What Debt You Should Pay Off First

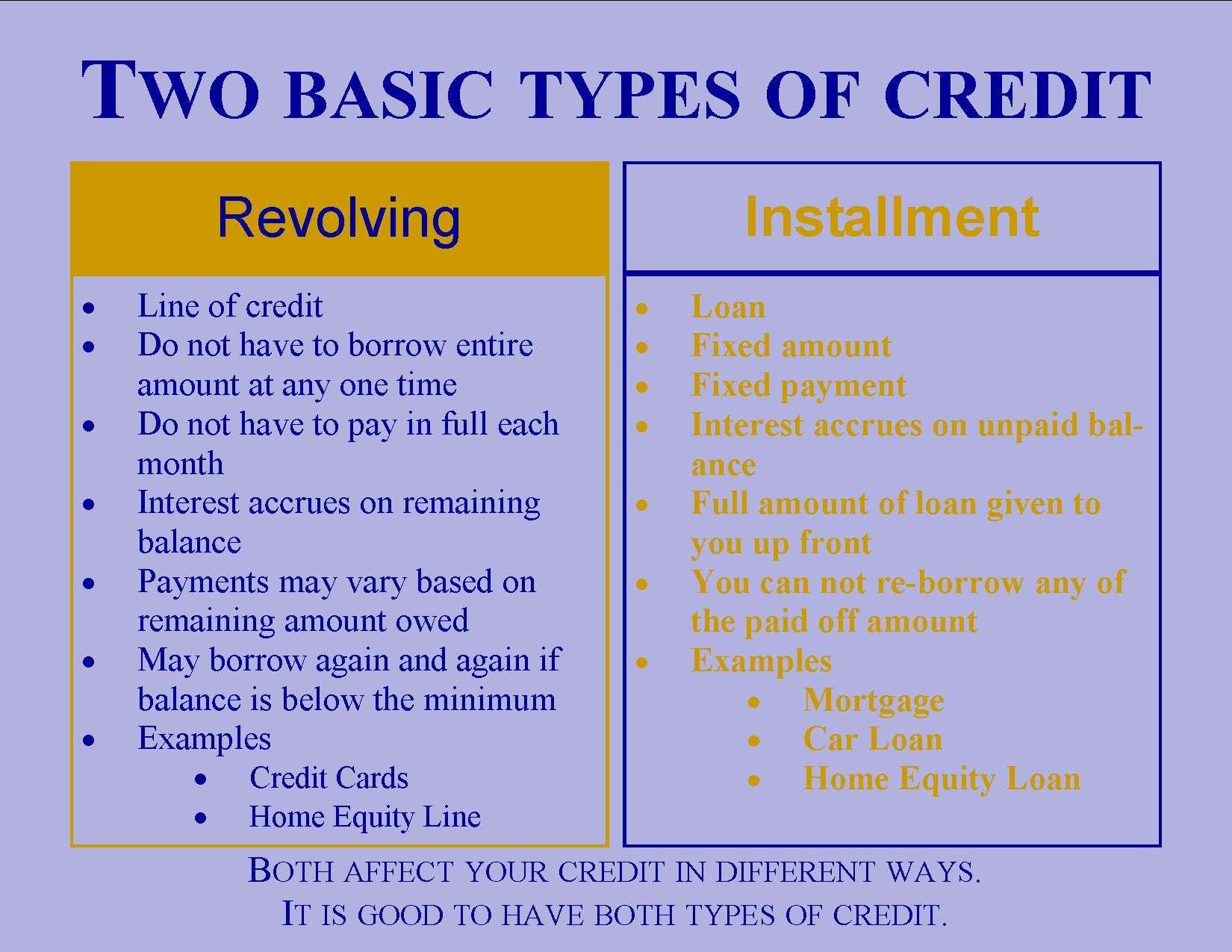

Having both installment loans and revolving credit will help your credit score, as long as you pay the bills on time. Both types of credit illustrate to lenders that you are able to borrow varying amounts of money each month and consistently pay it back.

But if you’re struggling to decide which to pay off first, focus on your credit card debt.

Experts generally agree that the most basic rule of thumb when developing a long-term debt pay-off plan is to ask yourself a simple question: Which debt is costing you more? If you carry a balance on your credit card from month to month, that ballooning balance is likely costing you much more than your installment debt.

