Additional Fees The Va Allows An Applicant To Pay

The VA regulates which fees VA loan applicants can be charged. These smaller expenses are often included in a lump-sum lender fee: typically about 1% of the total loan amount. Note that even though Movement Mortgage waives all lender fees for VA loans, we thought it would be helpful to list some of these expenses so youll be aware of what other lenders may cover with their lender fees:

- VA loan application fees

- Termite inspection fees

Types Of Closing Costs

A common way to remember which costs a veteran is allowed to pay for is to remember the acronym ACTORS. That stands for:

- A Appraisal

- R Recording Fee

- S Survey

These are common charges found on most every VA mortgage and while they can vary a bit by amount these fees are the ones that can be paid for by the veteran. But what about these charges?

- Attorney

- Document

- Tax Service

These fees, and others, are example of charges that the veteran is not allowed to pay. Even though the VA lender requires a processing and an underwriting fee in order to approve the VA loan, the veteran may not pay for these charges and any other fee deemed “non-allowable.” So if the veteran can’t pay them, who does?

Is Rolling Closing Costs Into Your Loan The Same Thing As A No

Rolling closing costs into your mortgage is usually not the same thing as a no-closing-cost mortgage.

Generally, when lenders advertise no closing cost or zero closing cost mortgages they are referring to the process of trading a slightly higher interest rate in return for a lender credit.

A lender credit means the mortgage company will cover part or all of your closing costs.

With these mortgages, the lender will front many of the initialclosing costs and fees, while charging a slightly higher interest rate over theduration of the loan.

The downside is youll pay a larger monthly payment over the long haul. And, youre likely to pay significantly more in interest overall.

However, the idea is that you dont have to come up with as much cash up front. This can be helpful when you are also having to come up with a large down payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What If I Cannot Afford The Va Home Loan Closing Costs

No doubt, closing costs can be expensive. But you can reduce your VA home loan closing cost in several ways.

The fourth option may be your best one. You do not have to rely on the seller for a credit, which most wont give in this market. Likewise, closing cost assistance programs are hit and miss. But most lenders can give a credit on most transactions by simply giving you a slightly higher interest rate. In some case, you can receive thousands of dollars from a lender credit by taking a 0.25% higher rate. Ask your lender for specifics on your loans.

Veterans And Preparing For Va Closing Costs

The VA loan program was established to help make it easier for veterans to become homeowners. They do this by eliminating the down payment, which is a large upfront cost that other types of mortgages usually require. However, even without the need to make a down payment, you will still be required to pay for a number of VA Home Closing Costs.

Don’t Miss: What Car Loan Can I Afford Calculator

How Can I Get More Information About Va Home Loans

The best way to find out if you qualify to buy a home with a VA loan is to request a rate quote. Call 317-2815 or simply complete our online form.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Cookie Settings.Do Not Sell My Personal Information.

How To Limit Out

Besidesnegotiating with the seller to pay for some of the closing costs, you can cut your expenses by avoiding points, which reduce your interest rate but cost money upfront.

In addition, there are some special circumstances in which a borrower can be exempt from the funding fee. These include if the borrower is:

- Living with a disability connected to their service and being compensated for the disability

- Living with a disability connected to their service and receiving military retirement pay

- An active-duty Purple Heart recipient

- A surviving spouse whose partner died in service or from a service-related disability

- Eligible to be compensated due to a pre-discharge

You can also try to snag more savings by asking your mortgage lender if it has any discounts or rebates some might even waive certain costs if you ask. If possible, try to close your mortgage towards the end of the month, as well. This reduces the amount of per-diem interest youll have to pay.

There might also be some closing cost and down payment assistance programs available at the state level specifically for veterans. Some cities and counties offer programs of their own, as well. Ask your lender about availability.

Recommended Reading: Apply For Avant Loan

Va Funding Fee For First

VA borrowers who are using a VA loan for the first time and have full entitlement available do not need a down payment. However, the lower your down payment amount, the higher your funding fee will be.

