Subsidized Direct Student Loan Interest

Subsidized Federal Direct Stafford loans dont accrue interest while the student is in school or during the six-month grace period after the student graduates or drops below half-time enrollment.

Technically, subsidized loans do accrue interest, but the interest is paid for the student loan borrower by the federal government.

The government pays interest that accrues during the time the borrower is in-school and grace periods, as well as other periods of authorized deferment .

Consolidating During A Grace Period

You can consolidate during grace periods. This may lead to a lower interest rate on a Direct Consolidation loan, but only if you are consolidating variable rate loans. However, once you consolidate, you lose any remaining grace period. You will generally receive your first bills within 60 days after the new Direct Consolidation loan is made. The good news is that the Department explains on its web site that if any loan you want to consolidate is still in the grace period, you can delay entering repayment on your new Direct Consolidation Loan until closer to your grace period end date. You can indicate this when you apply, and the consolidation servicer will wait to process your application until the appropriate time.

How Does Interest Work For Subsidized Loans

Direct subsidized loans are student loans offered by the federal government to undergraduate students who demonstrate financial need. They start accruing interest the day you receive your loan.

The federal government pays the interest on subsidized loans while you’re a student at least half-time, during the six-month grace period following graduation and during any loan deferments. Once your grace period ends, you’ll begin making loan payments, including interest, on your direct subsidized loans.

Recommended Reading: What The Highest Apr For Car Loan

Study Loans From Commercial Banks

Major banks in Singapore offer study loans with interest rate that ranges 4% p.a. 6% p.a. and tenures that range between one to 10 years.

To qualify, students need to have an annual income of at least S$18,000 or a loan guarantor who makes at least S$30,000 annually.

Not all study loans are created equal: some require you to start repaying the month loan approval while others let you start repaying after graduation.

Remember to compare when choosing a study loan! Keep an eye out for the interest rate, processing fee, loan tenure, maximum loan amount, and early repayment fee.

Its never too early to think about how the study loan will be repaid. Here, weve put together handy tips to help you clear education loans quickly. Good luck!

Delta College Loan Code Of Conduct

Delta College recognizes that ensuring the integrity of the student financial aid process is critical to providing fair and affordable access to higher education in Michigan. Therefore, these guidelines are designed to avoid any potential for a conflict of interest between Delta College and students or their parents in the student financial aid process. Accordingly, the College shall adhere to the following principles in the Colleges financial aid operations:

No employee of the College shall accept a gift or anything of more than nominal value on his or her behalf or on behalf of another person or entity from any Lending Institution. The term gift means any gratuity, favor, discount, cash, stocks, gifts, entertainment, expense-paid trips, or other item having a monetary value of more than a de minimus amount. Likewise, an individual should never receive payment or reimbursement from a Lending Institution for lodging, meals or travel to conferences or training seminars. However, an employee of the College may:

Also Check: When Do I Pay Back Student Loan

Loan Payment Walkthrough Example

For example, lets assume a borrower has a $10,000 loan balance at the beginning of repayment with an interest rate of 5% and a 10-year level repayment schedule.

They would make payments of $106.07 per month and pay $2,727.70 in total interest over the life of the loan. For the first month, the payment would be applied as follows:

$41.67 to interest

$64.40 to principal

But, if the borrower sends in $188.71 the first month, a greater proportion of the payment would be applied to reduce the loan balance:

$41.67 to interest

$147.04 to principal

If the borrower continues making monthly payments of $188.71, the loan will be paid off in only five years with a total interest of $1,322.76.

How Do You Decide On Repayment Period

The repayment periods are generally driven by our evaluation of the student’s potential earning capability and risks we perceive in extending any particular loan. At HDFC Credila, we understand that students want to start repaying loans immediately after they get a job. However, they may find higher EMI’s at the start of their careers, very challenging. Thus we offer longer tenure to facilitate smooth transition of student from campus to corporate. This way they can start their earning and professional lives with positive credit histories that help them to take other loans in future.

You May Like: What Kind Of Car Loan Interest Rate Can I Get

Repay Education Loan By Cheque/dd

Repayment of student loan by cheque is accepted by almost all the banks. Many banks even have a provision of assigning PDCs . These post-dated cheques are pre-signed cheques of dedicated EMI amount submitted to the bank which are only used when the EMI is due.

