Finding The Best Lender

While a low mortgage rate is often an important consideration when choosing a home loan, its not the only thing to consider. Take a look at the closing costs associated with the loan and consider customer service. When comparing mortgage lenders, you should think of it like youre comparing apples to apples.

Additionally, if you have a unique situation, you might need to consider a local financial institution thats more likely to work with you on conventional home loan requirements. Here are some tips for finding the best lender:

- Look online for lenders that offer conventional home loans

- Ask your real estate agent for a recommendation

- Turn to friends, family and coworkers for their suggestions

- Contact your current bank to find out what they can do for you

- Read reviews from trusted resources like J.D. Power and the Better Business Bureau

You can also find out if a local lender will match the home loan offers and terms you find online. Figure out what matters most to you when it comes to your relationship with a lender. Realize that many conventional home loan originators will sell your loan to a different institution, and that will be the company that collects your payments and manages your customer service needs.

Finally, if you do your shopping around, do it in a short period. Your FICO score takes into account loan shopping, and if you have a lot of mortgage inquiries within a two-week period, they wont each impact your score individually.

Fha Vs Conventional Mortgage Payment Showdown

For many people without 5% down, who only have money for a small down payment, the dilemma is whether to get a conventional loan or an FHA loan.

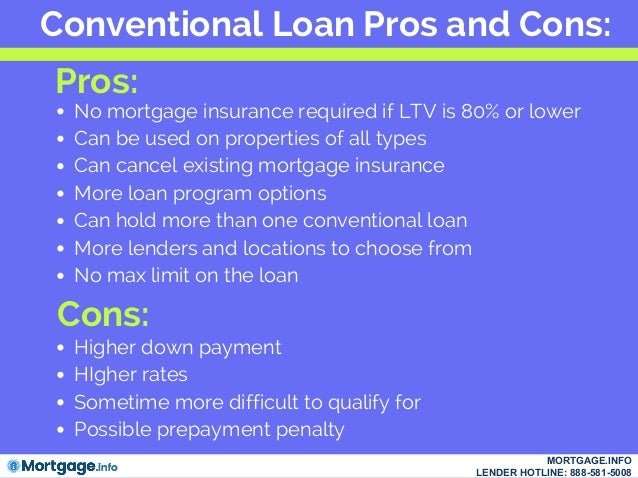

Both loans require mortgage insurance. Conventional loan borrowers making a down payment of less than 20 percent will need to get Private Mortgage Insurance . The good news is that once you reach a loan-to-value ratio of at least 78 percent, you can cancel the insurance.

The bad news with an FHA loan is youre stuck paying PMI over the life of the loan unless you refinance.

Heres an example of how close monthly mortgage payments can be, comparing an FHA 3.5 percent down payment loan with a conventional 3 percent down payment loan:

Stevenson says that if someone is buying a $200,000 home with a conventional loan and a 3 percent down payment, the interest rate might be about 4.62 percent which is a higher interest rate than the 3.5 percent an equivalent borrower might get on an FHA loan. But remember, all of this really hinges on your credit score with a higher credit score, you get a lower interest rate.

Fannie Mae charges points also known as extra fees to do their 97 percent loans. Typically borrowers pay those fees by accepting a higher rate rather than paying out of pocket. So the rate ends up quite a bit higher than that of the FHA option.

The monthly mortgage insurance premiums or PMI for the conventional loan will be $151 a month.

- 3% down conventional: $1,148 per month

- FHA: $1,018 per month

Down Payment Assistance Programs

Special programs in your state or local housing authority offer help to first-time buyers. Many of these programs are available based on buyers income or financial need. These programs, which usually offer assistance in the form of down payment grants, can also help with closing costs. The U.S. Department of Housing and Urban Development lists first-time homebuyer programs by state. Select your state then Homeownership Assistance to find the program nearest you.