VA loan funding fees for first-time borrowers

| Down payment |

|---|

| $6,900 | $4,702 |

| Pro Tip: If youre a veteran with a service-related disability, you may be exempt from the VA funding fee. |

The Definition Of Closing Costs

The term closing costs is loosely defined and can refer to many expenses associated with your mortgage. Some closing costs may be financed, others may not. And some expenses associated with your loan may be paid by the seller, while others may not. VA mortgage loan rules make it clear that any down payment you make is a separate expense from all other closing costs.

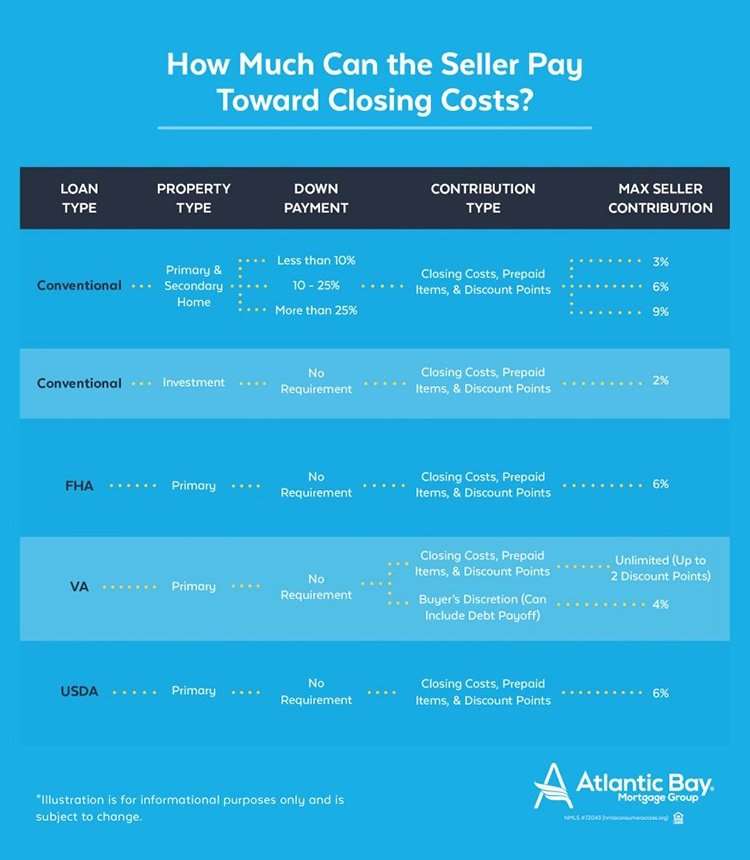

That does not mean the down payment isnt due at closing time, but it does mean that your down payment is subject to certain restrictions including preventing the seller from paying money toward your down payment. The seller IS permitted to help you with up to 4% of the non-down payment closing costs you incur.

Some readers understand that VA mortgages feature no down payment in many cases, and may be confused by our discussion of making down payments, but the VA Lenders Handbook explains that borrowers who make a down payment of five or ten percent are authorized to receive a reduced VA loan funding fee as a result of making that down payment.

Thats why its a very good idea to consider your options with regard to making the down paymentyou could save yourself some money in other areas by saving the extra funds to put down.

Recommended Reading: How To Get Loan Originator License

How Military Buyers Can Include Va Closing Costs In Their Purchase

The two most popular questions on a VA loan are: How much is my monthly payment? and How much do I need to bring to closing? VA home loans are 100% financed . In this article, we explain closing costs and buyer strategies and solutions allowed by the Veterans Administration. These solutions may be huge for Veterans, service members, and surviving spouses looking to purchase a home.

Other Va Loan Closing Costs

Heres a look at other VA loan fees.

