What Is The Fha Bankruptcy Waiting Period

The FHA guidelines indicate that the FHA bankruptcy waiting period is 1 to 2 years after the bankruptcy discharge date depending upon the type of bankruptcy. However, an exception can be granted to reduce that waiting period to just 1 year.

The waiting periods and requirements will depend upon whether you filed a chapter 7 or chapter 13 bankruptcy in addition to some other factors which are detailed below.

Is An Fha Loan Right For You

The only government-guaranteed loan is an FHA loan from the Federal Housing Administration. An FHA mortgage can be risky because you lose your house in foreclosure if you cannot make the mortgage payments.

However, it can be less risky to you since the government will pay your mortgage lender if you cannot make the payments. It will not add to your debt, but you will have a foreclosure on your new credit report on top of the bankruptcy filing.

You can get an FHA loan when:

- Two years have passed since you filed for Chapter 7 bankruptcy

- You have made one year’s worth of on-time payments in your Chapter 13 repayment plan

- The lender agrees to approve the loan

- The bankruptcy court agrees you can take on more debt before you have good credit again

Chapter 13 Fha Bankruptcy Waiting Period

Whether in a chapter bankruptcy or discharged after making all payments, FHA has certain requirements for loan approval

- At least 12 months of on-time bankruptcy payment history

- Bankruptcy and other credit payments made on-time

- If not discharged, the borrower must have written permission from bankruptcy court to enter a mortgage

