Who Sets Va Loan Rates

VA loan lenders determine VA loan rates, which can be lower than the interest rates for conventional loans. VA loans come from a variety of mortgage lenders, including banks, non-bank institutions and credit unions.

Its important to shop around, as rates can differ widely by lender. In fact, a 2020 study by mortgage technology company Own Up found that in a cohort of 20 VA loan lenders, the interest rates from the highest-cost lender and lowest-cost lender differed by up to 1.25 percentage points. However, a 2021 update by Own Up found the difference had narrowed to 0.52 percentage points. In either case, a gap like that, and even slight changes in interest rate, can significantly impact the overall cost of your loan.

Bankrate can help you shop around for the best deal on a VA loan.

Va Residual Income Rules

VA underwriters perform additional calculations that can affect your mortgage approval.

Factoring in your estimated monthly utilities, your estimated taxes on income, and the area of the country in which you live, the VA arrives at a figure which represents your true costs of living.

It then subtracts that figure from your income to find your residual income .

Think of the residual income calculation as a real-world simulation of your living expenses.

It is the VAs best effort to ensure that military families have a stress-free homeownership experience.

Here is an example of how residual income works, assuming a family of four which is purchasing a 2,000 square-foot home on a $5,000 monthly income.

- Future house payment, plus other debt payments: $2,500

- Monthly estimated income taxes: $1,000

- Monthly estimated utilities at $0.14 per square foot: $280

This leaves a residual income calculation of $1,220.

Now, compare that residual income to VA residual income requirements for a family of four:

- Northeast Region: $1,025

- South Region: $1,003

- West Region: $1,117

The borrower in our example exceeds VAs residual income standards in all parts of the country.

Therefore, despite the borrowers debt-to-income ratio of 50%, the borrower could get approved for a VA loan.

How To Protect Yourself Against The Risks Of Buying A Home

As the buyer, you will probably encounter more risks in the home buying transaction than any other party. After all, you are buying a home that you have only seen a few times. Fortunately, there are many ways to protect yourself against all the involved risks. However, the most important of them all is getting title insurance.

This important policy protects you from the possibility that your seller or previous sellers didnt have clear ownership of the home. This could prevent them from rightfully transferring the ownership to you. Please keep reading to understand what title insurance is, how it works, why you need it, and how to acquire it.

Also Check: How To Transfer Car Loan To Someone Else

Your Guide To The Different Mortgage Loan Products Available To Borrowers

Rae Hartley Beck has more than eight years of experience writing about personal finance, starting with an advice column in her college newspaper, which helped students learn about saving, wise spending, and budgeting on limited means. Her expertise includes mortgages, credit card rewards, and personal finance. She has a bachelor’s degree from Berea College.

When shopping for a home loan, it’s easy to get overwhelmed by the lingo and types of mortgage products available to you. Learn more about the most common mortgages and see if you are eligible for any of the specialty mortgage types listed below.

Va Vs Conventional Loan Mortgage Rates

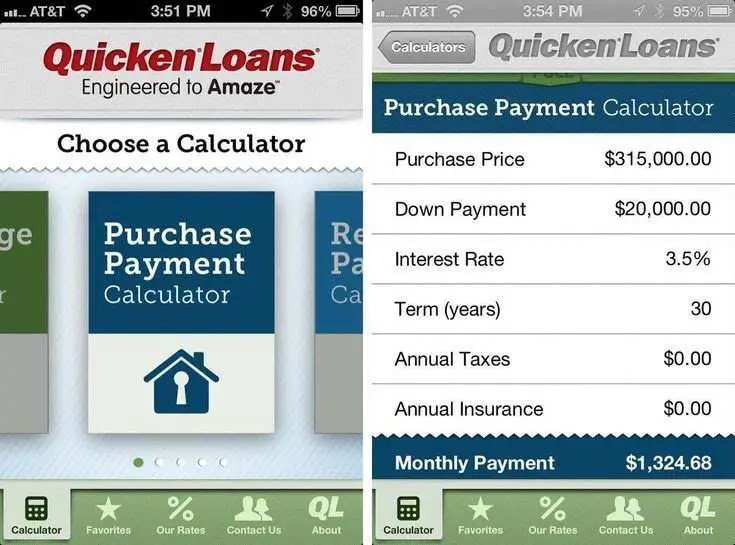

Mortgage rates fluctuate often, and the rate youll receive depends on your credit score, down payment, loan amount, and where youre buying.

