Its Important To Understand The Risks And Rewards

Traditional bank loans are a valuable source of financing, but they are not always the most appropriate or accessible source. Sometimes a company has a limited operating history or finds its earnings hard to predict. The business might be in a transitional growth period, or it might be dependent on services or commodities with high potential for seasonal or short-term fluctuations.

In these cases, asset based financing can be a more accessible source of financing than traditional loans, which often require a companys earnings and related financial statement ratios to remain in certain ranges. Asset based loans are not bound by these restrictions and, therefore, can provide companies with a safety net or resource for strategic growth.

For Residents Of Hong Kong:

Access to the Sites is by invitation only to institutional investors. No information or material contained in the Sites is or should be construed as amounting to an offer to enter into any transaction or investment whatsoever. The information on these Sites is provided by the Hong Kong branch of Bank of America, N.A., and is compiled from information prepared by subsidiaries and affiliates of Bank of America Corporation. Your agreement for the use of this Site is with the Hong Kong branch of Bank of America, N.A.

Hard Money Loans Vs Asset

Hard money loans and asset-based loans are considered synonymous by many people, but can be distinguished from one another.

Hard money loans are an alternative to traditional loans and far easier to secure. They do, however, typically come with incredibly high interest rates and are an extremely risky way to get money. Real estate investors tend to prefer hard money loans because they use real estate as collateral for the loan.

Hard money loans are actually a form of asset-based lending because they use something physical as collateral. The primary difference is that hard money loans nearly always use real estate as collateral, while asset-based loans rarely use real estate as collateral, preferring to secure loans with other assets, such as inventory or receivables.

Also Check: Typical Student Loan Debt

Difficulty Qualifying For Traditional Loans

Institutions that offer asset-based loans place much more emphasis on asset value than credit score, revenue, profitability, or cash flow. On the other hand, traditional institutions might reject your application solely because your credit score or monthly revenue does not meet their highly stringent criteria. If an applicant does not meet the requirements but manages to get approved, he or she will likely face higher interest rates, restrictive terms, or lower borrowing amounts.

The requirements of traditional business loans make them relatively inaccessible for young businesses. It can take several years for a new company to draw a profit or stabilize its cash flow. For this reason, asset-based lending could be a growing businesss only viable gateway to higher borrowing amounts and appropriate terms.

What Are The Benefits

Asset-based lending enables businesses to raise funds without credit checks or a cash flow forecast. It’s ideal for scaling a business or safeguarding working capital in unpredictable markets. Some of the primary benefits are as follows.

-

Higher levels of funding than invoice finance alone

-

Faster release of working capital against both inventory and property

-

Flexible additional funding for plant and machinery

-

More control over cash flow finance

-

Financial stability for SMEs, micro-businesses, and medium-sized enterprises

-

A tailored solution built around the particular needs of the business

You May Like: Www Upstart Com Myoffer

How Do You Qualify For Asset

Trucking companies and owner-operators can qualify for asset-based lending with detailed and accurate financial information. Then, the borrower will typically put up an assessed asset, such as trucks or trailers, as collateral.

Some lenders may not require a credit check or collateral to secure an ABL, so be sure to check with your lender to learn about their requirements.