Some banks also provide cheque collection service, at a nominal surcharge which helps in doorstep servicing of student loan. Demand Draft is a different story although. Not all banks allow loan repayment by demand draft, because they are comparatively unsafe. But students should definitely ask for demand draft option for student loan repayment.

Can I Start Paying On A College Loan Before Graduation

Question: I was wondering if I can start paying off a student loan before graduation? My daughter is currently a college junior and has a student loan. Id like to begin paying on the loan before she graduates. Any information would be helpful.

Paying on student loans before college graduation is a great idea. This will help to eliminate her student loan debt total and lighten the financial impact of paying for student loans after graduation.

Unfortunately, many students do not take these payments into account when planning their post-grad, new-career professional budget. Some students are shocked at the monthly payment totals of their repayment plans.

If she has any federal student loans via the Direct Loan Program, she will have a grace period before shell be required to begin paying back her loan balance. According to StudentAid.Gov, this grace period is generally six months. For a Perkins loan, the grace period is nine months.

Why Paying Back Your Federal Student Loans Before Graduation Is a Good Idea

The sooner you can begin to pay back these loans the better. While the Federal Direct Loans have a fixed rate , you can begin to tackle repayment earlier. This will cut your overall loan cost, and help you pay off your loan faster.

There are many reasons why beginning to pay back your student loans before graduation is a good idea.

There is no penalty for pre-paying these loans. You wont face any extra charges for starting your repayment before you graduate college.

You May Like: Who To Call About Student Loan Garnishment

Simple Vs Compound Interest

The calculation above shows how to figure out interest payments based on whats known as a simple daily interest formula this is the way the U.S. Department of Education does it on federal student loans. With this method, you pay interest as a percentage of the principal balance only.

However, some private loans use compound interest, which means that the daily interest isnt being multiplied by the principal amount at the beginning of the billing cycleits being multiplied by the outstanding principal plus any unpaid interest that’s accrued.

So on Day 2 of the billing cycle, youre not applying the daily interest rate0.000137, in our caseto the $10,000 of principal with which you started the month. Youre multiplying the daily rate by the principal and the amount of interest that accrued the previous day: $1.37. It works out well for the banks because, as you can imagine, theyre collecting more interest when they compound it this way.

The above calculator also assumes a fixed interest over the life of the loan, which youd have with a federal loan. However, some private loans come with variable rates, which can go up or down based on market conditions. To determine your monthly interest payment for a given month, youd have to use the current rate youre being charged on the loan.

