Finding Your Federal Student Loan Balances

You can always access student loan information through your My Federal Student Aid account, where you can find your federal student loan balances under the National Student Loan Data System . This is the U.S. Department of Education’s central database for student aid, and it keeps track of all your federal student loans.

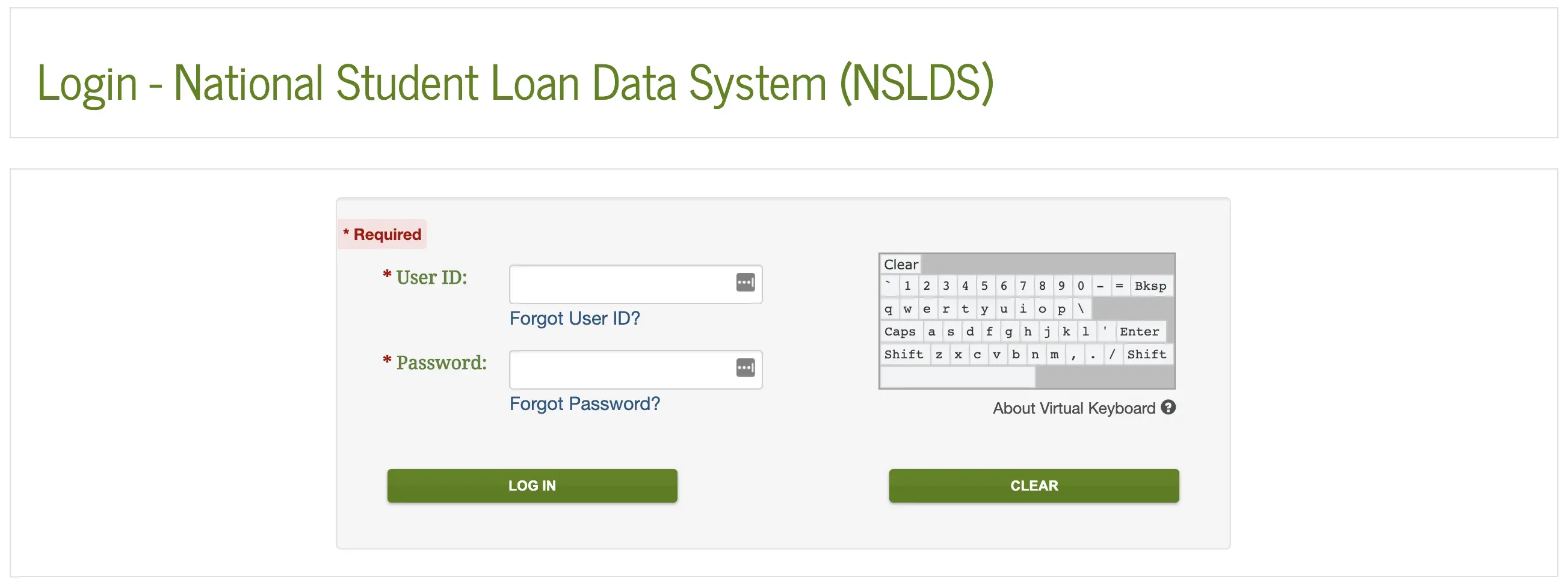

You’ll need a Federal Student Aid ID username and password to log in to the site. The ID serves as your legal signature, and you can’t have someonewhether an employer, family member, or third partycreate an account for you, nor can you create an account for someone else. The NSLDS stores information so you can quickly check it whenever you need to, and it will tell you which loans are subsidized or unsubsidized, which is important because it can determine how much you end up paying after graduation.

If your loans are subsidized, the U.S. Department of Education pays the interest while you’re enrolled in school interest accrues during that time with unsubsidized loans. To qualify for a subsidized loan, you must be an undergraduate student who has demonstrated financial need. Unsubsidized loans are available to undergraduate, graduate, and professional degree students, and there are no financial qualifications in place.

Explore Different Student Loan Strategies

As you think through your loans, income and other financial factors, you can identify the plan of attack that best fits your situation.

The nice thing about the tools above is they take the focus off doing math and place it on creating a strategy that works for you.

With so much information out there and so many decisions to make, its easy to become overwhelmed. Dont let fear about your student loan situation paralyze you and prevent you from making decisions that will make your life easier in the long run.

