Myautoloancom: Best Used Car Loan Rates

- New Car Loan Starting APR: 2.24%

- Used Car Loan Starting APR: 2.49%

myAutoloan.com is an internet-based lender that has been around since 2003, and it currently has new car loan offers with rates of just 2.24%. The company has a 4.3 out of 5.0-star rating from over 800 customers on Trustpilot and an A+ rating with accreditation from the Better Business Bureau .

Borrowers need a minimum credit score of 575 to qualify. This is a lower credit score requirement than many other top lenders, making myAutoloan a good option for people with lower scores who need to secure a car loan.

One thing that makes myAutoloan different from most companies is that its an online marketplace where you can see rates from multiple lenders at once. Its always a good idea to do some comparison shopping to find the best auto loan rates, and you can save some time with myAutoloan. Be aware that you need to borrow at least $8,000 when using myAutoloan.

myAutoloan.com Pros and Cons

The following table lists out some of the pros and cons of choosing myAutoloan.com:

| myAutoloan.com Pros | |

|---|---|

| Extremely easy to compare rates | Not available in Hawaii or Alaska |

Its rarely difficult to find some of the best auto loans from myAutoloan, as the site works as an online marketplace. Its not the place to get a minor car loan, though, as youll need to finance at least an $8,000 loan to be eligible.

For more details on myAutoloan.com, head to the companys website.

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Improving Your Credit Score

If you’re able to take a few months to improve your credit score, you can lower your interest rate. One of the best ways to do this is to lower your debt-to-income ratio by paying down other debts you owe. You can also continue to make on-time payments to reduce the impact of recent late payments.

A higher credit score will help you qualify for better loan rates, but it may take several months for you to improve your score. Some people see faster results when they make two payments each month instead of one, depending on how often the creditors report to credit bureaus.

Also Check: Bad Credit Personal Loan Direct Lenders

What Factors Contribute To Auto Loan Interest Rates

While it is true that the interest rate you will receive varies depending on the lender and is somewhat out of your control, there are still choices you can make to increase approval. Consider these aspects and how they will affect loan approval and rates.

