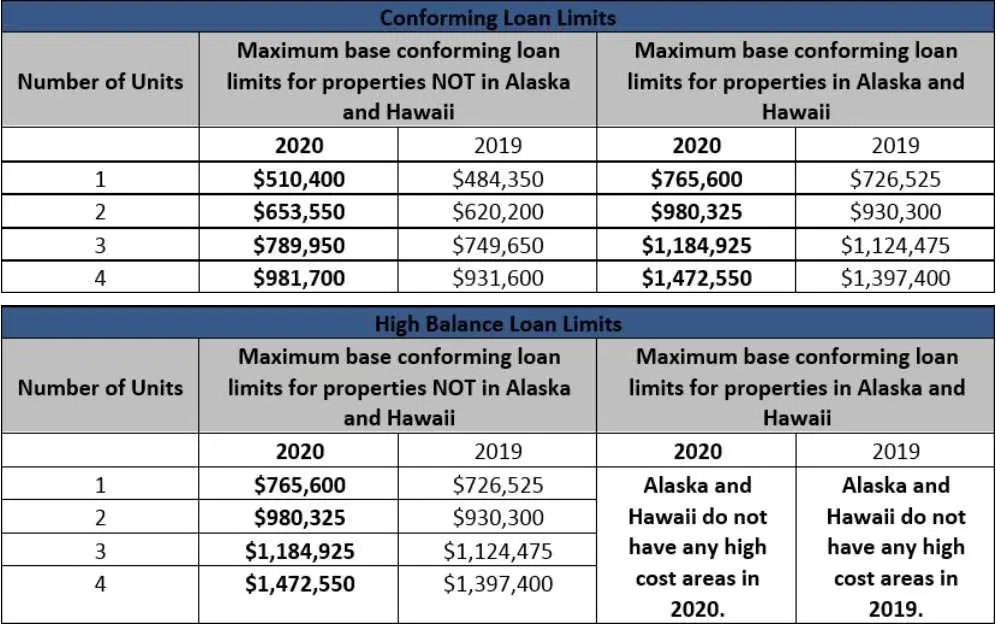

You’ll notice that most counties within California have a 2020 conforming loan limit of $510,400, for a single-family home. Higher-priced areas, like those in the San Francisco Bay Area, have conventional limits of up to $765,600 due to higher home values.

What is the maximum conforming loan amount in California?

$484,350

What Is The Conforming Loan Limit

The conforming loan limit is the dollar cap on the size of a mortgage that the Federal National Mortgage Association and the Federal Home Loan Mortgage Corp. will purchase or guarantee. Mortgages that meet the criteria for backing by the two quasi-government agencies are known as conforming loans.

Under the mandate of the Housing and Economic Recovery Act of 2008, the conforming loan limit is adjusted every year to reflect changes in the average price of a home in the United States. The annual limit is set by Fannie Maes and Freddie Macs federal regulator, the Federal Housing Finance Agency , and announced in November for the next year. The FHFA uses the October-to-October percentage increase/decrease in the average house price, as indicated in the House Price Index report issued by the Federal Housing Finance Board , to adjust the conforming loan limit for the subsequent year.

You May Like: Typical Student Loan Debt

Whats The Jumbo Loan Limit For 2022

Technically theres no jumbo loan limit for 2022.

Since jumbo mortgages are above the conforming loan limit, theyre considered nonconforming and are not eligible for lenders to assign to Fannie Mae or Freddie Mac upon closing.

That means the lenders offering jumbo loans are free to set their own criteria, including loan limits.

For example, one lender might set its jumbo loan limit at $2 million, while another might set no limit at all and be willing to finance homes worth tens of millions.

But the amount you can borrow via a jumbo or nonconforming loan is limited by your finances.

You need enough income to make the monthly mortgage payments on your new home. And your debttoincome ratio cant exceed the lenders maximum.

You can use a mortgagecalculator to estimate the maximum home price you can likely afford. Or contact a mortgage lender to get a more accurate number.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: Fha Land Loan

Is A Conforming Loan The Same Thing As Conventional

The terms conforming and conventional are sometimes used interchangeably. But these two adjectives mean different things, and sometimes they overlap. A conventional mortgage loan is one that does not receive any kind of government insurance, guarantee or backing. This distinguishes them from the government-backed home loan programs like FHA, VA and USDA.

