What Loan Repayment Programs Are Available

Repayment starts immediately after graduating. Once you enter repayment, any unpaid interest capitalizes. This means its added to the total principal balance of the loan.

Ideally, you can avoid your interest capitalizing by paying it off while in school. If you feel like you need to defer your payments after graduating, reach out to your servicer immediately about deferment and forbearance options.

Unlike Parent PLUS Loans, Grad PLUS Loans have a variety of repayment plans available. You can choose between the following repayment plans based on your needs:

All of these payment plans are designed to work with your current financial needs so you can afford your loan payment. If you know how much you aim to borrow, check out the Student Loan Planner® calculator to plan for your future repayment.

Grad Plus Loans: What You Should Know Before Applying

Grad PLUS loans are one way to fund grad school. This article breaks down how you can qualify for one and what the next steps are.

Elizabeth Spencer

As the cost of attending a graduate or professional program rises, many students need to borrow more than permitted with a Direct Unsubsidized Loan. Is it best to make up the difference with a grad PLUS loan?

The answer depends on a variety of factors, such as your credit score and your desired repayment plan. Lets look at the seven most important things to know about grad PLUS loans before you start an application. Then you can make an informed decision about whether to apply for a grad PLUS loan or a private graduate loan to finance the costs of your education.

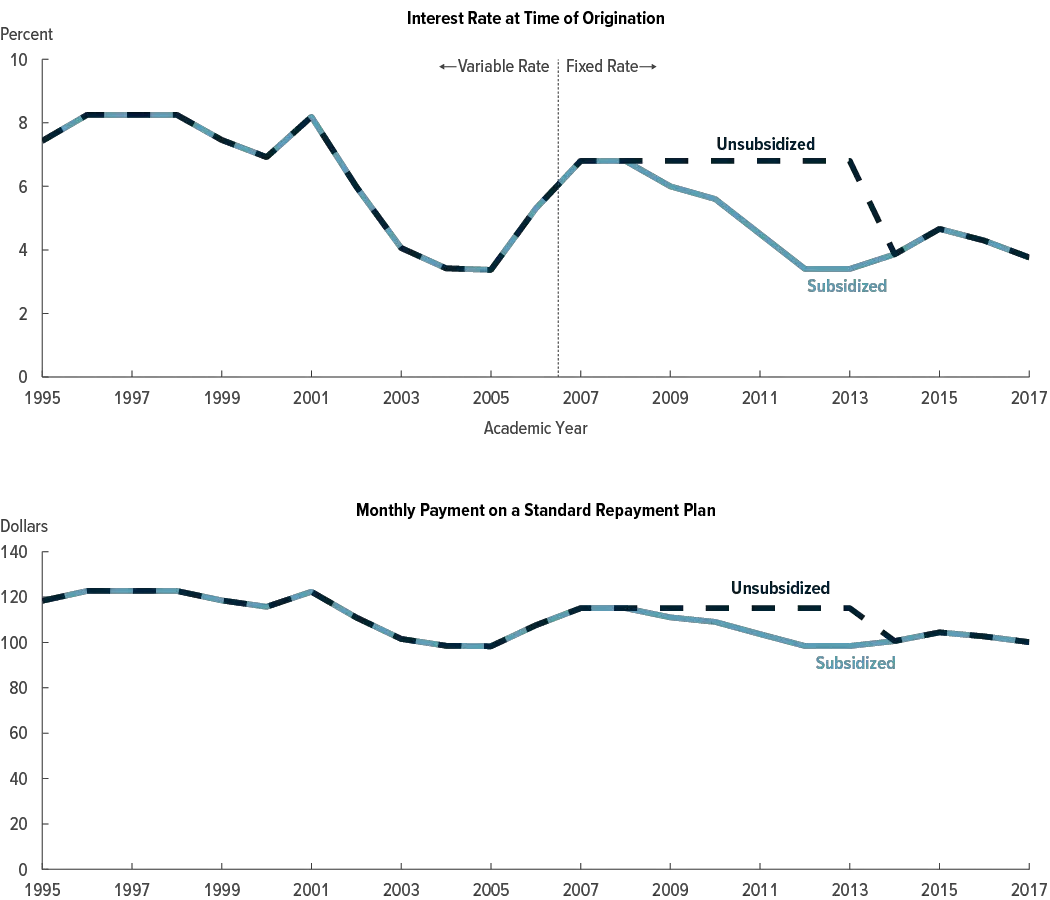

Interest Rates On Federal Plus Loans

The interest rates on Federal PLUS Loans are fixed rates that change only for new loans each July 1. The new interest rate is based on the last 10-year Treasury Note Auction in May.

