How To Cancel A Regular Payment

Direct Debit

You can cancel a Direct Debit by contacting your bank or building society, or through your online banking app.

If you no longer want the goods or services, its best to also tell the organisation supplying them to you so your order is cancelled and no further payments are taken.

If you still want to receive the product or service, contact the supplier as soon as possible to arrange an alternative payment method.

If you want to ask your bank to cancel a Direct Debit, theres a template letter you can use on the Which? website

Standing order

You can cancel a standing order, or change the amount, date or frequency, by contacting your bank or building society.

Recurring payment

You can cancel a recurring payment by contacting your bank or card issuer and telling them youve withdrawn permission for the recurring payment.

The organisation youve been paying must refund any payments taken along with any related charges. But you need to let them know by the end of the working day before the payment is due

If you want to cancel payments, theres a template letter you can use on the National Debtline website

Of course, cancelling the recurring payment doesnt alter the fact you still owe the debt to the lender.

If youre cancelling because of difficulties paying back the money, tell the lender as soon as possible and ask if they can give you time to pay.

You should also consider getting free debt advice to help you deal with your debts.

Payday Loan Changes Retracted

The Consumer Financial Protection Bureau introduced a series of regulation changes in 2017 to help protect borrowers, including forcing payday lenders what the bureau calls small dollar lenders to determine if the borrower could afford to take on a loan with a 391% interest rate, called the Mandatory Underwriting Rule.

But the Trump administration rejected the argument that consumers needed protection, and the CPFB revoked the underwriting rule in 2020.

Other safeguards relating to how loans are paid back remain, including:.

- A lender cant take the borrowers car title as collateral for a loan.

- A lender cant make a loan to a consumer who already has a short-term loan.

