What Other Income Matters

Have you ever heard of the term residual income? This term refers to the amount of money you have leftover every month after any major expenses are paid in full and is a factor that lenders consider when determining how much home you can afford. Depending on the size of your family and the location you live in guidelines regarding residual income for lenders can vary but theyre important to help determine if you have enough cash to cover any unexpected expenses that may arise.

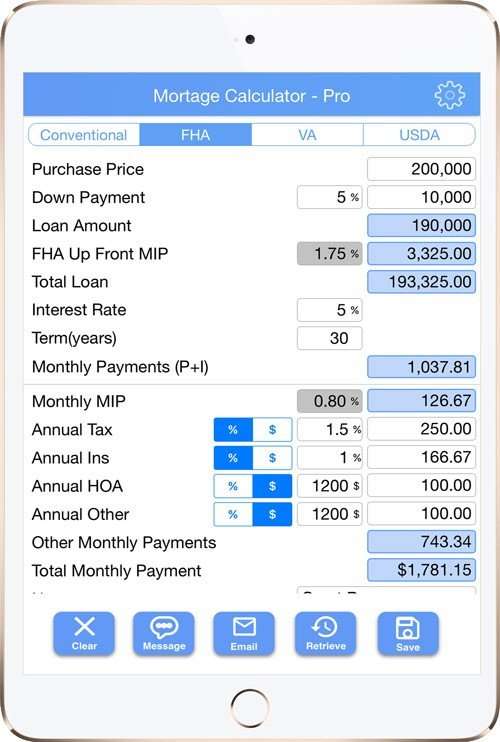

Use This Va Mortgage Calculator To Get An Estimate

This VA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that you’re buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $225,000 base loan amount with a 30-year term at an interest rate of 4.125% with no down-payment would result in an estimated monthly payment of $1,126.45 with an Annual Percentage Rate of 4.471%.1

About Our Va Loan Mortgage Affordability Calculator

Figuring out how much home you can afford is a great first step when you want to buy a home with a VA loan. Thats why we offer this VA loan calculator. It will help you understand the price of houses that fit your budget.

VA loans are a great choice for homebuyers who qualify. VA loans have competitive interest rates, $0 down payments for many homebuyers, and no mortgage insurance. Veterans, active-duty military personnel, and surviving spouses can all be eligible for VA loans.

Our VA loan calculator estimates affordability starting with your annual gross income. Then it adds in these important financial factors.

Monthly debt payments

These are payments for things besides your mortgage like car loans, student loans, and credit cards. Lenders want to feel confident you will be able to afford all your monthly bills not just your monthly mortgage payment before they approve your VA loan.

We often do this with your debt-to-income ratio . Debt-to-income ratio is calculated by dividing your total monthly debt by your monthly income and making the result a percentage. For example, pretend you have a monthly income of $7,000. Then pretend you have monthly debt payments that total $800 and you want to buy a home with a $2,000 monthly payment. That means your total monthly debt would be $2,800.

$0 down payment

Term

Interest rate

You May Like: Classic Car Loans Usaa

How Do The Interest Rates For Va Home Loans Compare With Those For Other Mortgage Products

As noted previously, the interest rates for VA home loans are generally quite a bit lower than for traditional mortgage products. In fact, this is one of their major selling points and is the main reason why so many people are sold on them. For people with poor credit, especially, the low interest rates offered through the VA home loan program are very enticing. After all, those with low credit scores generally enjoy the same competitive interest rates that people with topnotch credit scores enjoy. Whether your credit score is 750 or 600, you’re going to pay a lot less interest with a VA loan.

Basically, if you want to get a feel for how much a VA home loan will cost in terms of interest, you should just look at what standard, fixed-rate, 30 year mortgages are going for in terms of interest and shave a little bit off of the total. Since rates fluctuate, there is no point in documenting how much you are going to pay in interest for a VA home loan. Suffice it to say that it is generally a great deal less than you would pay for many other popular mortgage products.

The reason VA loans are able to charge a lower rate than other mortgages is the Veteran’s Administration guarantees to pay the lender up to 25% of the value of the home. This means if a buyer bought a house for $500,000 & was foreclosed on the VA would cover the lender for any loses up to $125,000.