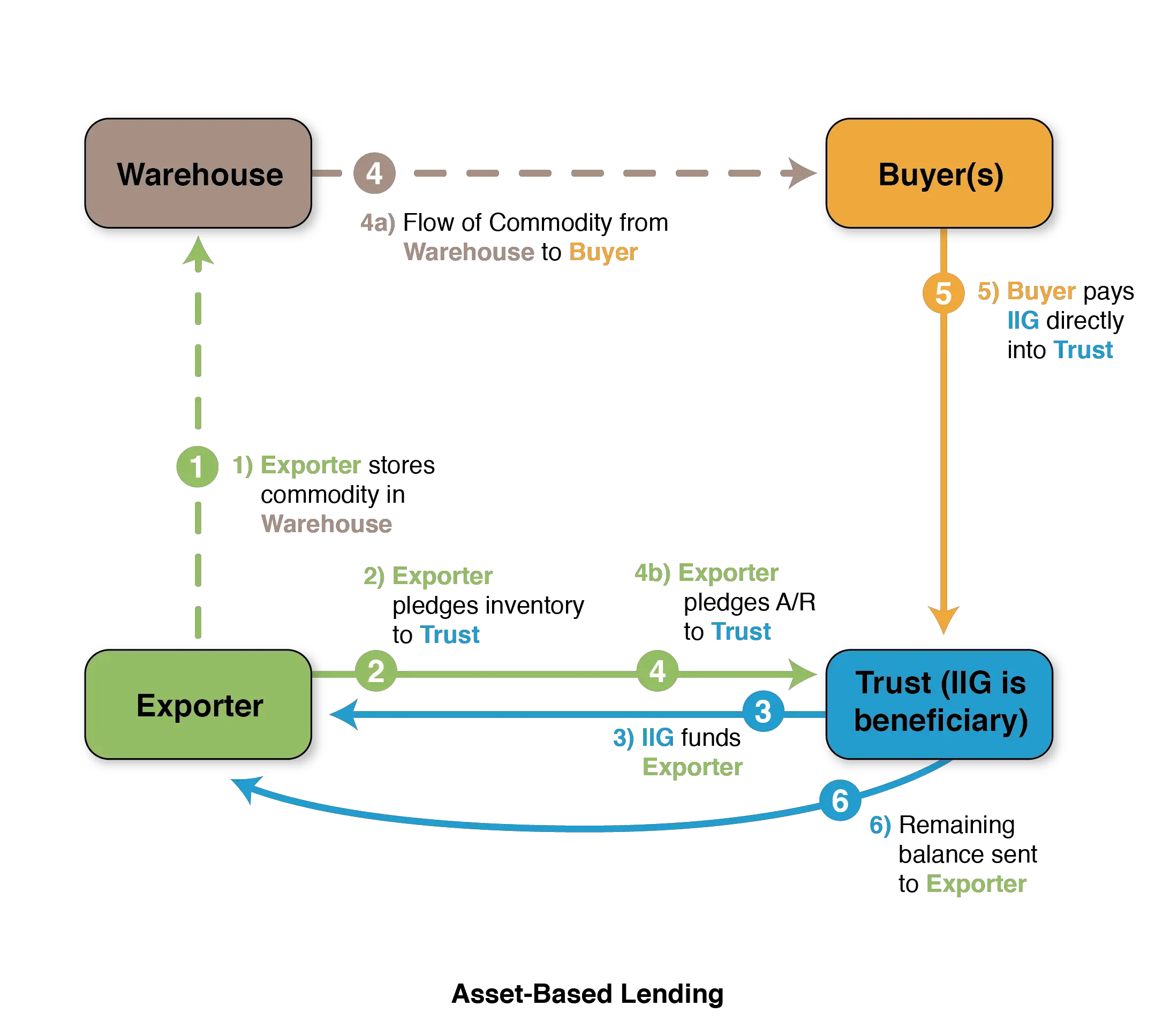

How Asset Based Lending Works

The cash flow problem of companies may stem from various reasons like rapid growth, which requires additional capital apart from existing ones to invest and sustain business activities, or due to long debtor collection period or brief delay in payments it expects to receive, which may create problems in payment of dues to its employees, creditors, and supplier of capital.

For Example A real estate company is constructing building A, and it also won a bid to construct building B. So before it could receive cash flowCash FlowCash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. read more from selling an apartment in building A it has to construct building B.