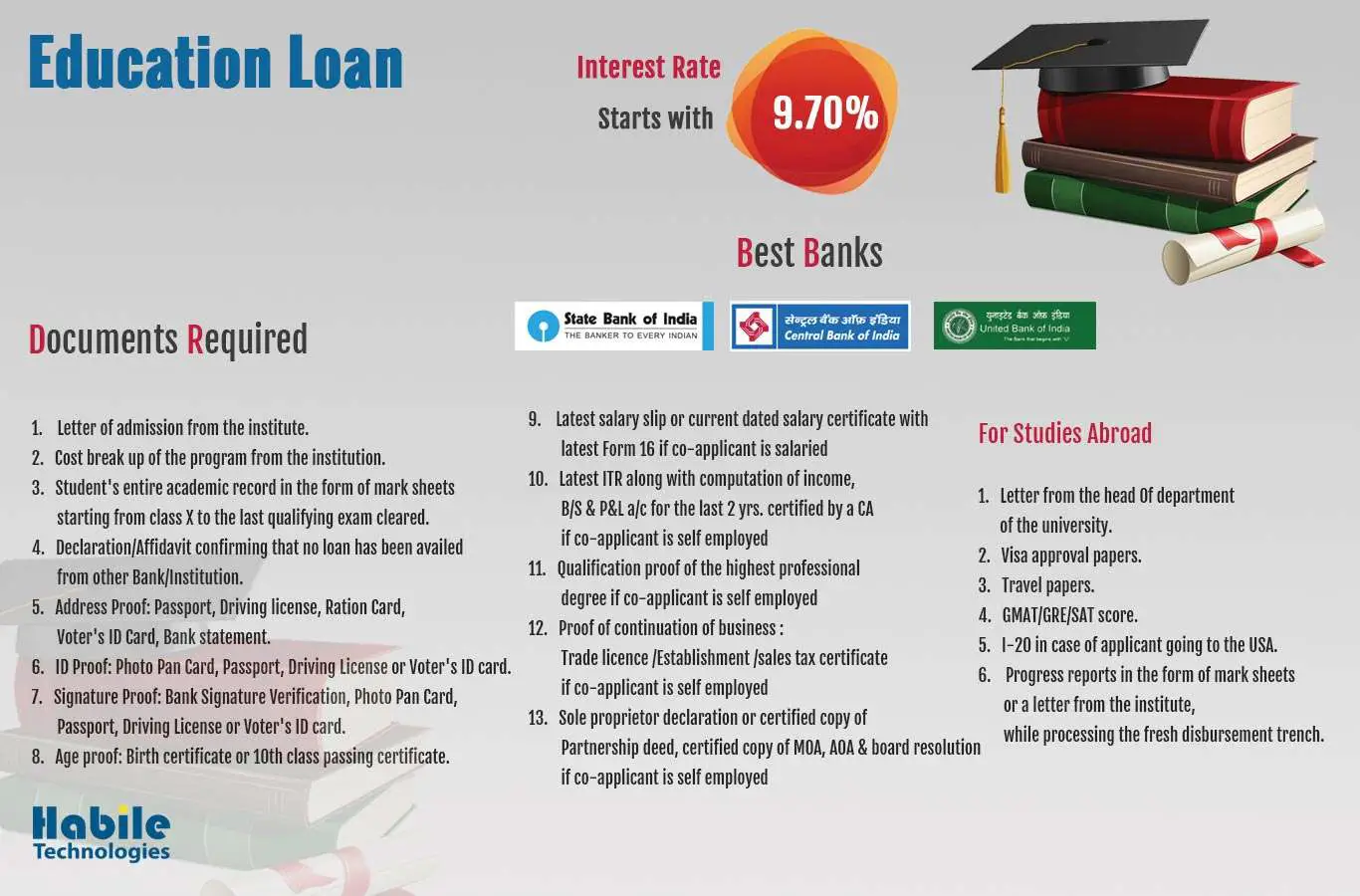

Factors To Look Out For

There are many factors to look out for when choosing an education loan. These would be:

- Eligibility criteria

- Courses for which the loan is applicable

- Collateral required, if any

These are some of the documents required to complete your loan application:

- Fully filled in application form with passport-size photographs affixed as required

- Admission letter on letterhead of the educational institute

- Academic certificates of the applicant

- Scholarship document, if any

- Proof of identity such as Aadhaar card/passport/driving license/PAN card, etc.

- Proof of address or residence such as utility bills/ration card/Aadhaar card/passport, etc.

- Proof of age such as birth certificate or 10th standard certificate

Read Also: What Form Is Student Loan Interest Reported On

How To Calculate Student Loan Interest

If youve recently graduated or left college, you might be surprised at how much of your student loan payment goes just to the interest portion of your debt. To understand why that is, you first need to understand how that interest accrues and how its applied toward each payment.

The Student Is The Main Applicant For The Loan

It is important to note that the student pursuing the course or degree is the main applicant for the loan, and they will be responsible for repaying the loan. Parents, spouse or siblings can be co-applicants for the loan and are held responsible in case the student themselves is incapable of paying back the loan.

You May Like: Is My Loan Fannie Mae

How To Apply For Sbi Education Loan Online/offline

You can apply for an SBI education loan either online or offline:

1. Offline:

- Walk into your nearest SBI branch with all the necessary documents.

- Fill in and submit the application form that you can obtain from there.

2. Online:

- Visit the SBI official website

- Navigate to the section on Education Loan

- You will be redirected to the next page where you will have to enter your contact details

- A bank representative will get in touch with you

3. SBI Scholar loans: Available in select campuses or mapped branches

Understand Capitalized Interest On A Student Loan

Capitalized interest is a second reason your loan may end up costing more than the amount you originally borrowed.

Interest starts to accrue from the day your loan is disbursed . At certain points in timewhen your separation or grace period ends, or at the end of forbearance or defermentyour Unpaid Interest may capitalize. That means it is added to your loans Current Principal. From that point, your interest will now be calculated on this new amount. Thats capitalized interest.

