Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Car Loan Emi Calculator

Calculate how much you may have to pay every month for your car loan with this interactive car loan EMI calculator

The rate mentioned in the calculator is an indicative rate only. The actual rate may vary.Owning your car is an effortless process in todays times. With finances readily available, bring home that dream car for you and your family. At HDFC Bank, we strive to meet your every requirement with utmost convenience and accessibility. We aspire to bring to you, services and facilities to fulfil every want of yours, including that of purchasing your dream car. With our tailor-made Car Loan EMI Calculator, we offer you the provision to identify the exact principal amount, with the interest rate and equated monthly instalments payable over a specific tenure before you intend to apply for your Car Loan.Regardless of whether you are a salaried individual or self-employed, with HDFC Bank, you have the advantage of purchasing a car through our Custom-Fit Car Loans. With the Car EMI Calculator, you only need to input the necessary information whether you intend to buy a new car or a pre-owned car, the sanction loan amount required, tenure of the loan, interest rate and select calculate. The Auto Loan EMI Calculator offers you a detailed view of your yearly principal and interest repayment amounts.

How To Use This Car Loan Payment Calculator

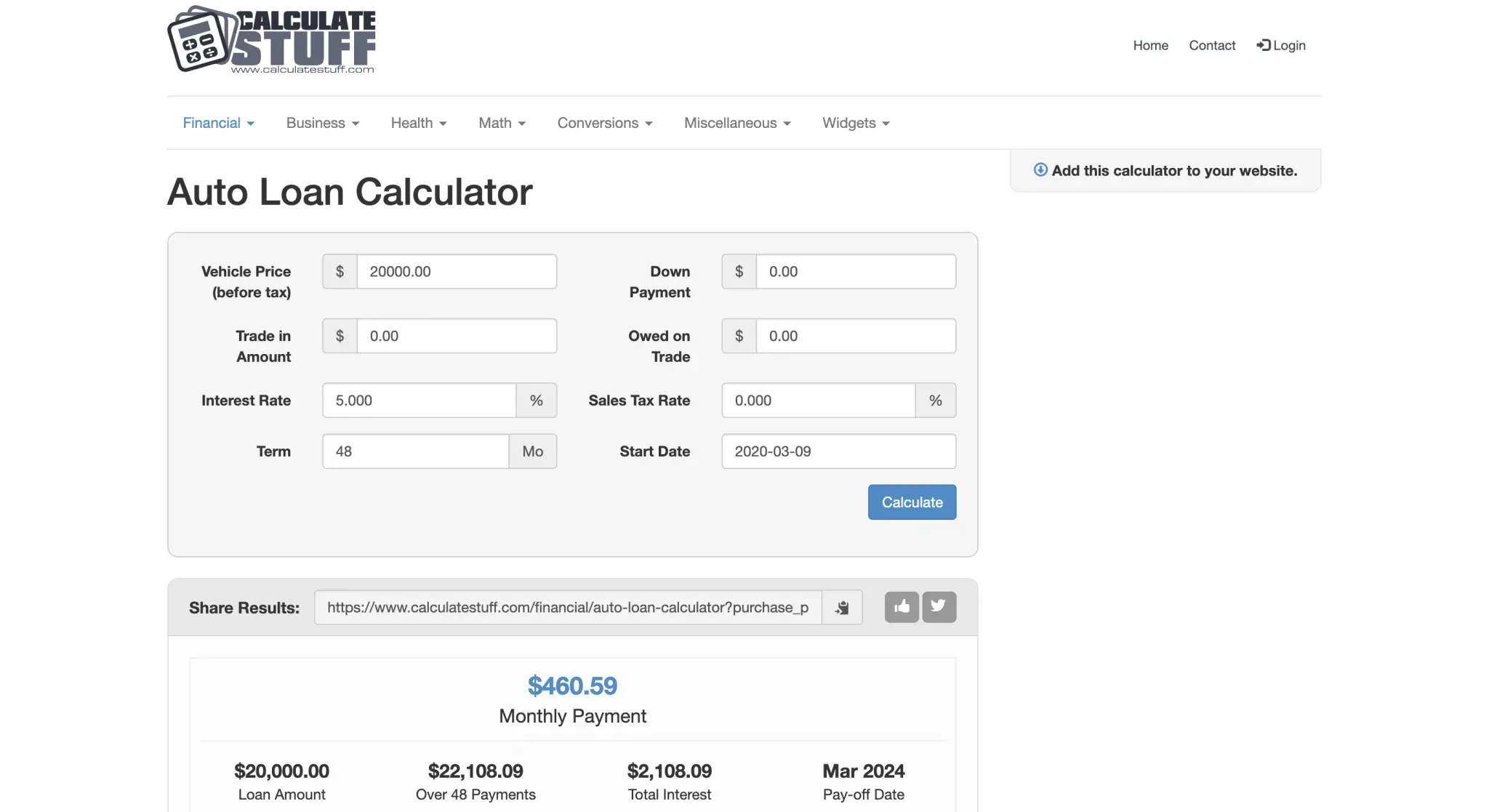

In addition to your monthly payment, this car loan calculator shows how much youd pay on your loans principle amount and how much youd pay overall in interest. The principle amount is the amount that you borrowed and should be equal to your loan amount. Total interest is the amount you would pay on top of the principle the cost of having your loan.

Don’t Miss: Usaa Refinance Auto Loan Rates

How Much Interest Will I Pay On My Car Loan

Our car finance calculator works out the interest that you might pay as part of your car finance plan. It does this by taking your interest rate and compounding it over the course of the loan period. It is this compounding of interest rate that forms the basis of the effective annual rate we feature in our calculator. You may be interested to note that we have a compound interest calculator for compounding interest on savings.

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

Also Check: Usaa Refinance Auto Loan

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

