Does Student Loan Refinancing Make Sense

Student loan refinancing can make sense for some borrowers, especially those with private student loans. If you have Federal student loans, refinancing typically only makes sense if you are NOT going for any type of loan forgiveness, and plan to pay off your loan within 5 years.

Remember, you’re going to get the best rate on a short-term variable student loan. The longer the loan, the higher the rate typically will be. It may not even be much better than your current loans.

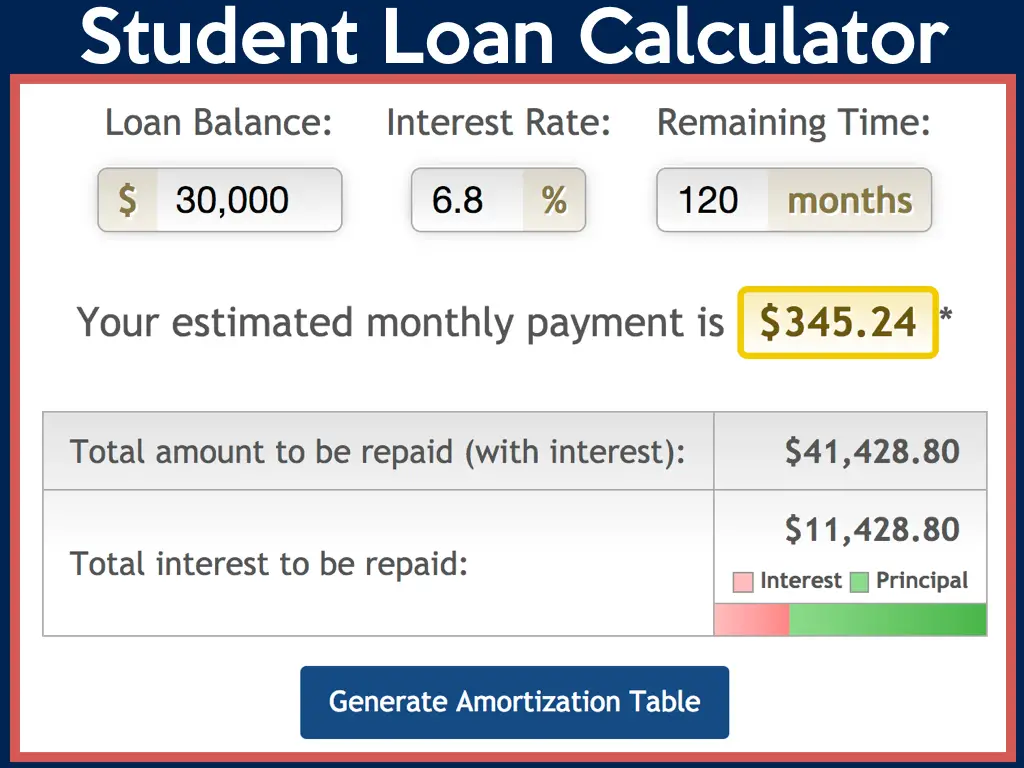

This calculator can help you figure it out:

Additional Factors To Consider

The important thing to remember with student loans , is that payment isn’t the only factor to consider.

Federal loans specifically have a lot assistance options that can be very beneficial. For example, student loan forgiveness options, hardship deferment options, and income-driven repayment plans. These benefits are likely worth more than a little extra interest.

However, for private student loans, you typically don’t have any of these options available, in which case student loan interest rate and term length are the biggest factors.

Finally, if you are considering refinancing your student loans, credit score and debt-to-income ratio play a big factor in getting the best rate. Make sure you know your credit score before applying so you know what to expect.

How Much Will The Total Loan Cost

It can be difficult to understand exactly how much you’ll pay when you have several competing loan offers. One might have a lower interest rate, while another offers lower fees. Figuring out which offer to choose means you’ll need to calculate the total cost of the loan including interest and fees. Calculators help with apples-to-apples comparisons. For example, some amortization calculators show you lifetime interest which you can use to compare interest costs from loan to loan.

