Pros Of Subsidized Federal Student Loans

- The government will pay the loan interest while the student meets enrollment requirements, during a six-month grace period and during deferment periods.

- The borrower doesnt need to go through a credit check.

- A co-signer is not required.

- The interest rate is fixed and often lower than private student loan rates.

- Borrowers having difficulty repaying the loan can ask for payments to be postponed.

- Income-driven repayment options may be available.

- All or part of the loan might be eligible for forgiveness under certain circumstances.

S In Applying For A Federal Direct Student Loans

Financial aid files must be completed at least three weeks prior to your fee payment due date for you to use your award toward payment of your tuition and books. If your file is incomplete by your fee payment due date, you must cover the cost of tuition and books. You will be reimbursed to the extent of your eligibility.

Annual And Lifetime Loan Maximums

Annual loan amounts may be limited based on other financial aid received and your cost of attendance while enrolled. Your total student aid, including loans, may not exceed your Cost of Attendance, even if you have not reached the annual loan maximum.

The following table outlines maximum annual and career/aggregate loan limits for Direct Subsidized and Unsubsidized Loans.

| Dependent Undergraduate Student with a Parent PLUS Loan denial* | Independent Undergraduate Student | Graduate and Professional Degree Student | ||

|---|---|---|---|---|

|

First-Year |

A maximum of $3,500 may be subsidized |

$9,500 A maximum of $3,500 may be subsidized |

$9,500 A maximum of $3,500 may be subsidized |

$20,500 |

|

A maximum of $4,500 may be subsidized |

$10,500 A maximum of $4,500 may be subsidized |

$10,500 A maximum of $4,500 may be subsidized |

$20,500 |

|

|

A maximum of $5,500 may be subsidized |

$12,500 A maximum of $5,500 may be subsidized |

$12,500 A maximum of $5,500 may be subsidized |

$20,500 |

|

|

A maximum of $23,000 may be subsidized |

$57,500 A maximum of $23,000 may be subsidized |

$57,500 A maximum of $23,000 may be subsidized |

$138,500 The graduate debt limit includes Direct Loans received for undergraduate study. |

Direct Subsidized and Unsubsidized Direct Loan maximum eligibility for Teacher Certification is $12,500 for the academic year. Due to federal statute, eligibility is based on fifth-year undergraduate loan limits, even though you are required to have a bachelor’s degree and your admission is administered by the Penn State Graduate School.

Also Check: Amortization Schedule For Auto Loan

How Are Private Student Loans Disbursed

Although federal student loans tend to have the best interest rates and benefits, they dont always cover the full cost of college. If thats the case, you might decide to borrow from a private lender, such as a bank, online lender or credit union.

When it comes to disbursement of private student loans, each lender sets its own policy.

Some lenders transfer the loan directly to your bank account shortly after your application is approved. In this case, its your responsibility to send the funds to your schools financial aid office to pay your tuition bill. Youre in charge of handling the money, paying tuition and using any leftover funds toward living expenses .

| College Ave Student Loans recommended timetable new borrowers | |

|---|---|

| Days before school | |

| Apply for your preferred student loan | |

| 10 | Look out for confirmation that the funds are slated for arrival |

On the other hand, your lender might act similarly to the federal government and disburse the loan directly to your school. When you borrow a school-certified private student loan, the lender typically sends your funds to your school rather than your own bank account, after first getting confirmation of your enrollment status, anticipated graduation date and cost of attendance.

As with federal student loan disbursement, you should receive any remaining money after your loan has been applied to tuition and fees.

How Much Can You Borrow

In addition to private loans, there are three main types of federal student loans: Direct Subsidized, Direct Unsubsidized, and Direct PLUS.

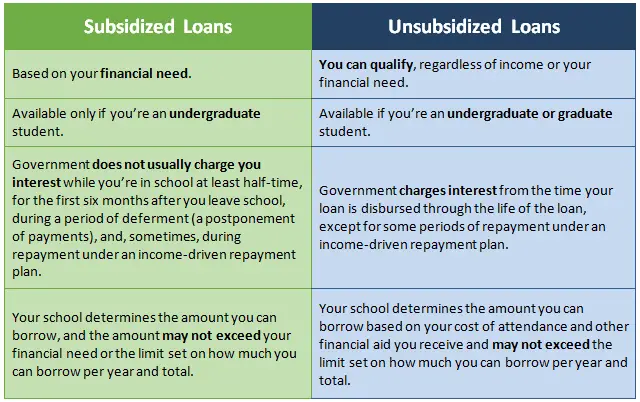

First, consider a Direct Subsidized Loan. Subsidized federal loans are simple to obtain, usually less expensive than PLUS or private loans, dont require a or cosigner, and have built-in protections and repayment options that unsubsidized, PLUS, and private loans don’t have. Subsidized federal loans are available for undergraduate students only. Unsubsidized federal loans can be taken out by both undergrads and graduate/professional students.

