Any Improvements Made To A Rental Property

You might use the money from a cash-out refinance to improve or repair a rental property and can deduct these expenses from your federal taxes. Any improvements or repairs you make to a property you rent out are almost always tax deductible. This is because the IRS considers any money you earn from rent as personal income. You can also deduct closing costs, interest and insurance you pay on a rental property from your income as business expenses.

Con: Your Home Equity Loan Isnt Automatically A Done Deal

Before the crisis in the housing of 2007, the process of getting the home equity loan was relatively simple If you owned some equity on your property, on papers, it was possible to qualify for the loan. Since 2007 lenders have begun to examine home equity applications more closely.

Youre unlikely to get a loan that exceeds 80 percent of the equity in your home which is its value less what you due on your mortgage and the process will likely be rigorous. The lender wants to be sure that it can be able to return its funds and will ask you to provide tax documents and proof of income and other information that proves the ability to pay monthly payments.

How Home Equity Tax Works In Canada

Taxing home equity in Canada stems from the tax laws on capital gains. Capital gains are profits from selling an asset, such as a property or financial investments.

Do you have to pay taxes on home equity? The confusing answer is yes and no. You do have to pay taxes on home equity when you sell a property that is not your primary residence and it has increased in value since the time you bought it. The amount of taxes on home equity payouts of this type will depend on your other income that year and your tax bracket.

You do also have to pay taxes on home equity increases when you sell an investment property at a profit , or a second home, such as a cottage.

What is home equity tax in Canada for your primary residence? Currently, there is no tax on home equity when you sell the home you live in. No matter how much profit you make you will pay no taxes on the home equity payout.

You May Like: Can I Refinance My Car Loan With The Same Lender

Gift Of Equity Steps For The Seller

A gift of equity sale requires a gift letter signed by the sellers. This letter states the amount of equity that the sellers are gifting and the address of the property. The letter also lists the relationship between the owners and the buyers and must include a statement that the equity is a gift, one that the buyers dont have to repay.

Sellers must also hire an appraiser to determine the current market value of the home. This helps them determine how much equity they are actually giving. If the home is appraised at $180,000 and the owners are selling it for $100,000, they are providing a gift of equity of $80,000.

How Do Tax Laws Affect Cash

Its important that we go over exactly how cash-out refinances work before we look at how the IRS views the money you get from this transaction. Basically, you replace your existing mortgage with a loan that has a higher principal balance. Your lender then gives you the difference in cash. You can use the money from a cash-out refinance for almost anything. Many homeowners use it to consolidate debt or make home improvements.

Lets look at an example. Say you have $100,000 left on your mortgage loan and you want to do $30,000 worth of repairs. Your lender might offer a new loan worth $130,000 at 4% APR. You take the refinance and your lender gives you $30,000 in cash a few days after closing. You then pay back your new mortgage loan over time, just like your old loan.

One of the first questions that homeowners have when they take a cash-out refinance is whether they need to report it as income when they file their taxes.

As you can see, the cash you get from this kind of refinance isnt free money. Its a form of debt that you must pay interest on over time. The IRS doesnt view the money you take from a cash-out refinance as income instead, its considered an additional loan. You dont need to include the cash from your refinance as income when you file your taxes.

Protect what’s precious

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Are Home Equity Loans Tax

Here’s what you need to know about your taxes when borrowing against your home.

Get our 43-Page Guide to Real Estate Investing Today!

Real estate has long been the go-to investment for those looking to build long-term wealth for generations. Let us help you navigate this asset class by signing up for our comprehensive real estate investing guide.

Chances are, you’ll reach a point in life when you’re inclined to borrow money for one purpose or another. You may need a loan so that you can renovate your home, fix your car, or pay for college. Or you may want that money to treat yourself to a much-needed vacation.

You have several choices for borrowing money at your disposal. Personal loans are an option if your is good, and you could also charge expenses on a and pay it off over time. But personal loans aren’t always easy to qualify for, and credit card debt is generally bad news. That’s why you might consider borrowing against your home, provided you have enough equity in it to do so. Not only is that generally an affordable option, but it may offer some tax benefits to boot.