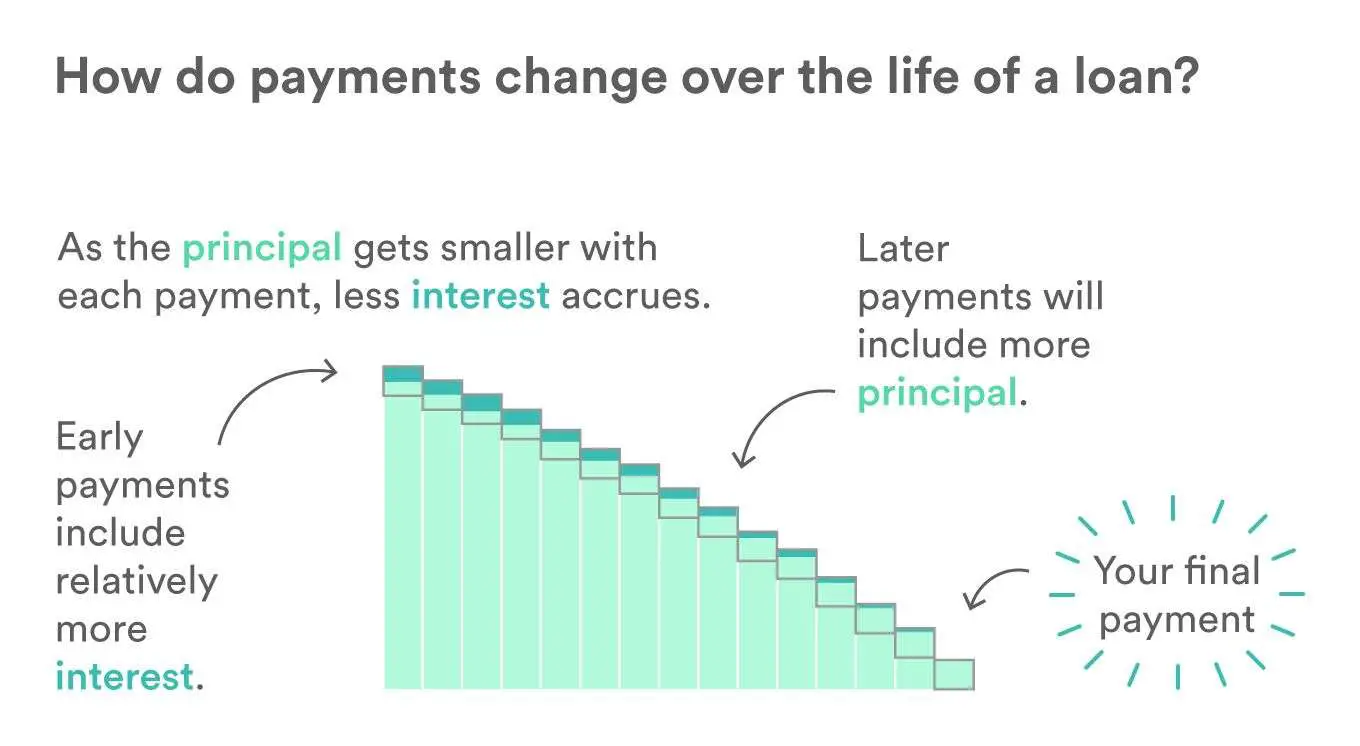

- The lender is restricted to extending loans to borrowers who have paid at least one-third of the principal owed on each extension.

- Lenders are required to disclose the Principal Payoff Option to all borrowers.

- Lenders cant repeatedly try to withdraw money from the borrowers bank account if the money isnt there.

Congress and states are also working on strengthening protections, including a move to bring the 36% interest cap to all states. In 2021 alone, Illinois, Indiana, Minnesota, Tennessee and Virginia all clamped down on payday loan interest rates.

Qualifying Property Types May Be Different

According to Quicken Loans, an investment property typically needs to fit into one of the following categories:

- Condo

- Single-Family Unit

- Multi-Family Unit

In general, youll need to stick with one to four-unit properties when you apply for a rental property loan. If you want to buy an investment property with more than four units, you might need to consider a commercial residential loan or an apartment loan as an alternative. FHA multi-family financing might also be a good fit.

Its worth noting that if you purchase a multi-family unit and plan to live in one unit yourself, you might be able to take out a primary mortgage on the property. For owner-occupied properties, you may be able to use an FHA loan or VA loan to finance your purchase. A conventional mortgage could also be worth considering. Any of these financing options might translate to a lower interest rate and better terms on your mortgage. Loan-to-value ratio , down payment requirements, and DTI requirements may be less strict in this scenario as well.

You May Like: Becu Auto Smart

What Happens If You Cant Afford Your Monthly Payment

Now listen, you guys: When you take out student loans, you commit to paying back the money. But you mightve heard about some loan-dodging options that let you take the easy way out. Honestly, these options are only temporary, short-term fixes to long-term problemsand sometimes, they can end up costing you more in the long run.

- Forbearance: Your payment is put on hold, but the loan continues to accumulate interest. There are two types of forbearance: general and mandatory .

- Deferment: With deferment, you temporarily dont have to make payments, and you may not be responsible for paying interest on your loan. Not everyone is eligible for deferment or forbearance, but you might qualify if youre unemployed, serving in the military during wartime, or serving in the Peace Corps.

- Student Loan Forgiveness: Again, not everyone qualifies for thisthere are a whole bunch of different requirements, like working full time in a qualifying public service job while making payments for 10 years, teaching in a low-income school for at least five years, etc. The scary thing is, as of May 2020, only 1.3% of applications for student loan forgiveness through public service were actually approved.6 You cant rely on this stuff, yall.

How Payday Loans Make Money Off You

While a payday loan might seem like a great way to obtain money quickly, you should know that these loans have significant downsides, including punishing interest rates and short repayment time frames. Once you fully understand how they work and consider the costs and risks involved, you might change your mind about getting one.

You May Like: Does Va Loan Work For Manufactured Homes

Alternatives To Cash Advances

Taking out a cash advance may seem like a good idea in the moment, but it can quickly lead you to rack up debt. We recommend avoiding a cash advance altogether and opting for some alternative options that have better terms.

- Borrow from family or friends: You can ask family or friends for a loan. While it can be uncomfortable to ask, this can be the most cost-effective way to get the cash you need. Make sure you create a repayment plan to keep your relationship on good terms.

- Take out a personal loan: Personal loans usually offer better terms than a cash advance, and you can have access to more cash if you have good credit. With a personal loan, you usually can pay back the loan at a fixed interest rate that’s much lower than the APR charged by credit card issuers.

Editorial Note:

How To Apply For A Personal Loan

Despite all of the requirements and factors that your lender will check before giving you a loan, on your end, applying for a personal loan actually isnt that complicated.