This approach of paying off the balance with the highest first and then working your way through all your debt from highest to lowest APR, is known as the “avalanche” method. With this method, you end up paying less overall in interest.

As an example, let’s take a look at the current interest rates on credit cards compared to student loans .

The average credit card APR is 16.61%, according to the Federal Reserve’s most recent data. That’s more than six times higher the 2.75% federal student loan interest rate for undergraduates for the 2020-21 school year. Even the federal rates for unsubsidized graduate student loans and parent loans don’t come close to credit card interest rates.

Installment Loans And Revolving Loans: Whats The Difference

Sam– Apr 8, 2018Building Credit,

There are two types of loans or debts which a person can possibly have. One type is an installment loan. Another type is the revolving loan.

In this post, I will share with you the differences of installment loans and revolving loans and how they may impact your credit score in different ways.

Personal Line Of Credit Repayment Structures

Due to the variety of repayment structures in the market, borrowers should be wary of the unique terms associated with their loan. The majority of personal lines of credit will function like a credit card, as outlined above. However, other repayment terms exist, and may have cumbersome provisions associated with them. Weve identified some less common forms of repayment below:

Draw and repayment periods: In some instances, personal lines of credit can feature separate draw and repayment periods allowing the borrower to withdraw funds during the draw period, while requiring them to make monthly payments during the repayment period.

Balloon payment: A personal line of credit may require payment of the entire balance at the end of the term, otherwise known as a balloon payment. Balloon payments come with the added need to refinance if the borrower is unable to repay the full amount.

Demand line of credit: In rare cases, banks may offer a “demand line of credit,” which functions similarly to a standard line of credit, but gives the lender the right to call the loan for repayment at any time.

Read Also: Usaa Personal Loan Approval Odds

When Can You Access Borrowed Funds On Revolving Debt Vs Installment Loans

When you take out an installment loan, you get the entire amount youre borrowing in one lump sum when you close on the loan. If you took out a $10,000 personal loan, youd have $10,000 deposited into your bank account, or would get a $10,000 check. If you decide you need to borrow more money, youd be out of luck — even if you paid off almost your entire $10,000 balance. You would need to apply for a new loan to borrow more.

With revolving debt, you get to choose when you borrow funds. You could borrow right after opening a credit card, wait six months, or wait years to borrow, depending on what you want . As long as you havent used your full line of credit, you also have the option to borrow again and again, especially as you pay down what youve already borrowed.

Installment loans tend to be best when you want to borrow to cover a fixed cost, such as that of a car or another big purchase. If you know youll need to borrow but its hard to predict when youll need the money or how much youll need, then revolving debt may make more sense.

Revolving Loans May Be Harder To Get Approved For

For the reason explained above, revolving credit is usually not backed by a collateral and is only backed by a personal guarantee, it may be harder to get approved for a revolving credit loan than to get approved for an installment loan. This will answer the question which many people ask me. How come I got approved for a mortgage, but I cant get approved for a credit card? Yes, it may be harder to get approved for a credit card than for a mortgage! That is because the bank is, to some extent, taking less of a risk when they approve a mortgage that is backed with collateral than when they approve you for a credit card that is not backed by any collateral .

You May Like: Usaa Rv Buying Service

Now You Know The Difference Between Revolving Debt And Installment Loans

Now you know the key differences between revolving debt and installment loans, which include:

- How borrowing works: With installment loans, youre approved to borrow a fixed amount and cant access more money unless you apply for a new loan. With revolving debt, youre given a maximum credit limit and can borrow as much or as little as you want. You can also borrow more as you repay what youve already borrowed.

- When you access funds: If you take out an installment loan, you get the full amount youve borrowed up front. With revolving debt, you havent actually borrowed anything when youre given a credit line. You can borrow anytime you want as long as the credit line remains active.

- How repayment works: Installment loans have a set repayment schedule and a definite payoff date. Your monthly payments are calculated so you pay off the loan by the designated date. With revolving credit, you can make minimum payments as you borrow. And, because you can borrow more as you pay back what you already owed, there may not be any definite date as to when youll be free of the debt.