But looking at VA vs conventional rates generally, VA loans have had the lowest rates in the market for the past several years, even more so than the other government-backed loan programs .

Still, borrowers with high credit scores and solid finances can qualify for competitive conventional loan interest rates as well.

Your best bet is to request quotes from several lenders so you can compare the costs on different loan programs from different companies and choose the all-around best fit.

Read Also: Why Are My Student Loans On My Credit Report

Down Payment And Assets

VA loans are one of the few loan options that dont require a down payment. Your lender may have specific requirements for a no-down-payment VA loan.

For example, they may require that you have a higher credit score if youre putting down less than 10%. The requirement to purchase a home with a VA loan through Rocket Mortgage® with no down payment is still a median of 580.

Its important to keep in mind that no down payment doesnt mean zero cost. Here are some other VA loan costs, akin to closing costs due at a conventional mortgage closing, to be prepared for, even if youre putting 0% down: Heres a glance at just a few of them:

Va Loans And Rental Properties

You cannot use a VA loan to buy a rental property. You can, however, use a VA loan to refinance an existing rental home you once occupied as a primary home.

For home purchases, in order to obtain a VA loan, you must certify that you intend to occupy the home as your principal residence.

If the property is a duplex, triplex, or four-unit apartment building, you must occupy one of the units yourself. Then you can rent out the other units.

The exception to this rule is the VAs Interest Rate Reduction Refinance Loan .

This loan, also known as the VA Streamline Refinance, can be used for refinancing an existing VA loan on a home where you currently live or where you used to live, but no longer do.

You May Like: Usaa Used Auto Rates

How Much Will I Pay

This depends on the amount of your loan and other factors.

For all loans, well base your VA funding fee on:

- The type of loan you get, and

- The total amount of your loan. Well calculate your funding fee as a percentage of your total loan amount.

Depending on your loan type, we may also base your fee on:

- Whether its your first time, or a subsequent time, using a VA-backed or VA direct home loan, and

- Your down payment amount

Note: Your lender will also charge interest on the loan in addition to closing fees. Please be sure to talk to your lender about any loan costs that may be added to your loan amount.

How Much Are Va Loan Closing Costs

The Department of Veterans Affairs offers home loans to members of the military, including active-duty service members, veterans, and surviving spouses. If you qualify, a VA loan can be a tempting alternative to traditional loans due to benefits like a 0% down payment option and no mortgage insurance requirement.

While these features can save you money on your new home, its important to note that VA loans also come with different funding fees than conventional home loans. Most of these fees are mandatory, although you may be able to roll some of them into the loan itself. Well review the different types of VA loan closing costs and how much youll need to budget for them.

Recommended Reading: Usaa Auto Loan Process

Va Loan Income Guidelines

VA loan requirements for buyers are similar to other mortgages when it comes to debt loads and income.

VA mortgage guidelines on income requirements are similar to other mortgages when it comes for debt-to-income limits, VA home loan lenders typically like to see a borrower’s total monthly debt payments, including the mortgage, at no higher than 41 percent of gross monthly income, similar to other types of home loans. No more than 28 percent of gross monthly income should be for the planned mortgage payment, including property taxes and homeowner’s insurance. Lenders may go higher in some situations, however.

Va Loans For Realtor Clients

On Q Financial works with realtors and their clients to find the best loan programs to match their needs and ensure that well close on time.

We offer products and services to make sure your clients have the simplest mortgage experience with our Simplicity mobile app, On Time Closing Guarantee, Multicultural Advantage, and more.

You May Like: Car Loan Balance Transfer

Qualifying If You Receive Child Support Or Alimony

Buying a home after a divorce is no easy task.

