Year Interest Only Mortgages

These resemble conventional 30-year mortgages with a caveat: borrowers dont pay principal at the outset, usually for the first 10 years. Since the repayment period is the same as a standard 30-year loan, monthly principal payments in the final 20 years would be higher than they would if principal were paid from the beginning. Lenders generally want larger down payments and charge higher interest for these loans since they are considered risker than conventional loans.

Youre Paying More Interest Over The Life Of Your Home Loan

Because youre only paying the interest amount off your loan during your Interest Only period, youre not paying the loan balance , which means youll pay more interest over the life of your loan.

If you pay both the Principal and Interest youll reduce your loan balance earlier in the loan term, which means the amount of interest payable will also reduce, because interest is calculated on the outstanding balance of your home loan.

What Are The Benefits Of Interest Only Loans

Before you choose your home loan repayment type, itâs worth comparing the benefits and risks of interest only repayments.

Benefits of interest only loans:

- Lower repayments â The most significant benefit of interest only repayments are that it offers borrowers lower monthly repayments during the interest only period.

- Higher rate of return â If youâre a property investor, opting for interest only repayments may offer you a higher rate of return on the property by reducing your ongoing mortgage expenses.

- Free up cash â For owner-occupiers and investors alike, paying lower mortgage repayments may help free up some much-needed cash for other purposes.

Also Check: How Long For Sba Loan Approval

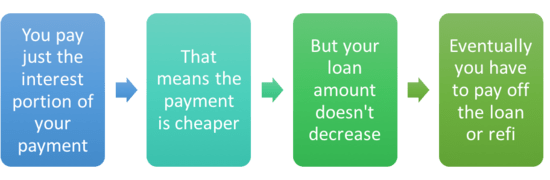

Do You Want To Pay Off Your Loan Or Keep Payments Low

- An interest-only mortgage is good for keeping payments low

- If you have times of the year where cash flow is limited

- The downside is you wont be paying down the loan

- Eventually youll need to unless home prices rise and you sell it

But what many prospective home buyers and homeowners may not realize is that offsetting or reducing monthly mortgage payments increases the overall interest one pays over the life of the loan, and reduces the amount of home equity one will gain.

If you make interest-only payments on your mortgage each month for the first ten years, you will pay substantially less than your fully-amortized payment, but gain nothing in the way of home equity. Precious home equity

So if you took out a mortgage with no money down, you would have zero ownership in your home unless it appreciated during that time. Meaning home prices must rise for you to gain any equity whatsoever.

If home values happened to fall during that time, you could easily find yourself in an underwater position seeing that you elected to put nothing down and pay no principal each month.

This could be a big problem if you planned on selling the home in a short period of time.

What Happens At The End Of An Interest Only Mortgage

If your repayment plan has stayed on track, you should already have enough money to pay off the outstanding mortgage at the end of its term. This could be in the form of investment funds, for example:

- A high-interest savings account or ISA

- Stocks and shares

- A pension fund

- A unit trust

If your savings or investment funds arent enough to cover the mortgage debt, dont panic. There are things you could try:

- Talk to your lender to see if theyll let you extend the term of your loan. This will give you more time to get the money together to pay off the outstanding balance.

- If youre a landlord with a portfolio of properties, you could use the equity in your other properties to pay off the outstanding balance.

- If youre on a high rate mortgage, you could look into the possibility of remortgaging. You may be able to find a cheaper rate repayment mortgage to switch to.

The final option would be to sell your property. If youve been paying interest only on it for the past 25 years, with any luck your home will have increased significantly in value. Once youve paid back the mortgage debt, you may find youre left with a sizeable sum to put towards a new home.

You May Like: How To Get An Aer Loan

When To Avoid An Interest

While an interest-only HELOC can be a great opportunity, you must understand the limitations.

First, this type of financing wont work for homeowners with little equity in their homes. According to Westrom, lenders have become more strict about how much equity homeowners can borrow against. While they used to let homeowners borrow up to 100% of their home value, most now limit it to 80%. If you dont have 80% equity in your home, then youll likely have to consider alternatives.

You also need a strong credit score and history. Lenders want to see a good track record of past loans and debts. Check your credit history and make sure it looks great before applying. If your credit needs work, consider other options to build it up.

One very important thing to remember is HELOCs are secured by your home. If you dont repay the loan, the bank can foreclose on your home.

Qualifying For An Interest

Interest-only mortgages have more risk for lenders since you won’t reduce your loan balance for many years. Because of the added risk, lenders have stricter qualifying criteria for this type of home loan.

Requirements vary, but even thebest mortgage lenders typically require good or excellent credit. Most also require a larger down payment than you’d need for a traditional mortgage.

Lenders also use the full loan payment amount to calculate your debt-to-income ratio . That includes principal and interest, even though you’re only paying interest to start.

Also Check: Fha Loan Limits Texas

When Does An Interest

An interest-only HELOC is a way to borrow money at a favorable interest rate for purposes such as home renovations, debt consolidation, and more.