How To Use Nerdwallet’s Va Mortgage Calculator

Enter the price you expect to pay for a home and your down payment. VA loans typically don’t require a down payment, but paying a chunk of money upfront will lower your monthly mortgage payment and make you a more competitive buyer in a hot real estate market.

Enter an estimated interest rate. Unsure? Check current VA mortgage rates to see what lenders are offering.

Choose a loan term of 15 or 30 years. You’ll pay less interest over the life of the loan with a 15-year term. Your monthly payment will be lower with a 30-year term because the repayment of the loan is stretched over a longer period.

Select whether this is your first VA mortgage. Your answer will affect the amount of your VA funding fee, a one-time charge most borrowers must pay.

Check the results. The “total monthly cost” estimates your monthly VA mortgage payment, including estimated costs for property taxes and home insurance. The “total cost” is how much you’ll pay over the life of the loan, including the VA funding fee.

For more detail, select the “Monthly” or “Total” box under “Breakdown of costs.” Some VA borrowers roll their funding fee into the total loan amount. If thats your plan, take the funding fee amount, found under the “Total cost breakdown,” and add it to the amount you expect to spend on a home under “Mortgage details.” That will adjust your monthly payment to include the financed VA funding fee.

» MORE: See how much house you can afford

Also Check: What Is The Fha Loan Limit In Texas

How Our Va Loan Calculator Works

Zillow’s VA loan calculator provides autofill elements to help you quickly estimate your monthly mortgage payment on a new home. Like most home loans, the mortgage payment on aVA loan includes the principal amount you borrowed and the interest the lender charges for lending you the money. Both of which are represented as P& I on the VA loan calculator breakdown. You can also choose whether to includetaxes and homeowners insurance in the total monthly payment amount. Learn more about the details used to calculate your va loan payment using the definitions below.

When Is The Best Time To Get A Va Home Loan

When shopping around for a mortgage, many people wonder if there is a “good time” to apply. For some mortgage products, there is no doubt that key market conditions affect how much they’re going to pay. However, there is no tried and true advice for when you should – or shouldn’t – apply for a VA home loan. The things that affect the interest rates that are attached to the typical VA home loan are so varied and complex that there is no hard and fast rule to refer to.

If you are considering a VA home loan, contact a number of qualified lenders and ask them what the current rate is. Try to get a feel for whether rates have recently crept up or gone down, and act accordingly. Either way, you’re going to be paying a lot less than those who don’t qualify for VA loans are going to. Also, without the worry of private mortgage insurance and without having to make a down payment, you’re going to be ahead of the game financially anyway. In fact, the relaxed conditions for VA home loans makes any time a good time to get one. The VA loan benefit is flexible and widely used across the country. Here are usage stats for fiscal year 2018.

| Loan Type |

|---|

| $264,197 |

You May Like: Parent Plus Loan Interest Deduction

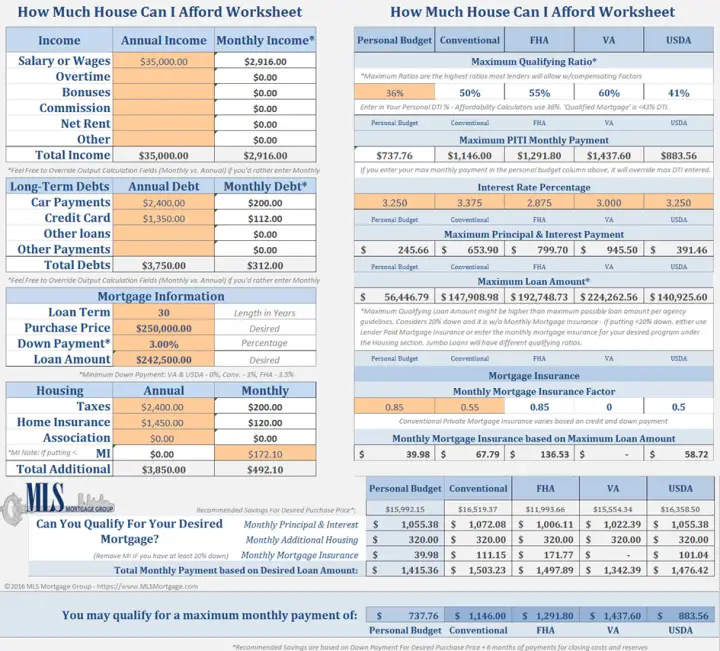

Two Types Of Dti Ratios

- Front-end DTI: This is the portion of your income that pays for all housing costs. It includes monthly mortgage payments, property taxes, homeowners insurance, etc.