Add A Free Monthly Interest Rate Payment Calculator Widget To Your Site

You can get a free online monthly interest rate payment calculator for your website and you don’t even have to download the monthly interest rate payment calculator – you can just copy and paste! The monthly interest rate payment calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

Recommended Reading: How Long Does It Take For Sba Loan Approval

Which Auto Loan Calculator Should You Use

Use the auto loan payment calculator if you know what you expect to spend.

For example, perhaps you think you can afford a $20,000 loan on a new car. A 48-month loan for the most creditworthy borrowers would be 3% or less. At that rate, you’d pay about $440 a month and $1,250 in interest over the life of the loan. A subprime rate might be 11%, making the payments about $515 and you’d pay more than $4,500 in interest.

Many people reduce payments by lengthening the term of the loan. If you change the term to 60 months, payments on that $20,000 loan at 11% fall from $515 to $435. However, you would pay nearly $6,100 in interest, or an additional $1,600, for doing so.

Use the reverse auto loan calculator if you have a specific monthly payment in mind. Say you have decided that you can afford to spend $350 a month on car. Depending on the interest rate and length of loan you choose, a $350 car payment could repay a $15,600 car loan at 3.66% in 48 months or a $19,100 loan at 60 months.

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

Read Also: Usaa Car Refinance

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Can I Refinance My Upstart Loan

Car Loan Repayment Calculator

Shopping around for a car? If you are considering taking out a car loan to help finance your purchase, Canstars Car Loan Repayment Calculator could help you figure out what your repayments may be and how much interest you could pay.

Simply enter the amount you wish to borrow, the current interest rate, the loan term and how regularly the repayments will be to see how much your repayments may be.

Please note: The calculations on this page do not take into account all fees and charges. The results provided by this calculator are an estimate only, and should not be relied on for the purpose of making a decision in relation to a loan. Interest rates and other costs can change over time, affecting the total cost of the loan. Consider seeking financial advice from a qualified adviser before applying for any credit product.

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 345,921 times.