The first thing youll want to do is pre-qualify for a personal loan from multiple lenders. To do this, all you need to do is provide the lender some information like what the loan is for, how much you want to take out, some basic personal information, and your desired monthly payment. This prequalification process usually only takes a few minutes and allows you to compare offers from multiple lenders.

After you read through the loan terms of each offer, compare all of your loan offers and select the best one for you, you can start the formal loan application process. To do this, youll need to gather some documents. This includes:

- Social security number

- Financial information

This step can either be done in person or online. Most lenders now offer both options. After you complete this step, all thats left to do is wait and find out whether your loan is approved or not. Once youre approved, it can take as fast a day for the funds to arrive in your bank account.

You May Like: 20/4/10 Car Calculator

Options If Your Credit Isnt Great

Most of the options weve covered require good to excellent credit. But what happens if your credit scores arent that great? You could consider a hard money loan, which is a short-term loan from private individuals or companies. Just like with traditional mortgage lenders, hard money lenders can take your property if you cant pay off the loan. Theyre easier to qualify for, and you can get your money faster, but the interest rates may be higher.

Documents Required In A Mortgage Application

When applying for a mortgage, there are various documents that you must have. Failure to hand in these documents may lead to the disqualification of the mortgage loan. This means that you will not be given the loan and will have to either apply again or find other finance sources. These documents include:

- Personal identification documents

- Proof that you are creditworthy

- Proof of mortgage affordability

- Proof of legitimate residence in the US

Don’t Miss: Usaa Credit Score Range

Getting A Debt Consolidation Loan

Some bank subsidiaries and consumer finance companies lend money in the form of consolidation loans. With a consolidation loan, you roll multiple older debts into a single new one that, ideally, has a lower interest rate than your existing debts. Then, your monthly payments are lower. While lowering your monthly debt payment might sound good, consolidation loans have both pros and cons.

Calculating Payday Loan Fees And Interest

Payday loans may seem like an easy and fast solution to a short-term problemneeding fast cashbut they actually cost a lot more than traditional loans. The average interest rate on the average payday loan is a sky-high 391%, according to Bennett. Thats if it is paid after two weeks.

For comparison:

- As of early July 2019, the prevalent was about 17.8%, according to Bankrate.

- According to economic data from the Federal Reserve Board of Governors, there was a 10.63% finance rate on personal loans at commercial banks as of May 2019.

Why are rates on payday loans so high? The fee-based structure. As Bennett points out, high lending fees due to the short-term nature of these loans make them expensive, as compared with other types of loans.

To calculate the APR, or annual percentage rate, of a payday loan, interest and fees for the amount borrowed are compared to what the cost would be for a one-year period. Consider this example, adapted from a St. Louis Fed economic education lesson called So How Much Are You Really Paying for That Loan? .

Don’t Miss: When Can I Apply For Grad Plus Loan 2020-21

Payday Loan Alternatives To Avoid

Long-term, high-interest installment loans: These loans extend repayment terms to as long as five years. You dont need good credit some may advertise themselves as no-credit-check installment loans but you typically must meet the requirements of a payday loan. Interest charges mount quickly: A $3,200, two-year loan at 87% APR will end up costing $6,844.

Auto title loans: These short-term loans, where theyre legal, require you to hand over the title to your vehicle as collateral for the debt. Theyre often compared with payday loans, but they can be even worse: If you dont repay, the lender can seize your car.

A payday loan is a high-cost, short-term loan for a small amount thats repaid with your next paycheck.

Payday Loans Target Military Low

Payday lenders prey on people in desperate economic situations, meaning low-income, minority families, members of the military and anyone else who has limited credit options.

The CFPB estimates that 80% of payday loans get rolled over and 20% end up in default, which goes on your credit report for seven years and all but eliminates you from getting loans in the near future.

Another penalty consumers often incur from payday loans is nonsufficient funds charges from you bank. If you dont have the money in your account when the payday lender tries to cash the post-dated check you wrote or takes the money out by direct deposit, most banks charge a $25-$35 penalty.

Default also opens you up to harassment from debt collection agencies, who either buy the loan from the payday lender or are hired to collect it. Either way, you can expect the phone to ring until you pay.