Consider more than just your monthly payment amount when reviewing the terms of a loan.

In addition to your monthly payment, its crucial to focus on the purchase price, lifetime interest, and any fees.

APR is another useful tool for comparing loan costs. On mortgages, some APRs account for upfront costs in addition to the interest rate you pay on your loan balance. But the lowest APR isnt always the best loan. You might not even qualify for the lowest advertised APR. If the APR is low but closing costs and fees are high, and you don’t keep your loan for very long, you won’t see the benefits of that low APR.

With mortgages, you’ll also want to take into account other costs, such as property taxes, homeowners insurance and homeowners association fees. A good mortgage calculator can help you account for all of those costs to get the true cost of the house.

Also Check: How To Get An Aer Loan

When Do I Have To Start Repaying My Student Loan

Most loans dont require any payments until at least six months after you graduate or drop below half-time enrollment, but from there youll need to make regular monthly payments. With federal student loans, you might be automatically enrolled in the standard repayment plan set to complete repayment in 10 years.

How To Calculate Your Monthly Student Loan Payment

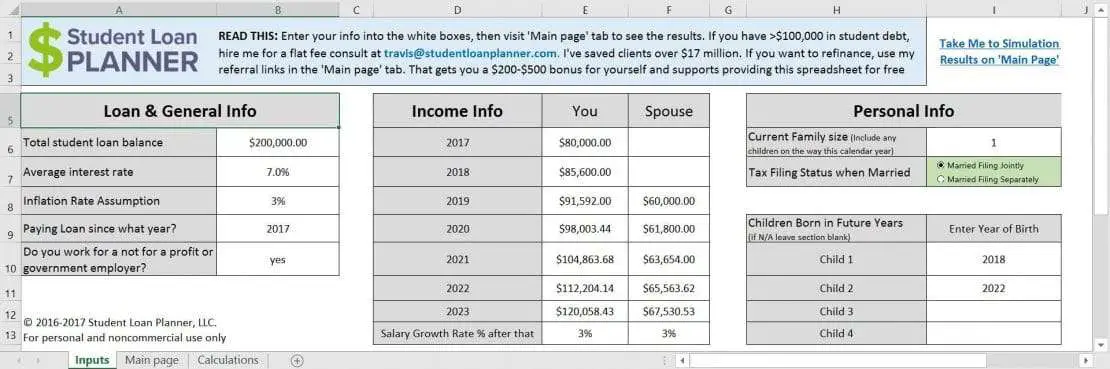

Your monthly payment will depend on how much you borrowed, your interest rate, and the loan repayment term . If you have federal student loans, you can usually enroll in an income-driven repayment plan with monthly payments that are based on a percentage of your income.

Estimate how long itll take to pay off your student loan debt using the calculator below. You can also use the slider to see how increasing your payments can change the payoff date.

Enter loan information

Also Check: Do Pawn Shops Loan Money

When Does Interest Accrue

Interest starts accumulating like this from the moment your loan is disbursed unless you have a subsidized federal loan. In that case, youre not charged interest until after the end of your grace period, which lasts for six months after you leave school.

With unsubsidized loans, you can choose to pay off any accrued interest while youre still in school. Otherwise, the accumulated interest is capitalized, or added to the principal amount, after graduation.

If you request and are granted a forbearancebasically, a pause on repaying your loan, usually for about 12 monthskeep in mind that even though your payments may stop while youre in forbearance, the interest will continue to accrue during that period and ultimately will be tacked onto your principal amount. If you suffer economic hardship and enter into deferment, interest continues to accrue only if you have an unsubsidized or PLUS loan from the government.

Those with federal student loans may encounter a gap in their requirement to pay interest: Interest on student loans from federal agencies and within the Federal Family Education Loan Program has been suspended until Sept 30, 2021, through an executive order signed by President Biden on his first day in office and an announcement by the Department of Education.