What Are The Tax Benefits Of A Home Equity Line Of Credit

If home improvements are part of your 2020 plan, you may be surprised to hear that you can still deduct interest on home equity loans and lines of credit. Although tax laws have changed in recent years, home equity debt still has tax benefits that can effectively reduce the cost of home improvement projects.

Learning how that deduction works can help when choosing the best way to pay.

Before 2018, deducting interest paid on home equity loans was relatively straightforward. But the 2017 Tax Cuts and Jobs Act changed things. Now, you can deduct interest costs on home equity debt only when you use the funds to buy, build, or make substantial home improvements.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

The Mortgage Interest Deduction Limit Has Gone Down

Under the current rules, homeowners can deduct the interest on up to $750,000 of home mortgage debt . That includes both your primary mortgage and any home equity loan or line of credit, combined. Given the high home values in Hawaii, this may impact a lot of island homeowners.

The $750,000 limit on home owner tax deductions generally applies to mortgages taken out after December 15, 2017. However, if you were in a binding contract to purchase your home on December 15, 2017, and the home was purchased before April 1, 2018, the higher $1 million limit still applies.

How Home Equity Loans Work

Home equity loans can provide access to large amounts of money and be a little easier to qualify for than other types of loans because you’re putting up your home as collateral.

-

You can claim a tax deduction for the interest you pay if you use the loan to buy, build, or substantially improve your home, according to the IRS.

-

Youll probably pay less interest than you would on a personal loan, because a home equity loan is secured by your home.

-

You can borrow a fair bit of money if you have enough equity in your home to cover it.

-

You risk losing your home to foreclosure if you fail to make loan payments.

-

Youll have to pay this debt off immediately and in its entirety if you sell your home, just as you would with your first mortgage.

-

You may have to pay closing costs, unlike if you were to take out a personal loan.

Also Check: Does Va Loan Work For Manufactured Homes

Pay The Irs Bill With A Credit Card

Although you can’t use a credit card when it comes to a downpayment on a new home, the IRS accepts all major credit card payments for taxes owed. One possible advantage is that if you use a rewards credit card, paying your taxes may earn rewards such as cash back or travel bonuses.

The catch to using a credit card is that the IRS charges you a processing or “convenience” fee. Another concern is that if you are unable to pay off the credit card balance quickly, you may have to pay higher interest than in other loans to pay off taxes. The expected time frame for paying off your credit card, and the associated interest charges, must be factored into whether or not using a card is a reasonable option.

Succumbing To Bad Habits

Let’s say you apply money from the cash-out refinance to erase credit card debt. While the cash can fix your short-term debt problem, it might simply be a bandage that hides a longer-term wound. You could be jeopardizing ownership of your home if this money only fixes a small issue that’s part of broader monetary troubles, such as spending that regularly exceeds your household budget. If you find yourself in a situation like this, it might be wise to seek help from a nonprofit credit counselor.

You May Like: What Happens If You Default On Sba Loan

Guidelines For Home Equity Loan Tax Deductions

The standard rule is that a couple can deduct the interest paid on up to $100,000 in home equity loan debt and a single filer can deduct the interest on up to $50,000. So if a couple has a $100,000 home equity loan and paid $7,000 in interest on it over the course of the year, they can take a $7,000 deduction on their joint tax return.

That’s going to cover most home equity borrowers. But there’s an added wrinkle that can raise those limits depending on how you use the money.

The IRS allows couples filing jointly to deduct the interest on home loans for up to $1 million in home acquisition debt, and up to $500,000 for single filers. Most of the time, that’s going to be the deduction for the primary mortgage used to purchase the home.

However, the IRS defines home acquisition debt as debt used to “buy, build or improve” a home. So if you take out a home equity loan and use it for home repairs or improvements, it’s considered home acquisition debt and subject to the higher $1 million/$500,000 limits.

So if a single filer were to take out a $75,000 HELOC and use it to build an addition onto his home, he could deduct the home equity loan interest paid on the entire $75,000. But if he were to use it to buy a boat or pay for his daughter’s college expenses, he could only deduct the interest paid on the first $50,000 of the amount.