You May Like: How To Get An Aer Loan

Interest Rates On Subsidized And Unsubsidized Loans

The federal government sets federal student loan interest rates, and the rates may change each school year. For the 2021-22 academic year, the interest rates are:

- 3.73 percent for undergraduate students who take out Direct Unsubsidized or Direct Subsidized Loans.

- 5.28 percent for graduate and professional-degree students who take out Direct Unsubsidized Loans.

Step : Complete A Direct Loan Master Promissory Note

Although you may have previously signed a Master Promissory Note to MPN to receive FFEL Program Loans, a FFEL MPN cannot be used to make direct loans. All borrowers must complete a Direct Loan Master Promissory Note. The MPN is the legal document through which you promise to repay your direct loans and any accrued interest and fees to the Department of Education. It also explains the terms and conditions of your loans. A Direct Loan MPN can be used to make loans for up to 10 years. Complete your Direct Loan MPN at studentloans.gov using your FSA ID and password.

You May Like: How To Find Your Student Loan Number

Are There Fees For An Unsubsidized Loan

Yes, unsubsidized loans come with a percentage-based loan fee that’s deducted proportionately from each loan disbursement you receive. The fee rate depends on when you took out the loan: If it was first paid out on or after Oct. 1, 2019, and before Oct. 1, 2020, the loan fee is 1.059%. If the loan was first disbursed on or after Oct. 1, 2018, and before Oct. 1, 2019, the fee is 1.062%.

You’ll also pay interest in exchange for the benefit of borrowing. For undergraduate unsubsidized loans, the current interest rate is 4.53%, and for graduate, 6.08%. Fortunately, these interest rates are fixed and stay the same for the life of the loan.

How Does Student Loan Interest Compound

Even though student loan rates are expressed as an annual rate, the interest is usually compounded daily. On a $10,000 loan, you might think that a 4.45% interest rate would mean $445 paid in interest during the year, but thats not the case.

Instead, your annual rate is divided by 365, to get your daily interest rate. So, in the above example, youd be charged an interest rate of 0.012% each day. At the end of your first day, your interest charge totals $1.20 and its added to the $10,000. On the following day, your interest is calculated on $10,001.20. At the end of the year, youll pay a total of $455.02 in interest providing the lender with an extra $10 just because of the way interest is compounded.

When you consider that this daily compounding takes place over all the years you are in school and beyond, you can see how interest charges lead to repaying so much more than you borrow.

Recommended Reading: How To Find Student Loan Number

What Does An Unsubsidized Loan Mean

Most other educational loans are unsubsidized. The Federal Direct Loan program offers unsubsidized student loans PLUS and private loans are also not subsidized.

With an unsubsidized student loan, the borrower is responsible for making interest payments as soon as the loan is issued.

This could mean paying interest payments during school, or it could mean adding those interest payments to the principal of the loan, to be repaid after graduation.

Direct Unsubsidized Loans are not based on financial need, and are available to graduate students as well as undergraduates. They have fixed interest rates, and students need to fill out the FAFSA to apply.

The aggregate cap for Direct Unsubsidized Loans is $31,000 total. Interest is due immediately, even during the post-graduate grace period and during deferment or forbearance, although it can be added to the principal instead of being paid right away.

Other unsubsidized loans have their own terms and conditions.

PLUS loans are also through the federal government, and private loans are available from a variety of lenders.

In all cases, however, you will find the interest either due during school or added to the balance of the loan and due during repayment.

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

Read Also: What Is The Commitment Fee On Mortgage Loan

What Happens After You Submit The Fafsa

After you submit the FAFSA, the government will send you a , which gives you basic information about your eligibility for federal student aid.

The colleges you included on your FAFSA will have access to this information, and theyll use it to determine the amount of federal grants, work-study, and loans you may qualify for.