- Lenders title insurance. Youll buy a lenders title policy to protect your lender from title disputes such as tax liens or judgments.

- Discount points. You can pay an upfront fee as a percentage of your loan amount to get a lower interest rate.

- Escrow account. Your homeowners insurance and property taxes are usually paid as part of your monthly payment. Funds are collected at closing to set up the escrow account.

- Prepaid fees. You may need to prepay a portion of your ongoing homeowners insurance and property tax costs at closing.

Also Check: Refinance Auto Loan With Same Lender

Can Sellers Pay Va Loan Closing Costs

The home seller can agree to pay a portion of the buyers closing costs, including the funding fee or origination fee, for instance. Note that for a VA loan, sellers are always required to pay for the real estate agent commissions, any brokerage fees and a termite report.

In any sale, most of the closing costs can be negotiated by the buyer and seller, Parker says. The same is true for VA loans, but the VA mandates that seller concessions cant exceed 4 percent of the total loan value.

Are Closing Costs Required

With a net worth below $7,000 on average, the typical VA borrower relishes any opportunity to cut down on the fees and expenses associated with purchasing a home. Closing costs are, unfortunately, intertwined with home buying. The income of mortgage professionals is supplemented through closing costs. The ugly truth is that most loans that promise limited or altogether no fees are advertising window-dressing like frills, and are built to recoup these costs through other charges. The VA loan program differs from these conventional loans for several reasons, lower underwriting guidelines, a government guarantee, and numerous real deal cost cutting facets. These include a no down payment requirement, re-fi options, no private mortgage insurance and no pre-payment penalties. While the VA loan does require closing costs, the buyer is not required to pay many of them, in fact, the Department of Veterans Affairs does not allow borrowers to pay numerous closing costs.

Don’t Miss: Usaa Car Refinance Rates

Fees Va Lenders Can Charge

| A flat fee |

|---|

|

Trustee’s Fees or Charges |

- More detail in the “Reasonable & Customary VA Loan Fees” section below.

If the lender takes the flat 1 percent route, the fee is simple to understand. For example, if the loan is $200,000, the borrower must pay the lender $2,000 at closing. Unlike closing costs for some traditional loans, an origination fee cannot be rolled into the balance of the loan. The one exception to this rule is when refinancing a VA home loan.

Va Loan Closing Costs: An Added Benefit

Besides the advantage of requiring no down payment for qualified VA borrowers, there’s also a distinct advantage for the borrower regarding closing costs. The veteran is limited to the types of closing costs that may be paid, helping the veteran save money at the closing table. But if there are costs associated with a VA loan and the veteran isn’t allowed to pay for them, who does?

Also Check: Usaa Auto Loan Refinance

The Va Loan Funding Fee

This expense is unrelated to the lenders fee, and is charged to veterans who use their VA home loan benefit.

The VA Loan Funding Fee offsets the taxpayer burden on the VA mortgage loan program and certain veteransthose who receive or are eligible to receive VA compensation for service-connected medical issues are exempt from having to pay this fee. However, this exemption is NOT automatictalk to a lender to learn what you will need to do to claim the exemption.

What Are The Va Loan Closing Costs

Closing costs on VA loans are practically the same as other mortgage loans with a few exceptions. Similar costs on a purchase include appraisal, title search, title insurance, closing attorney, recording fee, and any lender fees. Our lender fee is lower than our other loan types. In addition to closing costs, there are pre-paid items. Pre-paids include the first year of insurance premiums , set up for tax and insurance escrows, and interim interest due to cover a partial month after closing.

Also Check: How Do You Find Your Student Loan Account Number

Who Pays Closing Costs On A Va Home Loan

The closing costs of a VA loan consist of all of the fees involved in the homebuying process. These fees are paid to any number of involved parties, including the lender, title company, or real estate agent that you might be working with. Being familiar with the typical closing costs will likely be will make it a lot easier for you to budget for and prepare for a home purchase if you are applying for a VA loan.