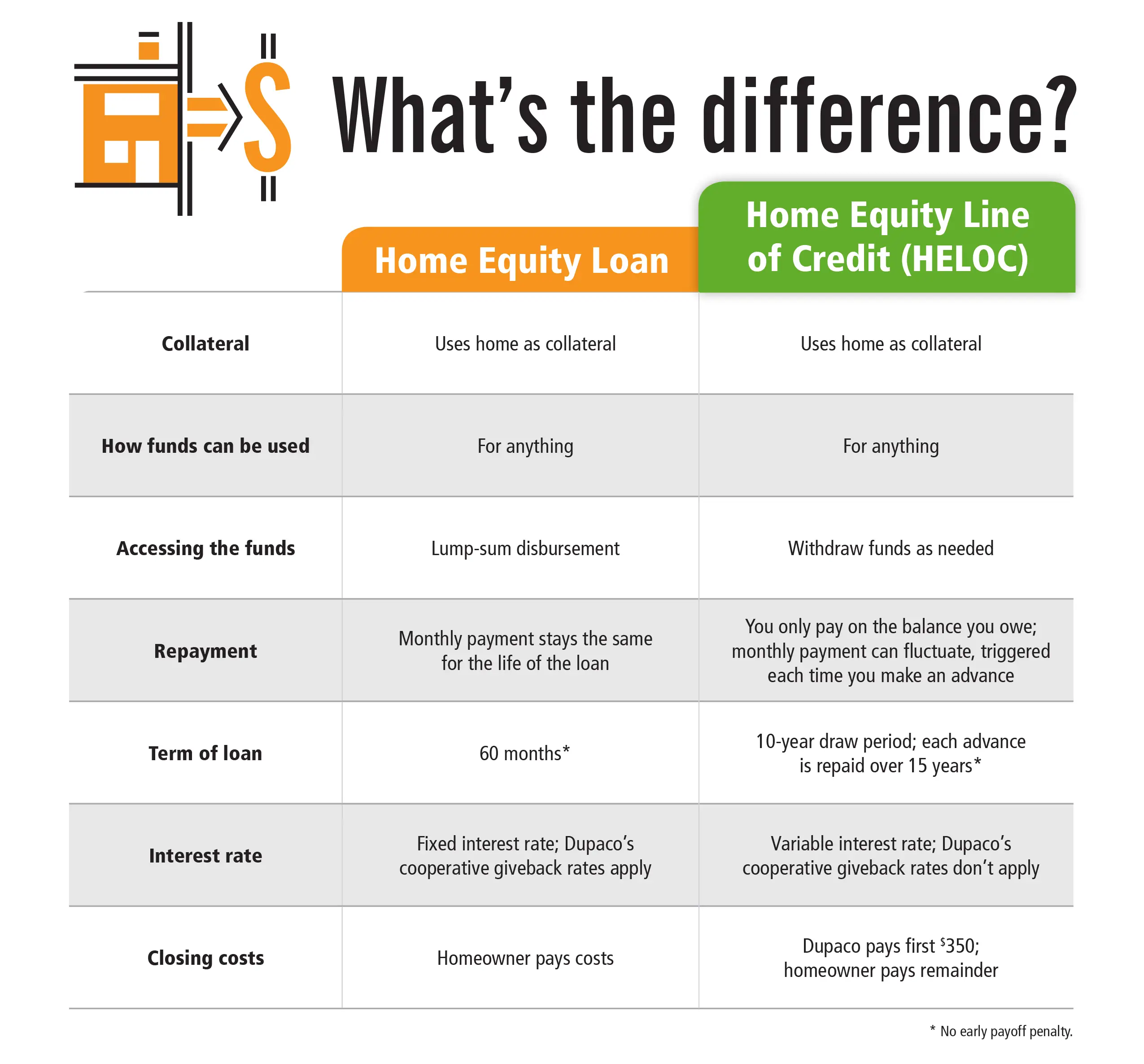

What Is A Home Equity Line Of Credit

The other major option in home equity borrowing is a home equity line of credit, or HELOC. A HELOC is a form of revolving credit, kind of like a credit card — you get an account with a certain maximum and, over a certain amount of time , you can draw on that maximum as you need cash.

The draw period is usually five to ten years, during which you pay interest only on the money you borrow. At the end of the draw period, you’ll begin paying back the loan principal. Your repayment period will usually be in the ten- to 20-year range, which means that, as with a home equity loan, you’ll pay less interest than you would on a traditional 30-year fixed mortgage, but your monthly payments will be proportionally higher. HELOCs sometimes have annual maintenance fees, which generally range between $15 to $75, and many have cancellation fees that can be several hundred dollars.