The interest rate on the Federal PLUS Loan is the same for both Federal Parent PLUS Loans and Federal Grad PLUS Loans.

Keep in mind, however, that you are not required to pay interest or make payments on any Federal Direct Loan during the current COVID-19 relief period. The relief period is in effect through at least September 30, 2021.

The interest rates are set according to this formula:

| Borrower |

Recommended Reading: Va Manufactured Home Guidelines

Read Also: How Much Va Loan Can I Get Calculator

Federal Direct Graduate Plus Loan Limits And Terms

You may borrow up to the full student budget less total financial aid from all sources. The interest rate is fixed at 7.543% for 2022-2023 loans. There is a 4.228% loan origination fee deducted from the loan by the U.S. Department of Education for loans with a first disbursement date prior to October 1, 2023 . The Grad PLUS Loan is credit-based and requires credit approval by the U.S. Department of Education.

Refer to the Federal Student Aid website for additional information regarding Direct Grad PLUS Loans.

Graduate Plus Loan Cancellation

Your school must notify you in writing whenever your account is credited with your loan proceeds. This notification must be sent to you no earlier than 30 days before and no later than 30 days after the school credits your account. You may cancel all or a portion of your loan if you inform your school within 14 days after that date that your school sends you this notice or by the first day of the payment period, whichever is later. Your school can tell you the first day of your payment period. If you receive Graduate PLUS Loan funds directly by check, you may refuse the funds by not endorsing the check.

Recommended Reading: Mortgage Loan Originator License Texas

Grad Plus Loans: Plus Loans For Graduate Students

With Grad PLUS Loans, you might be able to cover your schools entire cost of attendance.

Edited byAshley HarrisonUpdated July 1, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre planning to attend a graduate program, a Graduate PLUS Loan could help you cover the cost.

Grad PLUS Loans are specifically designed for graduate as well as professional students and could cover up to your schools cost of attendance .

Heres what you should know about Grad PLUS Loans:

Federal Direct Graduate Plus Loan Program

The Federal Direct Graduate PLUS Loan is a fixed interest supplemental loan program that enables graduate students to borrow directly from the U.S. Department of Education to help pay for their educational expenses. The Program is administered by the Harvard Graduate School of Education Financial Aid Office, which works with the U.S. Department of Education to offer this loan. This loan is only available to U.S. Citizens and permanent residents students must be enrolled in a minimum 6 credits per term in a degree-granting program to be eligible.

This loan has many benefits such as a fixed interest rate, high credit approval rate and streamlined application process. Loan payments can be deferred while in school at least half time and the loan has flexible repayment options. As part of the Federal Direct Loan Program, this loan would also conveniently become part of your loan account that contains your Federal Direct Subsidized/Unsubsidized Loan, thus reducing your number of lenders. Since Harvard University participates in the Federal Direct Loan Program this is the only supplemental loan that is recommended by the HGSE Financial Aid Office, however students may select any supplemental loan of their choice.

Read Also: What Do You Need To Get Car Loan

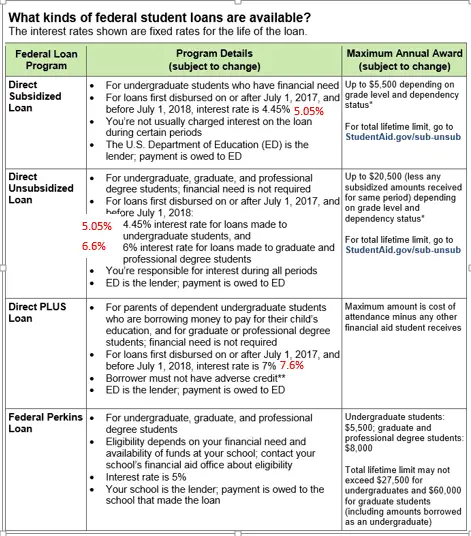

Differences In Subsidized And Unsubsidized Student Loan Terms

The federal government pays the interest on subsidized student loans during the in-school, grace and authorized deferment periods.

The federal government also pays the accrued but unpaid interest on subsidized student loans during the first three years of the income-based repayment , pay-as-you-earn and revised pay-as-you-earn repayment plans, but not for the income-contingent repayment plan.