Read Also: How Much Is My Student Loan Payment Going To Be

The Cost Of An Education Loan Is Usually The Most Important Criterion

The Fastweb Team

Eligible Expenses and Loan Limits Start of Repayment Loan Term Cost of the Loan Who is Responsible for Repaying the Loan Putting it All Together

Education Loan Emi Calculator

In a knowledge economy that we live in today, education plays a pivotal role. Education empowers us to reach new heights in our career, enables to live a respectable life, elevates our standard of living, aids accomplish financial goals, and much more!

Education is a long-term personal investment that has the potential to generate returns like none other.

With an education loan, you can make your dreams come true. The loan is available for career-oriented courses like medicine, engineering, management, etc. either at a graduate or post-graduate level in prime institutes in India and abroad. The loan covers tuition fees, examination fees, library subscription, cost of books, needed lab tools/equipment, laptop/computer, hostel charges , and so on.

Students can directly apply for an education loan. However, their parent or guardian will be treated as co-applicants, and their role will be akin to a primary debtor .

But before you apply for an education loan, as a prudent loan planning exercise, assess how much the Equated Monthly Instalment will be.

Axis Banks Education Loan EMI calculator is an automated tool that will quickly let you know your EMI.

Remember, the interest rate and your loan tenure are the vital deciding factors that determine loan EMI.

Axis Bank India offers education loans at attractive interest rates for a loan amount ranging from Rs 50,000 to Rs 75 lakh.

Apply for an education loan today and fuel your dreams!

Read Also: What Are Commercial Loan Rates Now

Reduce Steadily The Interest Charged On Interest Whenever You Can

Many education loan borrowers dont have actually the income to help make interest re payments as they have been in school. But, once education loan repayment starts, borrowers should stay away from missing repayments or trying to get a deferment or forbearance.

The interest that is unpaid have to be paid back, along side interest charged in the interest. Conversely, quickening student loan payment after graduation decreases the total interest charged regarding the interest that accrued throughout the in-school and elegance durations.

Student Loan Interest Start Dates

In most cases, your student loan interest starts accruing the day you take out your loan. The only exception is Direct subsidized loans. On these need-based loans, the federal government pays your interest while youre in school and during the six-month grace period after you leave.

But once that grace period is over, you become responsible for paying back both the principal and interest.

If you took out Direct unsubsidized loans, Direct PLUS loans or private student loans, interest accrues unpaid while youre in school. If you dont make interest-only payments, the accrued interest capitalizes and is added to your principal balance.

Going forward as you make payments, your student loan servicer will require you to pay off any late fees and accrued interest before applying any part of your payment to your principal balance.

Heres how your interest gets calculated:

Interest Rate x Current Principal Balance ÷ Number of Days in the Year = Daily Interest

As an example, lets say your current balance is $32,037 and your interest rate is 6.38%. Plug these numbers into the formula and you get:

6.38% x $32,037 ÷ 365 = $5.60 a day

The higher your balance and your student loan interest rates, the more interest will accrue on a daily basis.

You May Like: Does Applying For Personal Loan Hurt Credit

What Will Happen If You Default On Your Education Loan

As we see, the chances of an education loan becoming an NPA is very real. Let us discuss when your education loan will be classified as NPA and what will happen after that.If a student fails to pay the EMI for 3 consecutive months, the bank will classify the loan as a non-performing asset. The borrowers collateral will be at risk. The bank may seize your collateral and use it to recover the loan amount. Once the loan is classified as an NPA, the credit score of both the borrower as well as his co-applicants credit score will be affected. This will reduce your and your co-applicants ability to borrow money in the future.