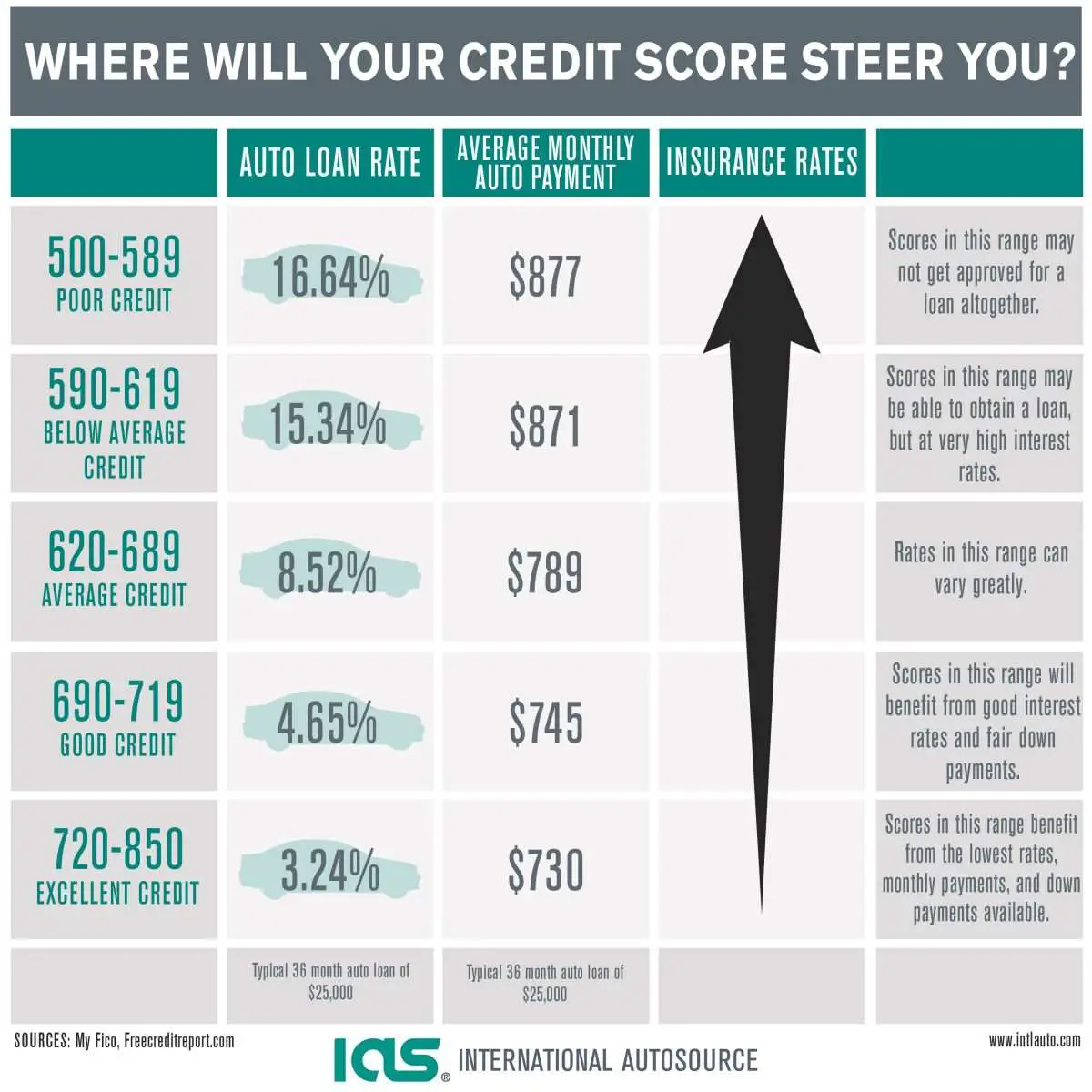

- Your credit history. Lenders use credit scores to measure the risk that borrowers carry. Very simply, the lower your credit score is, the higher your interest rate will be.

- Vehicle down payment. Putting down a large down payment will not only bode well with lenders but will decrease the amount you are borrowing saving you more money down the line.

- Loan term. Typically, a longer-term loan will equate to higher interest rates and more interest paid over the life of the loan. But a longer-term loan will decrease your monthly payment.

- Education and work history. Many lenders are expanding underwriting criteria outside of the sole measure of your credit score. This means you can still benefit from a competitive rate if you have a strong profession or educational background with or without a perfect credit score.

- Vehicle age. An older vehicle can carry additional risk of issues for both you and your lender. So, you can expect an older car to carry higher rates.

What Should You Consider When Choosing An Auto Loan

In a recent interview with Kathryn J. Morrison, consumer affairs expert and instructor at South Dakota State University, she said âWhen shopping for an auto loan, one needs to consider more than just the interest rate. Are there any additional fees that you will be charged? Do you need to have a down payment to qualify for this rate? What is the total loan amount, and how much interest will you be paying over the life of the loan?â

Thereâs a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q2 2021, the average credit score was 732 for a new-car loan and 665 for a used car loan, according to a report from Experian.

In Q2 2021, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 2.34% for new cars and 3.66% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 3.48% for new loans and 5.41% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 6.61% for new car loans and 10.49% for used.

Itâs also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

Read Also: What Is The Cheapest Student Loan Repayment Plan

Read Also: Huntington National Bank Car Loan

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Compare The Best Auto Loan Rates

| Lender | |||

|---|---|---|---|

| LightStreamBest Online Auto Loan | 3.99%* with Auto Pay & Excellent Credit | $5,000 to $100,000 | |

| Bank of AmericaBest Bank for Auto Loans | 3.59% | ||

| Consumers Credit UnionBest Credit Union for Auto Loans | 2.49% | ||

| Chase AutoBest for Used Cars | Not Advertised | ||

| myAutoloanBest for Bad Credit | 1.90% | ||

| CarvanaBest for Fair Credit | Not Advertised | Any Car They Are Selling | 36 to 72 months |

You May Like: How To Reuse Va Loan

Looking For Bad Credit Financing

Most traditional lenders are hesitant to approve borrowers with credit scores below the 660 range. If you find yourself in one of the lower credit score tiers, and youre looking for an auto loan, we want to help. At CarsDirect, were connected with dealerships that work with subprime lenders.