- Back-end DTI: This is the portion of your income that pays for housing expenses together with all your other debts. It includes your car loan, student loan, credit card debts, personal loan, etc.

Furthermore, expect conventional mortgages to have different DTI limits from government-backed loans. Lets review the different types of mortgages below.

Most homebuyers generally choose conventional loans, which are not directly financed by the government. Conventional loans are usually packaged into mortgage-backed securities that are guaranteed by Fannie Mae and Freddie Mac. These are available through private lenders such as banks, credit unions, and mortgage companies.

Do Lenders Count Military Income

Lenders can count VA disability income and certain military allowances to determine how much you can borrow with a VA loan. Active duty service members receiving Basic Allowance for Housing can use this income to pay for part or even all of their monthly mortgage payment.

Other types of military allowances that can count as effective income include: flight pay, hazard pay, imminent danger pay and more. Lenders can also count National Guard and Reserve income.

Don’t Miss: Usaa Used Car Loans

What Is A Va Affordability Calculator

A VA affordability calculator acts as a pre-approval tool by estimating how much house you can afford based on your income and expenses. To qualify for a VA loan, your lender will want to assess your debt-to-income ratio . Your DTI indicates the relationship between income received and what portion of it is eaten by major monthly debts. Typically, a lender will require a DTI of 43% or lower. If your DTI exceeds 43%, it is still possible to qualify for a VA loan. However, you should expect a deeper analysis of your financial records and may be asked to provide evidence of financial cushioning and accountability to mitigate the risk on a loan. This is why a VA affordability calculator is a useful preemptive tool that can help home buyers define the parameters of how much home they can realistically afford.

Can I Have More Than One Va Loan

Yes. However, if you have entitlement in use that will not be restored, your new VA loan must still be over $144,000, and the Freddie Mac county loan limit will factor.

So yes, you can have more than one VA loan. Use the VA entitlement worksheet to calculate your maximum VA loan amount.

Your new VA loan must be on an owner occupied primary residence.

VA uses conforming loan limits established for Fannie Mae and Freddie Mac to determine maximum VA loan eligibility when there is entitlement in use that will not be restored.

If the home you are buying is more than your remaining entitlement allows, you can still use a VA loan if you put down 25% of the difference of the purchase price and maximum loan amount.

Recommended Reading: Usaa Auto Refinance Phone Number

How Can You Lower Your Interest Rate

Some lenders have different interest rates for different types of loans. For example, some lenders offer better rates on VA loans compared to conventional mortgages. Some lenders may also feature different interest rates for jumbo loans versus conforming loans.

Your credit score is arguably one of the most important factors you can control. In general, the higher your credit score, the lower your credit risk, and the greater your ability to secure a lower interest rate.

Finally, buying discount mortgage points on your loan may allow you to secure a lower interest rate. When you buy points, you reduce the interest rate on your loan. In effect, you are prepaying a portion of the loan to secure a better interest rate. You can generally buy a point at the rate of 1% of your loan. So buying a point on a $250,000 mortgage would usually cost $2,500*. This payment can be made at closing, or it can be rolled into your loan.

Be sure to run the numbers to make sure buying points will pay off in the long run.

How Much Can You Qualify For With A Va Loan

When you’re considering buying a home and using your VA home loan benefit, one of the first questions you want answered is “How much can I qualify for?” VA loans are guaranteed, meaning any loan that the VA lender approves, has a government-backed guarantee of 25% of the loan amount. As long as the lender followed established VA lending guidelines, the guarantee is in place. The VA doesn’t approve the loan but establishes specific rules that lenders must follow in order to receive the VA guarantee. One of those rules limits how much you can borrow based upon a formula called the debt to income ratio, or simply “debt ratio.”

Don’t Miss: Auto Loan With 650 Credit Score

Other Va Loan Costs To Consider

You may pay some closing costs that the VA mortgage calculator does not include, such as fees for the credit report, title insurance, VA appraisal and other services.

But there are some fees you’ll avoid with a VA loan. The U.S. Department of Veterans Affairs, which backs VA mortgages, prohibits certain charges, including a lender’s fee for attorney services, settlement charges and mortgage broker commissions. The VA also limits the origination fee a lender charges to no more than 1% of the loan amount.