A conforming loan is simply a conventional mortgage product that meets or conforms to the size limits and other criteria used by Freddie Mac and Fannie Mae . Learn more about the distinction between conventional and conforming.

Raising The Conforming Loan Limit Backed Freddie Mac And Fannie Mae May Lead To Higher Prices Due To Increased Competition

The U.S. governments plans to raise the cap for mortgages backed by Freddie Mac and Fannie Mae to close to $1 million in high-cost areas could push prices even higher.

The U.S. governments plans to raise the cap for mortgages backed by Freddie Mac and Fannie Mae to close to $1 million in high-cost areas are meant to assist home buyers as prices continue to rise, but some warn that the move may not make much of a difference and could push prices even higher.

The conforming loan limitor the maximum amount of a mortgage that Freddie Mac and Fannie Mae will guarantee or buyis set to jump in 2022, The Wall Street Journal reported on Tuesday. For most areas, the limit is set to rise from $548,250 to $650,000, but in high-cost markets, such as New York City or the Bay Area in California, it would jump from $822,375 to just under $1 million. The exact loan limits are set to be announced Nov. 30 by the Federal Housing Finance Agency, which oversees Freddie Mac and Fannie Mae.

The median home price in the U.S. was $380,000 in October, up 8.6% compared to last year and up 21.8% compared to 2019, according to a report released last week by Realtor.com.

More: Manhattan Luxury-Home Market Inked a Half-Billion in Deals Last Week

The increased limits mean more home buyers will have access to conventional loans, which typically have lower down payments and interest rates than the jumbo loans available for higher-priced properties.

Newsletter Sign-up

Recommended Reading: How Much Do Loan Officers Make In Commission

Minimum And Maximum Loan Amounts

If you are wondering whether youll need a jumbo loan, you need to consider the limits set for conforming loans and U.S. Federal Housing Administration loans. The agency-set maximum limits for these loans provide a baseline for jumbo loans.

Most parts of the country have one maximum loan amount for conforming loans. In some high-cost areas, such as Washington D.C. and certain California counties, the threshold for the maximum conforming loan is higher.

For 2022, the Federal Housing Finance Agency raised the maximum conforming loan limit for a single-family property from $548,250 to $647,200. In certain high-cost areas, the ceiling for conforming mortgage limits is 150% of that limit, or $970,800 for 2022.