There also is long-term damage to your credit score. Though some payday lenders dont report directly to the three major credit reporting bureaus in the United States, most report to the minor agencies. If the debt goes to a collection agency, that agency almost always reports non-payment to the major credit bureaus, which ruins your credit.

You May Like: How To Transfer Car Loan To Another Person

Alternatives To Payday Loans

I want to recommend two good alternatives for trying to steer clear from payday loans since payday loans trap you into a cycle thats almost impossible to get out of.

One of the best alternatives to a payday loan is to take out a personal loan from a reputable lender. While personal loans still accumulate interest over time, the interest rate is much, much lower than predatory payday loans. Even borrowers with poor credit may qualify for a personal loan from some lenders.

Loan comparison tools like can help you quickly and easily compare lenders, check rates, and see which loans you may prequalify for. Monevo lets you compare over 30 different banks and lenders, and features a quick and easy rate check process that wont affect your credit score.

The best part, however, is the fact that Monevo is completely free to use, and many of the lenders Monevo partners with can have funds deposited into your bank account in as soon as one business day.

Another option is a Cash Advance from . Check your eligibility in the app and, if you qualify, youll get up to $250¹ deposited directly into your bank account. You wont pay late fees or interest on the Cash Advance. Empower will simply take the amount that was advanced out of your next direct deposit, as agreed in the app.

Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC.

% Money Transfer Credit Card

With this type of credit card, you can move funds from your card into your bank account. These funds can then be used to pay off existing debts more cheaply, or to put towards purchases or unexpected bills. Again, there is usually a transfer fee to pay and once the 0% deal ends, youll pay interest.

Read Also: How Do I Find Out My Auto Loan Account Number

Looking To Sell Or Pawn An Item Now

Get local cash offers â free, fast & easy.

Are you thinking about pawning your items to get some much-needed cash? If you are new to pawning and have no idea exactly how it all works, then you might be a bit apprehensive.

However, rest assured that you are not in uncharted waters. In fact, 7.4 percent of households in America have used a pawnbroker at some point.

This means that if you have been wondering, âhow do pawn shops work?â you are definitely not alone. Here are some guidelines as to what you can expect when you visit a pawn shop.

How Much Payday Loans Cost

Payday loans are very expensive compared to other ways of borrowing money.

This is because:

- you pay high fees

- the cost may be equivalent to an interest rate of 500-600%

- you may have to pay a fee if your cheque or pre-authorized debit doesn’t go through

These high costs can make your loan harder to pay back, which can increase your financial difficulties and stress.

Before taking out a payday loan, be very sure that you can pay it back on time. If not, your financial situation may get worse. Your debt can keep growing and you can end up paying a lot of money over time.

Figure 1: Comparing the cost of a payday loan with a line of credit, overdraft protection on a chequing account and a cash advance on a credit card

| $51.00 |

Financial Consumer Agency of Canada

The costs shown in this example are for illustration purposes only and are based on the following assumptions:

- a payday loan costs $17 per $100 that you borrow, which is the same as an annual interest rate of 442%

- a line of credit includes a $5 administration fee plus 8% annual interest on the amount you borrow

- overdraft protection on a bank account includes a $5 fee plus 21% annual interest on the amount you borrow

- a cash advance on a credit card includes a $5 fee plus 23% annual interest on the amount you borrow

Recommended Reading: Does Va Loan Work For Manufactured Homes

Basic Requirements For Payday Loans

According to the government’s Consumer Financial Protection Bureau , to qualify for a loan, most payday lenders only require that borrowers:

- Be at least 18 years old

- Have an active checking account and

- Provide some proof of income as well as valid identification.

The loan can be approved in as few as 15 minutes. In most circumstances, the borrower writes a check for the loan amount plus a lending fee, and the lender holds onto the check until a predetermined due date.

Most payday loans are extended for just a few weeks. When the loan comes due, the borrower either pays off the loan or allows the lender to cash the post-dated check or otherwise make a withdrawal from the borrower’s account.

Personal And Business Needs

Businesses usually need a cash injection for current and future needs like purchasing resources, stock, equipment or expansion into new premises. A secured loan can come in handy when you need a financial boost for your business.

Secured loans can also finance different personal financial needs and purchases. You can use it to buy a home, car, advance your education, finance a family vacation or the wedding of your dreams.

Related quick help guides:

Also Check: Becu Car Repossession