Similar to home equity loans, the amount of money you can borrow with a HELOC is based on the amount of equity you have. Usually that means you will be able to borrow some percentage of the home’s value, reduced by the existing mortgage — usually 75% to 80%. Unlike home equity loans, the interest rate on a HELOC is usually variable, so it can start low but climb much higher. HELOC interest rates are usually tied to the prime rate, reported in The Wall Street Journal, and the maximum rates are often very high — similar to the rates on a credit card.

Don’t Miss: How Long For Sba Loan Approval

If You Have Poor Credit

Home equity loans can be easier to qualify for if you have bad credit, because lenders have a way to manage their risk when your home is securing the loan. Nevertheless, approval is not guaranteed.

Collateral helps, but lendershave to be careful not to lend too much, or they can risk significant losses. It was extremely easy to get approved for first and second mortgages before 2007, but things changed after the housing crisis. Lenders are now evaluating loan applications more carefully.

All mortgage loans typically require extensive documentation, and home equity loans are only approved if you can demonstrate an ability to repay. Lenders are required by law to verify your finances, and you’ll have to provide proof of income, access to tax records, and more. The same legal requirement doesn’t exist for HELOCs, but you’re still very likely to be asked for the same kind of information.

Your credit score directly affects the interest rate you’ll pay. The lower your score, the higher your interest rate is likely to be.

Home Equity Loan Tax Deduction

You can borrow money against the value of your home with a home-equity loan or a home-equity line of credit. You can secure both with a second mortgage. Both provide access of up to 100% or more of the equity in your home.

A home-equity loan is usually distributed in one lump sum. Its rate is often fixed for the entire term of the loan.

You can access a home-equity line of credit at your discretion. Unlike a home-equity loan, the rate for a home-equity line of credit changes based on an index. It often converts to a fixed rate after a set period of time.

Both provide access of up to 100% or more of the equity in your home.

Tax advantages

If you itemize, you might be able to fully deduct interest payments on either type of loan. This distinguishes these loans from other forms of consumer credit. Since the collateral is your home, interest rates are lower than other consumer loans or credit cards.

Potential risks

However, since your house is the collateral for these loans, failure to repay can cost you your home. Make sure you think carefully about what you plan to buy with your loan or credit line. A home-equity loan with a lower, set amount might be better than a flexible line of credit.

To learn more, see these tax tips:

- Second Home

Are you a wage earner in Oklahoma? Find out everything you need to know about Oklahoma tax rates and brackets, with help from the tax pros at H& R Block.

Read Also: Can You Use A Va Loan To Buy Land And A Manufactured Home

Is Interest On A Home Equity Line Of Credit Tax Deductible

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

If you need cash and have equity in your home, a home equity loan or home equity line of credit can be an excellent solution. But the tax aspects of either option are more complicated than they used to be. Interest on a home equity line of credit may be tax deductiblebut there are conditions.

There are two types of home equity lending: a fixed-rate loan for a specified amount of money or a variable-rate line of credit . Depending on your need for the funds and how you plan to use them, one option may work better. Interest paid on either loan, like the interest on your first mortgage, is sometimes tax-deductible.

If You Decide To Cancel

If you decide to cancel, you must tell the lender in writing. You may not cancel by phone or in a face-to-face conversation with the lender. Your written notice must be mailed, filed electronically, or delivered, before midnight of the third business day.

If you cancel the contract, the security interest in your home also is cancelled, and you are not liable for any amount, including the finance charge. The lender has 20 days to return all money or property you paid as part of the transaction and to release any security interest in your home. If you received money or property from the creditor, you may keep it until the lender shows that your home is no longer being used as collateral and returns any money you have paid. Then, you must offer to return the lenders money or property. If the lender does not claim the money or property within 20 days, you may keep it.

If you have a bona fide personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel and eliminate the three-day period. To waive your right, you must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel. The statement must be dated and signed by you and anyone else who shares ownership of the home.

The federal three day cancellation rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when:

You May Like: Mortgage Loan Officer Salary Plus Commission