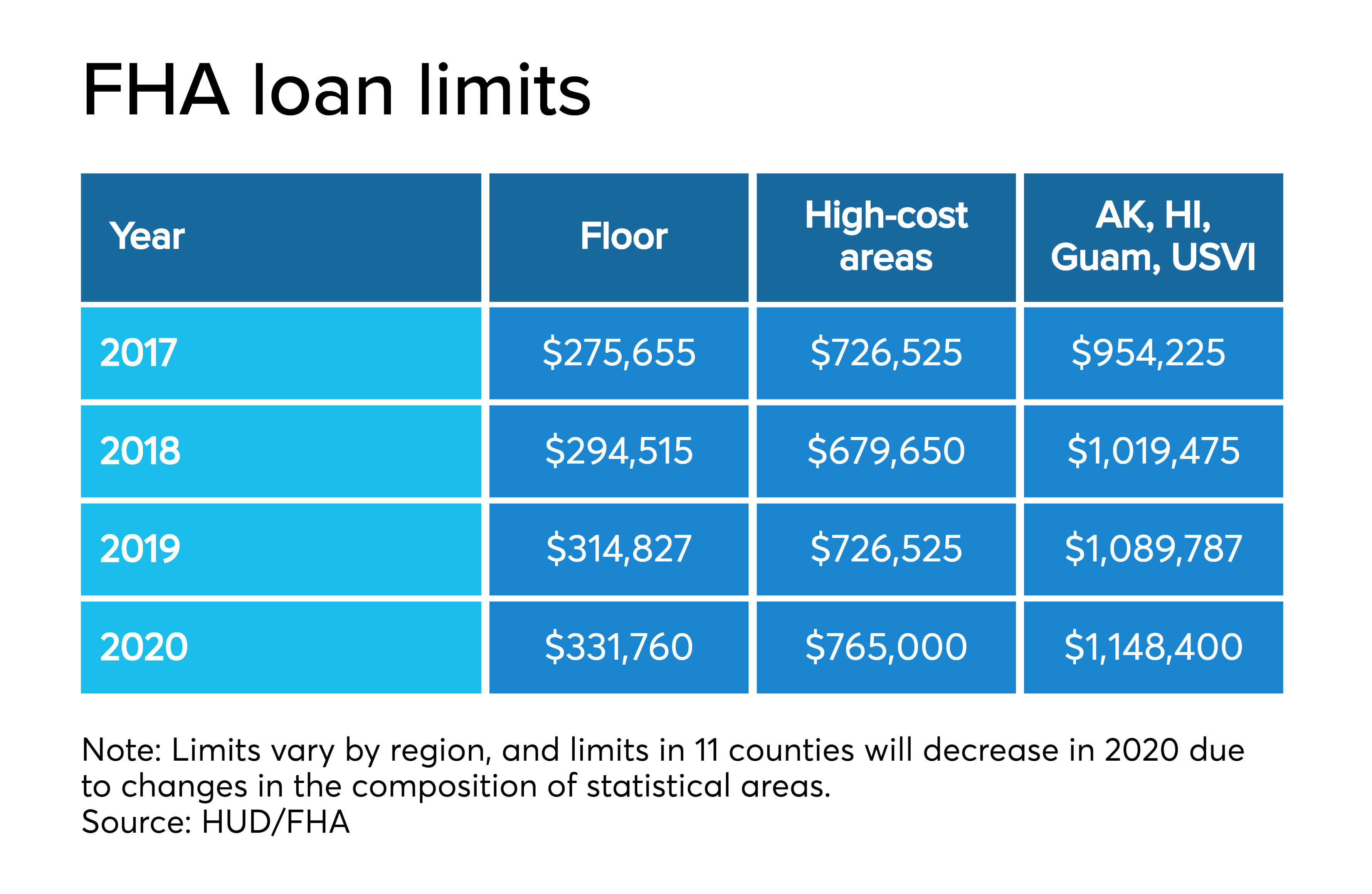

Those limits apply to conforming loans that follow Fannie Mae or Freddie Mac guidelines. A different loan limit kicks in if youre buying a home in 2022 using an FHA loan, which is backed by the Federal Housing Administration. The maximum FHA loan limit for one-unit properties in low-cost areas in 2022 is $420,680, up from $356,362 in 2021. The maximum limit for one-unit properties in approximately 70 high-cost counties has been raised to $970,800, up from $822,375 in 2021.

Why Conforming Loan Limits Matter In California

Here are some of the reasons why Loan Limits Matter:

Also Check: Current Usaa Car Loan Rates

What Qualifies As Jumbo Loan

A jumbo loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan. The maximum amount for a conforming loan is $548,250 in most counties, as determined by the Federal Housing Finance Agency . Homes that exceed the local conforming loan limit require a jumbo loan.

California Realtors Commend Fhfa For Raising Fannie Mae And Freddie Mac Conforming Loan Limits

Image by Kelly Alpert from Pixabay December 6, 2021 – LOS ANGELES The CALIFORNIA ASSOCIATION OF REALTORS® last week issued the following statement in response to the Federal Housing Finance Agencys announcement to increase the 2022 conforming loan limits for mortgages acquired by Fannie Mae and Freddie Mac to $647,200 on one-unit properties and a cap of $970,800 in high-cost areas. The previous loan limits were $548,250 and $822,375, respectively.

With Californias home prices climbing so significantly during the pandemic, C.A.R. commends the FHFA for recognizing the record-setting home price increases and raising maximum conforming loan limits in high-cost markets to $970,800, said 2022 C.A.R. President Otto Catrina. Conforming loans provide safe and affordable mortgages to Californias homebuyers across the state. If loan limits were not allowed to increase every year to keep up with home prices, first-time and moderate-income homebuyers across the state would not have access to affordable mortgage capital, which reduces homeownership opportunities for those who need it the most.

C.A.R. and the NATIONAL ASSOCIATION OF REALTORS® both have long advocated for loan limits to reflect an areas cost of housing. As a result of C.A.R.s and NARs efforts, areas with high median home prices have benefited from a loan limit above the national conforming loan limit.

You May Like: Usaa Auto Loan Reviews

How The Conforming Loan Limits Work In 2021

Conforming loan limits are tied to home prices. Each year, the FHFA updates its baseline loan limit based on its House Price Index report, which tracks the average increase in home values over the previous year.