Loan limits are lower on subsidized Federal Direct Stafford loans. The annual limits are $3,500 for freshmen, $4,500 for sophomores, $5,500 for juniors and $5,500 for seniors, with an aggregate limit of $23,000. The subsidized Federal Direct Stafford loan limits are the same for dependent and independent students. Any amounts that the student does not receive as a subsidized loan can be borrowed as an unsubsidized loan, up to the overall Federal Direct Stafford loan limits.

If a dependent undergraduate students parents are denied a Federal Parent PLUS loan because of an adverse credit history, the student becomes eligible for the same Federal Direct Stafford loan limits as independent students. The increase in loan eligibility is limited to unsubsidized Federal Direct Stafford loans there is no change in subsidized Federal Direct Stafford loan limits.

Other loan terms, such as interest rates and fees, are the same for subsidized and unsubsidized Federal Direct Stafford loans.

Also Check: Va Loan Mobile Home Requirements

Can Graduate Students Get Subsidized Loans

With subsidized federal student loans, the Department of Education pays your interest charges while youre enrolled or in deferment. That means you pay less for the student debt you take on.

But the federal student loan interest subsidy is available only to undergraduate students who have demonstrated financial need.

Unfortunately, the office of Federal Student Aid no longer offers subsidized loans for graduate school.

| In the past, FSA offered subsidized loans for graduate school | |

|---|---|

| Subsidized Stafford Loans for graduate students | Also called Direct Loans, these Subsidized Stafford Loans were offered to graduate students with a demonstrated financial need until July 2012. Then they were cut to free up funding for other forms of federal student aid. |

| Federal Perkins Loans | The Federal Perkins Loan Program created funds that allowed colleges to offer additional loans to low-income students. Federal Perkins Loans came with a federal interest subsidy and were available to both undergraduate and graduate students. Unfortunately, the Federal Perkins Loan Program expired in 2017 and wasnt renewed by Congress, so this subsidized student loan option is no longer available. |

Recommended Reading: How Much Can You Borrow Home Loan

Should I Apply For A Grad Plus Loan

Short answer: No. If you havent realized by now, Grad PLUS loans are just another way to go even deeper into student loan debt.If youre like most people, youre probably banking on getting a good-paying job after grad school so you can pay off all your student loans. But that doesnt always work out. And it may take a while to find the right job and work your way up to a higher salary. Or you may get a year into grad school and realize you dont really want to be a college professor or work on Wall Street anymore. But youll still have student loans to pay off regardless. Ouch.

Plus, by the time you finish school, youve already racked up a ton of interest. And when youve got a huge student loan with a huge interest rate, that debt can grow faster than you can make progress. Just ask the doctors, dentists and lawyers out there who are still paying off their student loans from decades earlier.

The truth is, student loans are straight-up dangerous. They steal your paycheck and your peace, hanging over your head for years and forcing you to pay a ton of extra money in interest.

Federal Graduate Student Loans

Federal student loans are originated by the U.S. Department of Education and are loaded with borrower protections and flexibility. Within this program, graduate students can choose between a Direct Unsubsidized student loan and a grad PLUS loan.

You can borrow up to $20,500 each school year with a Direct Unsubsidized student loan, with a $138,500 aggregate limit for most degrees. A grad PLUS loan allows you to borrow more up to 100 percent of the cost of attendance. In general, it’s best to maximize your unsubsidized loan options first, as interest rates are lower than those of grad PLUS loans. Additionally, you must go through a credit check for grad PLUS loans, which is not the case for Direct Unsubsidized Loans.

To apply for either of these loans, you’ll have to complete the FAFSA, which opens on Oct. 1 each year. If you’re applying for a grad PLUS loan, you’ll also have to fill out a separate application once the FAFSA is complete. If this is your first time receiving a Direct Loan, you’ll be required to complete entrance counseling.

You May Like: How To Get Cash Loan From Bank

Can I Cancel A Loan If I Decide That I Dont Need It Or If I Need Less Than The Amount Offered

Yes. Before your loan money is disbursed, you may cancel all or part of your loan at any time by notifying the financial aid office. After your loan is disbursed, you may cancel all or part of the loan within certain time frames. Your promissory note and additional information you receive from the financial aid office will explain the procedures and time frames for canceling your loan.

You May Like: Is First Loan Com Legit

Grad Plus Loans Are Unlocked With A Fafsa Form

Your eligibility for a grad PLUS loan is determined when you fill out the Free Application for Federal Student Aid .

The borrowing process is relatively simple in addition, federal loans typically offer more benefits than private student loans, such as income-driven repayment and student loan forgiveness programs. In the end, this can make graduate PLUS loans a very attractive choice.