The colleges youre accepted to will send you a detailing the financial aid you are eligible to receiveincluding federal student loans, grants, and work-study.

The amount of federal aid you receive from each school can vary, just as the cost of attending each school varies.

Direct Subsidized/unsubsidized Loan Proration

Federal regulations require schools to prorate the Direct Loan amounts for graduating undergraduate students when their final period of enrollment is less than a full academic year . The loan limit proration determines the maximum loan amount that a student may borrow for the final term of study based on the degree they are earning.

Graduating undergraduate students who are only attending one semester of the academic year will have their Direct Loans prorated based on the number of credit hours they are enrolled.

Note: Graduate and professional students are excluded from the loan proration requirement

Bachelor’s Degree

Read Also: Va Manufactured Home 1976

Is An Unsubsidized Or Subsidized Loan Better

Subsidized loans have obvious benefits over unsubsidized loans, since the government pays the interest during certain periods of time. But that doesnât mean unsubsidized loans arenât worthwhile they help many students pay for college. Furthermore, many students wonât always have a choice between the two loan types, since direct subsidized loans are only offered to students who demonstrate financial need.

Unsubsidized loans provide a helpful alternative for families who may make too much money but still need help paying for the cost of tuition. If you have an unsubsidized loan, you might consider making a payment on the accrued interest while youâre in school. It will help free up more discretionary income down the road in the years after graduation.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

Types Of Federal Student Loans

There are three types of federal student loans:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as well as loans that can be issued to a student’s parents, also known as .

These loans are available through the Federal Direct Loan Program. Since federal loans offer different benefits than private student loans, you should always explore them first.

Learn more about the three types of federal student loans:

Read Also: How To Find Student Loan Number

Which To Borrow: Subsidized Vs Unsubsidized Student Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read more on federal student loans

-

Government loan rates:Current student loan interest rates

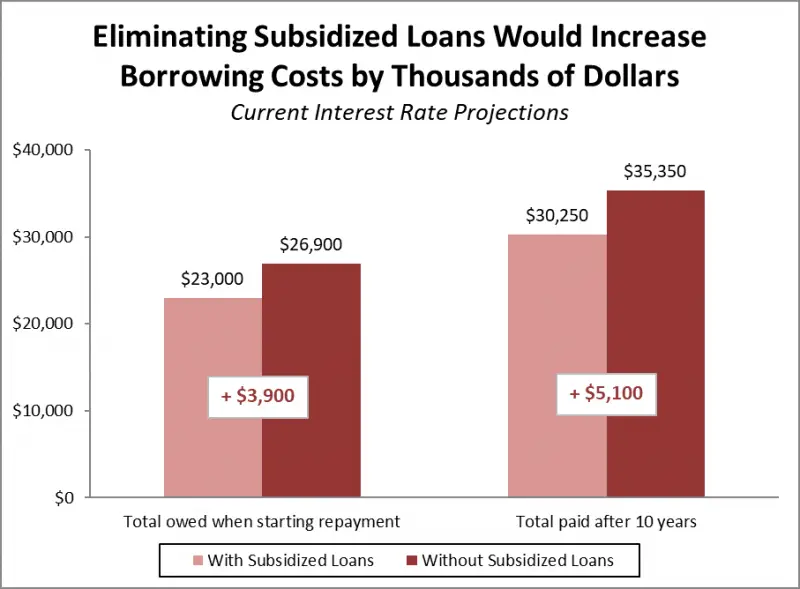

When choosing a federal student loan to pay for college, the type of loan you take out either subsidized or unsubsidized will affect how much you owe after graduation. If you qualify, youll save more money in interest with subsidized loans.

|

What you need to qualify |

Must demonstrate financial need |

Don’t have to demonstrate financial need |

|

How much you can borrow |

Lower loan limits compared with unsubsidized loans |

Higher loan limits compared with subsidized loans |

|

How interest works while you’re enrolled in college |

Education Department pays interest |

|

|

Undergraduate and graduate or professional degree students |

Direct Subsidized And Unsubsidized Loan Procedures

Direct Subsidized and/or Unsubsidized loans are offered up to maximum eligibility for students grade level as determined by the Registrar. The UTC Financial Aid Notification is sent to the students UTC email account.