Appraisal And Compliance Inspections

The veteran can pay a VA Appraiser fee and VA compliance inspector’s fee. The veteran can also pay for a second appraisal if they are requesting a reconsideration of value. The veteran cannot pay for a second appraisal if the lender or seller is requesting a reconsideration of value or if parties other than the veteran or lender request the appraisal.

Read Also: What Is The Commitment Fee On Mortgage Loan

Have Questions About The Program

Bridgepoint Funding specializes in the VA home loan program. Were passionate about this program because it rewards our brave men and women in uniform. Its one of the best mortgage options available for military home buyers in California.

If you have questions about closing costs, or any other aspect of this program, please contact our staff. We serve the entire state of California and welcome your questions!

Mike Trejo is a Bay Area mortgage broker with 20+ years of knowledge and experience.

Common Misconception There Are No Va Closing Costs

Lets get the facts straight on VA closing costs. There are always closing costs associated with VA loans. Many Veterans will state, But, VA has no closing costs! That is assumed because it is common that another party covers the Veterans costs.

This misconception could cause issues later in the process. For instance, a purchase contract or lender not accounting for the closing costs would mean the buyer would pay the fees at closing. Not that there is anything wrong with the buyer paying closing costs, but many buyers choose not to bring or dont have those funds for the closing costs.

Also Check: How To Get Loan Officer License In California

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Seller Contributions Are Allowed

In some real estate transactions, the seller might agree to pay some of the home buyers closing costs. This is true for FHA, VA and conventional mortgage scenarios. Sellers often use this strategy in sluggish real estate markets, when they have to go above and beyond to land offers from buyers.

But the Department of Veterans Affairs limits the amount of money a seller can contribute toward the buyers VA loan closing costs. In California, and nationwide, these seller concessions are usually limited to 4% of the loan amount.

As it states on the VAs website:

We require that a seller cant pay more than 4% of the total home loan in sellers concessions. But this rule only covers some closing costs, including the VA funding fee. The rule doesnt cover loan discount points.

Its also important to understand the distinction between allowed and required. In California, home sellers are allowed to pay a portion of the buyers closing costs when a VA loan is used. But they are not required to make such a concession. Its negotiable, and it largely depends on local housing market conditions. So seek your real estate agents advice on this matter.

Veteran Mortgage Relief With The Va Loan

The U.S. Department of VeteransAffairs, or VA, provides home retention assistance. The VA intervenes whena veteran is having trouble making home loan payments.

The VA works with loan servicersto offer options to the veteran other than foreclosure.

In fiscal year 2019, the VA madeover400,000 contact actions to reach borrowers andloan servicers. The intent was to work out a mutually agreeable repaymentoption for both parties.

More than 100,000 veteranhomeowners avoided foreclosure in 2019 alone thanks to this effort.

The initiative has saved thetaxpayer an estimated $2.6 billion. More importantly, vastnumbers of veterans got another chance at homeownership.

Also Check: Upstart Loan Calculator

Who Pays Closing Costs For A Va Loan

While many borrowers pay closing cost themselves, VA borrowers have a few options to get those expenses covered:

- Request that the seller pays them. The VA seller concession maximum cannot exceed 4% of your loan amount. The seller can even pay the VA funding fee, which helps you avoid financing the fee over the term of your loan. For example, a second-time VA borrower putting zero down on a $300,000 house could ask the seller to pay some or all of the $10,800 funding fee.

- Ask for a donor gift. You can get a gift for your closing costs, as long as the donor completes a gift letter and shows proof of funds.

- Apply for military closing cost assistance. Depending on where you live, you may be eligible for closing cost assistance. Income and family-size limits apply, so read the fine print before applying.

- Roll closing costs into the loan amount. The VA funding fee can be added to your loan amount for any type of VA loan. However, unless youre refinancing, closing costs cannot be added to the loan amount.