With a little bit of ingenuity, hard work and help from Student Loan Hero, you can do more than manage your student loans you can conquer them.

Andrew Pentis and Honey Smith contributed to this report.

Who Is My Federal Student Loan Servicer

A loan servicer is a company that handles the billing and other services for your federal student loans. To find out who your loan servicer is, you may login to the Student Aid website. Here you may view information about all of the federal student loans that you have received and find contact information for the servicer of your loans. You will need your Federal Student Aid ID to access this information.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Campus Based Student Loans

Heartland ECSI is the Universitys contracted servicer for University of Illinois Campus Based Student Loan.

You can view your account online at Heartland ECSI. This website also has an available live chat feature. For more information on accessing and managing Campus Based Student Loan click on the links below:

To discuss Campus Based Student Loan by phone, borrowers may call Heartland ECSI at 549-3274.

National Student Loan Data Service Nslds

The NationalStudentLoanData Service is the U.S. Department of Educations central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that recipients of Title IV Aid can access and inquire about their Title IV loans and/or grant data.

Students may access their federal student loan history through the National Student Data Service at: .

NSLDS Most Frequently Asked Questions FAQs

Information About My Loans and Grants

Where does my student aid information come from? The loans and grants listed on this web site have been reported from different sources. In general, the agency that authorized the aid award is responsible for reporting aid information to NSLDS. Direct loans are reported by the Direct Loan Servicing Center, Perkins loans are reported by schools , and grants are reported by the U.S. Department of Educations Common Origination and Disbursement System.

How current is this information? Grant information is reported to NSLDS daily. New loans are reported to NSLDS within 30 days of receipt of funds. If you have been making payments on a loan, the outstanding principal balance listed by NSLDS may be as much as 120 days old. You can contact the loan servicer for more up-to-date balance information.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Attending School Less Than Half Time You Can Still Apply For A Student Loan

Whether youre a full time, half-time, or less than half-time student, you can use school loans to pay for all your school-certified expenses at degree-granting institution.Taking winter or summer classes? Studying abroad? Taking continuing education or professional certification courses? We have student loans that can help you pay for classes taken online, on campus, or anywhere.

Federal Direct Student Loan Program

The William D. Ford Federal Direct Student Loan program is funded directly from the U.S. Department of Education. For Federal Direct Loan and Federal Stafford Loan repayment information, borrowers must contact their loan servicer for repayment information. Borrowers can access their loan history at Federal Student Aid.

To sign Master Promissory Note:

Also Check: Can You Transfer Car Payments To Another Person

Loan Servicer For Private Student Loans

If you have private student loans, your loan information wont show up in the NSLDS. Private institutions such as banks, credit unions and online lenders originate these loans and hire loan servicers to manage the accounts much like federal student loans.

To find out who services your private student loan, log in to your lender website or app. You should be able to find details about your loans, including the loan balance, interest rates and loan servicer.

You can also check your credit reports. The loan servicer should be listed next to the account, along with contact information.

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies, loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Reservist Status In The Canadian Forces

If you are a reservist in the Canadian Forces on a designated operation you can delay repayment and interest on your student loan.

Complete the Confirmation of Posting Assignment for Full-Time Students form and submit it with your loan application to maintain your interest-free status. Make sure you attach a copy of your notification of posting instructions that you received from the Department of National Defence.

If you need help with this, contact your provincial or territorial student aid office.

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

Read Also: Usaa Proof Of Residency Request Form

Find Out How Much You Owe Even If You Forgot Your Lenders

It can be easy to lose track of all of your student loans and your total balance, especially when you’re busy in college. Many students receive multiple small loans per semester, which can be a mixture of federal student loanssuch as Perkins, Stafford, and PLUSand private student loans. While your school financial aid office may be able to help you find some basic facts and figures, there are other effective ways to find out your total student loan balance.

Student Debt Relief Loan Refinancing Advertiser Disclosure

Student loan offers that appear on this site are from companies or affiliates from which Student Debt Relief may receive compensation. This compensation may impact how and where products appear on this site . Student Debt Relief does not include all student loan companies or all types of offers available in the marketplace. Student Debt Relief tries to keep all rates offered by lenders up to date. There may be instances where rates have been changed, but Student Debt Relief has not been made aware of those changes, and/or has not yet had a chance to update its website. We make no guarantees as to the rates being offered. For more information see our privacy policy.