If, prior to your divorce, you lived in a two-income household, you now have less spending power and a reduced monthly income for purposes of your VA home loan application.

With less income, it can be harder to meet both the VA Home Loan Guarantys debt-to-income guidelines and the VA residual income requirement for your area.

Receiving alimony or child support can counteract a loss of income.

Mortgage lenders will not require you to provide information about your divorce agreements alimony or child support terms, but if youre willing to disclose, it can count toward qualifying for a home loan.

Different VA-approved lenders will treat alimony and child support income differently.

Typically, you will be asked to provide a copy of your divorce settlement or other court paperwork to support the alimony and child support payments.

Lenders will then want to see that the payments are stable, reliable, and likely to continue for another 36 months, at least.

You may also be asked to show proof that alimony and child support payments have been made in the past reliably, so that the lender may use the income as part of your VA loan application.

If you are the payor of alimony and child support payments, your debt-to-income ratio can be harmed.

Not only might you be losing the second income of your dual-income households, but youre making additional payments that count against your outflows.

What Are The Rules For Down Payment Mortgage Insurance And Other Fees

VA loans do not require you to put down any money to obtain a loan, and dont require you to pay mortgage insurance. However, youll owe a funding fee, with the amount based on

- Whether youre in the military, are in the national guard, are a qualifying spouse, or are a veteran of the military or national guard

- The amount of your own down payment, if any

- The type of loan

- Whether youre a first-time borrower or youve had a past VA loan

Funding fees vary depending on whether youre buying or refinancing and other factors. This funding fees table on the VA website will help you figure out what youll owe.

Surviving spouses of deceased veterans who died because of their service dont have to pay a funding fee, nor do certain eligible veterans entitled to compensation for service-connected disabilities. When owed, the funding fee can be paid upfront or financed.

Lenders may also charge additional fees, including any of the following:

- Discount points to reduce your interest rate

- Loan origination fees

Fees and costs vary by lender.

You May Like: Refinance Car Loan Usaa

What Are The Types Of Title Insurance

There are two main types of title insurance. They include

-

Lenders title insurance

Also known as a mortgagees policy, a lenders title insurance policy protects the company giving you the mortgage. The lender has the greatest financial risk in a home sale. Therefore, they need to ensure that their investment is well protected even in the case of title issues. A lenders title insurance is important when you take out a mortgage for refinancing or buying a home. However, if youre buying a home without a mortgage, you may not have to pay for a lenders policy.

-

Owners title insurance

An owners title insurance is designed to protect you, the homebuyer, from title issues, and the seller caters for it. The owners title insurance coverage amount is normally the same as the purchase price, and it remains constant for as long as you own the home. This policy is optional and is a one-time purchase.

Pentagon Federal Credit Union: Best Overall Experience

The Pentagon Federal Credit Union is one of the top credit unions in the country and serves military members and their families. Providing 30- and 15-year fixed VA home loans, this credit union also provides a host of additional banking services, including student refinancing, personal loans, rewards credit cards and auto loans.

Pentagon Federal Credit Unions current 30-year and 15-year VA mortgage rates are 2.5% and 2.750% respectively. APR rates for 30-year loans are offered as low as 2.631%, while the 15-year loan APR is offered as low as 2.997%.

You May Like: Refinancing Fha Loan Calculator

What You Need To Know About Va Refinance Funding Fees

Having extra equity in your home wont reduce the funding fee on most VA refinances. Youll pay the same percentage rate whether youre tapping equity with a cash-out refinance or paying off a non-VA loan, such as a conventional loan. If you use your VA benefits for the first time to refinance, the rate is slightly lower.

If you currently have a VA loan, youll pay only a half-percent percentage point for an IRRRL funding fee. Even better: You wont need any income documentation or a home appraisal.

If You Apply With A Credit

In states with community property laws, VA lenders must consider the credit rating and financial obligations of your spouse. This rule applies even if he or she will not be on the homes title or even on the mortgage.

Such states are as follows.