Don’t Miss: How To Pay Towards Principal On Car Loan

Fha Chapter 13 Dismissal Guidelines

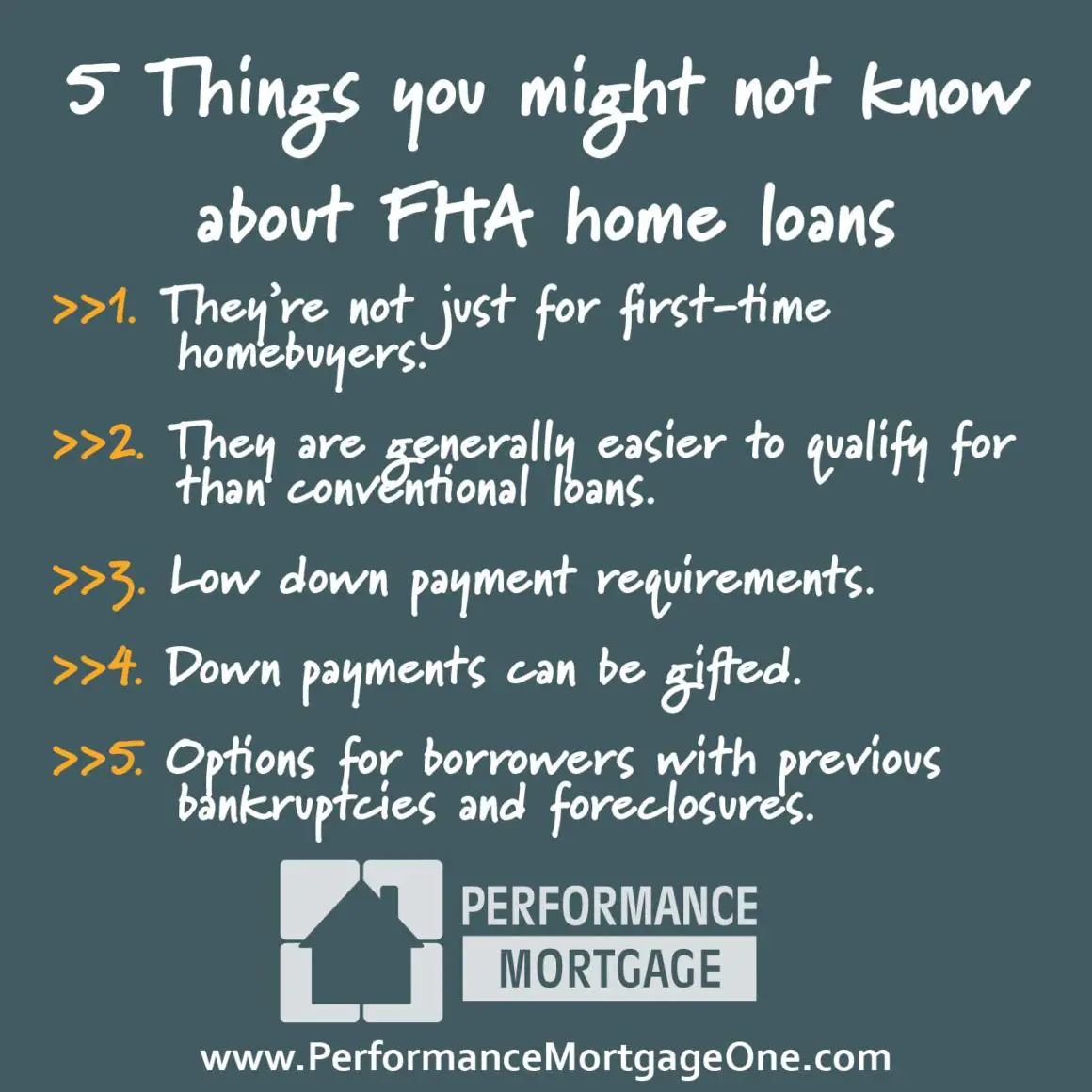

The Federal Housing Administration insures mortgages for borrowers with low and moderate incomes as well as borrowers with credit challenges. FHA loans differ from the strict underwriting guidelines of conventional loans, that is, non-government guaranteed loans. Borrowers with prior bankruptcy may still qualify for an FHA loan if they have followed through with the courts terms and conditions. They may even qualify after a Chapter 13 dismissal under certain circumstances.

Waiting Intervals After Bankruptcy Foreclosure & Short Sale

Depending on the type of mortgage, having foreclosure or bankruptcy history requires waiting periods before you can qualify for a loan. Taking a conventional loan, for instance, usually requires a longer time compared to a loan backed by the Federal Housing Administration . In other cases, loans backed by the U.S. Department of Agriculture does not allow borrowers to apply again if their old USDA loan was foreclosed. Meanwhile, those with loans sponsored by the U.S. Veterans Affairs can secure a mortgage after 2 years of being discharged from foreclosure.

With a bankruptcy or foreclosure record, you cant expect to be eligible in a couple of months. The waiting period is based on how long it takes to rebuild your credit score. Those with significantly low credit scores can take more years to recover. Lenders also consider your individual situation when evaluating the reasons behind defaulting on your mortgage. Certain extenuating circumstances, such as an accident resulting in expensive medical bills, are regarded differently from exorbitant credit card purchases.

Extenuating Circumstances

The following sections highlight waiting intervals for different types of home loans, including extenuating circumstances before you can apply again for a mortgage.

You May Like: Mortgage Loan Officer Salary New York

Chapter 7 Bankruptcy And Fha Home Loans

Chapter 7 Bankruptcy is slightly different from a Chapter 13 Bankruptcy due to the fact a Chapter 7 Bankruptcy requires the borrower to wait during the FHAs seasoning period. This period of time is a minimum of two years, in addition to any extra time applied by the lender after evaluation. Some financial institutions will require a total of three years before applying for a new home loan. All in all, a Chapter 7 Bankruptcy requires a longer period of time than a Chapter 13 Bankruptcy timeline.

Dismissal Vs Discharge Of Your Bankruptcy Claim

When debtors declare bankruptcy, theyre asking the Bankruptcy Court to take over their finances. The immediate impact of the declaration is that the court issues a temporary stay of collection activity. That means foreclosure or auto repossession efforts as well as phone calls and letters must stop while the case is being resolved.

In some cases, the court will dismiss Chapter 7 claims if it determines debtors have the ability to repay creditors some or all of what they are owed. The court determines the debtors income is sufficient, given the cost of living and average incomes in your area. If your bankruptcy declaration is dismissed, you end up back where you started.

If the court accepts a claim for relief, the Chapter 7 bankruptcy filing results in the liquidation of the debtors assets and the debts being discharged. This is referred to as a bankruptcy discharge, which means that the debtor is no longer a debtor and can begin with a fresh start, albeit with a substantially lower credit score. With a Chapter 13 bankruptcy, the discharge is usually granted 4 years after filing, as repayment plans typically last 3 5 years.

Don’t Miss: How Much Will My Home Loan Be

Chapter 7 Vs Chapter 13

A Chapter 7 bankruptcy indicates the debtor is seeking to liquidate their assets and wipe away all debt. The bankrupt party emerges from the process with a fresh start and a significantly impaired credit history. Some creditors can claim security interests.

For example, your auto loan is secured by your car, and your mortgage by your home, so those assets will be sold, and the proceeds paid to satisfy those debts. You may have the option of keeping your home if you can reaffirm your debt. This allows you to keep making payments and not include it in the bankruptcy. Unsecured creditors generally get very little of what theyre owed.

In a Chapter 13 bankruptcy, debtors seek a reorganization of their debts and commit to strict repayment plans. Debtors must make payments to creditors, but they dont lose all their assets and they dont take as hard of a hit to their credit. Thats because creditors reward debtors who are committed to paying their debts.