Changes To Support You During Covid

As of April 1, 2021, no interest will be charged on Canada Student Loans and Canada Apprentice Loans. This measure is temporary. For more information, please see the proposed changes in this years budget announcement.

Provincial interest rates may still apply. Contact the NSLSC or your province or territory to find out more.

Sections on this page impacted by these temporary changes are flagged as Temporary COVID-19 relief.

Recommended Reading: How To Find Student Loan Number

Pay Off In 6 Years And 2 Months

The remaining term of the loan is 9 years and 10 months. By paying an extra $150.00 per month, the loan will be paid off in 6 years and 2 months. It is 3 years and 8 months earlier. This results in savings of $4,421.28 in interest payments.

If Pay Extra $150.00 per month

| Remaining Term | 6 years and 2 months |

| Total Payments |

| 9 years and 10 months |

| Total Payments |

| $11,188.54 |

Average Medical School Student Loan Payment

- Standard repayment plan $3,533

- Refinance into 10-year loan at 5% $2,912

- Refinance into a 5-year loan at 4% $5,057

With an average medical school debt of $251,600, new doctors must cope with sizable monthly student loan payments. But they typically earn a lot, too, once they have completed their residencies.

If you tried to start paying off your medical school loans right after graduation on the standard 10-year repayment plan, youd be looking at monthly payments of $2,870. Many doctors cant afford to do that, and put their loans in forbearance or enroll in an income-driven repayment plan like REPAYE during residency.

| Repayment plan | |

|---|---|

| 10 years | $361,645 |

| Average monthly payment for $251,600 in medical school debt with a weighted average 6.6% interest rate at graduation. REPAYE estimates based on $56,000 salary during residency, $211,000 after residency. |

You May Like: How Much To Loan Officers Make

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan. Temporary COVID-19 relief

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

What Types Of Student Loans Are There

The two types of student loans available are federal loans, provided by the federal government, and private student loans, made by financial institutions like banks and credit unions. Federal student loans typically come with lower interest rates and more consumer protections than private loans. So its best to borrow those up to the maximum allowed, if necessary, before considering private loans.

Don’t Miss: Genisys Credit Union Auto Loan Calculator

Smart Moves To Make If You Can Afford Your Student Loan Payment

If you have plenty of income left each month after paying your student loans and other bills, that could be a sign that you could save money by paying down your student loans faster.

Here are a few ways to pay off your student loans faster:

- Accelerate payments on your student loans: You can always make more than the minimum payment without being penalized by your loan servicer.

- Refinancing your student loans: If youre paying high interest rates on your loans, refinancing them at lower rates can help you pay them back even faster.

The good news is, Credibles done the heavy lifting for you. Weve partnered with top student loan refinancing lenders to make it easy for you to compare rates all in one place. You can compare your prequalified rates from each of these lenders in two minutes without hurting your credit.

Find out if refinancing is right for you

- Compare actual rates, not ballpark estimates Unlock rates from multiple lenders in about 2 minutes

- Wont impact credit score Checking rates on Credible wont impact your credit score

- Data privacy We dont sell your information, so you wont get calls or emails from multiple lenders

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

Don’t Miss: Amortization Schedule For Auto Loan

If You Enroll In Repaye

Your payments in an income-driven repayment program like REPAYE will depend on your income. Lets say youre making $55,660, the median income for workers who are just starting out and have a bachelors degree. Your monthly payments in REPAYE would start at $308 and gradually increase to $469. Thats an average monthly payment of $389.

How Long Will It Take Me To Pay Off My Student Loan: Usa

In the US, a student loan is treated more like a traditional bank loan. It requires regular repayments, whatever the circumstances. It will not be written off after a certain amount of time, so small repayments can feel stressful for the borrower, who is aware that the interest is constantly growing.

Don’t Miss: Is Bayview Loan Servicing Legitimate

Statement And Due Date

We send you your monthly billing statement for each account about three weeks before a payment is due. Your monthly statement and Nelnet.com account will show your current amount due and due date for that account. For more information on your monthly billing statements, visit Statement Overview.

