What Type Of Loan Do I Have

You must know what type of student loan you have in order to understand your options.; You can use the National Student Loan Data System to find out what federal loans you have. As of February 2020, the NSLDS site is found on the Departments StudentAid.gov site. There is a large Log In button on the right side of the screen that you must use to see your account information . Once you enter your FSA ID, you will have access to a lot of information, including your student aid summary.

You must have a FSA ID to access your loan information. If you do not already have an FSA ID, you can create one by clicking on the Create Account button on the StudentAid.gov site. The Department has posted answers to frequently asked questions about the FSA ID system.

Once you access your loan dashboard, you will see an aid summary as well as more detailed information about each individual grant, loan, and aid overpayment. The Department says that the new dashboard will allow you to keep track of your remaining eligibility for Direct Subsidized Loans and Federal Pell Grants and Iraq and Afghanistan Service Grants .;You should also be able to track your progress toward repaying loans and track the number of qualifying payments made toward Public Service Loan Forgiveness if applicable. In addition, the aid summary will include information about your loan servicer and a link to the loan servicers website.

Examples:

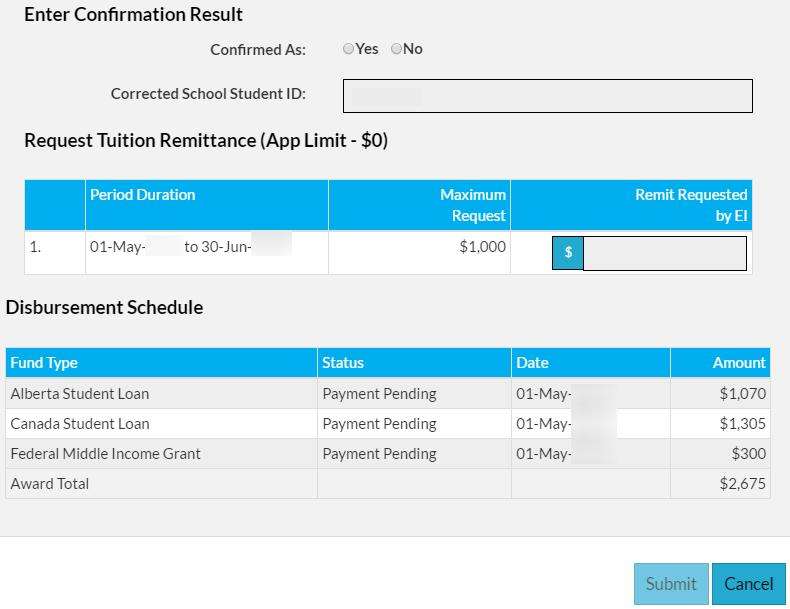

What Happens After I Submit An Application

After you submit your application for funding, it is assessed. StudentAid BC assesses your financial need considering allowable costs and resources and determines whether or not you will receive funding.

You will receive a notification of assessment that tells you how much funding you will get. If you applied for assistance for full-time studies you can also check the status of your application online .

The receive your funding section describes the steps you need to take to use your funding to pay for school.

If you do not receive funding, you can appeal your assessment.

Here’s How To Find The Holder Or Servicer For Your Loans

By , Attorney

Student loans that the federal government provides or guarantees usually fall into two categories: Federal Direct Loans and Federal Family Education Loans . The Department of Education makes Federal Direct Loans. Before July 1, 2010, the federal government also guaranteed loans that private lenders made. These loansFFELsare also considered federal student loans. Perkins Loans, another kind of federal student loans, were previously available toundergraduate, graduate, and professional students who had exceptional financial need.

No matter what type of federal student loans you have, you might need to know, and deal with, the loan holder or loan servicer.

Read Also: How To Take Out Equity Loan

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

Don’t Miss: Can I Get Another Loan From Upstart

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

Read Also: How Long Does It Take To Get Sallie Mae Loan

Use The National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System , a database run by the Department of Education.

When you enroll into a college or university, the schools administration will send your loan information to the NSLDS. The database also pulls information from loan servicers and government agencies, so its a comprehensive outline of all federal student aid youve received.

To find your federal student loan balance on NSLDS:

While the NSLDS is useful, there are some limitations:

- Not always up to date: Information on the NSLDS can be as much as 120 days old, so it may not be the most up to date view of your loans.