What Is The Legal Process Of Liquidating Assets To Repay Creditors

Bankruptcy entails the legal process of liquidating an individuals assets to repay creditors. This is often considered the last resort available to a potential defaulter. When the person is unable to repay the sums of money borrowed from creditors, bankruptcy is often cited as the most prudent solution for repayment.

Read Also: Can You Get Home Equity Loan Without Job

Keep Your Credit Card Balances Low

The amount you owe to creditors is the second-largest factor in your FICO score. Accounting for 30 percent of your score, your outstanding debt may prove easier to clean up than your payment history. A large amount of debt can depress your credit score, so whittling away the amount you owe is key to improving your score.

What To Do

First, avoid adding to your outstanding balance. If youve recently come out of a bankruptcy, dont load up on the credit offers you will find stuffing your mailboxes, both virtual and real. Pay off any debt the court orders you to pay, and do not pay discharged debt. If you had a foreclosure or short sale, work on paying down any debt you owe. Avoid the temptation to game the system by rolling debt from one credit card to another.

Second, understand the implications of credit-related decisions before opening, closing, or asking for a boost to your available balance. For example, dont close any credit card accounts in an attempt to raise your score. This tactic usually backfires because having fewer open accounts can lower your credit score. Recently closed accounts will continue to show up on a credit report, and FICO. may include them in your FICO score calculations. Moreover, the same amount of debt spread over fewer accounts means that you are using more of your remaining line of credit and thats a red flag to lenders.

Read Also: How To Claim Bankruptcy In Massachusetts

How Discharge And Dismissal Dates Work

The waiting periods start from the date that the bankruptcy is discharged. Thats the date that your debts are wiped out. For a Chapter 7 filing, your clock starts ticking almost immediately after filing because the discharge typically happens fast.

Note that discharge is different from dismissal. If a judge dismisses your Chapter 7 filing, its as though there was never a bankruptcy. So there is no waiting period. However, youll still have to meet credit scoring and other underwriting guidelines.

For Chapter 13 filings and conforming loans, its different. Chapter 13 payment plans run from three to five years. You file, pay into your plan, and after several years, you get your discharge. Then the clock starts on your waiting period. So if it takes you five years to discharge a Chapter 13, and then you have a two-year waiting period after the discharge, you cant get a loan until seven years after filing.

For Chapter 13 bankruptcy dismissals and conforming loans, your waiting period is four years after dismissal. If youre in a Chapter 13 bankruptcy, government-backed loans allow you to finance a home much sooner. Note that youll need the approval of the Bankruptcy Court.

Read Also: How To Get Best Apr For Car Loan

Seven Steps To Apply For Fha Loan After Bankruptcy

Applying for an FHA Loan after bankruptcy is fairly simple.

Remember, you can buy a home even if youve filed for bankruptcy. If youve been working with a lender who says you dont meet their requirements due to overlays, wed love to help you. Just click below to get started.

How Soon Can You Purchase A Home After Chapter 7

During a Chapter 7 bankruptcy, a court wipes away your qualifying debts. Unfortunately, your credit will also take a major hit. If you’ve gone through a Chapter 7 bankruptcy, you’ll need to wait at least 4 years after a court discharges or dismisses your bankruptcy to qualify for a conventional loan.

Read Also: The Notary Signing Agent’s Loan Documents Sourcebook

How Long Does It Take To Get An Fha Loan After Filing For Bankruptcy

Filing for bankruptcy can have a significant impact on your life. Its something that happens, and it isnt always because of poor spending habits. In most cases, people are struck by sudden hardship that prevents them from keeping up with their usual expenses. Job losses, medical bills, and more can cause a persons finances to plummet into debt.

When this happens, many people consider bankruptcy. It isnt an easy process, and it will have some short-term negative effects. However, it can give you a way to catch up or a fresh start that could be beneficial in the long run.

The number of filings in the United States has increased in the past decades. The number increased to two million in 2005 but dropped back down to 600,000 in 2006. In 2019, 477,106 filings for Chapter 7 and 288,039 filings for Chapter 13 were submitted.

Your Credit Report After Bankruptcy

Bankruptcy will impact your credit for years. Freedom Financial Asset Management vice president Freddie Huynh stated that he refers to bankruptcy as kind of Armageddon on someones credit.

As long as you take the right steps, you can heal your credit report and regain your financial standing. In the meantime, it is best to prepare for what will happen immediately after filing for bankruptcy.

Since those accounts are no longer showing as unpaid or past due, your credit score will eventually begin to rebound. You should take steps to gradually rebuild credit and fully recover.

What is an FHA Loan?