Usaa Car Loan Calculator

USAA Car Loan Calculator is a self-help tool that helps you estimate your monthly expenses if you go on and get an auto loan.

To use the calculator, select the loan type to auto loans, choose the purpose of the loan, select the collateral modal year and enter details like loan term and loan amount.

The calculator will show the estimated monthly payment, total loan amount, finance charges, and total loan cost.

Also Check: Can You Refinance An Upside Down Car Loan

The Advantages Of Paying 20% Down

- Improves your chances of loan approval: Paying 20% down lowers risk for lenders. A larger down payment also makes you look like a more financially responsible consumer. This gives you better chances of qualifying for a mortgage.

- Helps lower your interest rate: Paying 20% down decreases your loan-to-value ratio to 80%. LTV is an indicator which measures your loan amount against the value of the secured property. With a lower LTV ratio, you can obtain a lower interest rate for your mortgage. This will help you gain interest savings over the life of your loan.

- Reduces your monthly payment: A large down payment also significantly decreases your monthly mortgage payments. Though you spend more now, having lower monthly payments will make your budget more manageable. This gives you room to save extra money for emergency funds, retirement savings, or other worthwhile investments.

- Helps build home equity faster: Paying 20% down means paying off a larger portion of your loan. This allows you to pay off your mortgage sooner. If you plan to make extra payments on your mortgage, having 20% equity will help speed up this process, allowing you to cut a few years off your loan term.

- Eliminates private mortgage insurance : As mentioned earlier, PMI is an added cost on a conventional loan if you pay less than 20% on your mortgage. Consider paying 20% down to avoid this extra fee.

Know the Closing Costs

Va Loan Calculator Estimate Your Monthly Mortgage Payment And Va Funding Fee

Advertiser Disclosure: Opinions, reviews, analyses & recommendations are the authors alone. This article may contain links from our advertisers. For more information, please see our .

Use this VA loan calculator to estimate your monthly mortgage payments. Simply insert your military status, purchase price, downpayment and any tax and homeowners insurance information, if you have that information handy.

Recommended Reading: When Should I Refinance My Fha Mortgage

Va Funding Fee Rate Charts

Effective January 1, 2020, based on Public Law 116-23

Review the VA funding fee rate charts below to determine the amount youll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount.

For example: Let’s say youre using a VA-backed loan for the first time, and youre buying a $200,000 home and paying a down payment of $10,000 . You’ll pay a VA funding fee of $3,135, or 1.65% of the $190,000 loan amount. The funding fee applies only to the loan amount, not the purchase price of the home.

Edmunds Auto Loan Calculator

Auto loan calculator by Edmunds considers all aspects of an auto loan and calculates your estimated monthly income. First, youll need to enter the zip code of your location.

Then, enter the vehicle details like the vehicles sales price, tax rate, cash incentives, and title and registration. After entering vehicle details and zip code, you must enter the trade-in value, amount you own in the trade-in, and the down payment you are willing to make.

At last, enter the loan details like loan term, interest rate, and credit score. After entering all the details, the Edmunds auto loan calculator will calculate the estimated monthly expenses.

Don’t Miss: Navy Federal Auto Loan Pre Approval Hard Inquiry

How Much Will My Va Loan Payment Be

There are a variety of factors that play into the calculation of your monthly loan payment. Typically, the factors affecting your monthly payment include the home price, down payment, interest rate, and if you have to pay the VA funding fee.

As with any mortgage calculator, these numbers are estimates. To get exact figures, contact Veterans United Home Loans and speak with a home loan specialist.

How To Use A Va Loan Calculator

Here are the steps to using a basic VA mortgage loan calculator.

- Enter the expected cost of the house and the amount you are willing to make as a downpayment. You can also choose not to make a downpayment. However, putting money down upfront would reduce your monthly payments.

- Enter the interest rates.

- Select the loan term. You can either choose 15 years or 30 years. Selecting a longer term would mean lower monthly payments but higher interest rates.

- Select whether or not it is your first time borrowing a VA loan.

- Look for the result. The total monthly cost combines monthly installments, insurance, taxes, interest and VA funding fees.

- You can also select the breakdown of the cost to get a detailed analysis.

Also Check: Mortgage Originator License California