- Not all loans are listed: The NSLDS only contains information about Title-IV eligible loans and grants, so if you took out other federal loans such as loans for medical or nursing school programs they wont show up on the NSLDS. Private student loans also wont be listed.

Most Frequently Asked Questions

How do I find out which companies are servicing my federal student loans?

You may have federal loans in addition to those serviced by Granite State Management & Resources. Get the details on all of your student loans and student loan servicers online through the Department of Education’s National Student Loan Data System at nslds.ed.gov. Youll need the same Federal Student Aid ID used to file FAFSA® to access your Federal Student Aid records online.

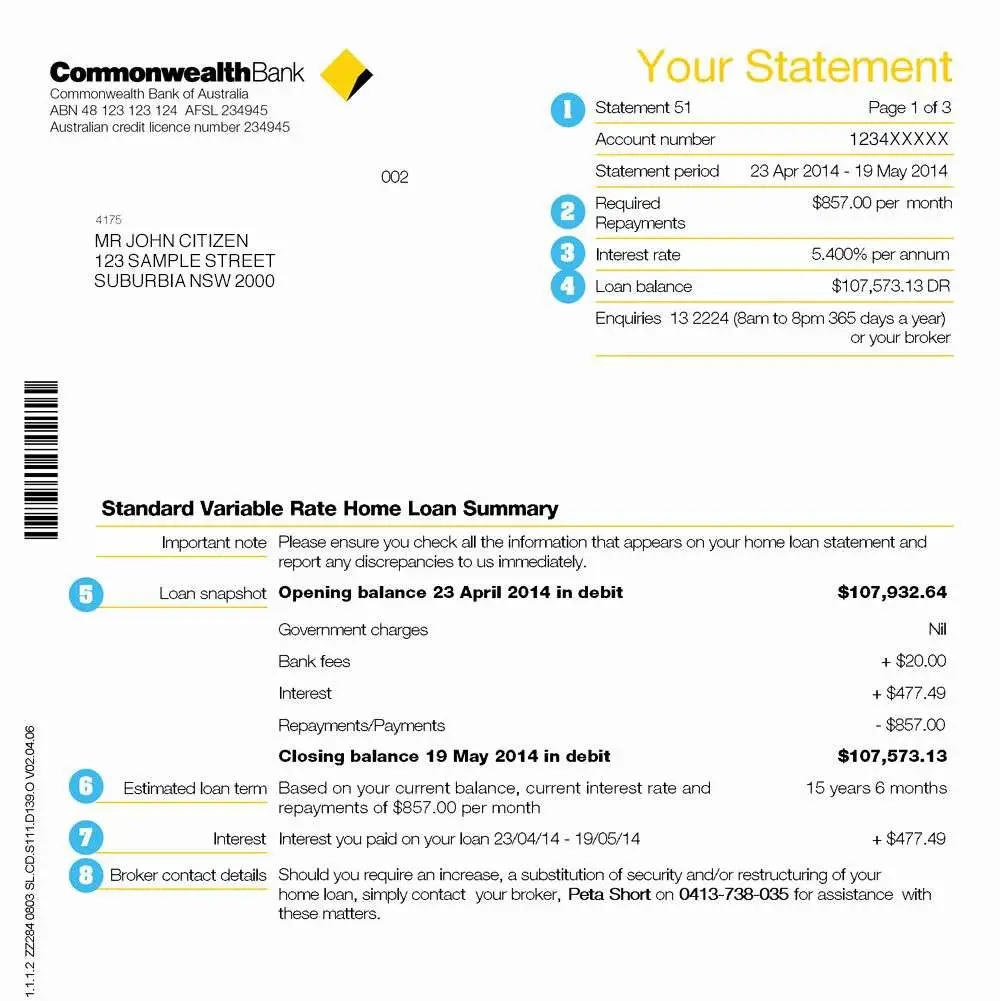

How do I access my account online?

Access your account by clicking Manage My Account from the homepage. If you are a first time visitor to our site, please complete the steps for online account access. You will need to have your nine-digit account number to create your account; your nine-digit account number can be found on your monthly statement.

Through Manage My Account you can:

- Apply online for deferments or forbearances.

- Reset your own password.

- Access our convenient and secure online message system for monthly statements and correspondence.

- Access real-time information easily while logged into your account with the confidence of knowing it is password-protected and confidential.

How do I make that loan payment on behalf of a child/friend/spouse?

A parent or other third party can quickly and easily make a payment on an account online once they have been established as an . The Borrower must follow these quick steps to establish an authorized payer:

How do I request a pay-off statement?