Read Also: Personal Loan To Buy Land

Supports For Students Affected By Wildfires

Are you affected by the current wildfire situation? Do you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast track your application for the Repayment Assistance Plan.

- For Alberta Student Loans, call 1-855-606-2096

Currently in School

If your studies have been disrupted as a result of the wildfires, and you have:

- Extended your study period

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Student Aid Service Centre, or login to your Student Aid Account and submit a Request for Reconsideration. Eligible students may receive up to $7,500 in Alberta Student loan funding to help cover unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

Student Loan Refinancing Requirements

Eligibility can vary slightly between lenders, but the following are standard requirements for most refinance loans:

- U.S. citizen or permanent resident

- Aged 18 years or older.

- Reside in a state where your chosen lender is authorized to lend.

- Have employment, sufficient income from other sources, or have an offer of employment starting within the next 3 months.

- Have graduated with an undergraduate degree or higher from a Title IV school thats eligible to process federal student loans.

Lenders also look at the following:

- This involves a hard credit inquiry which temporarily affects your credit score. Your credit history is the most important factor in determining your interest rate.

- Income. Your lender will ask to see your pay slips or proof of other sources of income, in order to assess whether you have sufficient monthly cash flow to meet your monthly payments.

- Savings. In addition to income, your level of savings will also help the lender assess your ability to make monthly payments.

- Debt amount. The amount of remaining debt will help the lender determine the rate and term duration of your loan.

Don’t Miss: How Long Sba Loan Approval

The National Student Loan Data System

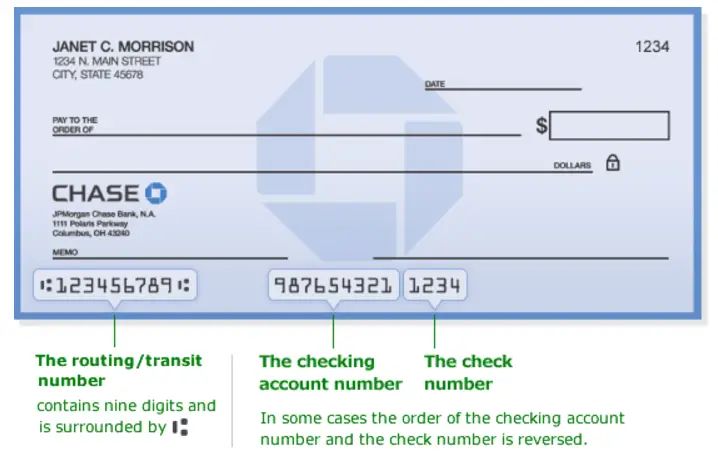

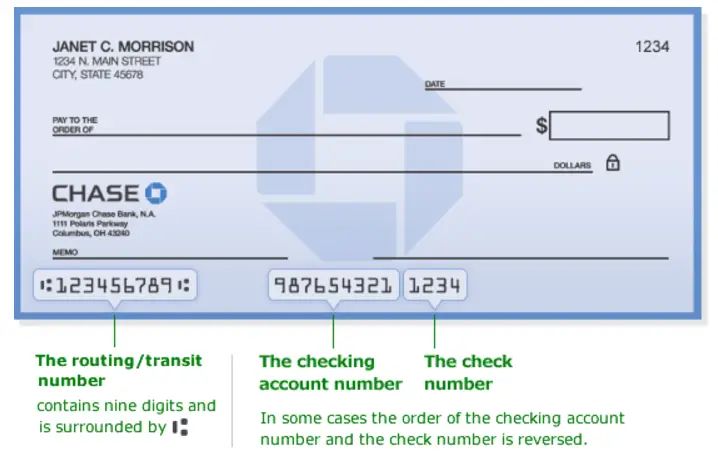

The Department of Education’s central database for student aidthe National Student Loan Data Systemprovides information about what kind of loan you have, as well as loan or grant amounts, outstanding balances, loan status, and disbursements. Identification information is required to access the database. You’ll need a user ID and password to get into the system, which you can get online. You can also access the database by calling the Federal Student Aid Information Center.

Change Your Bank Information

Log-in to your NSLSC account if you need to update your banking information.

If youre in a micro-credential program, you can update your banking information through your OSAP web account before you receive your funding.