The home equity loan can be a useful tool when its used properly, said Melissa Cohn, an executive mortgage banker at William Raveis Mortgage. A home equity loan is good if you have a single-purpose use for it. You need to purchase something, pay taxes, etc. As long as you can manage the repayment, its a useful tool.

With mortgage rates so low, however, many homeowners are instead choosing to access their home equity by refinancing their mortgage, which could generate cash as well as lower the interest on your entire mortgage. The number of refinance loans has jumped significantly, which is partly why HELOCs have been harder to qualify for.

An Interest-only HELOC also isnt a good substitution for some other types of favorable financing. For example, some people use HELOCs to cover the cost of higher education. People who are eligible for federal student loans should consider those first, says Leslie Tayne, a debt relief attorney at Tayne Law Group.

How To Apply For An Interest

You can apply for an interest-only mortgage direct through a lender or through a mortgage broker.

Often, the best interest-only mortgage deals are only available through brokers.

Thats because some lenders, such as Kent Reliance Building Society and Santander, only offer their interest-only deals through intermediaries, which means you have to apply through a mortgage broker to get the mortgage.

A good whole-of-market mortgage broker will compare all available deals – including both intermediary-only mortgages and also those you can only get by applying direct – before making a recommendation on the best deal for you.

Recommended Reading: Www Chfainfo Com Homebuyer

Disadvantages Of An Interest

Interest-loans can be risky, especially if you find you are unable to jump to a higher monthly payment when its time to start paying principal. Since new federal consumer-protection guidelines took effect in 2013, lenders know what sort of loans they can offer and to whom.

Here are other things you should consider before pursuing an interest-only mortgage:

Potential Tax Benefits For Investors

The interest paid on a home loan could tax-deductible if you use that home as an income-generating investment . This means investors with an interest-only loan could potentially have their monthly payment be tax-deductible.

An interest-only home loan could also be considered by investors or homeowners who plan to sell their property a few years down the track. If someone was expecting the value of their property to increase in the short-term, an interest-only loan could mean smaller monthly payments before selling and paying back the remainder.

Also Check: How To Get An Aer Loan

Who Is Eligible For Interest

Each individual lender will assess who is eligible for an interest-only home loan. In general, the lending criteria is similar to that of principal-and-interest home loans.

However, due to the increased risk involved with the interest-only period, they might have stricter credit requirements than their principal-and-interest home loan offerings. It will also depend on each individual borrower’s personal and financial circumstances.

If you’re interested in applying for an interest-only home loan, get in touch with one of our friendly loans.com.au lending specialists today.

What Are The Advantages Of An Interest Only Mortgage

- Interest only mortgages typically have lower monthly payments than repayment mortgages.

- You can invest these savings in your home and potentially increase its value.

- If youre after a buy-to-let mortgage, its worth knowing that many buy-to-let landlords opt for interest-only mortgages, then put any profit from rent towards the capital amount.

Recommended Reading: What Credit Score Does Usaa Use For Auto Loans

Who Should Consider An Interest

Lenders will generally make interest-only loans available to those who can demonstrate a high monthly income, a rising income and substantial cash savings in reserve. High net worth individuals may desire an interest-only mortgage because they feel their cash would be better served in a higher return investment vehicle rather than low-rate, low-volatility home equity.

Learn More About Home Loans

What is an interest-only loan? How do I work out interest-only loan repayments?

An interest-only loan is a loan where the borrower is only required to pay back the interest on the loan. Typically, banks will only let lenders do this for a fixed period of time often five years however some lenders will be happy to extend this.

Interest-only loans are popular with investors who arent keen on putting a lot of capital into their investment property. It is also a handy feature for people who need to reduce their mortgage repayments for a short period of time while they are travelling overseas, or taking time off to look after a new family member, for example.

While moving on to interest-only will make your monthly repayments cheaper, ultimately, you will end up paying your bank thousands of dollars extra in interest to make up for the time where you werent paying off the principal.

How can I calculate interest on my home loan?

You can calculate the total interest you will pay over the life of your loan by using a mortgage calculator. The calculator will estimate your repayments based on the amount you want to borrow, the interest rate, the length of your loan, whether you are an owner-occupier or an investor and whether you plan to pay principal and interest or interest-only.

If you are buying a new home, the calculator will also help you work out how much youll need to pay in stamp duty and other related costs.

What is ‘principal and interest’?

Also Check: Defaulting On Sba Loan

Barclays Simple Life Insurance

Protect your family

Have you thought about what would happen to your loved ones if you died or became terminally ill? With Barclays Simple Life Insurance, you can give them some financial security with a one-time payment from £6 per month.

Life Insurance is underwritten by Legal & General Assurance Society Limited. Terms, conditions, exclusions and eligibility criteria apply.

Who Is Not A Good Candidate For The Interest

Klein is quick to point out that interest-only mortgages arent for everyone. Some people think interest-only loans will help them buy more house or that they can afford more, he says. Thats not always the case since the standards are more stringent. Qualifying for interest-only loans is much harder than qualifying for a normal, qualified mortgage , he explains. Often, the standards for an interest-only mortgage will include higher credit scores, more cash reserves and assets, and higher household income than a traditional amortized loan, which means a portion of the monthly mortgage payment goes toward the principal. After the Great Recession in part caused by subprime loans for people who couldnt afford them lenders and investors are more cautious about extending interest-only loans.