Students then access their financial aid award in MyMocsNet. Students must accept, reduce or decline the loans through their MyMocsNet account. Students borrowing Direct Loans for the first time at UTC must complete Entrance Loan Counseling and a Master Promissory Note prior to receiving their first loan disbursement at UTC.

The Direct Subsidized and Unsubsidized Loans have origination fees that are deducted proportionately from each loan disbursement the student receives. This means the money you receive will be less than the amount you actually borrow. You are responsible for repaying the entire amount borrowed and not just the amount received.

Graduate students are not eligible to receive Direct Subsidized Loans.

Loan Limits for the academic year are:Dependent Students

- Freshman

Read Also: How To Transfer Car Loan To Another Person

Information For Fall Graduates

In accordance with federal regulation, 34 CFR 682.204 , , your student loans must be adjusted to reflect your enrollment for your final term of study if you were not enrolled in summer term. This regulation requires the school to prorate your student loan based on the number of credits you are enrolled in at the time of disbursement. Proration is done by dividing your maximum student loan eligibility for fall semester. If your loans must be prorated, you will be contacted by our office.

Subsidized Vs Unsubsidized Student Loans

Both subsidized and unsubsidized loans are distributed as part of the federal direct loan program. However, if you meet the financial need requirements to qualify for subsidized loans, youll pay less over time than you would with unsubsidized loans.

» MORE:Types of student loans: Which is best for you?

Thats because while your subsidized loan for undergraduate study will carry the same interest rate as an unsubsidized loan, interest wont accrue while youre still in college and during other periods of nonpayment. For this reason, its best to exhaust any subsidized loans youre offered before taking out unsubsidized loans.

Here are the main differences between subsidized and unsubsidized student loans:

Subsidized: Undergraduate students enrolled at least half time.

Unsubsidized: Undergraduate, graduate and professional degree students enrolled at least half time.

» MORE: Am I eligible for financial aid?

Subsidized: First-time borrowers on or after July 1, 2013 can take out loans until 150% of the published length of their academic program. This is equal to six years for a typical four-year program or three years for a typical two-year program.

Unsubsidized: There is no time limit on using these loans.

Subsidized: You must demonstrate financial need, as determined by the information you supply when you submit the Free Application for Federal Student Aid, or FAFSA.

Unsubsidized: Any students can borrow, regardless of financial need.

Read Also: How Much Do Mortgage Officers Make

Step : Application Process

Apply for financial aid by completing the Free Application for Federal Student Aid . In step 6 of the application, list SFSC School Code 001522. Begin the process by creating your FSA ID and Password.

Complete the Federal Direct Student Loan Request, and submit it to the SFSC Financial Aid Office.

At SFSC, all first-time borrowers are required to attend entrance counseling before their loans are processed. You may complete this requirement at studentloans.gov using your FSA ID and password. Entrance counseling explains what means to borrow funds and your responsibility toward repayment.

What Additional Steps Are There To Receive My Loan

Start by heading to the U.S. Department of Educations website to fill out the FAFSA each year. Once the department processes your application , youll receive a Student Aid Report .

The SAR details your expected family contribution and goes to the school you listed on your FAFSA application. Your school will tell you which types of loans you qualify for and the amounts you are approved to borrow. If a federal student loan is part of your total financial aid package, your schools financial aid administrators can tell you how to accept the loan.

Recommended Reading: What Car Loan Can I Afford Calculator

Are Unsubsidized Loans Bad

Unsubsidized loans have many benefits. These loans, unlike subsidized loans, can be used for undergraduate and graduate school, and students do not need to show financial need to qualify. The interest does begin accruing as soon as you take out the loan, but you don’t have to pay the loans back until after you graduate, and there are no credit checks when you apply, unlike private loans.

How Is Student Loan Interest Calculated

Student loan interest rates are expressed as an annual percentage rate. Federal rates are set by Congress each year. Because federal loans are set by the government, the rate you get will not change based on your personal financial circumstances. The amount you get, however, can be influenced by the household income reported on your Free Application for Federal Student Aid, or FAFSA.

Private student loan rates, however, are set by lenders based on financial market rates, typically with the London Interbank Offered Rate , a benchmark interest rate used as a reference for many types of loans.

The rate you get with a private student loan, also depends on a variety of factors, including your credit history, credit score and income. Lenders have their own models for calculating risk, so the rate you get can vary from lender to lender.

Also Check: Is Bayview Loan Servicing Legitimate