Subprime, or bad credit, lenders consider more than your credit score for approvals. They look at conditions like your income, overall stability, and willingness to pay to make credit decisions. If approved, the dealer works with you to find a vehicle on their lot that falls within the budget that the lender approves you for.

If youve got less than perfect credit, or a unique credit situation, fill out our free car loan request form to get matched to a dealership in your local area with a special finance department.

Find A Car You Can Afford

Instead of finding the car you want, try to find one that fits reasonably into your budget. Use an auto loan calculator to determine a comfortable monthly payment, but give yourself some wiggle room, too.

Remember youll still need to pay for gas, maintenance, car insurance and other expenses. Once you know how much car you can afford, browse vehicles within that price point.

Featured Partner Offers

On Consumers Credit Union’s Website

Recommended Reading: How To Qualify For Loan Modification

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

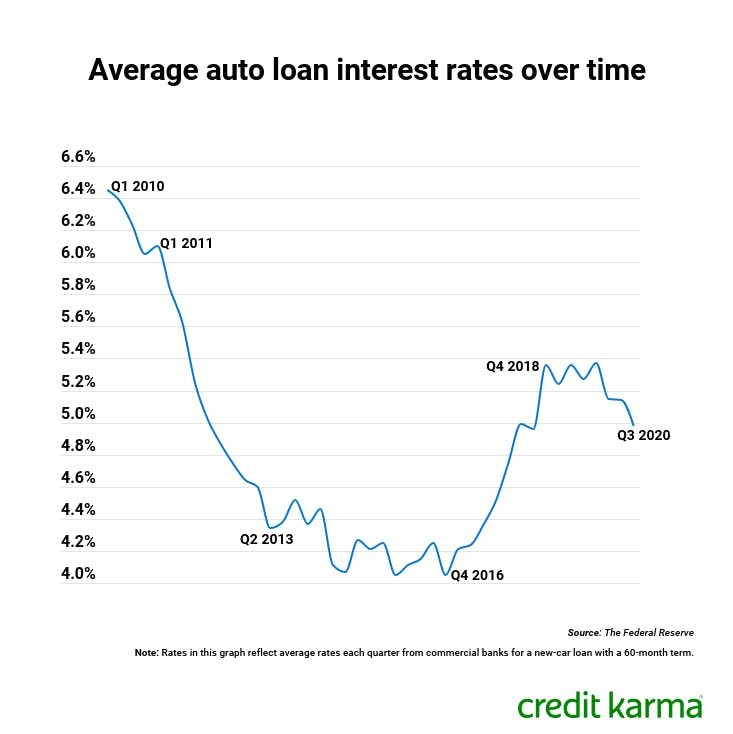

How The 2022 Fed Hikes Impact The Cost To Finance A Car

The July meeting of the Federal Open Market Committee raised the benchmark rate to 2.25-2.5 percent, this is up from the June meeting and is working towards the goal of controlling growing inflation. For drivers already dealing with new vehicles costing an average of over $48,000 in July 2022, according to Kelley Blue Book, and the price to fill up at the pump hitting record highs, the added burden of higher rates feels daunting.

The benchmark rate doesnt directly shift auto rates, but it affects the number that auto lenders base their specific rates on. This means that it is possible you will be met with steeper costs to borrow money for vehicle financing due to the Fed hike, but the hike itself is only one part of that increase.

Even with higher costs across the board, there are still a few ways to prepare and save money, regardless of movements made by the central bank.

You May Like: What Kind Of Loan Do You Get For An Rv

Where Can I Find The Best Car Loan Rates In Canada

You can often find competitive car loan interest rates in Canada from the following providers:

- Dealerships. Dealers usually have an incentive to offer the best car loan rates in Canada because they want you to buy a car from them. Dealers provide in-house financing and/or are partnered with multiple lenders, including the big banks. However, you may want to secure financing first before you visit a dealership so you have more negotiating power.

- Banks and credit unions. While financial institutions do not have an incentive to sell you a car, they may still offer competitive interest rates. When weighing your bank or credit union options, check if their auto loan is secured or unsecured. Secured loans generally have lower rates than unsecured loans. Most auto loans are secured, but some auto loans from banks or credit unions may not be.