You May Like: Transfer Auto Loan To Another Bank

Pnc Bank Compared To Other Mortgage Lenders

| PNC Bank | |||

|---|---|---|---|

| 0% for VA and USDA 3% for conventional 3.5% for FHA | 0% for VA and USDA 3.5% for FHA 3% to 5% for conventional | ||

| Where does the lender operate? | All 50 states and Washington, D.C. | 47 states and Washington, D.C. | All 50 states and Washington, D.C. |

| Major loan types | Conventional, jumbo, VA, FHA, USDA, adjustable-rate, fixed-rate, refinance, cash-out refinance, streamline refinance, home equity lines of credit | Conventional, jumbo, VA, FHA, USDA, construction loans, adjustable-rate, fixed-rate, several refinance programs, home equity loans, home equity lines of credit | Conventional, jumbo, VA, FHA, USDA, various renovation loans, adjustable-rate, fixed-rate, refinance, cash-out refinance, reverse mortgages, home equity loans, home equity lines of credit |

Determining Your Down Payment

How much do you need for a down payment, then? Use an affordability calculator to figure out how much you should save before purchasing a home. You can estimate the price of a home by putting in your monthly income, expenses and mortgage interest rate. You can adjust the loan terms to see additional price, loan and down payment estimates.

Here are some steps you can take before determining how much home you can afford and how much you can put down on a house:

You May Like: Can You Refinance With An Fha Loan

Down Payment And Your Loan

Your down payment plays a key role in determining your loan-to-value ratio, or LTV. To calculate the LTV ratio, the loan amount is divided by the homes fair market value as determined by a property appraisal. The larger your down payment, the lower your LTV . Since lenders use LTV to assess borrower risk and price mortgages, a lower LTV means you pay lower interest rates on your mortgageand may avoid additional costs.

A lower LTV ratio presents less risk to lenders. Why? Youre starting out with more equity in your home, which means you have a higher stake in your property relative to the outstanding loan balance. In short, lenders assume youll be less likely to default on your mortgage. If you do fall behind on your mortgage and a lender has to foreclose on your home, theyre more likely to resell it and recoup most of the loan value if the LTV ratio is lower.

In addition to assessing your risk, lenders use the LTV ratio to price your mortgage. If your LTV ratio is lower, youll likely receive a lower interest rate. But if the LTV ratio exceeds 80%, meaning youve put less than 20% of the homes value as a down payment, expect higher interest rates. These rates cover the lenders increased risk of lending you money.

For loans that will accept down payments of 5% or less, consider Fannie Mae and Freddie Mac, individual lender programs, Government-insured FHA loans, VA loans, or USDA loans.

Using Gift Money From A Third Party

Weve covered some of the basic requirements for down payments on conventional loans in the San Francisco Bay Area. Now for a bit of good news. Most mortgage programs available today allow borrowers to use gift money to cover the minimum required down payment.

In this context, a gift is money donated by a third party and put toward a home buyers down payment or closing costs. There are specific requirements for gift money. For one thing, the money must truly be a gift or donation. The person giving you the money cannot expect you to pay it back.

Conventional loan programs in the Bay Area usually require a third-party donor to submit a signed letter stating that they do not expect any form of repayment.

Down payment gifts are a popular strategy among home buyers who use conventional loans in the Bay Area. When it comes to home prices, our region is one of the most expensive housing markets in the country.

Consider the difference:

- As of November 2021, the median home value for the San Francisco-Oakland-Hayward metro area was $1,340,000.

- During that same month, the median price for the nation as a whole was around $308,000, according to Zillow.

Because of our relatively high home prices, some buyers have a hard time meeting the minimum down payment requirement for a conventional loan in the Bay Area. And this is where gift money can prove useful.

Also Check: Sss Loan Application

How Do You Get A 3% Down Conventional Loan

To qualify for a conventional loan with a 3% down payment, homebuyers will need to meet a few criteria. For one, you will need to meet minimum credit score and debt-to-income * requirements.

Typically, youll need a and a DTI determined by the Automated Underwriting response run by your lender to be eligible for a conventional 97 loan.