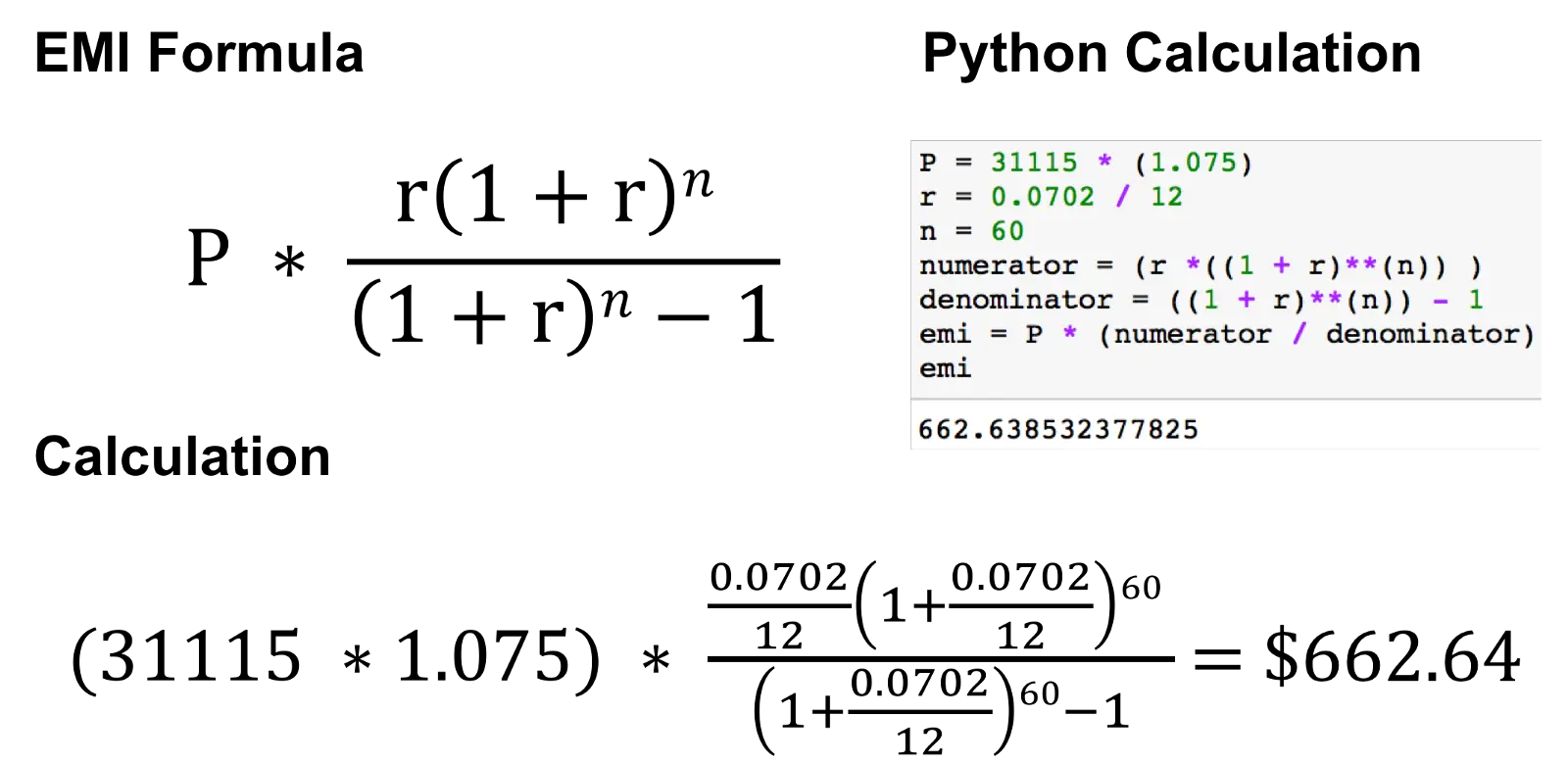

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Also Check: Apply For Capital One Auto Loan

Use A Car Loan Payment Calculator

Skip the hassle of math formulas and get straight to the answer you’re looking for by plugging the necessary information into a loan calculator. A calculator makes it easy to input different combinations of numbers, allowing you to instantly compare the costs of loans.

Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off. These variables help you plan ways to reduce your debt. Technically, you can use car loan payment calculators on any of your loans. As long as you know your loan factors, the calculator will work.

Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this tool, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. Full disclaimer. This tool is here purely as a service to you, please use it at your own risk.

Also Check: Mlo Endorsement To A License Is A Requirement Of

Where To Get A Car Loan

If youre looking to take out a loan to finance your auto purchase, you have plenty of options to choose from. When it comes to financing your vehicle, you should be sure to come prepared in order to ensure that your negotiation with a car dealership is successful and you dont wind up paying more than you bargained for.

Online rates comparison tools like can help you to learn more about what rates you qualify for. Monevo lets you compare loan offers from different lenders for free. If you see a loan that meets your needs, you can apply quickly and easily online, and have the funds available to you in as little as one business day.

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Read Also: Usaa Auto Loan Interest Rates

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

What Is A Car Loan

A car loan is a type of personal loan taken out to buy a motor vehicle such as a car, ute, 4WD, motorbike or other road vehicle. A car loan can be a helpful form of finance if you need a car and dont have enough savings to buy one, but you can afford to make regular loan repayments.

Your car will typically be used as security for the loan. This means that if you dont repay the loan on time, the lender will be able to repossess your car and sell it to recover the unpaid amount. In some cases, you may be able to take out an unsecured car loan . This type of loan often comes with a higher interest rate and is more common for the purchase of used cars than for new ones.

Don’t Miss: Va Partial Entitlement Worksheet