- Online brokers. If you have fair or bad credit below 660 and need help finding a lender who can approve you, you may wish to apply to an online broker that specializes in finding a car loan for borrowers like you. Online brokers are partnered with hundreds of dealers and can match you with multiple car loan rate offers. Be prepared for higher interest rates though, because lenders view borrowers with fair or bad credit as higher risk.

Loans Under 60 Months Have Lower Interest Rates For New Cars

Loan terms can impact on your interest rate. In general, the longer your term, the higher your interest rate is.

After 60 months, your loan is considered higher risk, and there are even bigger spikes in the amount you’ll pay to borrow. The average 72-month auto loan rate is almost 0.3% higher than the typical 36-month loan’s interest rate for new cars. That’s because there is a correlation between longer loan terms and nonpayment lenders worry that borrowers with a long loan term ultimately won’t pay them back in full. Over the 60-month mark, interest rates jump with each year added to the loan.

Data from S& P Global for new car purchases with a $25,000 loan shows how much the average interest rate changes:

| Loan term |

| 72-month used car loan | 4.07% APR |

While there’s a direct correlation between a longer repayment term period and a higher interest rate with new cars, it’s not the case with used cars. It is unclear exactly why these rates dip with longer repayment terms.

It’s best to keep your auto loan at 60 months or fewer, not only to save on interest, but also to keep your loan from becoming worth more than your car, also called being underwater. As cars get older, they lose value. It’s not only a risk to you, but also to your lender, and that risk is reflected in your interest rate.

Don’t Miss: What Is Hard Money Loan

Average Interest Rates For Car Loans With Bad Credit

Experian, one of the country’s three main credit bureaus, issues quarterly reports that study data surrounding the auto loan market. Their State of the Automotive Finance Market Report from the first quarter of 2022 found that the average interest rates for both new and used auto loans look like this:

| $8,720 | $22,720 |

Using the average used car loan interest rates from the first table, you can see that as credit scores drop and the interest rate increases, the total cost of financing goes up dramatically.

What Goes Into Your Credit Score

- Payment history :One of the most significant factors in your credit score is whether youve missed payments. This includes whether youve had accounts that were delinquent.

- Amounts owed : While having debt doesnt necessarily mean youll have a low credit score, using too much of your available credit can cause your score to fall.

- Length of credit history :How long youve had accounts open with creditors affects your score. Having older accounts with long histories of regular, on-time payments will boost your credit score.

- New credit : Opening a new credit account can temporarily cause your credit score to drop.

- : Having a variety of credit accounts, such as credit cards, student loans and a mortgage, improves your score.

Don’t Miss: How Much Home Loan Can I Get On 90000 Salary

Good New And Used Car Loan Rates

For an auto loan term of 48 months, good new car loan rates from credit unions are 2.67% or lower while good new car loan rates from banks are 4.60% or lower. New car loan rates tend to be lower on average, but loan rates for used cars are slightly higher. To put this in perspective, below is a table comparing new and used auto loan rates with different terms.

Average New And Used Car Loan Rates

| New or Used Vehicle Loan | Loan Term |

|---|---|

| 5.03% |

Current Market Interest Rates And Key Factors That Affect Apr

As you may know, the current interest rate is always fluctuating. Think of it like the stock market. Economic factors and happening across the globe can have a huge impact on the interest rates. Depending on the type of loan you take out, your interest rate may or may not change as the federal rate changes. Along with the federal interest rate, there are lot of the components to the constantly changing APR and competitive rates. Finding a lower monthly payment can require real effort.

test

What are current used car loan rates?

Used car loan rates have historically always been higher than loans for new cars. With a good credit score, rates start as low as 4%. Those with a poor credit score can expect to pay well over 10%.

What car loan rate based on credit score?

The annual percentage rate is based off your credit score. Lenders use your FICO score to determine the risk when issuing you a loan and your likelihood to pay it back.

What is good interest rate on an 84-month auto loan?

A good interest rate on an 84-month auto loan is 5%. Since the term length is longer than most other car loans, you can handle an interest rate slightly higher than a short-term loan due to the already low monthly payments.

When feds raise interest rates, does it affect car loan rates?

Yes, when feds raise the interest rates lending becomes more expensive for everyone. An increase in the interest rate wont affect you if you have a fixed auto loan.

What auto loan rate can I expect after ch.13?

Also Check: How To Apply For Va Loan