What can a company do to get the finances to construct building B? It will go to a bank, keep the building or its equipment as collateral and obtain a loan. The company gets its financing done in the absence of other options by converting illiquid assets into liquid ones or sometimes pledging liquid assets like

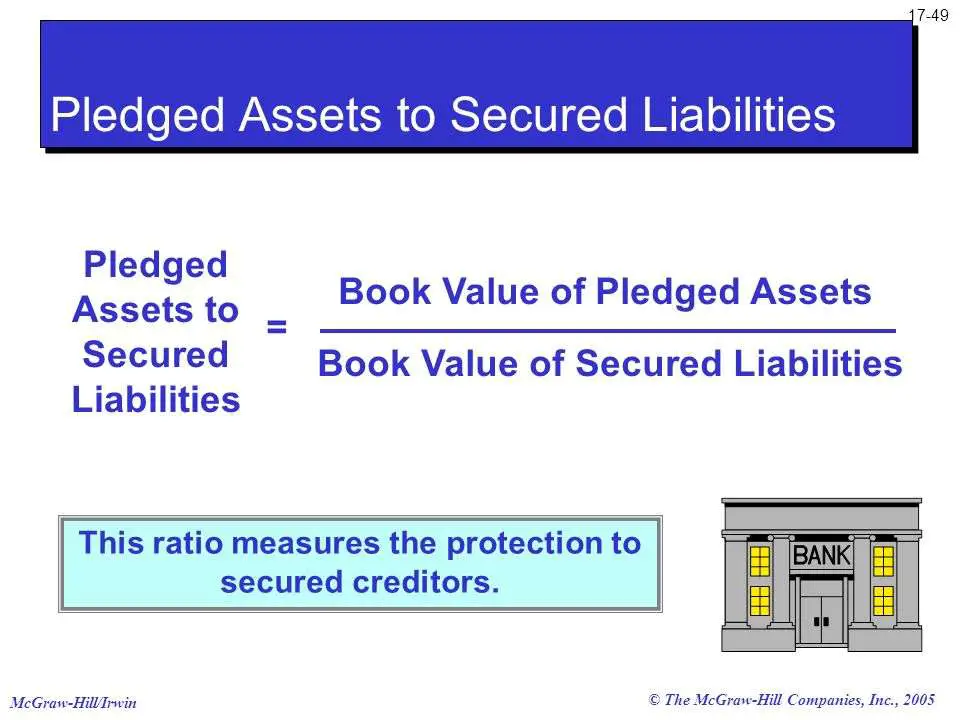

One may ask a question as to why a company gets a loan of only 70-80% of even marketable securities despite the asset being liquid. The reason lies in the possibility of default of these securities and also includes costs of converting the collateral to cash if the borrower defaults.

Recommended Reading: Usaa Used Auto Loan

Why Use Asset Based Lending

Most asset-based loans are structured to work as revolving lines of credit, allowing the company to borrow as needed and on a continuing basis. This provides a continual stream of cash for operations, expenses and investments and can generally bridge gaps between outgoing cash for operations and incoming cash from payments.

A revolving line of credit allows a company to access cash repeatedly without having to open new loans, thus saving time and money.

A revolving line of credit allows a company to access cash repeatedly without having to open new loans, thus saving time and money.

What Is An Asset Based Loan

An asset based loan is a type of business financing that is secured by company assets. Most asset based loans are structured to work as revolving lines of credit. This structuring allows a company to borrow from assets on an ongoing basis to cover expenses or investments as needed.

Who uses asset based loans?

Asset based loans are used by companies that need working capital to operate or grow. Often, companies that request an ABL have cash flow problems. However, many of these cash flow problems stem from rapid growth. The asset based lending facility helps companies manage the rapid growth issues and positions the company for growth.

Who qualifies for asset based lending?

Generally, asset based financing is offered to small and mid-sized companies that are stable and have assets that can be financed. The companys assets must not be pledged as collateral to another lender. If they are pledged to another lender, the other lender must agree to subordinate its position. Also, the company must not have any serious accounting, legal, or tax issues which could encumber the assets.

Most asset based loans have a minimum of $750,000 to $1,000,000 in utilization requirements.