If you need to change your banking information after youve started repaying your micro-credential OSAP loan, you must contact the National Student Loans Service Centre for OSAP Micro-credentials Program to update this information.

Don’t Miss: Get A Loan Without Proof Of Income

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Our Student Loan Customers Benefit From

- Applying for a student loan only once to get the money needed for the entire school year

- Student loans that feature 100% coverage for all school-certified expenses like tuition, fees, books, housing, meals, travel, and even a laptop

- Multi-Year Advantage: Returning undergraduate and graduate school loan customers with cosigners have over a 90% approval rate, faster student loan applications, and the convenience of managing all private loans with one lender.

- No origination fee

- Competitive interest rates

- Multiple repayment options on loans for students

- 0.25 percentage point interest rate discount when enrolled in and making monthly payments by auto debit

- Free access to FICO® Scores, updated quarterly online

- 100% U.S.-based customer service teams

You May Like: What Kind Of Loan Do I Need To Buy Land

Kentucky Higher Education Assistance Authority

WANT TO KEEP ON TOP OF THINGS?

If youre interested in knowing whats going on in college planning and preparation, sign up for the monthly Your KHEAA College Connection. Well email you a link to the latest edition of this electronic newsletter each month.

Youll find stories about planning, preparing and paying for college for students of all ages, as well as general education news that you can use. Check out the latest edition to see what its like.

Review Free Annual Credit Reports

The FSA website is the best way to see all your federal student loans, but it wont list any private student debt you might have. To see these student loans, you can request your free annual credit report.

Your credit report will include the following information:

- All the student loans you have, including both private and federal student loans.

- The lender or student loan servicer that holds each loan. You should also be able to see if a student loan was transferred or sold to a new servicer.

- The student loans initial balance and most recent balance.

- Payment history, including any missed payments and the date of the most recent payment on the loan.

While a credit report will likely list all your student loans, there are no guarantees. You might want to pull reports from all three major credit bureaus to be sure no loans are missed.

Don’t Miss: What Car Loan Can I Afford Calculator

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Department Of Education’s Federal Student Aid Information Center

For help accessing the National Student Loan Data System and to find information about the holder of your loan, as well as other information on your loans, call the Department of Education’s Federal Student Aid Information Center at 800-433-3243 or 800-730-8913 . For loans in default, contact the Department of Education’s Default Resolution Group at 800-621-3115 or 877-825-9923 .

Read Also: How To Apply Loan In Sss

What Type Of Loan Do I Have

You must know what type of student loan you have in order to understand your options. You can use the National Student Loan Data System to find out what federal loans you have. As of February 2020, the NSLDS site is found on the Departments StudentAid.gov site. There is a large Log In button on the right side of the screen that you must use to see your account information . Once you enter your FSA ID, you will have access to a lot of information, including your student aid summary.

You must have a FSA ID to access your loan information. If you do not already have an FSA ID, you can create one by clicking on the Create Account button on the StudentAid.gov site. The Department has posted answers to frequently asked questions about the FSA ID system.

Once you access your loan dashboard, you will see an aid summary as well as more detailed information about each individual grant, loan, and aid overpayment. The Department says that the new dashboard will allow you to keep track of your remaining eligibility for Direct Subsidized Loans and Federal Pell Grants and Iraq and Afghanistan Service Grants . You should also be able to track your progress toward repaying loans and track the number of qualifying payments made toward Public Service Loan Forgiveness if applicable. In addition, the aid summary will include information about your loan servicer and a link to the loan servicers website.

Examples:

Consolidate Your Federal Student Loans

Consolidate your defaulted federal student loans to bring them out of default. A consolidated loan is simply a new loan that equals the total balance of your individual loans. The interest rate is the weighted average interest rate rounded up to the nearest 1/8th of a percentage.

You can apply for a Federal Direct Consolidation Loan online or via U.S. mail. If you apply online, youll see information for your new loan servicer at the end of the online application process. If you apply by mail, you should see the loan servicers contact information when you download or print the paper application.

After consolidating, enroll in one of the income-driven student loan repayment plans. These plans base your monthly payment on your income, making payments more manageable. Do this to avoid falling into default again.

If you already have a Direct Consolidated Loan or if you are in active wage garnishment, youre not eligible for consolidation. Your next best option is loan rehabilitation.

Read Also: Does Va Loan Work For Manufactured Homes