Between 2019 and 2020, home values rose an average of 7.42%, according to the FHFA HPI, which means that the conforming loan limit also rose 7.42% from 2020 2021.

Conforming loans are great for consumers because they typically come with lower interest rates than other, non-conforming loan types.

If youre trying to purchase a home whose sale price exceeds the conforming loan limit for your area, increasing your down payment so that you stay within the limit can be one way to be able to enjoy the benefits of a conforming loan without having to take out a jumbo loan.

What Is A Jumbo Loan

A jumbo loan is any loan that exceeds FHFA loan limits. Jumbo loans can be conforming or non-conforming. They can also be conventional loans if they’re not part of a federal government loan program.

Taking out a jumbo loan is something you may consider if you’re buying a more expensive home. A regular conforming loan may not be large enough to complete the purchase based on the conforming loan limits for the county or state the home is located in.

Also Check: Car Loan Calculator Usaa

What Are Jumbo Loan Rates

Jumbo home loans come with a fixed rate which indicates the amount of interest you are charged in exchange for the amount lent by your financing company. Rates can vary and are influenced by individual factors and Federal Reserve benchmarks.

Interest rates for jumbo loans change daily. You can visit Bankrate toview current jumbo loan interest rates.

Conforming Loan Limits In California 2022

The U.S. Median Home Price has increased over 15% year over year so it is no surprise that the Federal Housing Financing Agency has increased the Conforming Loan Limits significantly for 2021.

Conforming Loan Limits refer to the maximum loan amounts that Fannie Mae and Freddie Mac will allow for financing for one, two, three, and four-unit properties.

The two tables below show the new 2022 Conforming Loan Limits for high and low cost areas.

Also Check: Usaa Rv Loan Rates

Do Conventional Loan Limits Change

Every year, the Federal Housing Finance Agency looks at conventional loan limits. They determine the conventional loan limit and high-cost limit in certain areas based on the median cost of homes in the nation and specific areas.

Bottom Line

The California conventional loan limits change annually and they typically increase as we see with the California 2022 conforming loan limits. This makes it easier for borrowers with all qualifications to secure conventional financing.

Jumbo loans can be harder to secure because of the risk they involve. Only borrowers with great credit, low debts, and a lot of assets qualify, which rules out the general population. Fortunately, with higher conventional loan limits, loans are easier to get in California, making homeownership a reality for millions of people.

Buying A Multifamily Home With An Fha Loan

As long as you plan to live in one of the units for a year after you purchase it, you can use the higher multifamily home FHA loan limits to buy a two- to four-unit home. Qualified buyers can purchase a multifamily home with a low 3.5% down payment and use the rental income to help qualify (conventional guidelines typically require at least a 15% down payment for multifamily purchases. In California, this gives you more than a million dollars worth of borrowing power in the most expensive areas:

- $1,243,050 for a two-unit home

- $1,502,475 for a three-unit home

- $1,867,275 for a four-unit home

Also Check: Www Upstart Com Myoffer

Are Jumbo Loan Rates Higher

Jumbo mortgage rates Taking out a jumbo mortgage doesn’t immediately mean higher interest rates. In fact, jumbo mortgage rates are often competitive and may be lower than conforming mortgage rates. … But, if lenders are able to provide jumbo mortgages, they’ll usually keep their rates competitive.

California Conforming Loan Limits By County

Update, 12/1/21: Federal housing officials recently announced the 2022 California conforming loan limits. As expected, the limits were increased due to significant home-price gains over the past year. We have updated this page to include the revised numbers for 2022.

Officials from the Federal Housing Finance Agency announced this change on November 30, 2021. The table below has been fully updated to show the increased limits for all counties across the state.

Youll notice that most counties within California have a 2022 conforming loan limit of $647,200, for a single-family home. Higher-priced areas, like those in the San Francisco Bay Area, have conventional limits of up to $970,800 due to higher home values. Other counties fall somewhere in between these floor and ceiling amounts.

Read Also: Usaa Car Financing Calculator

What Does 30 Year Fixed Rate Conforming Mean

A fixed-rate mortgage comes with an interest rate that wont change for the life of your home loan. A conventional mortgage is a loan that conforms to established guidelines for the size of the loan and your financial situation. Terms of these conventional loans typically range from 10 to 30 years.