What assets can be used as collateral?

The main collateral for an asset based loan is usually accounts receivable. However, other collateral such as inventory, equipment, and other assets can also be used.

What is the borrowing base? How is it determined?

How does the due diligence process work?

Read Also: Usaa Loans Auto

Pricing And Market Information

Actual prices can be obtained only on a real-time, expressly agreed-upon basis. Any indicative valuations on the Sites are provided for information only. They are not an offer to enter into, transfer and assign or terminate any transaction, or a commitment by Bank of America or its Affiliates to make such an offer. An indicative valuation may differ substantially from an actual value. Such estimates do not necessarily reflect Bank of Americas or its Affiliates internal bookkeeping or theoretical model-based valuations. Certain factors, which may not have been assessed for purposes of these valuations, including, for example, notional amounts, credit spreads, underlying volatility, costs of carry or use of capital and profit, may substantially affect a stated valuation. Indicative valuations may vary significantly from indicative valuations available from other sources. While Bank of America and its Affiliates have obtained the information on which these evaluations are based from sources they believe are reliable, Bank of America and its Affiliates make no representations or warranties with respect to any indicative valuations. Prior to the execution of a Transaction based upon the Content of these Sites, Client is advised to consult with its broker or other financial representative to verify pricing information.

How Does An Asset

With this type of lending, you will be borrowing against your assets. The amount you are granted for your loan, known as the borrowing base, will be established based on a percentage of the assets value.

For your asset-based mortgage, you can use 70% of what you have in retirement and investment accounts and 100% of liquid assets, the value of your bank accounts.

The borrowing base and loan terms will be determined by the lender.

Recommended Reading: Usaa Home Loan Credit Score Requirements

Disclaimer For Hong Kong:

Bank of America and BofA Securities are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Lending, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, National Association, Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation , including, in the United States, BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA.

Bank of America, National Association, Hong Kong Branch, is a branch of a national banking association organized and existing with limited liability under the laws of the United States of America.

Evaluate Your Business Financials

Although asset-based lenders are primarily concerned with the value of your businessâs assetsâthat doesnât mean they donât care about your businessâs financial standing.

Even if your asset-based lender doesnât ask to see all of the following documents, itâs a good idea to prepare and review them ahead of time:

- Balance sheet

- Sales forecast

- Business bank statements

- Business tax returns

Also Check: Usaa Auto Loan Refinance Calculator

How To Apply For An Asset

You could find asset-backed financing from traditional banks and online business lenders. Online lenders usually have simpler applications and faster time to funding than banks, though they often charge higher interest rates as well as fees.

When applying, you would offer either hard assets or paper assets as collateral. Property, such as real estate or vehicles, would be considered a hard asset, while stock, investments or bonds would count as paper assets.

In addition to collateral, a lender would likely consider the following information about you and your business:

- Personal credit history: Your credit score would carry more weight if you have little business history to show.

- Business plan: A lender would likely want to see your business plan to understand how you will repay your loan.

- Balance sheet: Your assets and liabilities would show whether or not youve over-extended your finances. Your cash flow projections could be required as well.

- Revenue: The amount of money coming into the business would affect your eligibility for financing.

- Type of business: Lenders consider some businesses riskier than others.

Lenders would gather this information from various documents, which could include:

What Is Asset Based Lending

Asset-based lending refers to the loan provided by a financial institution to a business or a large corporation that is secured by asset collaterals, including equipment, inventory, accounts receivable, property like real estate, and other balance sheet assets.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Asset Based Lending

Recommended Reading: Mortgage Loan Signing Agent

The Pros And Cons Of Asset

One of the pros about asset-based lending is that companies can still have ownership over their assets over the life of the loan. This loan comes with a short approval period which means you can get the funds quickly which is key if you are in need of funds as soon as possible.

The downside is that it can be expensive to pay back the loan. The APR is between 7%-17% plus loan fees. There is risk of losing your assets in case you default on payments and not all assets qualify as collateral.