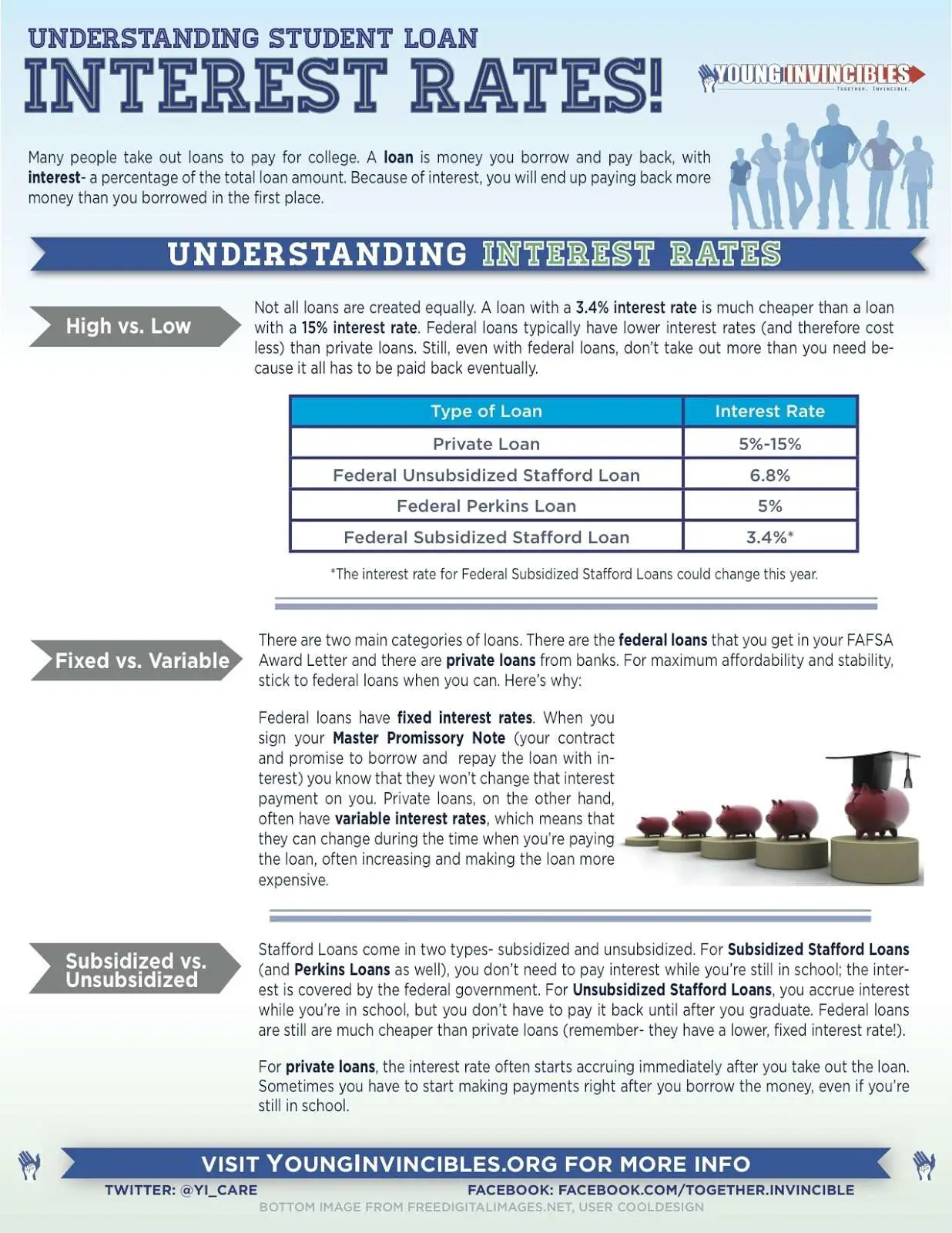

How Student Loan Interest Works

When you take out a student loan, you agree to pay back the loan, plus interest. Your interest rate is the cost of borrowing the money. There are 2 types of rates:

- Fixed interest rates stay the same over the life of the loan.

- Variable interest rates change with the financial markets . Variable rates may seem great at first but can end up costing a lot more over the life of a loan.

Don’t Miss: Is Federal Student Loan Forgiveness Real

How To Reduce The Interest You Pay On Your Student Loans

There are ways to reduce the amount of interest you pay over the life of your loans. The best way is to pay off your loans as quickly as possible. Since interest accrues every day, the faster you pay off your debt, the less interest will accumulate. Its also useful to put your loans on autopay if you can afford to, since doing so will automatically get you a rate discount of 0.25%.

If you have unusually high interest rates on your federal loans, you can also potentially refinance them into a private loan at a lower interest rate. This can save you thousands of dollars over the life of your loan.

Ultimately, the faster you pay off your loans, the better. Now that you understand how interest is calculated and added to your bill, you know how important it is to eliminate your student loan debt while paying as little interest as possible.

Rebecca Safier and Cat Alford contributed to this article.