How do I change my payment due date?

Also Check: How To Payoff Car Loan Quickly

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and;how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.;

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

Recommended Reading: How Much Do We Qualify For Home Loan

Nelnet Your Student Loan Servicer

Nelnet works with the Department of Education to help you achieve your educational goals. We provide customer service on your federal student loans, so we answer your questions, offer solutions if you’re having trouble paying, and process your payments.

You’ll typically go through three stages during your loan’s life cyclein school, in grace, and in repaymentand will receive a variety of communication from us depending on the stage your loan is currently in.

We want you to have the best borrower experience possible. Let us know how we can help you.

What Do I Do With My 1098

You’ll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you don’t need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, you’ll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. It’s as easy as that!

You May Like: Which Loan Is Better Conventional Or Fha

Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the;Federal Student Aid Information Center .

Is The Amount Of Interest Higher Than You Expected

Capitalized interest may be counted as interest paid on the 1098E. That capitalized interest and your origination fees may be tax deductible. If you have more questions on your 1098-E, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

Also Check: Are There Student Loan Forgiveness Programs

Federal Student Aid Ombudsman Office

If you’ve tried all of these places and are still in need of help, consider contacting the Federal Student Aid Ombudsman office. The Department of Education’s student loan ombudsman helps borrowers with student loan problems. The ombudsman is a last resource; usually, it will help you only after you’ve tried to resolve your issue yourself. You can contact the student loan ombudsman office at 877-557-2575.

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies,;loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Recommended Reading: How To Calculate Amortization Schedule For Car Loan

How Do I Find My Student Loan Account Number To Verify My Identity For The Irs

;Check with the lender from whom you have the student loan.;;Wouldn’t it be on the information you use when you make your payments?; Look on the loan website.

If you are trying to enter student loan interest you paid you need your 1098E.

STUDENT LOAN INTEREST

Only the person whose name is on the student loan and who is legally obligated to pay the loan can deduct the student loan interest. If you co-signed then you are legally obligated to pay if the primary borrower defaults or does not pay.;;If you did not sign or co-sign for the loan you cannot deduct the interest.

You cannot deduct student loan interest if you are being claimed as someone elses dependent, or if you are filing as married filing separately.

The student loan interest deduction can reduce your taxable income by up to $2500

There is a phaseout for the Student loan interest deduction, which means the amount you can deduct gets reduced when your modified adjusted gross income hits certain income levels and is even eliminated at certain income levels – ;

If your filing status is single, head of household, or qualifying widow, then the phaseout begins at $65,000 until $80,000, after which the deduction is eliminated entirely.

If your filing status is married filing joint, then the phaseout beings at;;$130,000 until $160,000, after which the deduction is eliminated entirely.

;Enter the interest you paid for your student loan by going to Federal>Deductions and Credits>Education>Student Loan Interest Paid in 2020

Federal Student Aid Information Center

To find out which lenders hold your Stafford, Direct and/or Perkins Loan, contact the Federal Student Aid Information Center.

- STEP 1: Call 433-3243. Listen to the telephone menu and select option ‘3’; and when prompted, say the word ‘LOANS’ to obtain information on your existing student loans and lenders.

- STEP 2: Have your FSA ID ready in order to access your data.

Recommended Reading: How Are Student Loan Rates Determined

Paying Back Student Loan Debt

With federal student loans, there are multiple payment plans available:

;; Standard repayment plan: This is a ten-year repayment plan and students who choose this will typically pay less back, over time, than in other plans. This isnt a good choice if the student is interested in obtaining Public Service Loan Forgiveness .;; Graduated repayment plan: With this plan, payments increase every two years. This can help students who expect their income to increase, but they would pay more interest over time than if on the standard repayment plan.;; Extended repayment plan: Payments can be made during a period of up to 25 years. This can help with monthly payment amounts, but students will pay back more over the life of the loan than those who use the standard or graduated repayment plans.;;Income-based repayment plan : There are four different plans where student loan payments factor in the borrowers income; this can be a good choice for those who plan to use PSLF, but borrowers will typically pay back more than under the standard plan.

PSLF is a forgiveness program that borrowers employed by a governmental or non-profit organization might qualify for. If a student has been denied for PSLF in the past, there is currently a Temporary Expanded Public Service Loan Forgiveness program to explore.

Recommended: How Much Do I Owe in Student Loans?