Chapter 7 Bankruptcy Waiting Periods

Chapter 7 bankruptcy is known as liquidation bankruptcy. It is meant to clear away unsecured debt and help you reset your finances. This will have a long-term impact on your credit report. Borrowers who have gone through Chapter 7 bankruptcy will have to

- Wait at least 2 years after the official discharge date to qualify for an FHA loan

Its important to note that the 2-year period is a minimum set by the FHA. Lenders can impose their own qualifications above the 2-year minimum and require additional documentation. In certain cases, you may be able to get around the 2-year waiting period if you can prove that the bankruptcy was beyond your control, although this is rare.

Recommended Reading: What Is The Best Loan For College

Can I Get A Mortgage After Chapter 7 Bankruptcy

5 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Yes, you can get a mortgage after a Chapter 7 bankruptcy. Lenders have their own requirements and waiting periods.

Written byAttorney Eva Bacevice.

Yes! You donât have to give up on the American dream of becoming a homeowner just because you filed a bankruptcy. You can absolutely get a mortgage after a Chapter 7 bankruptcy. The larger question is when are you able to qualify for a mortgage, which can vary based on the type of loan you are pursuing.

In general, for most loans you are eligible two years after you receive your discharge in a Chapter 7 case. Below weâll examine the different types of real estate loans and their guidelines, and offer suggestions for steps you can take to best prepare for your home purchase.

Tips To Qualify For A Mortgage With Chapter 13

Just meeting the 12-month requirement for a government loan doesnt guarantee youll qualify.

You still need to meet lending guidelines for credit score, income, employment, and down payment, among other things.

These will all need to be documented and verified during underwriting.

And you may need to supply extra documents due to your Chapter 13. Lenders might require copies of your bankruptcy petition and discharge or dismissal documents.

Finally, make sure youve budgeted correctly for homeownership.

Remember that your mortgage payment will include taxes and insurance as well as principal and interest. If you put less than 20% down, it will also include private mortgage insurance or FHA mortgage insurance.

These added costs can increase a mortgage payment substantially.

Before you jump into the application process, set aside some time to think about your maximum budget for payments and how the cost of homeownership will fit in with your debt repayment plan.

Read Also: What Is An Interest Only Home Loan

Timing To Buy A Home After Filing Bankruptcy

You need to consider these factors before you start your house hunt:

- Did you file a Chapter 7 bankruptcy? Your debt will be discharged, but you may face higher interest rates and difficulty finding a mortgage loan while you still have bad credit.

- Did you file a Chapter 13 bankruptcy? You will have a repayment plan that must be repaid on schedule. Can you save a down payment while making these monthly payments?

- Did you gain more credit card debt for a medical bill post-bankruptcy?

- What home loans, interest rates, down payment, and credit score requirements does the mortgage lender require?

- Do you have a down payment?

- What type of loan do you want?

Fha Loan Within One Year Of Bankruptcy

You may be able to get a loan within 12 months of a bankruptcy, if you qualify according to FHA post-hardship guidelines.

The FHA has committed to helping borrowers with extenuating financial circumstances, and will allow lenders who choose to participate to make an FHA loan within one year of an Economic Event. Some lenders have taken to calling this program the FHAs Back to Work program, a name derived from the subject of the guidelines they released for it.FHA defines the Economic Event as:

Any occurrence beyond the borrowers control that results in Loss of Employment, Loss of Income, or a combination of both, which causes a reduction in the borrowers Household Income of 20% or more for a period of at least six months.

Regardless of your bankruptcy type, youll be required to provide detailed information documenting this Economic Event to your lender.

Youll also need to complete one hour of housing counseling by a HUD-approved counselor. The counseling can be conducted in person, on the phone, or online, but it must be completed at least 30 days prior to submitting a loan application.

The FHA allows lenders to use its post-hardship guidelines, but lenders reserve the right to be more stringent than these guidelines allow. Therefore, the best way to see if you qualify for this program is to find an FHA lender to pre-qualify you.

Related Topics

You May Like: Should I Choose Fixed Or Variable Student Loan

Fha Mortgage Rates After A Bankruptcy

The FHA mortgage interest rates will not be higher simply because you have a bankruptcy. The rates are influenced by your credit scores. Since bankruptcies negatively impact your credit scores, then they also indirectly have an effect on your FHA interest rate. Many people are able to improve their credit scores soon after their bankruptcy has been discharged.

Deed In Lieu Of Foreclosure

When you have a deed in lieu of a foreclosure, you are transferring the title of your property to your lender to be released of your loan obligation and to avoid foreclosure. This is the trade-off borrowers make to be relieved of their mortgage debt. A deed in lieu of foreclosure typically reflects on your credit record for 4 years.

Also Check: When Interest Starts On Education Loan