Also Check: What Do Underwriters Look For Va Loan Approval

If Credit Check Is Approved

In order to borrow a PLUS Loan, the applicant has to pass a credit check. Once approved, the applicant must complete the following steps:

Federal Loan Rates Limits Terms

| U.S. Department of Education, 1-800-557-7394. | |

| Amount | Up to $3,500 Freshman, $4,500 Sophomore, $5,500 Junior and Senior. |

| Interest | Current interest rate 4.99%. Based on 10-year Treasury bond yield plus 2.05 percent. Interest rate not to exceed 8.25%. |

| Repayment | Standard: 10 years. Many other options are available: see Federal Student Aid |

| Fees | An origination fee of 1.057% will be deducted from each disbursement for loans first disbursed on or after October 1, 2021. Calculate fee |

| Eligibility | Student must maintain at least half-time enrollment status in each enrolled semester and meet basic eligibility requirements. |

| Deferral | Principal and interest*. Repayment begins six months after graduation or when the student falls below half-time status. |

For new Subsidized Loans, the interest subsidy during the six-month grace period is eliminated for students who fall below half-time status.

A Federal Direct Subsidized Loan is a low interest need-based loan made to students enrolled at least half-time who have completed the FAFSA for the appropriate academic year. The federal government pays loan interest while the student is in school, and loan repayment begins six months after the student graduates or drops below half-time enrollment. Eligible students are also automatically considered for the Federal Direct Unsubsidized Loan .

You May Like: How Much To Mortgage Loan Officers Make

Stafford Loan Limits For Independent Students

College students who can prove they are independent may qualify for more federal funding to help cover the cost of their educational goals. Independence as a student means there is no other person who can or is claiming the student as a dependent on their tax return.

Independent students are managing the financial aid process for their college years on their own, in theory, and therefore may need additional help through federal Stafford Loans.

While less restrictive than dependent students limitations, there are still federal student loan limitations imposed on independent students who qualify for financial aid. The restrictions are as follows:

- First-year undergraduate students $9,500, with no more than $3,500 in subsidized loans

- Second-year undergraduate students $10,500, with no more than $4,500 in subsidized loans

- Third- and fourth-year students $12,500, with no more than $5,500 in subsidized loans

Similar to dependent students, independent students face aggregate student loan limits. Undergraduates may have no more than $57,500 in total federal student loans, with no more than $23,000 in subsidized loans. It is also important to note that all graduate-level students are considered independent students. They also have federal student loan limits, as follows:

About Federal Direct Graduate/professional Plus Loans

If you are a graduate or professional student, consider a Federal Direct Graduate/Professional PLUS loan before an alternative loan or maxing out your credit cards. This loan helps qualifying students pay the difference between the financial aid already received from scholarships, grants and student loans and the cost of attendance. Unlike some private loans that come with variable rates that can climb several times a year, this loan has a fixed rate for the life of the loan.

Read Also: What Is The Standard Student Loan Repayment Plan

Private Graduate Student Loans

Private student loans are originated by private financial institutions, such as banks, credit unions and online lenders. You have dozens of options to choose from, but each lender sets its own rates, terms and eligibility requirements. Rates are commonly anywhere from 3 percent to 15 percent and can be fixed or variable. The exact rate you’re quoted depends on your credit score and financial profile. As such, you’ll have to go through a hard credit check in order to be approved for a loan.

Unlike with federal student loans, you’ll generally have a range of repayment terms to choose from with private lenders, usually between five and 20 years. Private student loan lenders also often offer degree-specific loans that are tailored to the needs of law school, medical school, business school and more.

Repaying A Federal Direct Graduate/professional Plus Loan

Your first payment will be due within 60 days after the loan is fully disbursed. Generally, this will be while you are still in school. There is no grace period.

You may request an in-school deferment if you are enrolled in at least a half-time status. Keep in mind, your GradPLUS Loan accrues interest while in deferment status and the interest will be capitalized unless arrangements are made with the holder to pay interest quarterly.

You must apply separately for an in-school deferment on your GradPLUS Loan, even if you have already received in-school deferments on FFEL subsidized or unsubsidized loans.

Read Also: Loan For Bad Credit Instant Approval

What Is A Graduate Student Loan

A graduate school loan is a type of student loan that can help pay for graduate school tuition, fees, books, housing and more. These loans often have higher borrowing limits than undergraduate student loans, since graduate school costs more, and they may have perks specific to your degree for instance, extended deferment during a clerkship or fellowship.