Youll need to decide which type of financing is right for your particular situation so that you can get a loan or line of credit that makes sense for you.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Also Check: Can I Use Va Loan For Investment Property

Why Use Installment Loans

Lets forget about the obvious mortgages and car loans for a moment, and consider personal loans. What are the advantages of a personal loan as an installment credit?

Well, a key benefit of installment loans is that they have a fixed monthly payment, so theyre easy to manage. So if you need a large lump sum of money for an unplanned expense or large ticket purchase, they make a great, low-interest option to consider.

Revolving Lines Of Credit

A revolving account like a credit card differs from an installment loan because it gives you access to an always available credit line, which is how much you can charge to that account at any given time. How much you owe and whether you owe interest each month depends on how quickly you pay off what youve charged. You will be given a due date each month which requires a minimum payment, though this minimum payment may be less than the full balance. Typically, if you carry a balance from one month to the next, you will owe interest. You can use revolving credit as needed, which gives you flexibility. But that flexibility can come at a price if you dont pay your balance in full each month interest rates on revolving accounts are often higher than installment loans. Personal and home equity lines of credit are additional examples of revolving accounts.

Understanding the key differences between your credit accounts can help you manage your cash flow, avoid unnecessary interest and fees and build good habits to maintain a healthy credit history.

WHY GOOD CREDIT HABITS MATTER

Don’t Miss: How Long It Takes For Sba To Approve Loan

Getting Out Of Revolving Debt

When you borrow an installment loan, repayment is fairly straightforward. You owe a fixed payment every month, which you can set up on autopay. As long as you make this payment on time, you wont have to worry about violating your loan agreement or falling behind.

With revolving debt, however, youre typically allowed to make a minimum payment every month and carry your balance over from month to month. However, sticking to the minimum payment is not recommended, as it could cost you in interest charges.

If you owe $5,000 on a credit card with an 18% interest rate, for example, and make a $200 payment monthly, it will take over two and a half years to pay off your balance and cost you $1,314 in interest. Thats not counting any additional debt you add on top of that balance.

To avoid these interest charges, try your best to pay off your balance in full every month. This means not charging more to your credit card or line of credit than you can afford to repay. To do this successfully, it can help to make a budget and track your spending.

If youre already dealing with revolving debt, here are a few repayment strategies that can help:

How Does Revolving Credit Work

When you are approved for revolving credit, there is a credit limit, or the maximum amount of money you have access to. With revolving credit, you can keep it open for months or years until you close the account. If you are a dependable customer, you might get credit raises to entice you to spend more money.

At the end of each pay period, youll have a minimum amount due. This amount is usually a small percentage of your total balance due. If you carry a balance, youll get hit with an interest charge on that amount. However, if you pay off your balance in full, youll skip the interest charge. Essentially, this is interest-free borrowing.

Make sure you pay your balance off in full every month when using revolving credit. You dont want to pay unexpected interest and fees associated with the money you borrow.

You May Like: Usaa Auto Loans

Revolving Credit Vs Installment Credit

Bottom Line

Its almost impossible to live in the modern world and not have some sort of credit. Whether its for a large purchase or just in order to organize day-to-day expenses, weve all encountered either revolving or installment credit or, more likely, both. Since theyre both tracked by credit bureaus, they can have a huge impact on your credit score. But whats the difference between the two? Today well be talking about revolving credit vs installment credit.

How Revolving Debt Can Affect Your Credit

Revolving debt can either help or hurt your credit score, depending on how you use it. Your FICO Score the most commonly used credit scoring model by lenders is based on a number of factors, including:

If youre able to consistently demonstrate a credit utilization rate of less than 30% meaning, you only use less than one-third of the revolving debt available to you this can help increase your score. However, the variable interest rates that come with revolving debt could cause you to miss a payment, which would make your score decrease quickly.

Showing that youre able to responsibly use a diverse mix of revolving and installment debt can give your score a modest boost since that accounts for 10% of it. Another advantage to taking on installment credit is that it doesnt count toward your credit utilization ratio. The lower this ratio, the higher your score could be.

However, your debt-to-income ratio takes all your debts into account. If lenders feel you dont have sufficient income to pay off your existing debts, this could affect your ability to get funding in the future. If youre not sure what your DTI is, use this method to calculate your debt-to-income ratio.