How To Get An Asset

To secure an asset-based loan or mortgage, you must apply with a lender. To apply for the loan you will need to identify the assets you will use to qualify and submit any requested documentation. Once the lender performs an initial review of your application and determines that you are a good candidate for an asset-based mortgage, they will present you with a preview offer and require you to make a preliminary commitment before they perform a complete review of your assets. Once your assets are fully audited, you will receive your approval and funding for your loan.

You May Like: 650 Credit Score Interest Rate

Complete Your Application And Submit Your Documents

The next step is to complete your asset-based lending application and submit the necessary paperwork. Alternatively, you could work with a loan specialist to help you through the process.

Be aware that some lenders might require that you have your financials audited by a third-party agency before your application can be processed, so check directly with the lender to clarify first.

Once youâve officially submitted your application, you might need to wait a few days to a few weeks for the lenderâs initial review. If the lender thinks youâre a strong candidate for an asset-backed loan, theyâll contact you to begin the due diligence period of your business loan application.

What Kind Of Collateral Is Used In Asset

Technically speaking, anything that the institution can liquidate into cash can count as collateral for an asset-based loan. This broad definition makes asset-

based lending accessible to countless types of businesses. Most asset-based borrowers, however, use one of the following four assets as collateral. If you offer an asset from this list, youll have the success of previous borrowers to support your application.

Also Check: Car Refinance Usaa

With Finra’s Brokercheck You Can Find Out:

– If a broker or brokerage firm is registered- What has been disclosed to regulators- About a broker’s past experience- What a broker or brokerage firm is qualified to do

You are leaving Bank of America website and being redirected to FINRA’S BrokerCheck. The website is not owned by Bank of America, Bank of America® or their affiliates and is subject to separate terms and privacy policies.

Who Uses An Asset

Manufacturers and service-based businesses can benefit from asset-based loans.

Lets say you own a small factory that recently got a big order. You dumped a bunch of liquid capital into raw materials. Then you spent weeks making the products.

You ship them out and invoice the customer. Except, you happen to run on a net 30 or net 60 invoicing policy. After the shipment goes out, you might not see payment for two months, and you depleted your liquid cash.

Another big order comes in, but you lack the funds to order the raw materials. You can use that accounts receivable as collateral for a fast infusion of cash. You get the raw materials you need, and your business keeps on trucking.

How does this work for a service business? Lets say that you run a floor cleaning business. Business picks up when fall and winter roll around because of the rain and snow.

People track in mud or slush, which means the floors need cleanings more often. You need more people to pick up the slack. As long as you invoice your customers in advance, you can use your accounts receivables the same way the factory owner does.

Recommended Reading: How Long Do Sba Loans Take To Get Approved

Common Types Of Collateral Used In Asset Based Lending

- Accounts receivable: if you have a service-based business that uses invoices for customers, receivables that are due within 90 days can be eligible as collateral in asset-based lending. The more invoicing you are doing, the greater the value of your invoices which means you would be able to borrow more.

- Inventory: if you are in an industry that has a good amount of inventory on hand then it can be used as collateral.

- Purchase Orders: purchase orders are commonly used in asset-based financing. A purchase order outlines the order when a customer places an order which shows the price, quantity, etc., and then the lender will review the terms to understand the customer and the value of the purchase order.

- Machinery or Equipment: if you are using your equipment as collateral, you need to detail each items purchase price, its condition, its age, and its location. You need to own your equipment for it to be eligible as collateral in an asset-backed loan.

- Real Estate: any real estate that a business holds can be considered as a fixed asset eligible for asset-based lending. Although it is possible to use real estate, the process is tricky. The first thing you need to get is an appraisal to determine the propertys market value.

- Intellectual Property: intellectual property is an intangible asset, but it can be used in calculation.

- Tangible Assets: depending on the type of business you have, there might be other assets that will qualify as collateral.