Recommended Reading: How To Calculate Amortization Schedule For Car Loan

What Should I Consider If I Have An Interest Only Mortgage

There are a few things to think about if you already have an interest-only mortgage:

- Can I switch to a repayment mortgage? If your circumstances change it could make sense to switch to a repayment mortgage. If thats the case, youll probably want tolook into remortgaging.

- Should I pay into an investment plan? Investing in stocks, shares or other financial products could be a good strategy for repaying your loan. But there are many products out there and some are riskier than others. Talk to an independent financial advisor before you make any decisions.

- Is it a good idea to make lump-sum repayments? If you suddenly come into money you get an inheritance, for example – it could be a good idea to make a lump-sum payment on your mortgage. However, some lenders may penalise you for doing this, so check any early repayment charges first.

- What are my remortgage options? You could look for another interest-only mortgage. Or if you want to switch to a repayment mortgage, its usually fairly straightforward. Interest-only mortgages will come with an initial rate, often lasting between two and 10 years. After this, if you dont remortgage, youll be put onto the lenders standard variable rate, which is likely to be uncompetitive. Its a good idea to take a look at whats available before your deal comes to an end.

How Can I Compare Interest

Overall, if youre considering an interest-only home loan, it may be a good idea to be mindful of the potential pros and cons, research whats on offer from a selection of providers, read the loan terms and conditions carefully before committing and perhaps even get some professional advice if necessary.

When comparing loans, consider weighing up your options based on the interest rate and the fees charged, as well as the loan features that lenders offer.

Canstars Home Loan Star Ratings may help you to determine which loans offer value for money based on a broad range of factors.

Read Also: Does Va Loan Work For Manufactured Homes

Find And Compare Interest Only Home Loans

| Enquire Now | Compare

A variable home loan with no upfront fees from one of Australia’s big four banks. Suitable for those with low deposits. More details |

| Enquire Now | Compare

A NAB home loan which offers helpful loan features, charges no upfront fees and offers up to $2k cash back for refinancers. More details |

| View Now | Compare

Pay only the interest on your owner-occupied home loan to help manage your mortgage payments for a limited time. More details |

| View Now | Compare

Do you have 40% deposit or equity available? Pay only the interest on your investment home loan to help manage your mortgage payments for a limited time. More details |

Embed

Special Considerations For Interest

Some interest-only mortgages may include special provisions that allow for just paying interest under certain circumstances. For example, a borrower may be able to pay only the interest portion on their loan if damage occurs to the home, and they are required to make a high maintenance payment. In some cases, the borrower may have to pay only interest for the entire term of the loan, which requires them to manage accordingly for a one-time lump sum payment.

Read Also: What Is The Commitment Fee On Mortgage Loan

What Are The Pros Of Using An Interest

Ready to see if an interest-only mortgage is a good fit for you? Here are some of the benefits.

- One of the biggest benefits of it is your monthly payment is significantly less than an amortized loan, Klein explains.

- Because interest payments on your primary residence are tax-deductible , 100 percent of your interest-only mortgage is tax-deductible if you itemize.

- For properties where the owner will sell or refinance before the interest-only term expires, it can be smart. For instance, one of Kleins clients is refinancing to an interest-only loan on a large home. Even with a slightly higher interest rate, the client will save approximately $2,000 per month, which he will put towards his kids college education. By the time the seven-year interest-only period is up, the homeowner will either refinance to a fixed-rate mortgage or will be ready to downsize and sell the home.

Are These Types Of Loans Widely Available

Since so many borrowers got in trouble with interest-only loans during the bubble years, banks are hesitant to offer the product today, says Yael Ishakis, vice president of FM Home Loans in Brooklyn, N.Y., and author of “The Complete Guide to Purchasing a Home.”

Fleming says most are jumbo, variable-rate loans with a fixed period of five, seven or 10 years. A jumbo loan is a type of nonconforming loan. Unlike conforming loans, nonconforming loans arent usually eligible to be sold to government-sponsored enterprises, Fannie Mae and Freddie Macthe largest purchasers of conforming mortgages and a reason why conforming loans are so widely available.

When Fannie and Freddie buy loans from mortgage lenders, they make more money available for lenders to issue additional loans. Nonconforming loans like interest-only loans have a limited secondary mortgage market, so its harder to find an investor who wants to buy them. More lenders hang on to these loans and service them in-house, which means they have less money to make additional loans. Interest-only loans are therefore not as widely available. Even if an interest-only loan is not a jumbo loan, it is still considered nonconforming.

Because interest-only loans arent as widely available as, say, 30-year fixed-rate loans, the best way to find a good interest-only lender is through a reputable broker with a good network, because it will take some serious shopping to find and compare offers, Fleming says.

You May Like: Does Va Loan Work For Manufactured Homes