Some programs also require that the borrower or, if more than one person is on the loan, at least one co-borrower be a first-time homeowner. Fannie Mae and Freddie Mac, the government-sponsored enterprises that back conventional loans, define this as someone who hasnt owned a home in the last three years.

Conventional loans are available to the full spectrum of borrowers, from low income to high-earning homebuyers.

First-time homebuyers may have to complete a homeownership course before the lender can approve the loan, depending on the program guidelines.

But there are 3% down conventional loans that dont have first-homeownership rules. So dont rule out a low down payment if youve owned before.

Additionally, programs like Freddie Mac Home Possible conventional 97 loans have income limits, meaning that the borrowers must not earn above a certain threshold.

However, there are plenty of conventional options that do not cap the amount of income you can earn in order to qualify. Conventional loans are available to the full spectrum of borrowers, from low income to high-earning homebuyers.

Does 3% Down Conventional Loan Payment Include Mortgage Insurance

The best thing about a 3% conventional loan down payment program is that there is an option of not having to pay mortgage insurance which is called Lender Paid Mortgage Insurance.

This option could help bring down your payments. Most of the time, it is built into the interest rate.

So you might pay a slightly higher rate, but because the mortgage insurance isnt there, your payment could be reduced by a couple of hundred dollars.

Even if you opt to pay the private mortgage insurance included in your mortgagee payments, you have to pay it until the loan to value ratio is paid down to 80%.

The mortgage insurance for a 3% Down Conventional Loan Program is risk-based which depends on your credit score.

Read Also: Pen Fed Car Buying Service

When Youll Need To Pay Private Mortgage Insurance

Any borrower with a conventional loan who puts less than 20% down is required to buy private mortgage insurance , which raises the annual cost of the loan. This mortgage insurance can be canceled once the homeowners equity in their home surpasses 20%. Mortgage insurance provides protection for your lender in case you default on your loan.

How Much Should You Put Down When Buying A Home

Your down payment plays an important role when youre buying a home. A down payment is a percentage of your homes purchase price that you pay up front when you close your home loan. Lenders often look at the down payment amount as your investment in the home. Not only will it affect how much youll need to borrow, it can also influence:

- Whether your lender will require you to pay for private mortgage insurance . Typically, youll need PMI if you put down less than 20% of the homes purchase price.

- Your interest rate. Because your down payment represents your investment in the home, your lender will often offer you a lower rate if you can make a higher down payment.

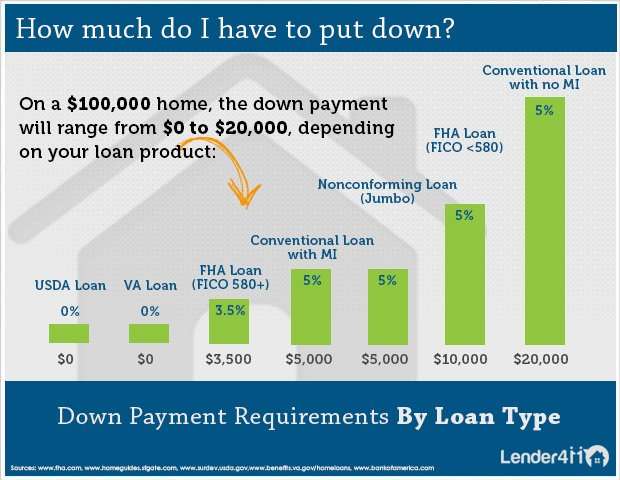

So how much of a down payment will you need to make? That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%.

Read Also: Usaa Auto Loan Rates Credit Score

Types Of Property And Down Payment Requirements On Conventional Loans

Any residential homes that are one to four units can qualify for conventional financing.

- FHA only requires a 3.5% down payment on an owner-occupant two-four unit multi-family property

- However, this is not the case with conventional loans

- Conventional loans require a 15% down payment on 2 to 4 unit owner-occupant primary residences

Both Fannie Mae and Freddie Mac require a 25% down payment on two to four-unit investment properties. Single-family homes, condos, and townhomes only require a 3% to 5% down payment.