If you have multiple accounts, it’s possible you may have different due dates. Log in to your Nelnet.com account to view your most up-to-date account information. You can call us anytime to request that we align the due dates on all of your loans to a date between the 1st and 28th of each month.

IMPORTANT: If you have both Department of Education-owned loans and loans owned by other lenders , you must send your payments separately to the address on the front of your statement to have them applied correctly to your loans. If you make your monthly payment online, you’re able to submit a single payment for all of your accounts.

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

You May Like: Aer Scholarship For Spouses

How Can You Lower Your Monthly Student Loan Payments

There are several ways to potentially lower your student loan payments. A few of these strategies include:

- Signing up for an income-driven repayment plan: If you have federal student loans, you might be able to sign up for one of the four IDR plans. Under an IDR plan, your payments are based on your discretionary income, which might reduce your monthly payment amount even to $0 in some cases.

- Consolidating your loans: You can consolidate multiple federal student loans with a Direct Consolidation Loan. With this type of loan, you can extend your repayment term up to 30 years, which could lower your payments. Just remember that the longer your repayment term, the more youll pay in interest over time.

- Refinancing your debt: If you refinance your student loans, you might qualify for a lower interest rate. Or you could choose to extend your repayment term. Either scenario might get you a lower monthly payment. Keep in mind that while you can refinance federal student loans, youll lose your federal benefits and protections, including access to IDR plans and student loan forgiveness programs.

Tip:

If you decide to refinance your student loans, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from our partner lenders in the table below in two minutes.

| Lender |

|---|

| Trustpilot |

Can I Get My Loans Forgiven

In some circumstances, your student loans may be discharged before your repayment term ends. For example, for federal loan borrowers, if you make 120 on-time loan payments while working full-time for the government or a qualifying nonprofit, you could get your loans forgiven through the Public Service Loan ForgivenessProgram.

Don’t Miss: How To Get Loan Originator License

How Much Are Average Monthly Student Loan Payments

Reports from the Federal Reserve from 2019 to 2020 reported the average monthly student loan payment at between $200 and $299 per month among those with outstanding student loan balances.

According to a report from the Federal Reserve, 30% of all adults have taken on at least one educational loan. While some of those borrowers have since paid back their debt, millions of Americans still owe money. In fact, the median outstanding student loan balance among those who still owe educational debt was between $20,000 and $24,999.

Many people had their loans deferred from 2020 to 2021, with close to three in 10 adults who still owed money for their education paying $0 per month due to CARES Act provisions pausing federal student loan payments, but expect those average payments to be back to at least pre-CARES Act levels when those provisions expire at the end of 2021.

Average Undergrad Student Loan Payment

- Standard repayment plan $305

- Graduated repayment plan $344

- REPAYE $389

The average student loan debt for recent graduates with a bachelors degree is $29,000. Lets say youre paying the average student loan interest rate of 4.53% for undergrads and enroll in the standard 10-year repayment plan, your monthly payments will be $305.

| Repayment plan | |

|---|---|

| 7 years, 9 months | $35,236 |

| Monthly payments for bachelor’s degree debt of $29,000 at 4.79% average interest rate for undergraduates. REPAYE assumes starting salary of $55,660, the median for younger workers with bachelor’s degrees |

Recommended Reading: How Long For Sba Loan Approval

What Interest Rate Will I Pay

Note: Effective April 2021, the Government of Canada has suspended the accumulation of interest on Canada Student Loans until March 31, 2022. Subject to federal Parliament approval, the Government of Canada has proposed to extend this measure until March 31, 2023.

The interest rate for the Canada portion of your integrated student loans is either a variable interest rate or a fixed rate.

The Canada portion of your integrated loan will automatically be charged the variable interest rate unless you choose to change to the fixed rate. Switching from a fixed to a variable rate is not permitted.

No interest is charged on B.C. government-issued student loans as of February 19, 2019.

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

Don’t Miss: How To Get Loan Originator License