- Arizona

- Washington

- Wisconsin

A spouse with less-than-perfect credit or who owes alimony, child support, or other maintenance can make your VA approval more challenging.

Apply for a conventional loan if you qualify for the mortgage by yourself. The spouses financial history and status need not be considered if he or she is not on the loan application.

You May Like: Is The Loan Forgiveness Program Legit

Veterans United: Best Customer Satisfaction

One of the largest VA mortgage lenders in the U.S., Veterans United limits its focus to only VA loans, offering superior customer satisfaction compared to many other lenders.

As is typical of VA loans, there is no minimum down payment required to secure a VA loan through Veterans United. In addition to the easy online application process, Veterans United is home to the Lighthouse program, offering credit counseling services to help active duty military and veterans build and improve upon their credit scores, manage their finances, set budgets and secure VA loan preapproval.

Veterans United offers 30-year and 15-year fixed loan options with competitive APR percentages and touts high rates of customer satisfaction.

Can I Get A Second Va Loan

As noted above, if you still have some of your guaranty left after purchasing a home, you can use it to get a another VA loan to purchase a second home for your personal use. However, once you use up your full guaranty amount, you cannot obtain further VA loans.

There is a one-time exception: you can apply to have the full amount of your guaranty restored once you pay off your VA loan in full. This often happens when a veteran sells their home and desires another VA loan to buy a new one. But you can only do this one time.

Recommended Reading: Will Va Loans Cover Manufactured Homes

Are Va Loans Guaranteed And Insured

Under the law, as amended, the VA is authorized to guarantee or insure home, farm, and business loans made to veterans by lending institutions. As of 2020, over 25 million VA home loans have been insured by the government. Such personnel are required to pay a slightly higher funding fee when obtaining a VA home loan.

Va Loan Assumption Savings

Buying a home via an assumable mortgage loan is even more appealing when interest rates are on the rise.

For example:

- Say a seller-financed $200,000 for their home in 2013 at an interest rate of 3.25% on a 30-year fixed loan

- Using this scenario, their principal and interest payment would be $898 per month

- Lets assume current 30-year fixed rates averaged 4.10%

- If you financed $200,000 at 4.10% for a 30-year loan term, your monthly principal and interest payment would be $966 per month

Additionally, because the seller has already paid four years into the loan term, theyve already paid nearly $25,000 in interest on the loan.

That comes out to a total savings of almost $60,000!

You May Like: Golden1 Car Loan

Can You Use A Va Loan For A Second Home Or Investment Property

A second VA loan can be used to purchase a second house, but there are some restrictions. You must be entitled and financially eligible for the second VA loan. You must also show the VA that your second property provides a net tangible advantage.

These tangible advantages include but are not limited to:

- Closer proximity to your workplace

- An upgrade to a larger home

- Having to downsize

- Purchasing a home for your spouse that lives in another state

To be qualified for a second residence, you must have at least one net tangible advantage. These standards should not be too difficult to meet if you are a military member moving to a new state.

Why Your Dti Is Important For Affordability

Your debt-to-income ratio is the relationship between your income and how much you spend each month on debt. For example, if your total monthly debt is $720 and your monthly income is $2,000, your DTI would be 36 percent.

You determine your DTI by dividing your total monthly debt by your total gross income.

Here is a quick example of how lenders calculate your DTI

Total monthly debt / Gross monthly income = Debt-to-income ratio .

Keep in mind most VA lenders only use active consumer debts that show up on your credit report to calculate your total monthly debt. In almost every case, VA-backed lenders wont use debt such as your cellphone bill, car insurance, health insurance premiums or utility bills to calculate your DTI.

The VA recommends that lenders cap your DTI at 41 percent. However, the VA doesnt provide the actual financing, so it’s up to lenders to use their own ratios to make loans.

If your DTI exceeds 41 percent, you may pay a higher interest rate or pay more fees. By paying more than 41 percent of your gross income on monthly debt, a slight downward shift in your pay could severely damage your long-term housing budget.

Don’t Miss: Refinance Usaa Car Loan