What Is A Down Payment

A down payment is the initial, upfront payment you make when purchasing a home. This money comes out of pocket from your personal savings or eligible gifts.

Traditionally, a mortgage down payment is at least 5% of a home’s sale price. Down payments are often, but not always, part of the normal homebuying process.

If a buyer put 10-20% down, they may be more committed to the home and less likely to default. If there is more equity in the property the lender is more likely able to recover its loss in the event of foreclosure.

Further, putting 20% down on your home when you purchase can help show the bank and yourself that you’re financially ready to purchase a house.

A down payment on a house also protects you as the buyer. If you want to sell your home and the market drops, you might owe more on your property than it’s worth. If you made a larger down payment when you purchased your house you may break even, or possibly make money when you sell.

Recommended Reading: Advance Auto Loaner Tools

Conventional Loans Vs Fha Loans

Whether you should get an FHA loan or a conventional loan depends on your situation. If you have limited savings and credit issues then an FHA loan may be the best loan option. However, if you have a lot in savings and good credit then a conventional loan may be a better fit.

You should also speak to a loan officer to compare FHA vs conventional loans to determine which one is most beneficial for you.

How Can I Avoid Pmi Without Putting 20 Percent Down

No one wants to pay extra for mortgage insurance. If youre putting down less than 20 percent on a conventional loan, there are a couple of options. The first is lender-paid mortgage insurance, which as it sounds puts the lender in charge of covering those mortgage insurance premiums. However, you will still pay in the form of a higher interest rate. Youll need to calculate whats better for your budget: paying the PMI yourself or finding an LPMI option.

The second option for avoiding PMI is an 80/10/10 loan, which is commonly called a piggyback loan. In this situation, you can put down 10 percent and take out two mortgages. One will cover 80 percent of the purchase price, and the other covers 10 percent. Youll never see a line item for PMI, but you will be paying back two mortgages with two sets of interest charges. Youll also pay two sets of closing costs to cover both loans.

Recommended Reading: Is Myeddebt Ed Gov Legit

How To Qualify For A Conventional Loan

Conventional loans can be more difficult to qualify for than government-backed programs.

To give yourself the best shot at a conventional mortgage, follow these steps:

Using Your Rrsp As A Down Payment

Under the federal government’s Home Buyer’s Plan, first-time home buyers are eligible to use up to $35,000 in RRSP savings per person for a down payment on a home. The withdrawal is not taxable as long as you repay it within a 15-year period. To qualify, the RRSP funds you plan to use must have been in your RRSP for at least 90 days.

Even if you already have enough money for your down payment, it may make sense to access your RRSP savings through the Home Buyers’ Plan.

For example, if you have already saved $35,000 for a down payment-and assuming you still had enough “contribution room” in your RRSP for a contribution of that amount, you could move your savings into an RRSP at least 90 days before your closing date. Then, simply withdraw the money through the Home Buyers’ Plan.

The advantage? Your $35,000 RRSP contribution will count as a tax deduction this year. Use any tax refund you receive to repay the RRSP or other expenses related to buying your home.

However, the money you borrow from your RRSP won’t earn the tax-sheltered returns it would if left in your account. Ask your financial planner if this strategy makes sense for you.

- Learn more about RRSPs.

- Learn more about the Home Buyer’s Plan.

Don’t Miss: Usaa Personal Loan Credit Score

Can I Use A Gift For A Down Payment

If you cant come up with all the money for a down payment on your own, but you have a really great person in your life who wants to help you out, youre in luck: You can accept a financial present from someone else. However, who can give that money to you depends on the type of loan. For conventional loans, it will need to be a family member. For FHA loans, there is a bit more flexibility to use gift funds from friends, labor unions and even employers. Regardless of your loan, getting a gift isnt as simple as cashing a check. Be sure to read the rules for using gift funds for your down payment before receiving any money.