You May Like: Usaa Pre Qualify Auto Loan

Installment Vs Revolving Credit: Which Is Better

When we compare revolving credit vs. installment loans, neither option is better than the other, and they are both important for your overall credit score.

That said, revolving credit can matter slightly more than installment loans.

Installment loans help to prove that you can consistently pay back borrowed money over time. However, revolving debt shows that you can borrow and repay month-on-month, manage your personal cash flow, and clear debts.

Lenders are more interested in your revolving credit accounts than your installment loans. For example, a credit card with a $1000 limit can have a much more significant impact on your credit score than a $50,000 auto loan.

However, its essential to pay off both these bills on time every month. On-time payments equate to 35% of your credit score. Credit cards prove that youll be a long-term reliable customer in the eyes of a lender.

What Is Revolving Debt

Interest rates on credit cards can be high. The national average annual percentage rate is currently over 16%.1 Plus, interest on credit cards compounds, so the longer you wait to pay off the balance, the more youll owe in interest. An online calculator can help you see how credit card interest adds up over time.

Also Check: Auto Loan 650 Credit Score

What An Installment Loan Is And How To Get One

According to a study from Spectrem Group’s Market Insights Report 2017, there are just 10.8 million millionaires in the United States. Assuming youâre not one of them – and letâs face it, most of us arenât – there are certain purchases that require a loan. Loans for these purchases – houses and cars among them – most often take the form of an installment loan, which begs the question: What exactly is an installment loan?

As stated in this article, an installment loan is a lump sum of money that is often used to pay for a purchase – like a house, a car or home repairs – and which the consumer pays back to the lender on a monthly basis with added interest until the loan is paid in full. The loan is typically made for a set period of time – or term – and borrowers cannot add more money to the loan unless they submit an additional credit application.

Installment loans can be a good tool to consolidate debt from high-interest credit cards or generally for situations where the consumer knows the specific amount they will need.

BBVA Compass offers a variety of installment loans, including its fully digital BBVA Compass Express Personal Loan.

Examples Of Revolving Debt

| Common types of revolving debt | |

| Type | How it works |

| The credit card issuer allows you to borrow up to a set amount. Youre responsible for paying back a percentage of whatever you borrow each month, plus interest if you do not pay off the balance within the grace period. These payment amounts, as well as the interest rate, may change from month to month. | |

| Personal or business line of credit | The financial institution gives you an unsecured loan from which you may withdraw funds as needed through a card, checks or transfers to a checking account. Interest rates may fluctuate and extra fees may apply for each transaction. Because its not secured by an asset, you could pay higher interest rates. Unlike credit cards, youre unlikely to benefit from a grace period. |

| Home equity line of credit | The financial institution decides how much you can borrow based on the equity you have in your home. Youre given a set time limit by which you must pay back the funds. Like a mortgage, if you default on your HELOC payments, you could lose your home. However, you could get a lower interest rate for using your home to guarantee the loan. |

Consumers with strong credit, on the other hand, can open an unsecured credit card, perhaps one with a 0% APR promotional period for 12 months or more.

PERSONAL LINE OF CREDIT

Don’t Miss: Capitalone Autoloans.com

How Borrowing Works On Revolving Debt Vs Installment Loans

Installment loans are made by banks, credit unions, and online lenders. Common examples of installment loans include mortgage loans, car loans, and personal loans.

Installment loans can have fixed interest rates, which means you know up front exactly how much youll pay in interest per month, and in total. They can also have variable rates. If you opt for a variable-rate installment loan, your interest rate is tied to a financial index , and can fluctuate. While your payment amount can change with a variable rate loan, your repayment timeline is still fixed — your payment amount simply goes up or down as your interest rate changes, ensuring you can pay back the loan on time.

Most installment loans are paid monthly. Youll know up front exactly when your debt will be paid off, and if its a fixed-rate loan, you will also know the loans total cost. These loans are very predictable — there are no surprises.

Revolving debt works differently. Common examples of revolving debt include home equity lines of credit and . With revolving debt, youre given a maximum borrowing limit, but can choose to use only a little bit of your line of credit, if you want. If youre given a $10,000 home equity line of credit, for example, you might initially only borrow $1,000 from it. As you paid that $1,000 back, the credit would become available to you again.